The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

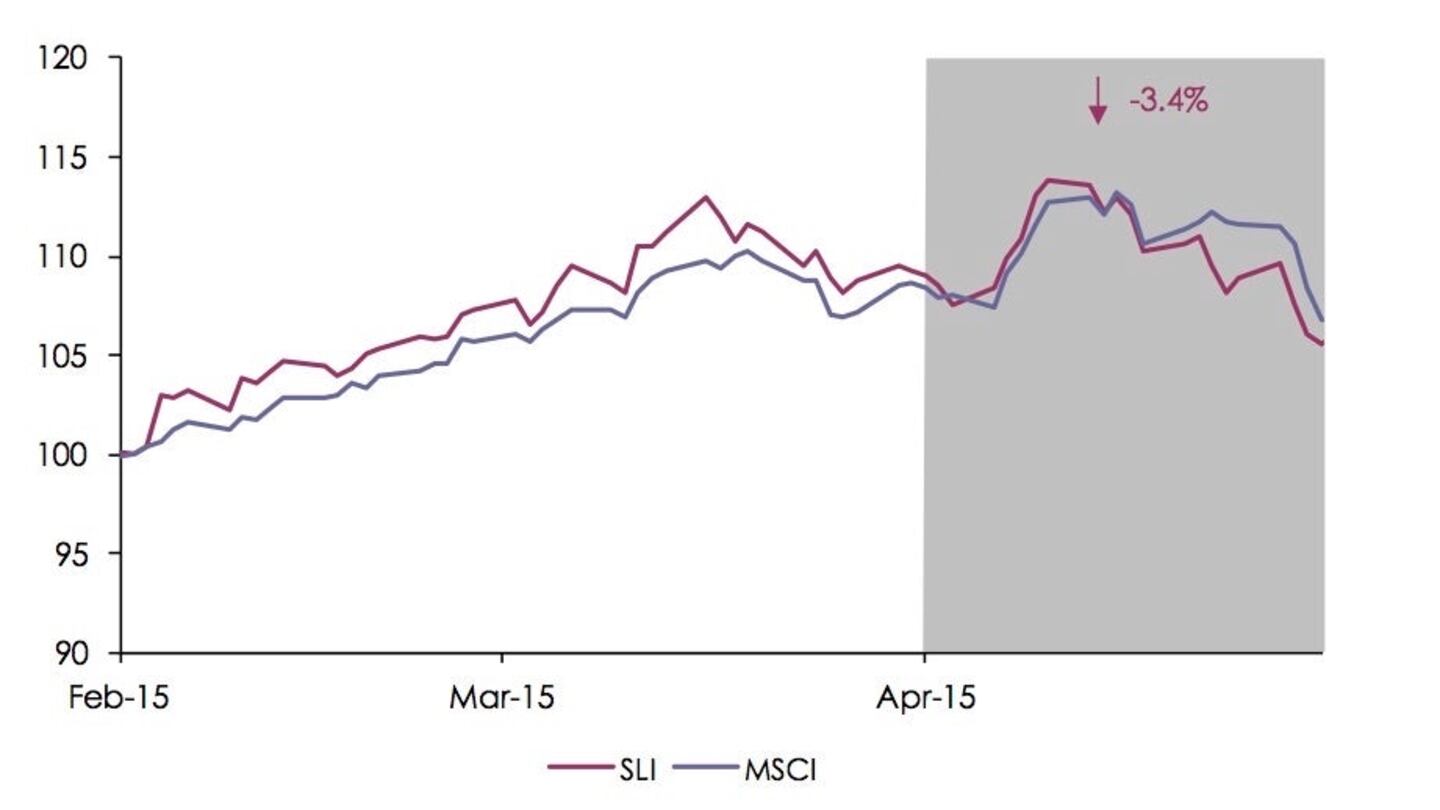

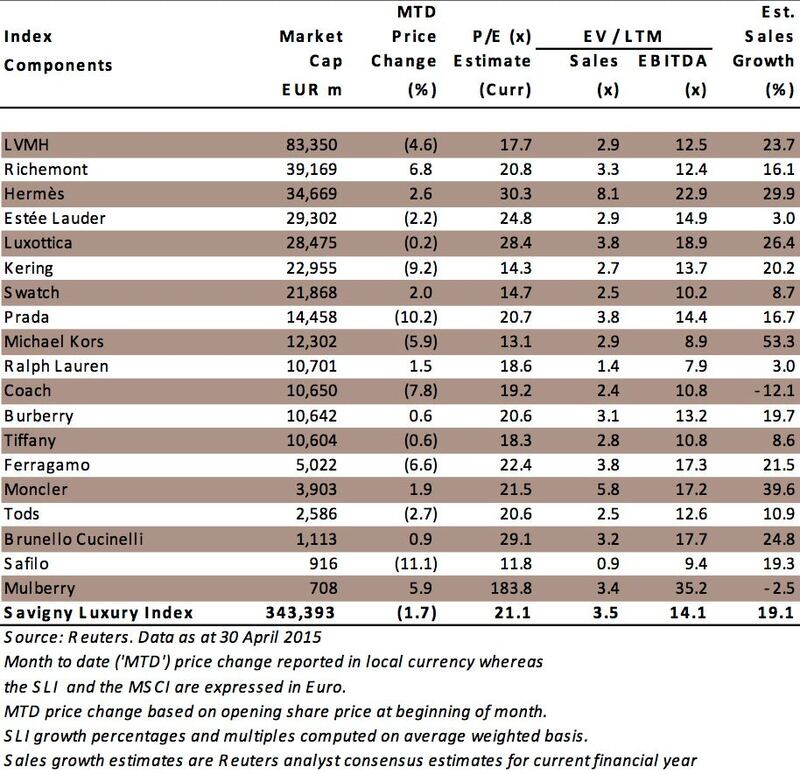

LONDON, United Kingdom — The Savigny Luxury Index ("SLI") fell sharply this month, losing more than two percent, driven by disappointing first quarter results. The MSCI World Index ("MSCI") over performed the SLI by almost three percent.

Big news

• Most luxury groups are still pondering over widening price differentials. Price cuts in Asia to combat parallel trading by Chanel, Richemont's Cartier, Patek Philippe and Burberry have set a strong precedent. Others, such as Prada and LVMH, are opting to rebalance their merchandising strategy rather alter their price structure, preferring to take time rather than "act in emergency" and keep a degree of flexibility.

• Many luxury players posted disappointing results. LVMH's leather and fashion division's sales were weak, Kering suffered a bigger than expected drop in sales at its flagship brand Gucci, Coach posted its worse decline in sales in North America in seven quarters and Richemont announced a profit warning. This negative news flow took a toll on the SLI.

ADVERTISEMENT

• Chinese luxury spending in Europe soared by 122 percent in March after a 52 percent rise in February, bringing the increase for the first quarter to 67 percent, said VAT refund company Global Blue. Demand was spurred by the double effect of a weak euro and a recently-introduced shorter visa process (48 hours).

• Richemont's stock witnessed the highest increase this month (up 6.8 percent) despite its profit warning. Investors were reassured that the announced decrease in profitability at the watch and jewellery group is due in large part to non-cash translation losses relative to how its cash pile is accounted for.

• Mulberry's share price rose by almost 6 percent, boosted by better than expected full-year profits helped by an improving retail demand.

Going down

• Safilo fell by more than 11 percent after it posted a decrease in net profit in its first quarter results due to the restructuring of its distribution network and the upgrade of its supply chain.

• Prada's stock slumped over 10 percent following disappointing annual results. It will take a little longer than expected to restore growth and significantly improve margins.

• Kering's share price has lost more than 9 percent this month, after posting a bigger than expected sales drop for its flagship brand Gucci, which it blamed on a transition period.

What to watch

Online annual luxury goods sales have been growing at 15-25 percent while the industry average has slumped to about 5 percent. Yet many luxury players have been slow to invest in e-commerce. We highlighted in our last letter the merger of Yoox and Net-a-Porter. Immediately after the deal was unveiled, Chanel said it would start retailing online next year. LVMH chairman and chief executive Bernard Arnault said at the group's recent annual general meeting that "more and more products would be sold online" and the group was "currently adapting to this situation." Customers now demand an omni-channel experience. Could this merger have finally set an inflexion point for the industry?

In 2020, like many companies, the $50 billion yoga apparel brand created a new department to improve internal diversity and inclusion, and to create a more equitable playing field for minorities. In interviews with BoF, 14 current and former employees said things only got worse.

For fashion’s private market investors, deal-making may provide less-than-ideal returns and raise questions about the long-term value creation opportunities across parts of the fashion industry, reports The State of Fashion 2024.

A blockbuster public listing should clear the way for other brands to try their luck. That, plus LVMH results and what else to watch for in the coming week.

L Catterton, the private-equity firm with close ties to LVMH and Bernard Arnault that’s preparing to take Birkenstock public, has become an investment giant in the consumer-goods space, with stakes in companies selling everything from fashion to pet food to tacos.