The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

NEW YORK, United States — Brick-and-mortar is paying off for Allbirds, a favorite among the tech crowd in Silicon Valley and, now, beyond.

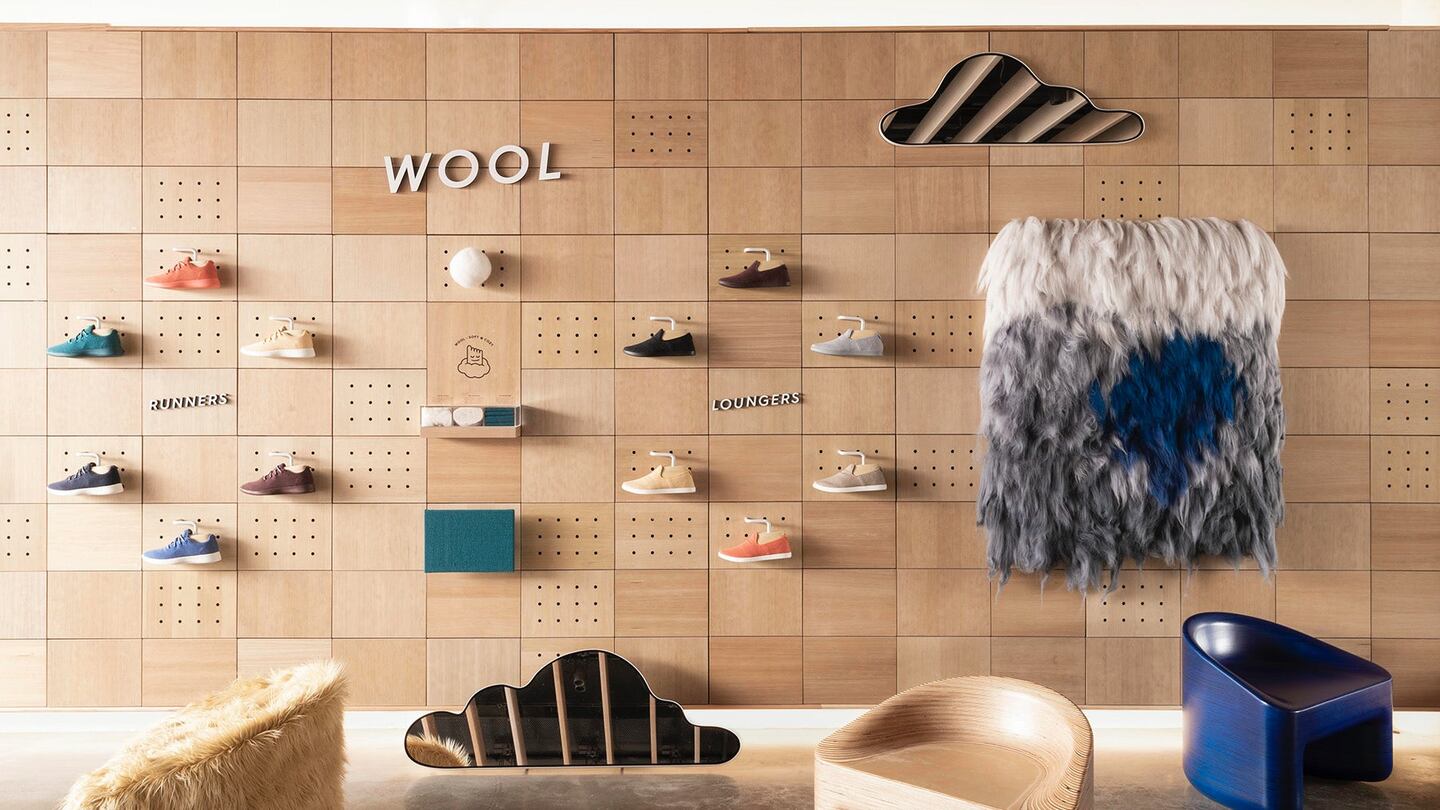

The footwear company is opening a 4,800-square-foot flagship store in New York City on Sept. 4, replacing its temporary outpost on Prince Street. The space, designed by branding firm Partners & Spade, will emphasise the try-on experience, founders Tim Brown and Joey Zwillinger told BoF.

“New York is our biggest and most important market,” Zwillinger said. “We needed something much bigger than what we have at Prince Street,” which spans 900 square feet.

The new location at 73 Spring Street has a long-term lease, he added.

ADVERTISEMENT

Founded in 2015, Allbirds has raised $27.5 million in funding from venture capital firms such as Tiger Global Management and Maveron, and can also boast Leonardo DiCaprio as an investor. The Allbirds style is characterized by oversized eyelets and knit material, including its signature merino wool — the popularity of which, some say, kicked off a worldwide trend of using wool fiber in footwear.

In the two years following its launch, Allbirds sold 1 million pairs of shoes, at $95 each. “We’re profitable and we have been for a long time,” Zwillinger said.

Allbirds has storefronts in San Francisco and Toronto, and recently signed leases in Chicago and Boston. Los Angeles and Washington, DC are in the pipeline, with the ultimate goal of opening eight stores in the US next year, and two more globally.

The shoe company joins a crop of direct-to-consumer brands that expanded from the internet to physical spaces, starting with pop-ups and eventually inking long-term leases. Online brands like Cuyana, Everlane and Away have infiltrated Soho, while some of their digital-native peers are even setting up camp alongside the luxury establishment in haute shopping districts like Fifth Avenue and Melrose Avenue in Los Angeles. Until recently, they would have been priced out of these neighborhoods. But as stores continue to close as legacy retailers struggle to compete with the likes of Amazon, landlords are increasingly willing to cut deals.

Brick-and-mortar locations also serve as marketing for startups like Allbirds, for whom digital marketing is becoming pricier.

“It’s a billboard effect,” Zwillinger said. Thanks to the brand awareness that Allbirds’ physical stores promote, e-commerce sales have also gone up.

Drawing from the mistakes and successes of its three existing stores, Zwillinger and Brown aimed to create a more customer-friendly environment with its new flagship. The layout of the space, for instance, is designed to accommodate both overwhelming traffic as well as a lighter customer load. The brand also devised its own furniture — wooden chairs — for shoppers to try on shoes.

Since coming to market with its Wool sneakers, Allbirds has released two new products: the Tree sneakers and the Sugar flip-flops.

ADVERTISEMENT

“We [are] unafraid about cannibalising our own sales. When we launched the Tree, we figured it was going to take sales away from Wool,” Zwillinger said.

But so far, it's been nothing but growth for Allbirds. The brand generated $50 million in top-line revenue in 2017 and is on track to double that in 2018, according to industry sources. Its merchandise will be released online in the UK starting October, and the founders are eyeing "other key markets" as well.

Related Articles:

[ Allbirds Wants Your Next Sneaker to Come From Eucalyptus TreesOpens in new window ]

As the German sportswear giant taps surging demand for its Samba and Gazelle sneakers, it’s also taking steps to spread its bets ahead of peak interest.

A profitable, multi-trillion dollar fashion industry populated with brands that generate minimal economic and environmental waste is within our reach, argues Lawrence Lenihan.

RFID technology has made self-checkout far more efficient than traditional scanning kiosks at retailers like Zara and Uniqlo, but the industry at large hesitates to fully embrace the innovation over concerns of theft and customer engagement.

The company has continued to struggle with growing “at scale” and issued a warning in February that revenue may not start increasing again until the fourth quarter.