Huda Beauty

The Business of Beauty Haul of Fame: Her Hair Is Full of Secrets

How women are claiming their space… and their blow dry routines.

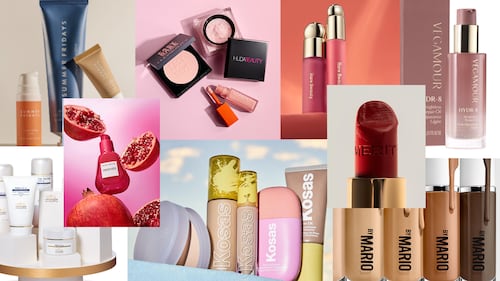

Beauty’s Most Sought-After M&A Targets in 2024

Now that the market has stabilised, beauty brands of all shapes and sizes are eager to get their dues. The Business of Beauty identifies the top targets of the year including Kosas, Summer Fridays and Selena Gomez’s Rare Beauty.

Where Will Global Beauty’s Growth Come From?

The State of Fashion: Beauty explores why the international growth strategies of beauty brands and retailers need a reset to capture opportunities in new markets, like India and Middle East, emerge along with industry juggernauts, the US and China.

Colour Cosmetics Make a Bold Comeback

Makeup is now growing twice as fast as skin care as beauty shoppers turn to neon eyeshadows and bold shimmery blushes to create looks inspired by TikTok trends and the Y2K revival.

Influencer Beauty Brands Are Trending in China

China’s influencers are the latest cohort to challenge long-dominant international players for a share of the world’s second-largest beauty market.