The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

Walmart wants to lure the luxury beauty shopper.

High-end brands such as the skincare line Skinceuticals and hair care line Color Wow (which is sold via third party), and added services like virtual try-on might feel unexpected for the mass retailer best known for low prices in its enormous hypermarkets it calls “Supercenters,” but Creighton Kiper, merchandising vice president of beauty, says they’re proving popular: “Luxury beauty as a whole will continue to be a focus at Walmart,” said Kiper, adding that it has seen “tremendous success” both in-store and online. Walmart operates over 4,600 stores in the US.

An added luxury push is right in line with Walmart’s evolving customer base, which has steadily begun to encompass more high-income households. In its fourth-quarter fiscal 2024 results announced in February, the company noted that gains with “high income households” in the grocery category (in which it includes beauty products) contributed to its 4 percent net sales growth to $118 billion. Overall sales for the fiscal year reached $449 billion, up 5.6 percent.

Walmart’s premiumisation push comes against a disjointed economic climate. Inflationary pressures have caused some higher-income customers to start to hunt for bargains, which has seen them increasingly turning to low-cost stores like Walmart they may have previously skipped for essentials. But they’ll likely still splurge on beauty while they’re there: even as they shop for cheaper alternatives to everyday items, consumers tend not to trade down on beauty products, seeing them as inalienable, must-have treats. Walmart could use that stickiness; Morgan Stanley estimates that by 2025, Amazon will supersede it as the US’s biggest beauty retailer. And Target, which has carried been first to carry masstige brands like Naturium, Odele and Versed through its own merchandising as well prestige labels Anastasia Beverly Hills and Benefit Cosmetics through its partnership with Ulta Beauty, has taken a different approach, launching a newer private label brand with some cosmetic products priced at less than a dollar.

ADVERTISEMENT

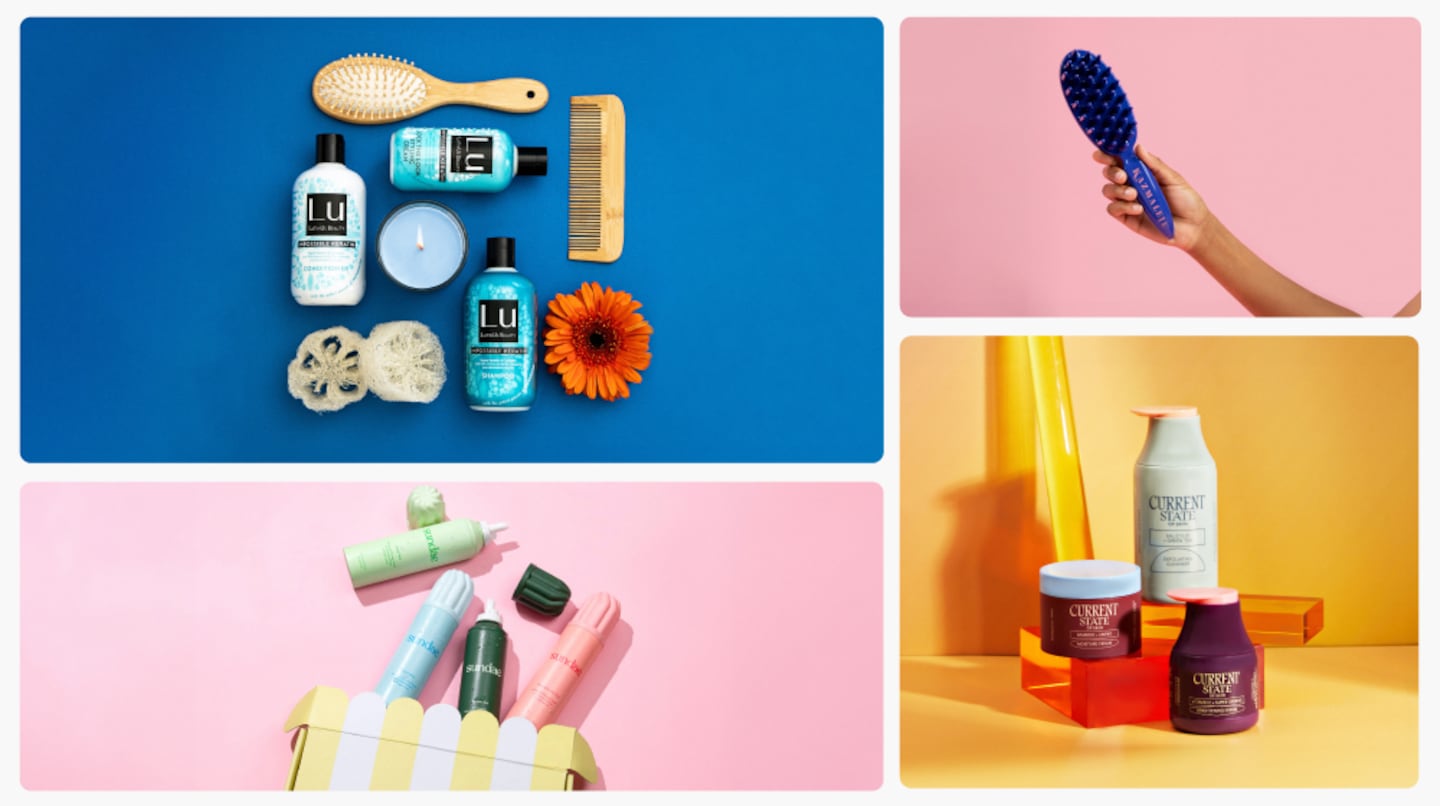

Thanks to the success of lines like skincare label Bubble, Walmart has further experimented with indie brands by launching its own brand accelerator, called Walmart Start, in 2023. The first cohort included hair brand Pardon My Fro and perfume line Dossier; the second cohort, announced today comprises skincare label Current State, hair brands Latinus and Kazmaleje and body care line Sundae Beauty.

Accelerators have become a popular way for established big-box retailers to network and build relationships with indie brands without needing to take the gamble of signing them outright. There’s Ulta Beauty’s Muse Accelerator, Sephora Accelerate and Target Takeoff, all designed to identify early-stage brands with potential and get them into the retailer’s owned environment.

“The easy part [about selecting brands] is we’ve got so much data that tells us what customers are looking for…what solutions they’re looking for,” said Kiper. “There’s just so many trends out there…we’re able to kind of marry customer data and industry data trends and then see what type of brands and suppliers are out there that fit that need,” he said, adding that they expect high growth potential from all brands carried.

In addition to the potential of being stocked at Walmart, brands in the accelerator programme also receive education on how to prepare for a successful launch in the retailer’s doors, mentorship and networking opportunities. Kiper said that while cult appeal is important, brands need to have the muscle to be able to succeed at a larger scale: “When we say scale, we’re talking about 500 to 1,000 stores.”

Walmart began to experiment with luxury beauty via a partnership with the British premium pure player Space NK in 2022. Dedicated “BeautySpaceNK” gondolas with curated products rolled out into almost 250 stores, while 15 brands including Mario Badescu and Slip were also shoppable online. The partnership has grown; Kiper says it now boasts 275 stores.

It’s also expanding its beauty virtual try-on services, which it developed in partnership with AR firm Perfect Corp. Originally launched with cosmetics in October 2023, it now includes hair colour products that can be “tried on” via Walmart’s Apple iOS app. Over 2,200 products can now be virtually sampled.

Category-wise, Kiper said that hair care and cosmetics still dominate, but that skincare is its fastest-growing segment. He still sees more growth potential in hair care, calling it an “entry point” to beauty: “There’s a lot of room: more problems to solve, more solutions needed, whether it’s washing, care or styling.”

Learn more:

ADVERTISEMENT

How New Beauty Brands Are Made

Retail accelerators have offered new founders help breaking into retail and boosting merchandising assortments. Results may vary.

How not to look tired? Make money.

In a rare video this week, the mega-singer responded to sceptics and gave the public a look at what her beauty founder personality might be.

Request your invitation to attend our annual gathering for leaders shaping the global beauty and wellness industry.

Excitement for its IPO is building, but in order to realise its ambitions, more acquisitions and operational expenses might be required.