The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

The Shanghai-based streetwear platform, known locally as Dewu, announced its intention to invest 320 million yuan ($50.23 million) in promoting new content creators, influencers and MCN agencies (multi-channel networks that represent stables of influencers).

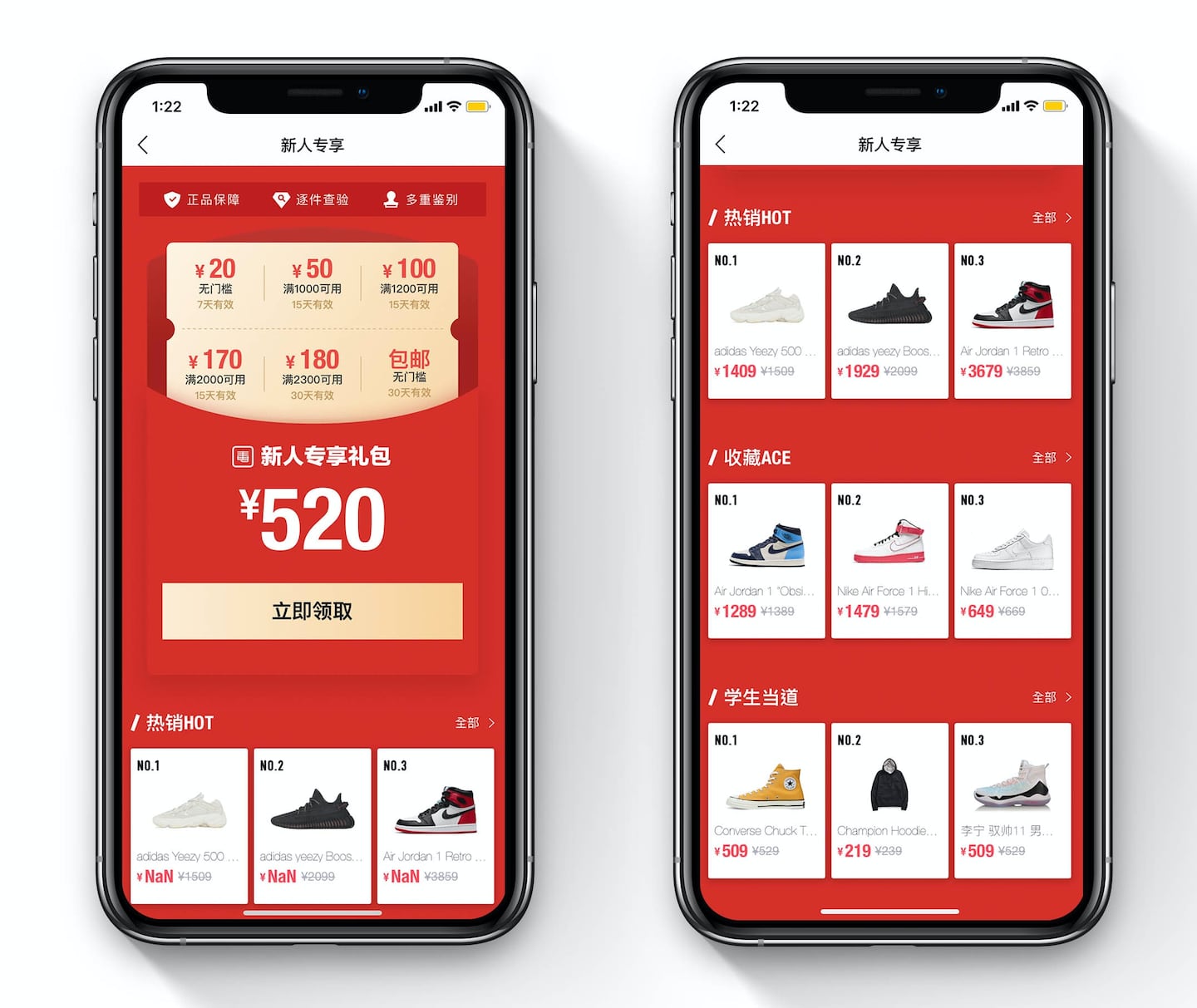

Poizon’s founder and chief executive Yang Bing said the move is geared towards the long-term development of the platform. Though it started life primarily as a sneaker resale and authentication platform for Chinese hypebeasts, it has more recently shifted towards content creation in order to attract a broader audience.

This is happening amid a broader shift in China, which is seeing content platforms, such as Xiaohongshu and Douyin, the Chinese version of TikTok, step into the e-commerce fray with offerings driven by KOLs (key opinion leaders, the Chinese term for influencers) and user generated content. The entertainment-driven commerce offered by these platforms is proving incredibly popular with young consumers, threatening the dominance of traditional e-commerce platforms like Alibaba’s Tmall.

According to third-party data, as of May, Poizon had 81 million monthly active users. The privately held company doesn’t routinely release revenue and sales data but in 2019, it was reported that Poizon’s GMV (gross merchandise value, a metric of goods sold) reached 7 billion yuan ($1.1 billion). More recently, Poizon has also opened two physical stores in Shanghai.

ADVERTISEMENT

Learn more:

A New Era for China’s $15 Billion Streetwear Market

Luxury brands, local labels, major exhibitions and digital platforms are driving a more complex and increasingly fragmented streetwear sector in China.

With consumers tightening their belts in China, the battle between global fast fashion brands and local high street giants has intensified.

Investors are bracing for a steep slowdown in luxury sales when luxury companies report their first quarter results, reflecting lacklustre Chinese demand.

The French beauty giant’s two latest deals are part of a wider M&A push by global players to capture a larger slice of the China market, targeting buzzy high-end brands that offer products with distinctive Chinese elements.

Post-Covid spend by US tourists in Europe has surged past 2019 levels. Chinese travellers, by contrast, have largely favoured domestic and regional destinations like Hong Kong, Singapore and Japan.