The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

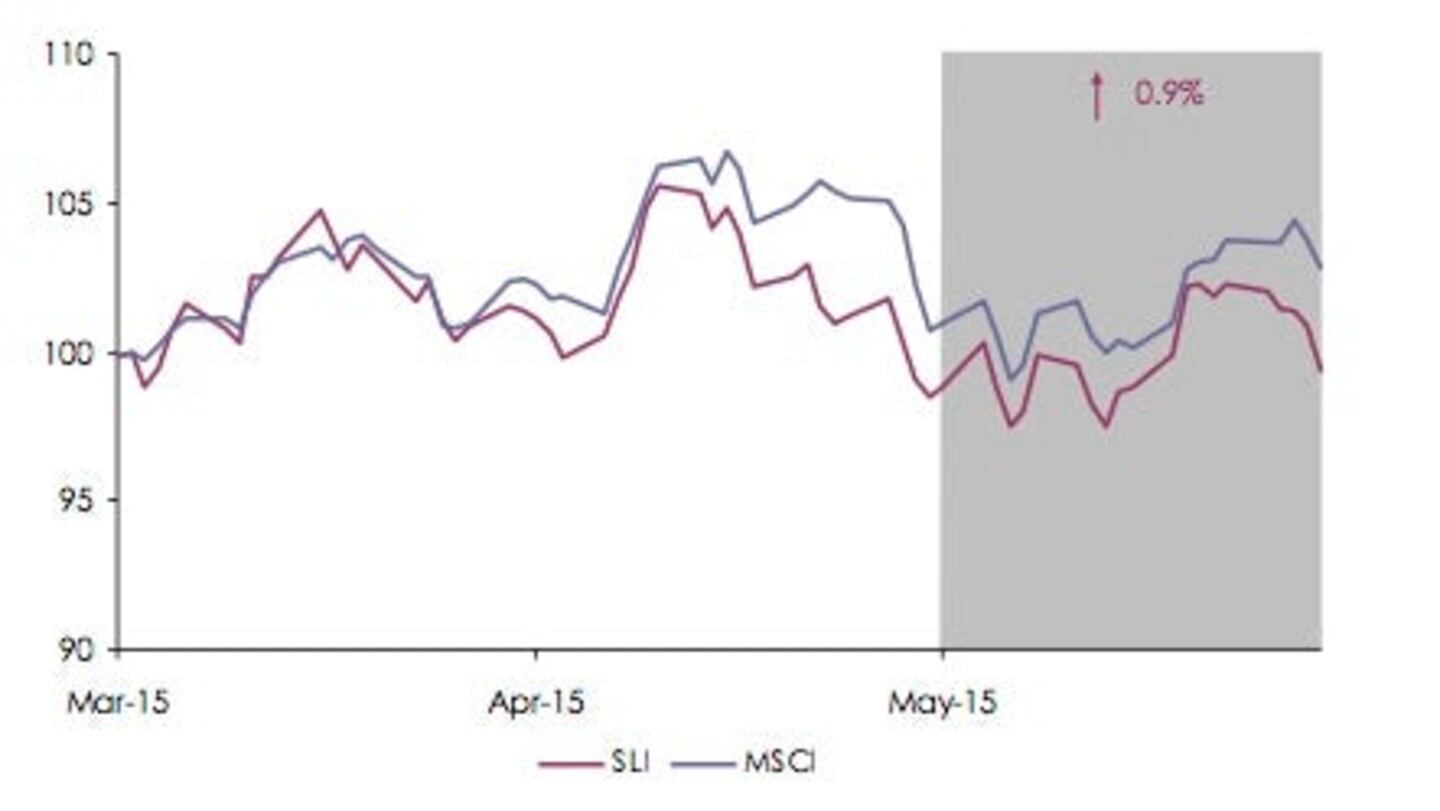

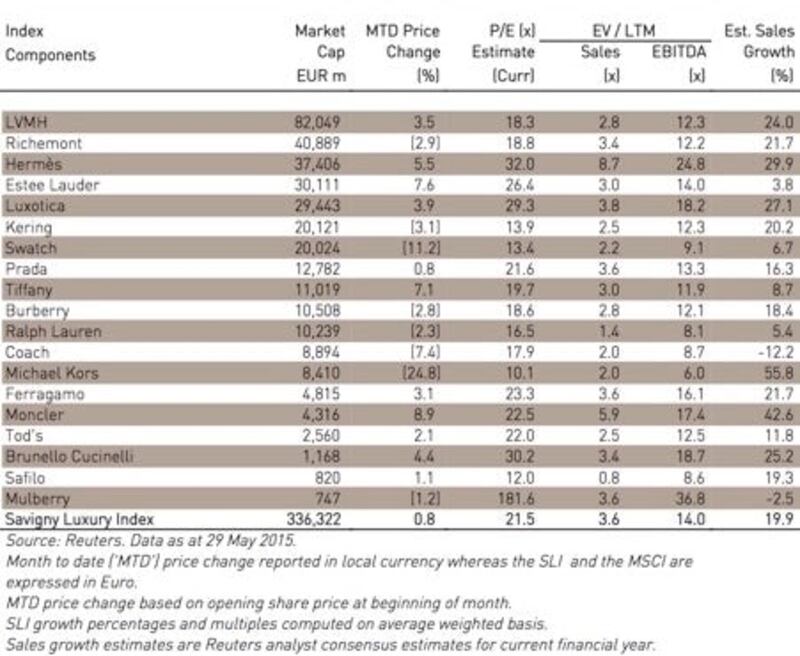

LONDON, United Kingdom — The Savigny Luxury Index ("SLI") ended the month of May up shy of one percent after a bumpy ride, whilst the MSCI World Index ("MSCI") climbed two percent. Currency fluctuations, which in many cases boosted the results of predominantly Euro-based companies, nevertheless created a heightened sense of uncertainty. Hong Kong continued to weigh on the sector's prospects, particularly for watch manufacturers.

Big news

• Whilst overall sector results were good, currency fluctuations provided some twists and turns causing the SLI to jump up and down over the month. The strengthening dollar hit Tiffany's first quarter sales, which would have otherwise risen at constant exchange rates, whilst it benefitted Moncler, Ferragamo and Brunello Cucinelli, who all have a strong footprint in the USA. The Italian companies' results were additionally boosted by a weak Euro relative to Asian currencies. Burberry's year-end results were tempered by a strong British Pound, despite coming in at above expectations with an underlying profit rise of 7 percent.

• Trading conditions in Hong Kong continued to be lacklustre across the board, not only affecting Burberry and Tod's in soft luxury but especially hitting the hard luxury players, for whom Hong Kong remains a strategic market.

ADVERTISEMENT

• Swiss watch exports fell 0.9 percent at current exchange rates in April, following a strong performance in March. Hong Kong saw the biggest contraction with a drop of almost 30 percent; this was somewhat offset by a 48 percent growth in China, driven mainly by temporary re-stocking. The only segment showing growth was affordable watches. Richemont's performance in April echoed this trend, with sales declining by 8 percent, following a strong performance in its year ended March 2015 (sales up 5 percent and EBIT up 10 percent)

• Corporate activity picked up this month. Fiskars signed a definitive agreement to acquire tablewear group WWRD Holdings, owner of Waterford, Wedgwood, Royal Doulton and Royal Albert, for Eur406 million from KPS Capital Partners. The new group will have sales of over Eur1 billion and be distributed in over 10,000 doors globally. Allessandro Dell'Acqua sold a 30 percent stake in his diffusion label No. 21 to manufacturer Gilmar SpA. De Beers acquired a 33 percent stake in laser micro jet company Synova, with a view to using its technology to improve diamond cutting processes and yields. Finally Eurazeo sold one third of its holding in Moncler for Eur340 million. The fund now retains a 15 percent stake in the luxury outerwear company.

Going up

• Moncler's shares hit a record high after it posted strong first quarter results, with sales up 38 percent, boosted by new store openings and like-for-like retail sales growth of 25 percent. Its shares progressed 9 percent during May.

• Estée Lauder beat market expectations with its third quarter results driven by strong performance of its luxury and make-up brands, as well as by the UK and emerging markets. The beauty group's shares rose 8 percent over the period.

• Tiffany surprised the market with better-than-expected first quarter results boosted by tourist spending in Europe and the success of its Tiffany T fashion jewellery line. Despite the unfavourable dollar exchange rate raining on its parade, the jeweller ended the month 7 percent up.

Going down

• Michael Kors lost a quarter of its value in May further to announcing the slowest quarterly sales growth (+17.8 percent) since the company went public. Investors had grown accustomed to quarterly sales growth rates as high as 70 percent. The company also lowered its outlook for 2016, sparking concerns over brand fatigue.

ADVERTISEMENT

• Swatch's share price took a beating, sparked in part by Richemont's announcement that trading in April and May had been slow, which was echoed by the decline in Swiss watch exports for April. The group tried to reassure the market that demand for Swiss watches remained strong and that the industry would weather the difficulties imposed by a much stronger Swiss Franc. Nevertheless the stock ended down 11 percent on the month.

What to watch

Currency fluctuations are set to cause more havoc for the SLI. Many companies have already tempered their outlook for 2015/16 with concerns over exchange rate movements. In an increasingly complex industry with a truly global supply chain model, it may become increasingly difficult to untangle the impact of these movements on individual players.

Sector Valuation

In 2020, like many companies, the $50 billion yoga apparel brand created a new department to improve internal diversity and inclusion, and to create a more equitable playing field for minorities. In interviews with BoF, 14 current and former employees said things only got worse.

For fashion’s private market investors, deal-making may provide less-than-ideal returns and raise questions about the long-term value creation opportunities across parts of the fashion industry, reports The State of Fashion 2024.

A blockbuster public listing should clear the way for other brands to try their luck. That, plus LVMH results and what else to watch for in the coming week.

L Catterton, the private-equity firm with close ties to LVMH and Bernard Arnault that’s preparing to take Birkenstock public, has become an investment giant in the consumer-goods space, with stakes in companies selling everything from fashion to pet food to tacos.