The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

Hello BoF Professionals, welcome to our latest members-only briefing. China’s colossal size and dynamism makes it a top priority for any global business, but it remains opaque to many in the fashion industry. Leveraging our rare access and local knowledge, the BoF China team demystifies the Chinese market with weekly industry analysis and the wider socio-cultural context you need to sharpen your focus.

NEW YORK, United States — Ruhnn's recent $125 million IPO marked the first time a company of its kind listed on the Nasdaq, or any global stock exchange for that matter. Part incubator, part management company, the Chinese influencer agency (also known as Ruhan) certainly made a splash on the stock market and across the media. But according to some analysts, Ruhnn could also be the last listing of its kind.

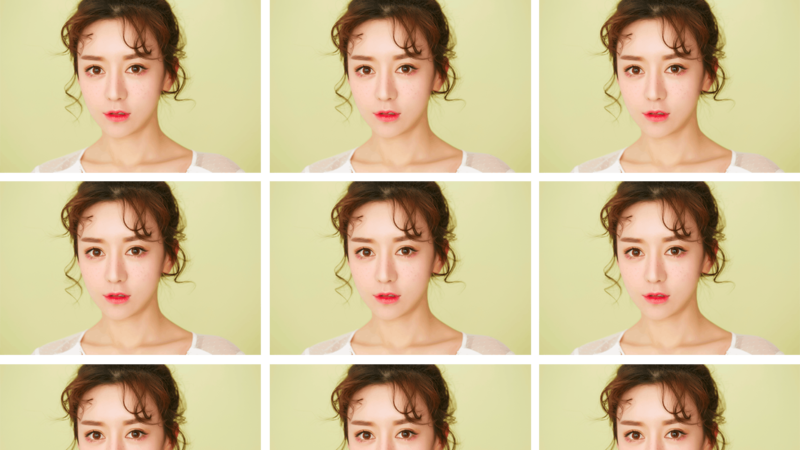

Soon after Zhang Dayi posted a photo of herself and the company chief executive Feng Min ringing the bell at Times Square, Ruhnn’s shares plummeted from $12.5 to $7.85. Zhang is the leading cash cow among Ruhnn’s cohort of 113 KOLs (influencers known locally as ‘key opinion leaders’), a wide-eyed beauty who later took the role of chief marketing officer.

Across Chinese media, the news prompted comments citing the 37.2 percent slip as an indication that China's influencer bubble is on the brink of bursting. "Have the Zhang Dayis of the world peaked?" asked tech and finance media sites alike.

ADVERTISEMENT

The trajectory of Ruhnn does give cause for concern. For many years, it was lauded for disrupting China’s lucrative influencer economy, which CBNData estimated was worth 116 billion yuan ($18.3 billion) by the end of 2018. Beyond incubating and managing talent, the company manages KOLs’ marketing and promotion activities, interactions with followers and brokers transactions with third parties.

Ruhnn's US IPO | Source: Zhang Dayi's Weibo

But according to several sources, Ruhnn's most important revenue stream is something completely different. The bulk of its business is said to be built around the branded e-commerce boutiques of its talent, with Ruhnn overseeing everything from designing products to providing customer service. Techcrunch reported that fashion and other merchandise sold on platforms like Taobao brought in 2 billion yuan ($300 million) in net sales last year, while local media 36Kr says that product sales still make up 88 percent of Ruhnn's total revenues.

Yet, Ruhnn has been haemorrhaging money for the past three years. According to its prospectus, the company reported 40 million yuan ($5.96 million) in net losses in 2017, followed by 90 million yuan ($13.4 million) the following year. Ruhnn did not respond to BoF's request for comment.

"Yes, revenues are coming in, but Ruhnn's costs are inexplicable," wrote billionaire businessman Wang Sicong on Weibo, noting that the company spent a puzzling 150 million yuan ($22.3 million) on marketing.

More worrying is that Zhang Dayi’s success has contributed to half of Ruhnn’s revenues in recent years — 50.8, 52.4 and 53.5 percent in 2017, 2018 and 2019 respectively, to be exact. “This business model is anything but healthy,” Wang continued. What’s more, five years after partnering with Zhang, Ruhnn has failed to fully replicate her success with its army of KOLs — its raison d’être, as an incubator.

Among Ruhnn's hundred-plus talents, "there are three that are considered top-tier influencers — meaning they have sold more than $15 million of goods in the past 12 months," said Ma Rui, the host of Pandaily's Tech Buzz China podcast earlier this month. Ruhnn also manages "seven [KOLs] who are second-tier, meaning they have sold between $5 and $15 million in the past 12 months."

“They only really have one super success story, one unicorn,” says Elijah Whaley, chief marketing officer of Shanghai-based influencer marketing agency ParkLu. “It’s a hard sell from an investors’ standpoint as they haven’t been able to repeat Zhang’s success, and it feels like a stroke of luck.”

ADVERTISEMENT

However, the company isn’t blind to its shortcomings, and has publicly acknowledged that changes are underway. “I don’t think that the company is just sitting there trying to stick to their original strategy,” says Lauren Hallanan, author of “Digital China: Working with Bloggers, Influencers and KOLs.” “They’re trying to pivot to different social media, different content types, different products. They’re [also] collaborating with brands rather than [just] producing their own goods.”

Chonny, one of Ruhnn's KOL stars | Source: Courtesy of Ruhnn

Whaley reckons that Ruhnn’s future is in marketing. “They’re going to provide more marketing services to make up the revenue in selling ads. That’s where the real sweet spot of monetisation is for social media channels, the cheapest and best way is through KOLs.”

Even so, is Ruhnn’s stock plunge an indication that that China has hit peak KOL? Not quite, according to Hallanan. “I think there’s still room for the industry to grow. I don’t think influencers will go away, but there will be a shift to what people engage with and trust.”

At its core, Ruhnn’s failure to create a Zhang Dayi 2.0 highlights that the Chinese market no longer wants homogenised, cookie cutter internet celebrities.

Oversaturated is an understatement when it comes to China's KOL ecosystem. Mid 2018, Weibo counted over 20,000 influencers with more than one million fans each on its platform. And though the figures in China are skewed by notoriously high volumes of bots and fake accounts across its social media platforms, this dwarfs the 3,600 Instagram accounts exceeding one million followers, an estimate by Upfluence for the same period.

China has become a breeding ground for apps that can make everyone — from office workers to ordinary older folks — a KOL. Their user bases say it all: social e-commerce platform Xiaohongshu grew its user base by 300 percent in 2018, and boasted 200 million registered accounts by January 2019, while Douyin, the viral short video app beloved by teens and luxury brands, reported 500 million global monthly active users last year.

Even traditional celebrities are conforming to KOL norms. “We’re seeing celebrities creating more “blogger”-style content,” says Gartner L2's senior editor of research Liz Flora. “This is especially true on Xiaohongshu, where you have a growing number of actresses and pop stars giving beauty tutorials.”

ADVERTISEMENT

I don't think influencers will go away, but there will be a shift to what people engage with and trust.

As a deluge of wide-eyed, photogenic “wanghongs” (Chinese for internet celebrity) flood into the country’s social media platforms, it’s increasingly difficult for brands to assess their credibility and suitability.

"There are too many of them. It's harder to stand out on social media and get traction now," renowned Chinese stylist, consultant and influencer Leaf Greener tells BoF. "The reality of the Chinese market is that if you're not an actor or [a more traditional] celebrity, you won't reach that number of fans anymore."

For consumers, the oversaturation manifests as fatigue. “The content all looks the same in China,” Leaf claims. “You rarely see influencers creating one-of-a-kind content or exploring new formats. It all conforms to one model, and followers are left feeling numb.”

The influx of sponsored content also manifests in a growing lack of trust that some followers feel towards top and mid-tier KOLs. "The environment has changed and people are becoming more suspicious of sponsored campaigns," says Hallanan. "Brands can't stick to their hard-sell tactics." According to a report published by Tencent, shoppers born after the year 2000 no longer look to bigwig KOLs to inform their purchasing choices, but prefer keeping up with what their own friends and micro-influencers are buying.

Though Zhang's feed is currently flooded with content promoting her own apparel and beauty brands JupeVendue and BigEve, she hasn't completely ruled out brand collaborations and has recently worked with Tom Ford Beauty and Chanel Beauty among others. Her 2018 Neutrogena collaboration famously sold 39 sunscreens per second in the first minute the product was released, while a limited-edition mask hit sales of 20 million yuan (around $3 million) in two hours. However, this level of engagement is far from the norm, even for the country's top KOLs.

“Campaigns with a blogger-type influencer alone, even a top-tier wanghong generally don’t make it into the upper echelons of those that drive the most engagement for luxury fashion or beauty brands,” Flora adds. “The main driver of social engagement for brands in China has always been celebrities and that remains the case.”

Shifts are already underway. “We do see a change from ‘horizontal’ to ‘vertical’ influencers," says Alexis Bonhomme, Farfetch’s commercial vice president for Greater China. “Brands are more likely to consider someone with a specific expertise and focus on one single vertical.”

Bonhomme raises the tailor-made activation that CuriosityChina created for Moncler in China as an example. To market the launch of the luxury brand's latest bubble sneakers, Farfetch created a localised campaign with selected influencers: dancers Han Yu, ED and A Suan of the hit reality show "Street Dance of China."

Moncler's Bubble Sneaker campaign | Source: Courtesy of CuriosityChina and Farfetch

“The result was very solid fan engagement on WeChat, Weibo and Douyin, as well as a high level of content creation, fitting not only for the product but also with the local targeted audience.” says Bonhomme.

Looking back at Ruhnn, what does this shift away from homogenised influencers mean for the future of the incubators, agencies and multi-channel networks (MCNs) that have taken China by storm? "These companies are realising that the homogenisation issue is real, and they're working harder to create or foster these unique personas for their influencers, but it doesn't always work," Hallanan continues. "You can create a cool unique persona but if someone is acting the whole time, people will sniff it out."

For Whaley, Ruhnn’s story points to the weakness of an incubation-centric business. “The idea that you would grow KOLs from before they’re hot into massive brands is a very challenging approach,” he tells BoF. “On the other hand, I’m bullish that the future big brands of China will come from KOLs. We’re now seeing the groundwork for what will become competitive brands in five, ten years.”

Looking even further ahead, Whaley is banking on brands hiring KOLs as marketing channels through exclusive long-term contracts, something he’s already seeing happen in China. “We’ve seen capsule projects, but I think brands will be buying KOLs’ entire business in the future,” he tells BoF. “You’re acquiring a brand, a community and a marketing channel you don’t have to pay up the nose for.”

时尚与美容

FASHION & BEAUTY

Source: Louis Vuitton

LVMH Shares Hit Record High as China Demand Resurges

The French owner of brands such as Louis Vuitton, Christian Dior and Celine reported its latest earnings on April 11, revealing first-quarter revenues rose 16 percent to €12.5 billion ($14.10 billion), due in part to a pickup in demand for its luxury goods in the Middle Kingdom. The group posted 15 percent gain in sales across its fashion and leather division, with China driving the sales boom, despite ongoing fears of an economic slowdown. Soon after, the group's share price soared 4.6 percent to €344.95 (around $390) — its highest since listing in 1989. With results that boosted stocks across the luxury sector including for rivals Kering and Hermès, it seems that the group is taking Chinese consumer' repatriation in stride. (Reuters)

Chinese Franchisee Buys LK Bennett

Rebecca Feng, the Chinese franchise partner of LK Bennett, has bought the ailing British womenswear retailer out of administration. It was reported on April 12 that Byland, a new company backed by Feng, managed to outbid Sports Direct owner Mike Ashley for the company's UK, Ireland and wholesale business, though Feng is also hoping to purchase LK Bennett's solvent European arm as well as its US arm, currently in administration. For the year ending 31 July 2017, the company reported an operating loss of £5.9 million (around $7.7 million), and the deal is expected to save over 21 LK Bennett stores, all of the group's concessions and 325 jobs, while 15 points of sale will close, meaning a loss of 110 jobs. (Drapers)

Gentle Monster’s Tmall Debut Pays Off

When it comes to making a splash in the Middle Kingdom, Korean luxury eyewear brand Gentle Monster isn't pulling any punches. Last week, the brand launched a flagship store on Alibaba-owned e-tailer Tmall in addition to a storefront on Tmall's exclusive luxury fashion platform Luxury Pavilion, and celebrated by releasing limited edition eyewear in collaboration with Chinese idol Li Yifeng — only 1,987 pairs were made, correlating with Li's birth year. What's more, ten lucky shoppers were granted access to a preview of the brand's interactive art exhibition in Beijing. The well-rounded launch campaign seemed to pay off, and the sunglasses sold out in under 24 hours. (Alizila)

科技与创新

TECH & INNOVATION

Beijing Wages War on Bitcoin

In a draft list published by China's economic planning body, Beijing declared its intention to eliminate cryptocurrency mining facilities across the country. The agency sought public opinion on a revised list of industries it wants to encourage, restrict or eliminate, and cryptocurrency mining (including that of Bitcoin) was included for its lack of adherence to relevant laws and regulations and unsafe nature among other considerations. However, the agency hasn't specified a target date nor plan for how it would do so in the world's largest market for computer hardware designed to mine cryptocurrencies. (Reuters)

Jack Ma Endorses “996” Lifestyle

Not one to shy away from controversial statements, billionaire Alibaba co-founder Jack Ma wrote a Weibo post further lauding the controversial 12 hour working culture that has reportedly become the norm for Chinese tech workers. "To be able to work 996 is bliss," Ma said, referring to expectations that employees will work 12 hours, six days a week. "If you want to join Alibaba, you need to be prepared to work 12 hours a day, otherwise why even bother joining?" In spite of the backlash that ensued across local social media platforms, he went on to write in the second post, "those who adhere to a 996 schedule are those who have found their passion beyond monetary gains," though he deemed forcing employees to work long hours "inhumane." (Bloomberg)

Firm Sells Stock Footage to Fake Lavish Lifestyles

While China's 400 million-and-growing middle class aspires to the high life, social media has become a stand in for the real deal. For the price of $1.5, Chinese netizens can now buy access to a stock library of stock videos of the interiors of high-end automobiles, luxurious resorts and fine dining meals, to share on their own social media accounts. Users can add their own voice overs to the videos and post them on their WeChat moments (akin to Instagram stories), a practice called "zhuangbi," or faking. In the same vein, other services offer netizens footage of bubble tea and fried chicken — allowing users to post content of their "meals" without having to suffer the unhealthy consequences. (SCMP)

消费与零售

CONSUMER & RETAIL

JD.com staff at a warehouse and distribution facility | Source: Shutterstock

JD.com Denies Employee Suicide Rumours

Chinese e-commerce giant JD.com isn't having a good year. On April 10, the company confirmed reports that an employee committed suicide, citing the deceased's passing as the result of his battle with depression. Amid reports that the company would lay off over 10,000 employees in coming months, a Weibo account by the name dalaofangjianbagua ("大佬坊间八卦") claimed in a post that soon went viral that the ex-employee had participated in an employee housing scheme, but committed suicide after being laid off and demanded by JD.com to repay loans immediately. Two days later, the company responded that the employee had not been dismissed, nor did he participate in the company's property purchase loan programme. It went on to say that legal action would be pursued against the accounts "spreading malicious rumours." (Sohu)

With $1.19 Billion GMV, Secoo Stakes Claim in Duty-Free

Chinese luxury e-commerce site Secoo recently announced its financial results for the year ending December 2018, during which it collaborated with companies such as Shandong Ruyi and Liberty London. As reported, Secoo's revenue increased 27 percent year-on-year to $260.7 million from $210.1 million in the fourth quarter of 2017, while its GMV soared 52.9 percent to just over 8 billion yuan (around $1.19 billion). A mere week before results were released, the company bought a 20 percent stake in China's oldest duty free retailer CNSC and will build a relationship with the latter through brand operation, big data and targeted promotions, omnichannel integration and new retail. The partnership is unsurprising given Secoo's recent deals inked with travel companies Caissa and Utour, and the fact that tourism-related spending accounted for almost eight percent of its GMV last year. (No Fashion)

Can China Save Uniqlo?

The Japanese retailer's stellar performance in the Middle Kingdom is distracting investors from declining revenues at home. As announced by owner Fast Retailing in its mid-term results on April 11, Uniqlo's international business saw a 14.3 percent boost in revenues, due in part to double-digit revenue growth in Greater China for the first half of the year. For the first time, the retailer's international operating profit rate of 15.3 percent beat the same figure for its local business, which saw its operating profits plunge 23.7 percent year-on-year. Domestic performance is no longer the determinant for Uniqlo's overall performance, and investors are taking notice: Fast Retailing's stock surged 6.74 percent in early trading after the results were announced. (China SSPP)

政治、经济、社会

POLITICS, ECONOMY, SOCIETY

Beijing and Washington Pave the Way to End Trade War

By agreeing to set up enforcement offices to monitor implementation of trade pledges, the US and China reached a milestone in their trade talks, it was announced April 11. The issue had previously hindered progress in the thawing of tensions between the superpowers. US Treasury Secretary Steven Mnuchin told CNBC that the parties "are really focused on the execution of the [trade deal] documents" currently under discussion, though a time frame has yet to be provided and companies — plagued by the trade war's effect on tariffs and consumer appetite — wait with bated breath. (SCMP)

Mother Apologises for Kicking Child Model Daughter

A woman has apologised after a video of her kicking her three-year-old daughter mid-photo shoot went viral. On Weibo, the mother wrote, "The girl is my beloved daughter, and she receives the best care and love," by which time the original video had drawn over 117,000 comments. Since then, the topic has prompted over 90 million Weibo mentions, Hangzhou women's federation has also intervened to determine whether the incident constitutes domestic violence, and over 100 childrenswear Taobao merchants issued a joint statement calling for regulation of the country's controversial child modelling industry. The industry cashes into a legal grey area — because many child models don't sign contracts, they're not technically in breach of China's child labour regulations. (Sixthtone)

Black Hole Excitement Sparks Stock Market Speculation

Soon after the first image of a black hole was captured by eight radio telescopes and released on April 10, Chinese companies linked to space telescopes and optical lenses saw their shares surge despite broader market declines. Though none of the country's telescopes were actually used to capture the final image, Phenix Optical surged 9.9 percent, Zhejiang Southeast Space Frame jumped as much as 10 percent, and Shanghai Moons' Electric climbed more than 4 percent, but the boosts were short lived and many stocks closed lower after an early surge, a familiar pattern for the country's mom-n-pop investors, who have been known to cash into stocks with names phonetically similar to President Donald Trump's. (Bloomberg)

China Decoded wants to hear from you. Send tips, suggestions, complaints and compliments to zoe.suen@businessoffashion.com.

With consumers tightening their belts in China, the battle between global fast fashion brands and local high street giants has intensified.

Investors are bracing for a steep slowdown in luxury sales when luxury companies report their first quarter results, reflecting lacklustre Chinese demand.

The French beauty giant’s two latest deals are part of a wider M&A push by global players to capture a larger slice of the China market, targeting buzzy high-end brands that offer products with distinctive Chinese elements.

Post-Covid spend by US tourists in Europe has surged past 2019 levels. Chinese travellers, by contrast, have largely favoured domestic and regional destinations like Hong Kong, Singapore and Japan.