The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

A new report from BoF Insights reveals that just 5 to 7 percent of resaleable fashion is currently being bought and sold on resale platforms, resulting in an estimated $2.1 trillion of fashion sitting untapped in closets around the world.

The Future of Fashion Resale is published by BoF Insights, a new data and analysis unit at The Business of Fashion providing business leaders with proprietary and data-driven research to navigate the fast-changing global fashion industry. The report estimates that the global secondhand fashion market is currently worth $130 billion.

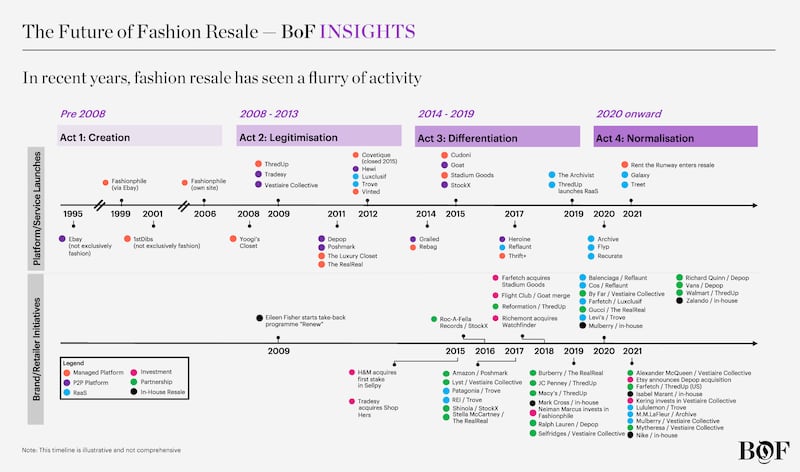

Of course, secondhand fashion has existed for decades, primarily in thrift and vintage stores, but the advent of online resale platforms has led to a step change in how used items can be bought and sold. Since 2019, there have been at least 13 new resale entrants, 6 new Resale-as-a-Service launches and 14 major brand partnerships.

Today, fashion resale is at an inflection point.

ADVERTISEMENT

While a flurry of platforms and services have emerged in just the last few years, and a handful of platforms have gone public since 2019, the stock performance of these public companies has been mixed as markets debate the viability of their business models and contemplate their losses as these platforms invest to scale.

In tandem, brands and retailers are realising that they need to establish their own resale strategies as the resale economy becomes more entrenched. By engaging in resale, they have the opportunity to accrue economic benefits and deepen relationships with both new and existing customers, while influencing a product’s positioning and residual value through its lifetime.

In speaking to brands and retailers, what we most often hear are analogies to how they debated e-commerce and/or outlets years ago — and a sense that they need to proactively craft a resale strategy now rather than reactively do so later.

While resale may be inevitable, crafting the right resale strategy is not. Industry participants need to evaluate a complex set of dynamics and weigh various options for how to engage, from partnerships to outsourcing capabilities to building them in-house.

In this new report, BoF Insights offers its perspective on online resale: how we think about the upside of the industry, how we believe the landscape will evolve, and how we recommend industry participants build their own resale strategies.

The report is based on a number of public and proprietary research inputs, including:

BoF Insights is The Business of Fashion’s data and advisory team, partnering with leading fashion and beauty clients to help them grow their brands and businesses. Get in touch at insights@businessoffashion.com to understand how BoF Insights support your company’s growth for the long term.

As the German sportswear giant taps surging demand for its Samba and Gazelle sneakers, it’s also taking steps to spread its bets ahead of peak interest.

A profitable, multi-trillion dollar fashion industry populated with brands that generate minimal economic and environmental waste is within our reach, argues Lawrence Lenihan.

RFID technology has made self-checkout far more efficient than traditional scanning kiosks at retailers like Zara and Uniqlo, but the industry at large hesitates to fully embrace the innovation over concerns of theft and customer engagement.

The company has continued to struggle with growing “at scale” and issued a warning in February that revenue may not start increasing again until the fourth quarter.