The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

The California-based company is profitable. It generated between $104 million and $106 million in net revenue and about $50 million in gross profit during the three months ending Oct. 3.

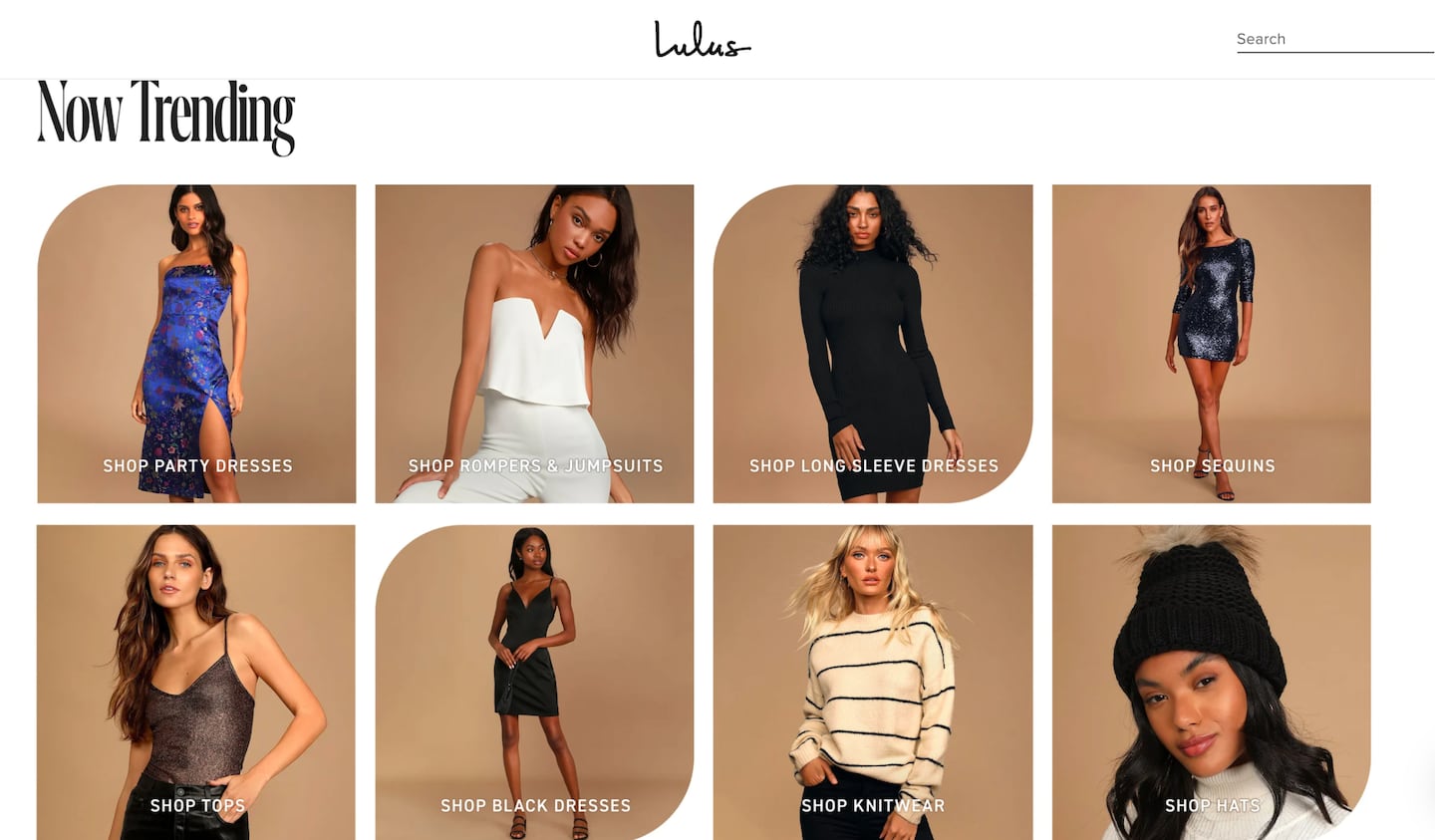

Lulu’s started off as a vintage boutique in California in 1995 but eventually transitioned to a purely digital business by 2008. Like many fast fashion brands, it releases hundreds of new styles weekly and operates on a data-driven model to determine what to keep producing.

”Our product creation and curation model leverage a ‘test, learn, and reorder’ strategy to bring hundreds of new products to market every week; we test them in small batches, learn about customer demand, and then quickly reorder winning products in higher volume to optimise profitability,” the company wrote in its prospectus.

Learn more:

ADVERTISEMENT

Investment firms like Andreessen Horowitz are backing start-ups that mimic the Chinese fast-fashion giant’s blueprint, as they look to build the next big Gen Z label.

As the German sportswear giant taps surging demand for its Samba and Gazelle sneakers, it’s also taking steps to spread its bets ahead of peak interest.

A profitable, multi-trillion dollar fashion industry populated with brands that generate minimal economic and environmental waste is within our reach, argues Lawrence Lenihan.

RFID technology has made self-checkout far more efficient than traditional scanning kiosks at retailers like Zara and Uniqlo, but the industry at large hesitates to fully embrace the innovation over concerns of theft and customer engagement.

The company has continued to struggle with growing “at scale” and issued a warning in February that revenue may not start increasing again until the fourth quarter.