The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

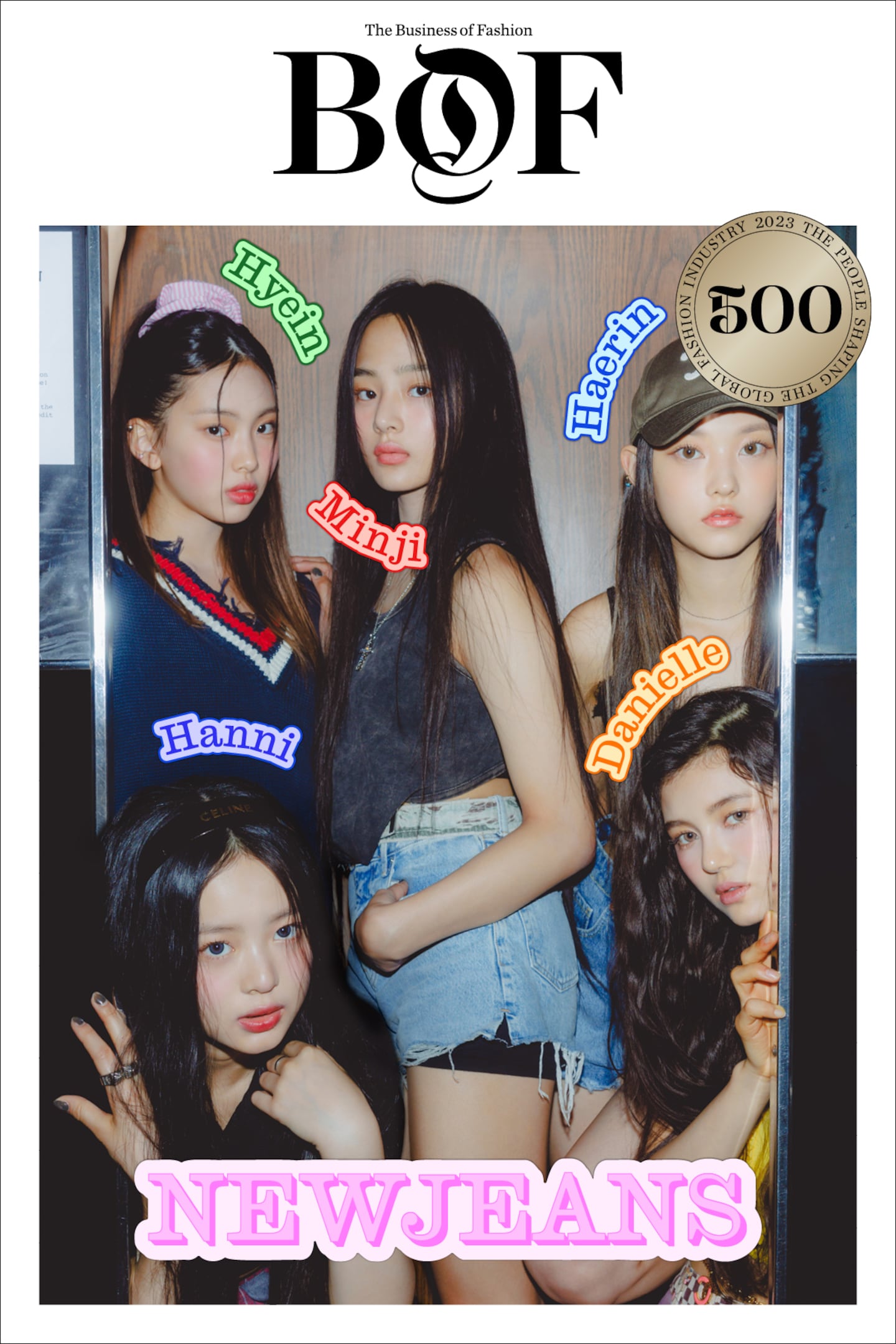

In early October, the throng of cheering spectators outside Louis Vuitton’s latest fashion show spilled onto the Champs-Élysées, barely contained by the metal barricades the security team had erected to maintain order. Amongst the loudest were fans of Hyein, the youngest member of K-pop sensation NewJeans, who made an appearance as a brand ambassador for the French mega-label.

Major K-pop acts like Blackpink and BTS have lit up fashion weeks in recent years, creating valuable buzz for the brands that signed marketing deals with them. Now, some insiders predict that NewJeans will be the next South Korean act to become a major force in fashion. The girl group’s five members have already inked high-profile contracts with top luxury houses: Minji with Chanel, Hanni with Gucci, Danielle with Burberry, Haerin with Dior and Hyein with Louis Vuitton.

NewJeans’s rapid ascent has been unlike anything the K-pop industry has seen before. When the group debuted in July 2022 with its single “Attention,” the track was successful in getting the group exactly that. Alongside their deals with luxury brands, the members of NewJeans have also been tapped by household names like Apple, Coca-Cola and McDonald’s, and taken turns doing solo covers for the South Korean editions of major fashion titles, from Vogue to Harper’s Bazaar. Nearly 10 million people follow the group on Instagram, up from 3 million just five months earlier.

“No K-pop group has had this momentum,” said Paul Jeong, co-founder of Altm Group, a company that advises fashion brands on celebrity partnerships in Asia. “Part of that is [other Korean bands like] BTS and Blackpink starting the conversation for them but in terms of endorsements even Blackpink didn’t have this many endorsements this early on.”

ADVERTISEMENT

Blackpink snagged contracts with brands such as Adidas while individually members of the girl group are the faces of Chanel, Calvin Klein, Dior, Cartier and more, but those deals were several years in the making. The fashion industry’s response to NewJeans has been far faster.

Positioning NewJeans as the direct successor to boy band BTS — a rare K-pop act that had a genuine mainstream breakthrough to western markets — could also be selling them short. BTS’ seven members have contracts with the likes of Louis Vuitton, Dior, Calvin Klein, Valentino and others, but the rapid expansion of the K-pop market — a Bernstein report predicts K-pop could generate around $10 billion in annual revenue by 2030, or roughly double its current value — suggests that NewJeans could ride a wider cultural wave that pushes the magnitude of its influence past that of BTS.

The K-pop phenomenon is growing fast around the world as digital content services extend the reach of hallyu, the broader wave of Korean culture that has swept the globe in recent decades. In western markets like the US and Europe, K-pop is going mainstream, prompting some to compare its rise to the explosion of hip-hop over the last half century. And just as the mainstreaming of hip hop birthed endless marketing opportunities, the fashion brands that align themselves with K-pop are betting that they will find themselves sitting on a goldmine of cultural capital.

When NewJeans burst onto the scene, their “back to basics” approach recalled K-pop girl groups from the Nineties like SES, said Suk-young Kim, associate dean at UCLA’s school of theatre, film and television and the author of the book K-pop Live: Fans, Idols and Multimedia Performance. “The name references something classic but also fresh. It’s like a pair of jeans. It’s something that we all have but something new is added to that.”

They abandoned the bombastic in-your-face concepts that had become a winning formula for K-pop girl groups of late. Instead of dramatic outfits and CGI-filled music videos, they were styled demurely. Their vibe is laidback, fun and cutesy. In a Zoom interview with BoF, the girls opted for simple red, black, and white basketball jerseys. The only makeup detectable on the computer screen was rosy blushed cheeks. Their hairstyles featured heavy bangs and high-swept ponytails.

“We’re heading off to perform at a university so this is our outfit,” Hanni explained. “But we do really like this jersey and sporty feel,” noting that it’s not too dissimilar to what they wore for part of their lead single music video.

“Our music is often associated with nostalgia,” said Hyein, attributing their ‘90s and Y2K-influenced fashion choices to their musical style. However, their current look is evolving. “What we’re doing right now is going through a curve to find new concepts, to find the best things for us.”

Their style isn’t the only thing that has challenged K-pop conventions. The music NewJeans released broke away from typical song structure as their tracks don’t include the standard rap bridge or a dramatic climax of soaring vocals. Their music also has a noticeably global slant to it, with influences as disparate as Jersey club kicks and the skittery percussion of UK garage.

ADVERTISEMENT

“They don’t exhaust listeners with big, glitzy pop peaks. Their melodies are simple and sleek, often delivered in an aloof style just beyond a whisper,” said Nick James, who runs the blog The Bias List, a K-pop reviews site. If NewJeans’ songs are put on loop, he added, “without paying attention, you’d scarcely realise when the song ended and started over again.”

That might sound like faint praise, but NewJeans’ ultra-catchy hooks generously repeated is precisely what gives their music its addictive quality. It’s the audio equivalent of snacks that melt in your mouth, tricking your brain into believing you’re not consuming as much as you actually are. A listener can finish their two EPs or scroll through eight different versions of the NewJeans “Hype Boy” dance challenge on TikTok without even noticing. “This is the point, and from a business perspective it’s really quite genius,” said James.

While the girls are a force as a quintet, each member is on a path to become a full-fledged star in her own right. Fashion brands have been carefully analysing how each is being positioned.

Minji, 19, as the oldest member has an “unnee” (older sister) quality about her. Because of her classic and elegant look, she secured a Chanel ambassadorship across fashion, beauty, watches and jewellery. She can speak some English thanks to the time she spent in Canada, but for western audiences it’s usually native English speakers Danielle, who is half Korean and half Australian, and Hanni, who is Australian, who take the lead on talking for the group.

Hanni, also 19, has more spunk and is often said to be the best dancer of the group. She’s signed deals with Gucci and Armani Beauty. Danielle, 18, is known among fans for her sunny, bubbly personality. From a young age she has been in front of the cameras as she got her start as a child actor. Burberry snapped her up to represent the house, while for beauty she has a contract with Saint Laurent.

Haerin, 17, is known for her cat-like features and personality, and is the most introverted of the girls. Since April, she’s been a Dior ambassador for fashion, beauty and jewellery. Hyein, 15, is an ambassador for Louis Vuitton. The youngest and the tallest of the group, she has the closest to a traditional runway physique, a quality that carries weight with certain brands.

But a girl’s popularity can vary significantly by market. On Naver, the dominant Korean search engine, the most popular member is Minji, who is something of a golden child for South Korea, then Hanni, Haerin, Hyein and Danielle. Google shows a very different pecking order. The most Googled member is Hanni, followed by Danielle, Hyein, Haerin, and Minji.

The K-pop market is set to grow at a 12 percent CAGR between 2022 and 2030, in line with the larger market for all things Korean or hallyu, according to Bernstein. In June, Netflix committed $2.5 billion of investment in Korean content over the next four years, and platforms like YouTube, Amazon Prime, Apple TV and Spotify, which collectively count 520 million subscribers, are also investing heavily into the space.

ADVERTISEMENT

In the Nineties and early 2000s, when acts like HOT, SES, Finkl and BoA were popular, the market size for K-pop was around $200 million, according to Bernstein, and it was predominantly a domestic affair. The second generation of K-pop falls roughly between 2005 and the 2010s, the period for Big Bang, Wonder Girls and Girl’s Generation. At the time, the market expanded to $2 billion thanks to growing popularity across the Asia region, although its audience outside of Korea remained limited.

By the time BTS and Blackpink arrived on the scene, in 2013 and 2015 respectively, the market had exploded to $5 billion thanks to the mainstreaming of the K-pop industry in China, Japan and Southeast Asia. Currently, K-pop is nowhere near the size of leading genres like hip-hop in the US and Europe — a report from music industry publication Trapital estimates that hip-hop accounts for a third of all music revenue in the US — but there are signs that the Korean genre is growing fast.

“I think it’s amazing to see how K-pop has grown over the years,” said Danielle. “I believe that music is a universal language that transcends.”

Meanwhile, Hybe, parent company of NewJeans’ record label and one of South Korea’s big four entertainment agencies, has decided to transplant its methodology of manufacturing stars to the west. It teamed up with record label Geffen for a show called The Debut: Dream Academy, a singing competition where winners are given a spot in a future US-based girl group. The show, which launched at the start of September and is on YouTube, tracks international hopefuls who undergo K-pop style training. Each episode typically attracts hundreds of thousands of views, and the show will be featured in a Netflix documentary series next year.

Fashion designer Humberto Leon, who formerly ran Kenzo and co-founded US-based boutique Opening Ceremony, was tapped to work with the 20 girls on the show as creative director.

“When you look at BTS, Le Sserafim or NewJeans, I think they’re entering culture and they have a voice,” Leon said, adding that Hybe is “pushing the boundaries of what K-pop could be. To me, [Hybe chairman Bang Si-hyuk] is a leader in looking at how K-pop could be global and bringing those artists to people all around the world.”

If NewJeans is any indication, then Korean pop music is well on its way to a more diverse audience. The group became the first K-pop band to achieve the million-seller milestone with their debut album landing two songs “Ditto” and “OMG” on the Billboard Hot 100. It also broke the Guinness World Record as the fastest K-pop act to reach one billion streams on Spotify.

It’s no coincidence that their songs contain a relatively high proportion of English lyrics and that the group films in overseas locations. This makes their output more relatable to non-Koreans, albeit in subtle ways. The group is also making a concerted effort to reference cultural touch points across the entertainment spectrum that are distinct from those of their peers.

A case in point is the music video for “Cool With You,” which features Hoyeon from Squid Games, a global hit for Korean content, playing opposite a love interest who is noticeably not Asian. It also included a cameo by the Hong Kong actor Tony Leung, a cinema legend who is popular across Asia.

Hybe has taken the huge hype around the group and parlayed that into a powerful endorsements juggernaut. The number, speed and quality of NewJeans’ brand partnerships is largely thanks to Min Hee-jin, chief executive of the band’s record label Ador, a Hybe subsidiary, and her track record in the industry as the producer behind a string of hit groups including Girls’ Generation, Shinee and EXO.

“She is a symbol of successful K-pop bands over the last ten years,” said Bernstein analyst Bokyung Suh, who covers the K-pop industry. “She already got some of the [luxury brand] ambassadorship offers even before launching the team.”

Luxury spending in markets like China and the US dwarfs that of South Korea, but South Korean nationals are now the world’s biggest spenders on luxury goods per capita, according to Morgan Stanley, a fact that helps explain why some luxury houses are eager to partner with K-pop idols even before they have a regional or global fanbase.

Luxury’s enthusiasm for Korean pop stars — and NewJeans in particular — is evident in the way partner brands fawn over them. When Gucci tapped Hanni, the Italian house said her “take on music and fashion style truly encompasses the brand’s motif of embracing authentic individuality and self-expression.” When Haerin was announced by Dior as an ambassador, the French brand characterised it as “a unique friendship in the name of creativity”.

Although most of the group’s partnerships are with global megabrands, NewJeans does work with smaller companies. Through their ambassadorship with Seoul Fashion Week, for example, the group helped promote emerging local brands such as Ulkin, Kanghyuk and Kusikohc.

“It’s more about the brand perception. It’s not about the company size,” Suh said, pointing to their deal with Stonehenge, a Korean costume jewellery brand. “Stonehenge is a very cheap accessory but it is number one in cheap accessories or non-gold [jewellery] items in Korea.”

The key is that the brand has to be top tier in its sector or category. “So that’s McDonalds not Burger King, it’s Nike not Adidas,” Suh added. “No matter how much you can pay, if your company is not the top and will hurt the brand reputation, Min Hee-jin shall reject it.”

It’s still too early to determine what the group’s bottom-line impact is for most partner brands but Musinsa, an online multi-brand fashion retailer selling Korean designers overseas, said that women’s apparel sales have doubled since its NewJeans partnership.

One of the main reasons brands find K-pop acts so appealing is that the kind of engagement they elicit is not like most other celebrity partnerships.

K-pop groups are known for having some of the most intense fandoms in the world because their management system demands performers place fans at the front and centre of everything they do. While western performers do have fan meets and other fan activities, their journeys tend to focus more on creative self-expression rather than giving the fans what they want.

During BoF’s conversation with NewJeans, over and over again the girls end their answers by expressing how grateful they are for the support of their fans, called “bunnies” or “tokki.”

“It’s our dream to meet the bunnies in every corner of the globe and to share our music with them,” said Hyein. “One thing that is mind-blowing is that we speak different languages but whichever country we are in, they sing along and they look so happy.”

According to Altm’s Jeong, the fan-artist relationship in Korea tends to be more reciprocal than in other markets. “It’s a sense of growing together whereas the feeling for western artists, it’s kind of a backburn … [The fan connection is] there for sure but with K-pop it’s just so right there in your face and so consistently too.”

For instance, when NewJeans releases a song, Hybe doesn’t just upload the music video. It also puts out a choreography version so that fans can see the dance steps clearly and learn it. This is key to spreading dance challenges and for increasing virality. That’s typically followed by anniversary specials which work like a director’s cut, in which the girls sit together and watch their old music videos and comment on what it was like to make it.

The amount of video content output, which is substantially higher than most western acts and even other K-pop groups, is aimed at strengthening the bond between fans and NewJeans. It also makes songs sticky, evidenced by the dance challenges for Hype Boy and Super Shy that have trended online.

“We are in love with our choreo and we dance it in our downtime frequently,” said Minji, “but honestly we didn’t expect it to blow up this big. It certainly [surpassed] our expectations. Especially the #ImSuperShy dance challenge this time around.”

NewJeans also offers fans high levels of access and intimacy. The group has its own app called Phoning, costing users $8.49 per month, that recreates the experience of having one-on-one chat with their idols. The group’s official YouTube channel gives a peek into everyday activities like a video of the girls going through purchases in their hotel after an outing to Supreme and other boutiques.

The immense desire to please fans was also apparent when the group took the stage at US music festival Lollapalooza wearing pleated skirts with white leg warmers over yellow Timberland boots. The Chicago event was a big milestone as it was their largest stage to date and first major live event in the west. Early into the set, Danielle turned to the crowd and said, “We’ve worked really really hard on each and every one of our performances hoping that we can live up to your expectations!”

Contrast that to musicians like Doja Cat, who despite being a consistent chart topper, has warred with her own fandom. The American artist recently lost 200,000 followers on Instagram after she minced no words about the burden of the performer-fan relationship, something that would be inconceivable for K-pop stars given the way they are strictly managed.

One factor that could temper NewJeans’ otherwise meteoric ascent in fashion is that historically K-pop boy bands are able to drive revenue much stronger than girl groups. This is because female fans, who tend to spend much more, typically follow or have crushes on male stars, whereas girl groups can’t usually generate that kind of loyalty from male fans.

“BTS has around 85 million in their fandom. The Blackpink fandom is 90 million, even more than BTS, but BTS makes three times more than Blackpink,” said Suh.

BTS generated 38 percent of Hybe’s revenue at its peak in 2022, Suh added, and he estimates that NewJeans will contribute around 5 to 10 percent for the company this year.

The life cycle of a K-pop act, even a popular one, is not long. A Bernstein survey of 20 A-list Korean idol groups found that the average act lasts just under seven years. Last year saw the debut of 39 new K-pop groups including NewJeans. Not all of them have flourished.

Le Sserafim, another Hybe girl group, which debuted in April just a few months before NewJeans, was set to be one of the buzziest acts of the year. But when allegations surfaced that one of its members, Kim Garam, hit a classmate and drank underage while still a high school student, the record label terminated her contract. It’s unclear how well the group can move past what many in the squeaky-clean world of K-pop consider to be a major scandal.

But scandals aside, the fickle nature of the music industry means groups often hit a ceiling and begin to plateau. Although recent girl groups like Ive, Twice, Aespa have all built up substantial fan bases, none have managed to break into the global mainstream in the same way that BTS has. Blackpink, the incumbent girl group, meanwhile is hitting their seven-year mark. Its members are currently in talks with their label YG but it’s unclear whether all of them will sign new contracts.

The near-term outlook for NewJeans may be bright but the group has already attracted a degree of backlash. Even by K-pop standards the group was young for a debut. All were minors at the time, ranging from 14 to 17 years old, and their song “Cookie” became a source of controversy for its heavy sexual innuendo with some listeners criticising its lyrics for being inappropriate for minors.

The group’s label Ador released a statement in response stating: “we think it’s unfortunate that there’s been controversy surrounding the lyrics of “Cookie”…We see now that our intention behind the song was interpreted differently from our expectations, and most importantly, we apologize for everyone who has felt uncomfortable and concerned as a result.”

Their ability to weather such controversies and endure, Professor Kim said, rests on whether NewJeans is able to create “crazy hardcore loyal fans or not … a fandom who will do anything to promote you. The reason BTS made it and truly is recognisable by anyone even if they don’t know what K-pop is, is because their loyal fans have been calling local radio stations until their local DJ started playing ‘Dynamite.’”

“You need that kind of fire engine to make it into a truly global breakthrough. It’s not a top-down massive pouring down of capital that made BTS massive. It’s the bottom-up grassroots movement. Right now, I don’t see that happening for NewJeans yet,” she said.

Most of the revenue for a K-pop group traditionally comes from direct fan engagement like concerts and album sales, but as Suh sees it, Hybe’s strategy for NewJeans is different, aimed at fashioning the group into a cultural icon that will stand up better to the test of time.

“They’re having phenomenal brand ambassadorships, a lot of TV commercials, a lot of brand collaborations,” said Suh. “[Their label’s] strategy is different from the previous winning formula. NewJeans is a different animal.”

Correction: A previous version of this article stated that Hanni’s age was 18 at the time of publication. This is incorrect. It was 19.

This week’s round-up of global markets fashion business news also features Latin American mall giants, Nigerian craft entrepreneurs and the mixed picture of China’s luxury market.

Resourceful leaders are turning to creative contingency plans in the face of a national energy crisis, crumbling infrastructure, economic stagnation and social unrest.

This week’s round-up of global markets fashion business news also features the China Duty Free Group, Uniqlo’s Japanese owner and a pan-African e-commerce platform in Côte d’Ivoire.

Affluent members of the Indian diaspora are underserved by fashion retailers, but dedicated e-commerce sites are not a silver bullet for Indian designers aiming to reach them.