The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

ZURICH, Switzerland — Cie. Financiere Richemont SA, the world's largest jewelry maker, reported first-half operating profit that missed analysts' estimates as luxury-goods demand in Asia weakened.

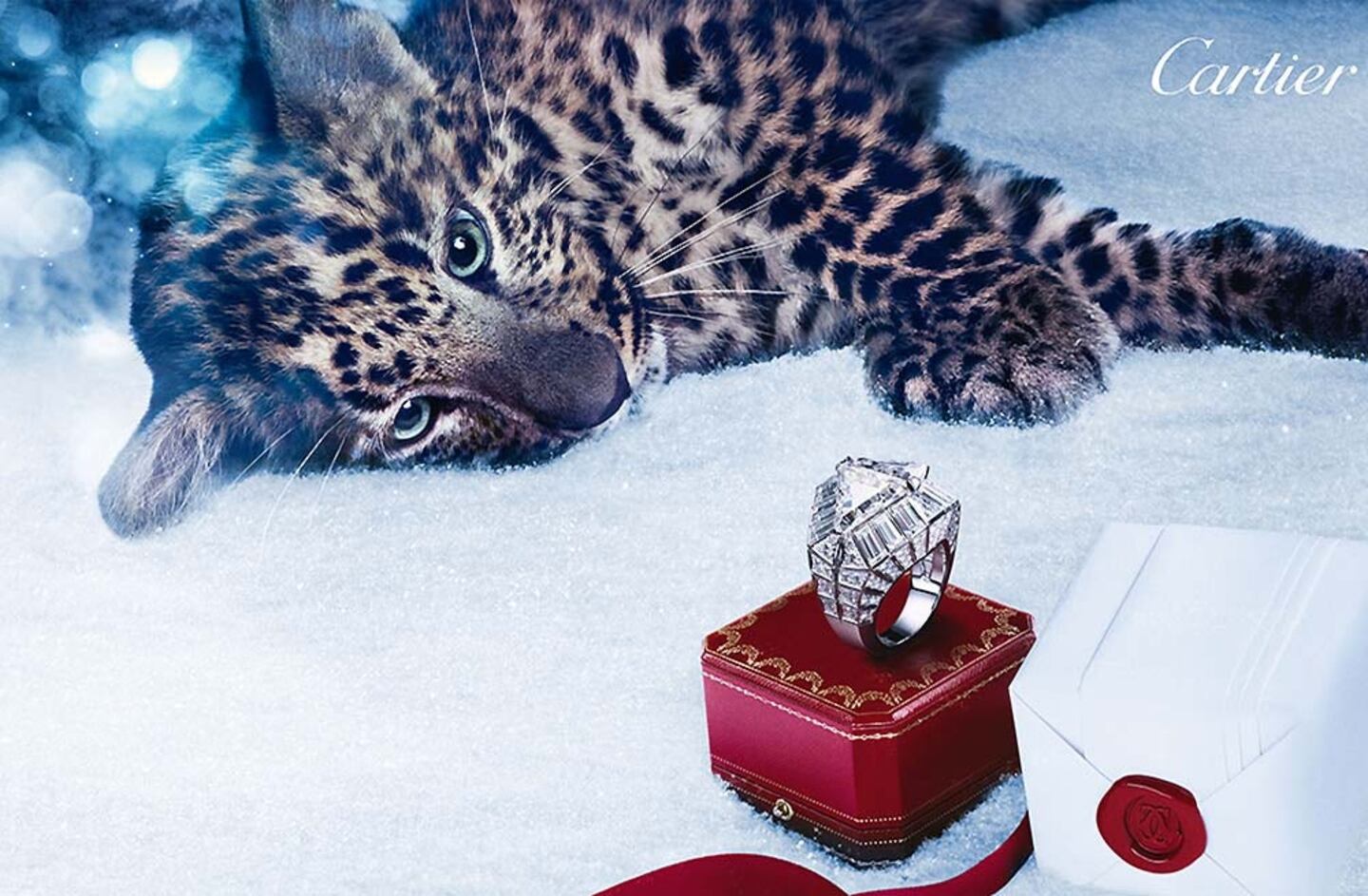

Operating profit dropped 4 percent to 1.31 billion euros ($1.6 billion) in the six months through September, the Geneva- based owner of the Cartier and Montblanc brands said in a statement today. Analysts had expected 1.35 billion euros, according to the average analyst estimate compiled by Bloomberg.

"The external environment remains difficult ahead of the holiday trading period," Chairman Johann Rupert said in the statement.

Luxury-goods makers such as LVMH Moet Hennessy Louis Vuitton SA and Burberry Group Plc have been reporting weaker Asian consumption due to pro-democracy protests in Hong Kong and the Chinese government's crackdown on bribery and extravagant spending.

ADVERTISEMENT

Richemont on Sept. 17 posted the slowest start to a year since 2009. The stock has dropped 13 percent in the past 12 months. That compares with a 2.3 percent decline in Hermès International SCA, which reported third-quarter sales that beat analysts’ estimates yesterday, as well as a 14 percent decline in watch revenue.

Demonstrators in Hong Kong, where wealthy Chinese buy watches and jewelry to avoid mainland China’s luxury taxes, blocked streets and caused shops to close in September and October. The pro-democracy protests coincided with one of the busiest times of the year, the China National Day holidays known as Golden Week.

“We see more risks to Chinese luxury demand than initially expected,” Francesca Di Pasquantonio, an analyst at Deutsche Bank AG in Milan, wrote in a note dated Nov. 3. “In the framework of weaker growth from Chinese consumers, destocking in the trade may be a cause of further pressure.”

Richemont has about 20 brands, including Vacheron Constantin, a 259-year-old Swiss watchmaker, and Giampiero Bodino, a Milan-based high-end jewelery label it added last year.

In 2020, like many companies, the $50 billion yoga apparel brand created a new department to improve internal diversity and inclusion, and to create a more equitable playing field for minorities. In interviews with BoF, 14 current and former employees said things only got worse.

For fashion’s private market investors, deal-making may provide less-than-ideal returns and raise questions about the long-term value creation opportunities across parts of the fashion industry, reports The State of Fashion 2024.

A blockbuster public listing should clear the way for other brands to try their luck. That, plus LVMH results and what else to watch for in the coming week.

L Catterton, the private-equity firm with close ties to LVMH and Bernard Arnault that’s preparing to take Birkenstock public, has become an investment giant in the consumer-goods space, with stakes in companies selling everything from fashion to pet food to tacos.