The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

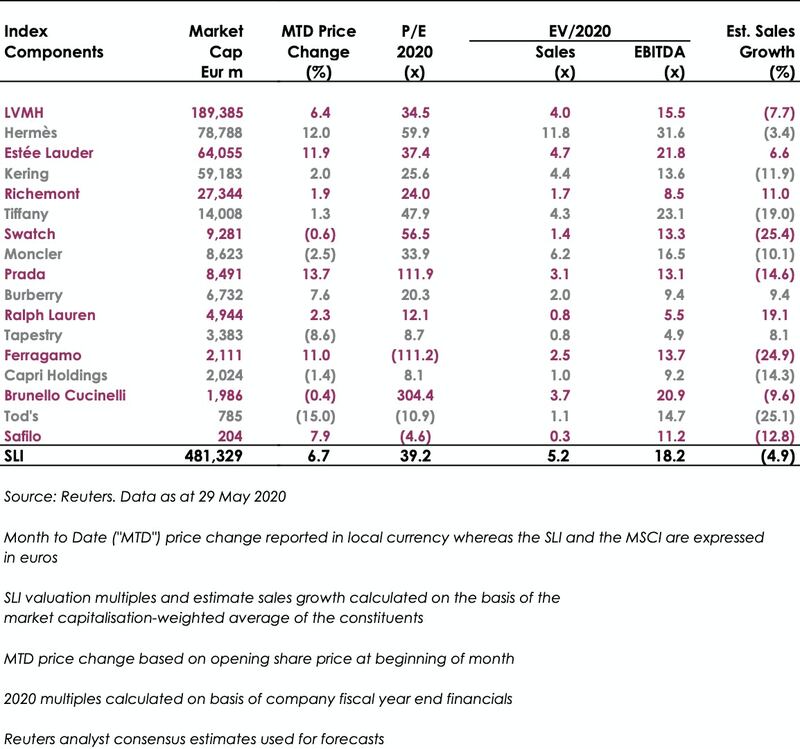

LONDON, United Kingdom — Luxury has never been more valuable, according to the Savigny Luxury Index (SLI), our company's measurement of the performance of 17 listed groups representing over 150 of the largest luxury brands in the world. The SLI's forward EV/EBITDA (enterprise value/earnings before interest, taxes, depreciation and amortisation) multiple crossed the 18x threshold for the first time since we have been covering the sector for BoF. This is against the backdrop of (anticipated) tough results for the second quarter, when the pinch of lockdown was felt the most and an expected industry decline of anything between 20 to 35 percent for the full year (according to a report by Bain & Co.). Yet positive news came with reports of recovery in China, notably at Prada, Burberry, Ralph Lauren, Tod's, Ferragamo and Estée Lauder, as well as a surge in online sales.

Stores in Europe and America also started to reopen this month, accompanied by anecdotes of queues around the block with local customers eager to spend their way out of lockdown. Nevertheless, this can only be considered a soft opening, as international travel and tourism have not resumed yet. In Europe, it is estimated that between 35 and 55 percent of luxury sales are generated by international tourists, who will only return gradually.

The fashion business model is once again being put into question, after many years of ever-grander shows, travelling collections and jam-packed schedules. Covid-19 seems to have knocked some sense into the industry, with many brands announcing a break from the fashion week circuit (Gucci, Saint Laurent and Armani, to name a few) with others (including Proenza Schouler and Dries Van Noten) calling to align the presentation of their collections with the appropriate season. A re-think of fashion's supply chain (more local?) and the usefulness of the constant influx of novelty (less waste?) triggered by Covid-19 would also work very well in the current zeitgeist of sustainability-first.

Two bankruptcy-related transactions took place this month. Neiman Marcus filed for bankruptcy as its crippling $4 billion debt burden left it with no headroom to navigate the Covid-19 crisis. The luxury department store group's creditors have agreed to acquire a majority stake in the company via a debtor-in-possession (DIP) transaction and to provide short-term liquidity to the business. American contemporary brand John Varvatos was acquired out of bankruptcy by private equity firm Lion Capital.

ADVERTISEMENT

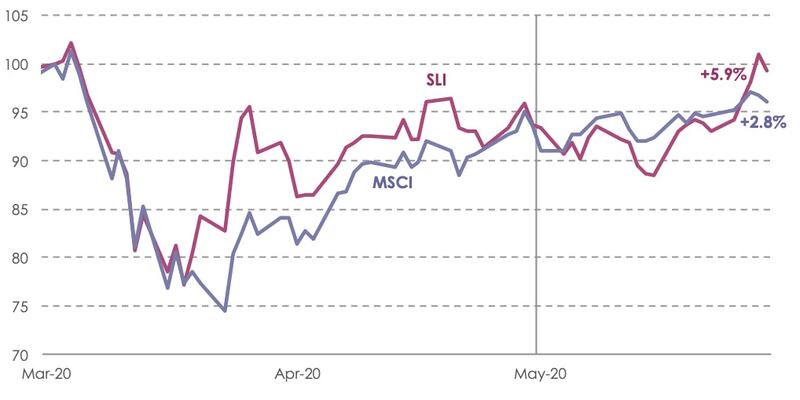

The SLI gained almost 6 percent this month, outperforming the MSCI by just over 3 percentage points, on the back of further evidence of post-Covid-19 recovery in China and the welcome gradual easing of lockdown measures in Europe and the USA.

SLI versus MSCI

SLI Graph May 2020

Going Up

Going Down

What to Watch

Luxury groups are hoping to return to normal business from year-end onwards. Ralph Lauren expects China to return to pre-Covid growth in the second half, while Brunello Cucinelli is looking to 2021 and 2022 for a buoyant and sizable recovery of the business. But the world will have somewhat changed by then, and groups will have to adapt their business practices accordingly. In the aftermath of the 2008 financial crisis, the luxury sector demonstrated remarkable flexibility in restructuring its supply chain to focus on inventory management and used a laser-sharp focus to capitalise on the growing appetite for luxury by Chinese consumers.

This time round, luxury players have seriously upped their online game with immediate results. The fashion sector is also looking to simplify its supply chain and its annual rigmarole of collections. We look forward to seeing other developments in this emerging new reality.

ADVERTISEMENT

Sector Valuation

Pierre Mallevays is the founder and managing partner of Savigny Partners LLP, a mergers & acquisitions advisory firm focusing on luxury brands and retail.

In 2020, like many companies, the $50 billion yoga apparel brand created a new department to improve internal diversity and inclusion, and to create a more equitable playing field for minorities. In interviews with BoF, 14 current and former employees said things only got worse.

For fashion’s private market investors, deal-making may provide less-than-ideal returns and raise questions about the long-term value creation opportunities across parts of the fashion industry, reports The State of Fashion 2024.

A blockbuster public listing should clear the way for other brands to try their luck. That, plus LVMH results and what else to watch for in the coming week.

L Catterton, the private-equity firm with close ties to LVMH and Bernard Arnault that’s preparing to take Birkenstock public, has become an investment giant in the consumer-goods space, with stakes in companies selling everything from fashion to pet food to tacos.