The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

BEIJING, China — Yet another Chinese technology company is headed for an initial public offering.

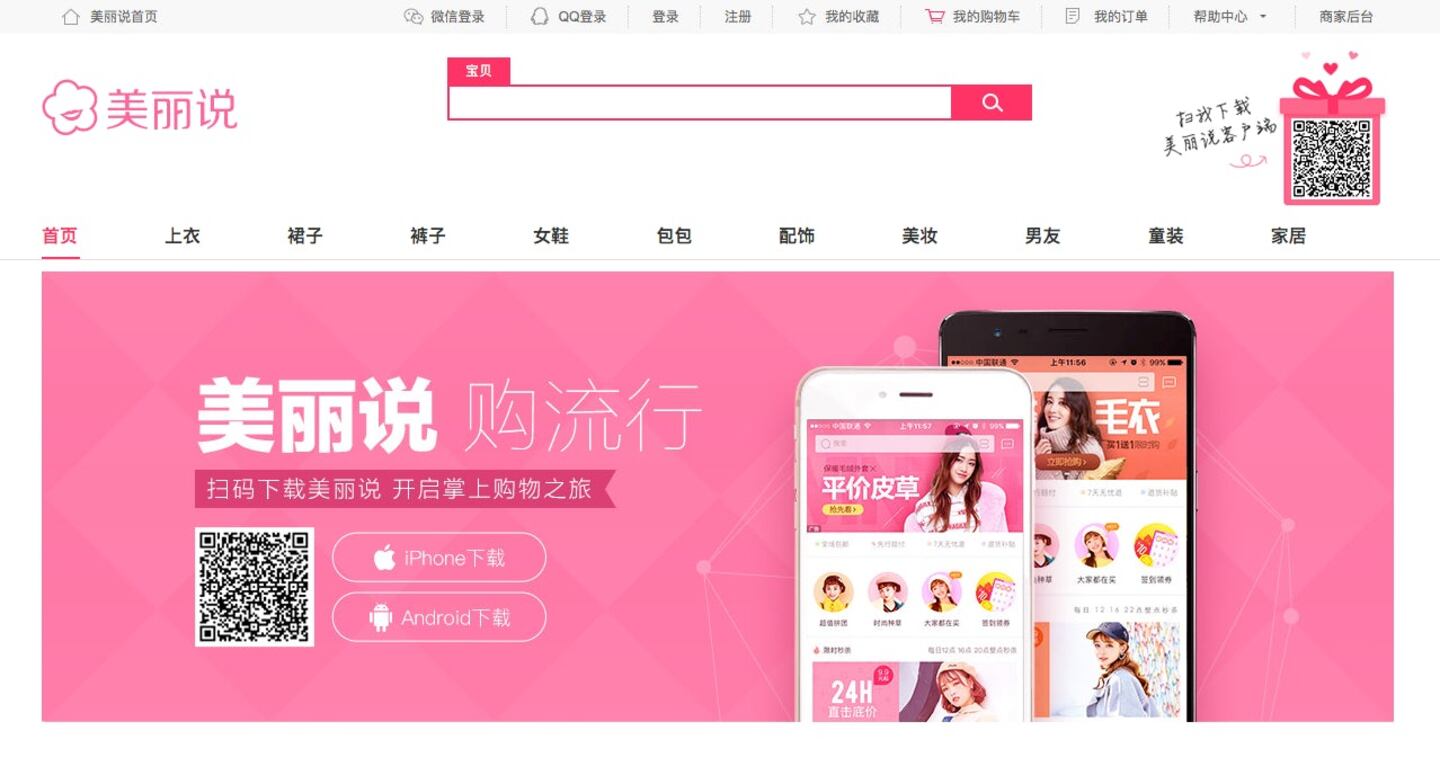

Meilishuo, the online fashion retailer backed by Tencent Holdings Ltd., is in talks with several investment banks about a US initial public offering that could value the start-up at about $4 billion, according to people familiar with the matter. The women-focused e-commerce company hosted a so-called bake-off to discuss IPO prospects with potential advisors and underwriters, the people said, asking not to be identified talking about private negotiations.

Meilishuo, which merged with rival Mogujie in 2016 to form a company with $3 billion in sales, was said to have been valued at $3 billion at the time of that deal. The company, whose name means “Beauty Talk,” is one of the more popular fashion and cosmetics retailers online, a niche it’s clung to despite the dominance of Alibaba Group Holding Ltd. and JD.com Inc. Meilishuo’s envisioned $4 billion valuation is an initial target and could change if a deal proceeds, the people said.

It’s one in a growing wave of Chinese technology companies looking to sell shares to the public. Smartphone maker Xiaomi Corp. is seeking a valuation of as much as $100 billion in a much-anticipated offering, people familiar with the matter have said, while Meituan Dianping, a Chinese food review and delivery giant also backed by Tencent, has begun discussions about a Hong Kong IPO at a valuation of at least $60 billion.

ADVERTISEMENT

Meilishuo, which didn’t respond to requests for comment, was said to have considered a US as early as two years ago.

Meilishuo, founded in 2009, runs an online marketplace selling clothes, shoes and handbags. As of 2016, it had about 15,000 merchants on its website and a mobile application that had been downloaded 100 million times. That year, it merged with Mogujie, founded in 2011 with about 130 million registered users.

By: Lulu Yilun Chen, editors: Robert Fenner, Edwin Chan, Peter Elstrom.

In 2020, like many companies, the $50 billion yoga apparel brand created a new department to improve internal diversity and inclusion, and to create a more equitable playing field for minorities. In interviews with BoF, 14 current and former employees said things only got worse.

For fashion’s private market investors, deal-making may provide less-than-ideal returns and raise questions about the long-term value creation opportunities across parts of the fashion industry, reports The State of Fashion 2024.

A blockbuster public listing should clear the way for other brands to try their luck. That, plus LVMH results and what else to watch for in the coming week.

L Catterton, the private-equity firm with close ties to LVMH and Bernard Arnault that’s preparing to take Birkenstock public, has become an investment giant in the consumer-goods space, with stakes in companies selling everything from fashion to pet food to tacos.