The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

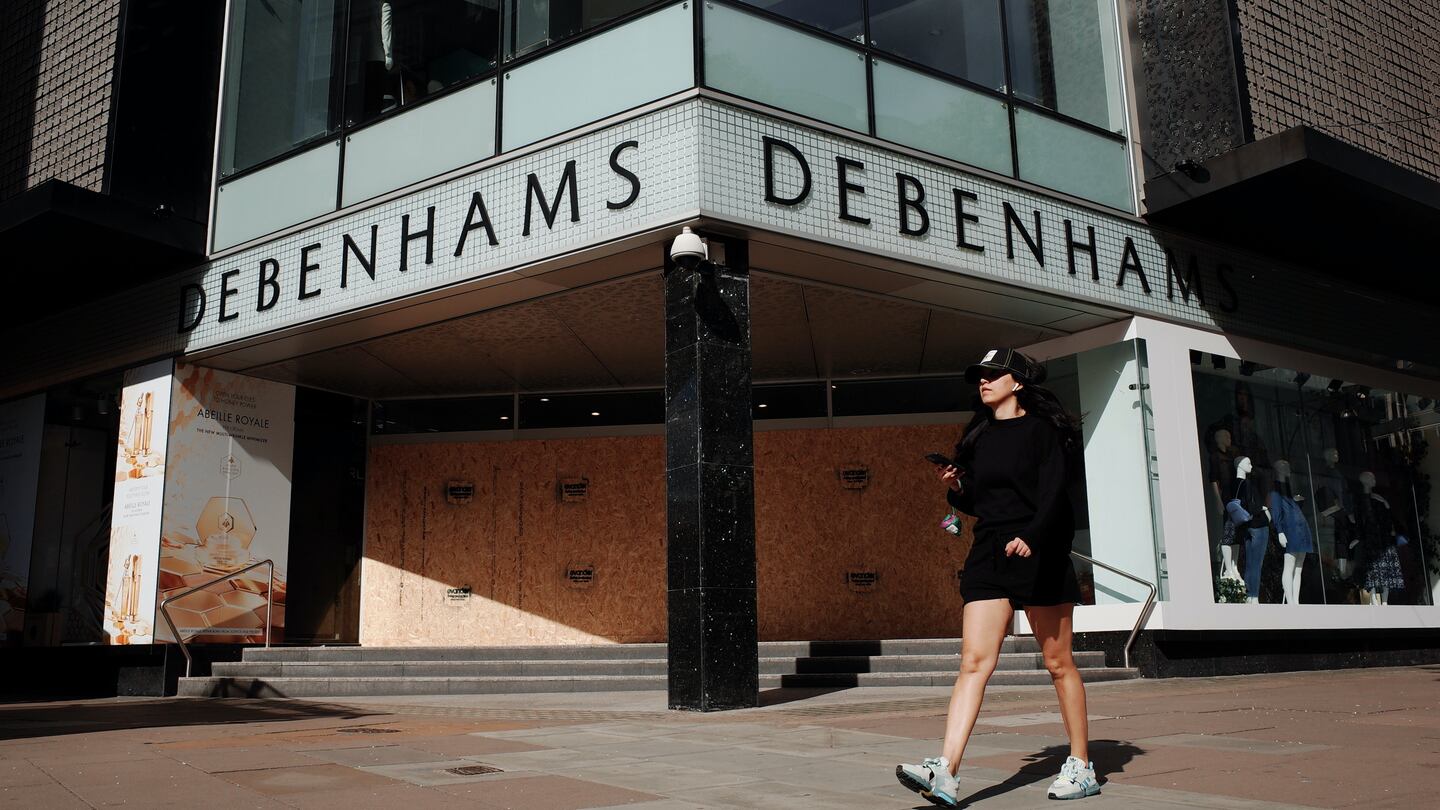

LONDON, United Kingdom — British department store group Debenhams went into administration for the second time in 12 months on Thursday, seeking to protect itself from legal action by creditors during the coronavirus crisis that could have pushed it into liquidation.

With Britain in lockdown during the pandemic, Debenhams' 142 UK stores are closed, while the majority of its 22,000 workers are being paid under the government's furlough scheme. It continues to trade online.

The retailer went into administration for a first time in April last year, wiping out equity investors including Mike Ashley's Sports Direct, and is now owned by a lenders consortium called Celine UK NewCo 1 Ltd.

Debenhams said administrators from FRP Advisory would work with the existing management team to get the UK business into a position to re-open and trade from as many stores as possible when restrictions are lifted by the government.

ADVERTISEMENT

Chief Executive Stefaan Vansteenkiste said he anticipated the firm's owners and lenders would make additional funding available to fund the administration period.

However, the group's business in Ireland looks doomed.

Debenhams said it expected administrators to appoint a liquidator to the 11-store Irish operation, which employs 2,000.

The moves makes Debenhams the first major retail casualty of the health crisis in Ireland, where the government, as in the UK, has closed all non-essential shops.

Ireland on Monday reported a trebling of its unemployment rate to 16.5 percent with a further surge expected later in the month.

"We are desperately sorry not to be able to keep the Irish business operating but are faced with no alternative option in the current environment," said Vansteenkiste.

By James Davey and Conor Humphries; editors: Alistair Smout and David Holmes.

The British musician will collaborate with the Swiss brand on a collection of training apparel, and will serve as the face of their first collection to be released in August.

Designer brands including Gucci and Anya Hindmarch have been left millions of pounds out of pocket and some customers will not get refunds after the online fashion site collapsed owing more than £210m last month.

Antitrust enforcers said Tapestry’s acquisition of Capri would raise prices on handbags and accessories in the affordable luxury sector, harming consumers.

As a push to maximise sales of its popular Samba model starts to weigh on its desirability, the German sportswear giant is betting on other retro sneaker styles to tap surging demand for the 1980s ‘Terrace’ look. But fashion cycles come and go, cautions Andrea Felsted.