The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

Resale as an industry is growing — and at 5x the rate of overall commerce. The market for pre-owned goods was $100 billion globally in 2022, and resale is expected to reach $250 billion globally by 2027, making up 23 percent of retail sales, according to the Ellen MacArthur Foundation.

In the last 30 years, resale platforms have gained traction in the West, pioneered by eBay and Fashionphile in the 90s, and followed by the likes of ThredUp, The RealReal, Depop and Poshmark in the 2010s. More recently, resale is becoming a cornerstone in the APAC region’s fashion industry — a 2020 survey by UBS found 72 percent of Chinese consumers had increased their purchases on luxury resale via online platforms, compared to 31 percent in 2018. Meanwhile, French resale platform Vestiaire Collective, which launched in 2009, raised €59 million in 2020 to expand into Korea and Japan.

Not only an economic opportunity but an environmental one, resale’s growing popularity reflects a changing attitude towards consumption habits. Shoppers are increasingly considering the ecological impact of buying new items and its knock-on effect on fashion’s substantial contribution to the climate crisis. As a result, brands and retailers have slowly but steadily weighed into the resale arena — Eileen Fisher was the first to enter the space in 2009, and the likes of H&M, Stella McCartney, Patagonia, Ralph Lauren and Macy’s have followed from 2015 onwards.

The popularity of this space is only set to increase in the face of economic uncertainty. BoF and McKinsey’s State of Fashion 2023 report states that resale is one of the three ‘R’s recommended for brands to explore in the face of financial instability — “resale, rental and repair can be integrated into the value proposition to allow consumers to combine responsible and affordable consumption,” it states.

Opportunity has given way to a plethora of resale options, from resale-specific websites to plug-and-play solutions, allowing brands and retailers to integrate resale into their branded operations through branded resale platform providers, enabled by companies like Trove.

A certified B Corp, Trove offers scalable, branded recommerce solutions, providing the trade-in and operations technology needed to generate a reliable supply to sell at scale on a brand’s own dedicated site, integrated into their existing channels. Launched in 2016, the company works with the likes of Lululemon, Levi’s, Patagonia, Elieen Fisher and Nordstrom. More recently, Trove has also enabled performance luxury apparel brand Canada Goose and premium workwear brand Carhartt to launch their own resale platforms at scale.

This year, Trove has undertaken a new annual benchmark of the resale industry’s progress towards brand resale, offering in-depth performance assessments of 40 leading brand resale programmes — agnostic of the resale platform provider — informing how others can build or elevate their resale programmes.

Brands were assessed against 147 criteria and scored in the following categories: brand positioning, commerce, and trade-in experiences, with consideration of how the resale business model potentially contributes to environmental sustainability benefits. Insights were then formed from nearly 40 interviews with founders, CEOs and senior executives, consumer surveys of 2,500 individuals, mystery shopping practices as well as third party data.

Now, BoF shares extracts from the report, distilling key insights alongside BoF’s own reporting and analysis, to understand how brands and retailers can win at fashion resale.

Trove: Recommerce today is what e-commerce was two decades ago: a more customer-centric retail model where customers satisfy their ever-increasing expectations for greater value, experience and sustainability. [...] And just like in the 2000s, brands have an unmatched opportunity to emerge as winners. Now, with 120+ brands with dedicated resale channels, it’s no longer a matter of “if” but “how.”

[However,] resale is not inherently sustainable. Rather, it is highly dependent on how the business model is set up to shift revenues away from new production, and determining the degree of sustainability of a resale programme is complex. [...] If a resale programme is truly circular, a brand can scale the programme to build a profitable business by selling pre-owned items without over relying on incentivising customers to purchase new products, thus cancelling out the circular benefit.

Trove’s analysis finds that, in more sustainable models, brands derive revenue from existing products by selling items multiple times, instead of making new products that carry the majority of environmental costs. What’s more, all 40 brands in the Trove Index touted sustainability as a customer benefit associated with their resale programmes.

BoF: For retailers, resale may eventually become a profitable part of their models — Selfridges announced that by 2030, nearly half of its sales should be from resale, repair, rental or refills — but most retailers are currently focused on resale’s potential for driving customer acquisition and loyalty.

Resale is not inherently sustainable. Rather, it is highly dependent on how the business model is set up to shift revenues away from new production.

While considering customer acquisition, resale players should understand that consumers in the US, UK, France and Germany surveyed for The BoF Insights report of The Future of Resale in 2021 cited their primary motivators in engaging with resale was “value” and “affordability,” with “sustainability” the tertiary motivator across age cohorts.

While sustainability might not be a primary motivator for consumers, or the greatest opportunity for brands and retailers, resale should still be leveraged appropriately to do more good than harm — especially as consumers are more wise to contradictory moves in ESG. For example, when ultra-fast-fashion giant Shein launched a resale platform for American consumers in October 2022 as part of a series of efforts to combat criticism, it was called out for greenwashing. Indeed, in 2021, Shein’s environmental impact amounted to about 6.3 million tons of carbon dioxide equivalent.

Resale only offers environmental benefits if the intent is to reduce the manufacturing of new products. After all, more than 70 percent of the industry’s greenhouse gas emissions are generated from upstream activities, according to the State of Fashion 2023 report.

Opens in new window

Opens in new windowTrove: There are four distinct models for approaching resale. The first two distinctions fall under “brand resale”, which include: managed, brand-owned sites, through which brands purchase items from customers, process and sell them directly to customers on a branded resale site. Resale platforms support brands with end-to-end solutions, including trade-in, logistics and commerce, and are used by Coach, Patagonia, Lululemon and Net-a-Porter’s The Outnet.

The second brand resale opportunity is peer-to-peer brand-owned, when brands enable customers to buy and sell items directly from each other on a branded resale site. Resale platforms support brands by offering seller/buyer tools for customers to list, purchase and ship a brand product directly to another customer. Examples include M.M. La Fleur, Outerknown and Steve Madden.

External marketplaces also fall within this second distinction, whether managed — like The RealReal and ThredUp — or peer-to-peer, such as Poshmark, Depop and Vestiaire Collective. Through this format, people sell their items to the platform directly and the platform sells the items directly to its customer base, or they sell directly to other consumers.

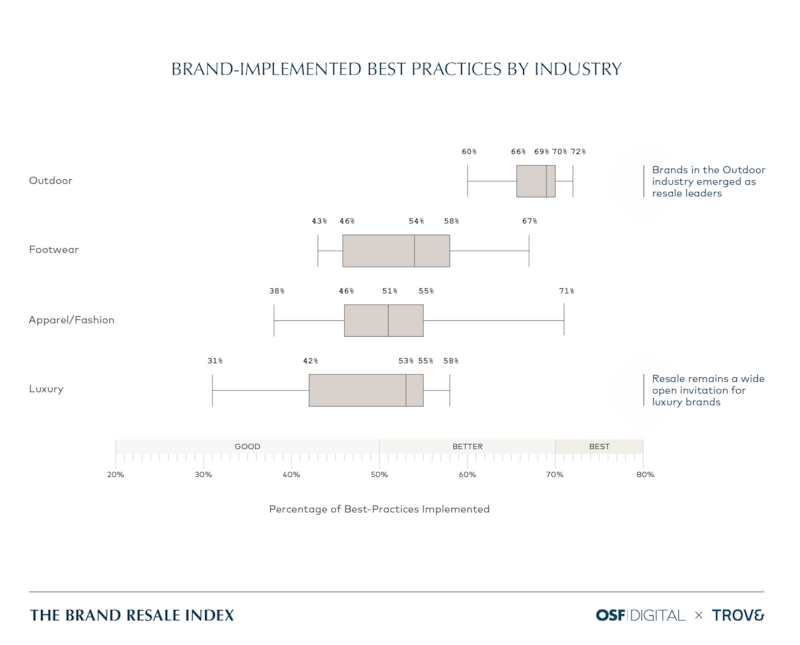

In Trove’s report, the fashion/apparel brands indexed had the highest representation of fashion resale solutions across all categories with 23 brands using resale — but all fell short when meeting leading practices. Philip Lim emerged as the category leader for luxury brands using resale, yet still only met 53 percent of the Index criteria for resale practice. Resale is typically challenging for luxury and higher priced items due to the need for authentication — and only 57 percent of indexed luxury brands included brand and product authentication of trade-in or consignment products.

BoF: In resale, there is no one-size fits all, and brands and retailers should understand which resale solution best suits its product offering and community.

The BoF Insights report on the future of resale explains that managed models tend to facilitate a smoother customer journey by removing frictions such as individuals needing to manage their listings, and ensures more accurate and consistent product listings. However, it also means more overhead and operational requirements, and could see additional risk given higher costs and having to hold inventory.

Resale is typically challenging for luxury and higher priced items due to the need for authentication — and only 57 percent of indexed luxury brands included brand and product authentication of trade-in or consignment products.

Peer-to-peer models are designed to simplify operational requirements for platforms, and make it easier to scale supply as inventory is listed and held by sellers. It is also easier for buyers and sellers to form communities given direct engagement. However, these models open up to uncontrolled variability in product descriptions and photography quality due to sellers listing their own products, and make it harder to facilitate transactions for higher value items due to the need for authentication.

As a result, luxury platforms, for example, tend to require managed processes due to the need to authenticate products and ensure quality control. Luxury brands run a greater risk with fake products — and with less regulation in authenticating in peer-to-peer marketplaces, this option can create more opportunity to damage a brand’s reputation. Alternatively, brands with more limited space to hold inventory for resale may prefer a peer-to-peer model — or a managed model that hosts the inventory on the brand’s behalf. Those looking to lean into community benefits may prefer peer-to-peer, but must consider the challenges in policing such spaces.

Trove: About 50 percent of brands promote pre-owned items through content such as guides, how-tos and blogs, and 50 percent of brands include content about resale programmes. However, only 34 percent of brands include content about their resale programme on their homepage. Few brands also fully integrate new and pre-owned into one shopping experience, with only 25 percent allowing customers to combine purchases of new and pre-owned in the same shopping cart.

A best-in-class example is Coach’s online storefront, which provides universal search across new and pre-owned products, and consistent item content, payment options, policies across new and pre-owned items. The brand also promotes resale in-store, with physical signage adding to the overall elevation of the brand story and offering.

Opens in new window

Opens in new windowBoF: The two most common motivators of UK and German consumers to engage in buying secondhand fashion is: if an item is sold out at a brand or retailer, and checking to see if it is available on resale; and to see if a branded item is available for a lower price, according to the BoF Insights report.

As a result, signposting to consumer the opportunity to search, within a brand or retailer’s own ecosystem, authenticated, brand-owned second-hand inventory can keep the user within the branded site for longer — and potentially find the item they are looking for. It is a further opportunity to connect them to related items, new or second-hand, and gather more data touchpoints on their product interests.

As omnichannel retail continues as a key focus for brands, the different channels should speak to one another. Physical stores today must serve as many functions as possible, from building brand awareness to serving as a mini-warehouse for e-commerce orders — while generating sales still matters, it’s no longer the only factor in a store’s success.

Leveraging marketing opportunities within these spaces, including for resale, is a natural extension of the relevance and purpose of a store today. It also enables brands and retailers to host some resale stock in-store, enabling in-house inventory storage as well as a chance for a new feature to draw consumers back in-store.

Trove: About 63 percent of companies using resale created specific resale branding to communicate how the programme supports and integrates with the brand mission and values, and 94 percent included branding on the pre-owned order email notifications. On indexed brands’ websites, 50 percent of brands promote pre-owned items through content such as guides, how-tos, blogs, etc.

Although most brands in the Index use social media channels to promote a new resale programme launch, few consistently promote pre-owned products on their social channels — only 35 percent of brands promote their resale programme through social media platforms. Similarly, only 20 percent of brands market their resale programme through email, and just 13 percent include a pop-up on the resale site for visitors to sign-up for email.

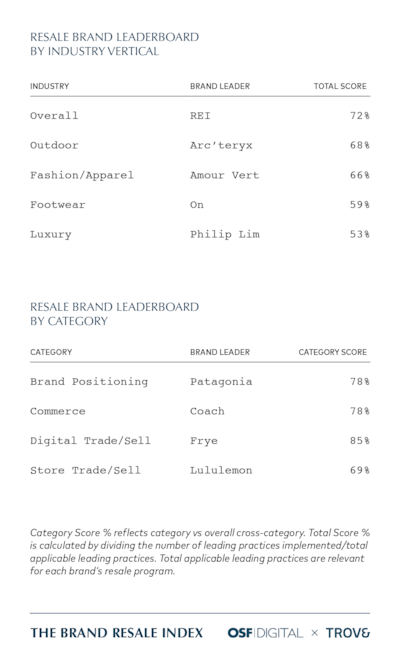

A best-in-class example is Patagonia’s Worn Wear programme, directly positioned as part of the brand’s mission to Save Our Home Planet. Patagonia promotes Worn Wear’s brand positioning with its “Better Than New” and “Scars Tell the Story” tag lines, and leverages user-generated Worn Wear content through their social channels, focusing on broadcasting “The Stories We Wear,” featuring stories of Patagonia clothing submitted by customers. Patagonia also promotes pre-owned items within mainline product pages.

BoF: While resale may be an add-on to a brand or retailer’s main business model, it is another key consumer touchpoint. Integrating resale more seamlessly into an overarching marketing strategy will boost visibility and thereby performance of the offshoot.

However, the unpredictable and somewhat unstable economic landscape today means marketing spend and budgets are under significant scrutiny. In January, BoF reported that marketers should “focus on maintaining a balance between performance marketing (typically short-term efforts in which brands pay based on a campaign’s measurable results) and brand building (longer-term projects that are not as directly tied to sales, but are fundamental to a brand’s overall image and reputation with consumers).”

While resale may be an add-on to a brand or retailer’s main business model, it is another key consumer touchpoint.

Typically, in times of difficulty, marketers will face pressure to focus on the former at the expense of the latter. However, the State of Fashion Report 2023 detailed how customer acquisition costs have spiked, with advertisers spending about $29 to acquire each customer in 2022, compared with $9 in 2013. As a result, brands are investing in creating non-ad content for their own social media channels and websites. These brand-building projects can benefit from authentic resale storytelling, such as Patagonia’s user-generated content “The Stories We Wear”.

As resale often offers sustainability-oriented narratives, brands and retailers must avoid greenwashing. The State of Fashion 2023 report recommends that brands should build bridges between a company’s sustainability, marketing and legal teams so that external, and internal, communications capture the complexities of responsible business practices.

Brands and retailers should also avoid broad, vague terms like “green” or “eco-friendly” when discussing environmental efforts as these have multiple interpretations and give a false impression about impact. Instead, provide important caveats or context, along with concrete and factual information.

Opens in new window

Opens in new windowTrove: One of the largest challenges of the resale movement is unlocking the $2.1 trillion of idle branded items in customers’ closets. Part of the solution is to make trade-in and selling processes easy and valuable for customers — for example, 93 percent of brands offer gift cards for trade-in or sales compensation.

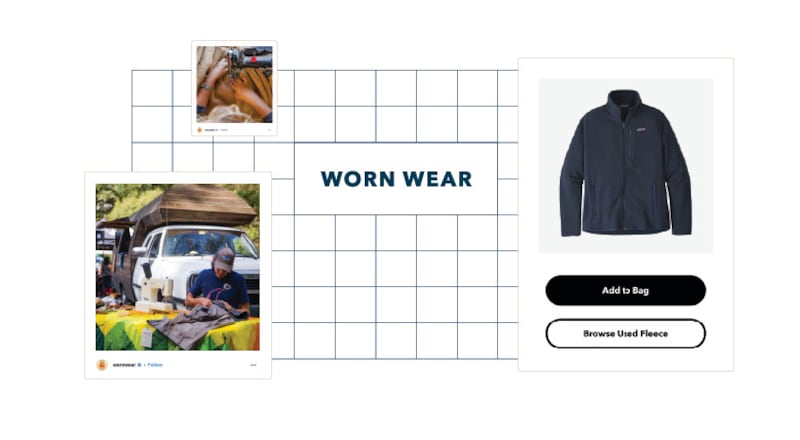

While the vast majority of brands include a trade-in explainer, there remains a significant opportunity to drive general trade-in awareness across the broader customer base. Within the Index, Frye was the brand that led digital trade-in, while Lululemon was the category leader for brick-and- mortar store trade-ins. Lululemon’s employees leverage a technology that enables them to process multiple pre-owned items in-store.

Supporting in-store and mail-in trade-in options gives the greatest flexibility, but less than 50 percent of brands exhibit implementation. Some 85 percent of brands offer trade-in by mail, while 44 percent allow customers to trade in their items in the brand’s brick-and-mortar store.

What’s more, 56 percent of brands identify items excluded from trade-in and/or selling, but only 29 percent return unacceptable items to the customer trading them in by mail.

BoF: Only about 5 to 7 percent of all resaleable fashion was resold in 2020, which is what has resulted in an estimated $2.1 trillion in fashion items sitting untapped in closets. While a crucial opportunity from a sustainable point of view, this is realistically also untapped resale inventory for brands and retailers. A key issue lies in encouraging consumers, through the easiest means possible, to trade in those items.

‘Sustainability’ is a tertiary motivator for resale consumers across age cohorts in the US, UK, France and Germany, but it is the primary motivator for sellers.

The pandemic inspired a surge in hybrid omni-channel logistics processes, like Buy Online Pick-Up in Store (BOPIS) — which saw BOPIS-driven sales surge 259 percent in August 2020 year-over-year, according to Adobe Analytics — and Buy Online Return In-Store (BORIS). This approach continues to resonate strongly with consumers looking for flexibility — and could offer a popular, supported trade-in route for consumers too.

However, consumers must understand the parameters under which these trade-ins can benefit them. Retailers and brands must clearly set out which items cannot be processed or what constitutes unsellable second-hand items to avoid alienating consumers.

While “sustainability” is a tertiary motivator for resale consumers across age cohorts in the US, UK, France and Germany, it is the primary motivator for sellers, according to BoF Insights. Some 87 percent of survey respondents prefer to sell on the secondhand market rather than discard an item. As a result, the opportunity to leverage sustainability sensibility to motivate trade-ins is high.

Opens in new window

Opens in new windowTrove: 84 percent of store associates are aware of the resale programmes offered by the brand. However, the level of awareness and knowledge about the details of the programmes varies greatly from brand to brand.

Employees can be essential ambassadors of a resale programme, and provide customers with information about resale programmes, answer their questions and help facilitate their participation in the programme through trade-ins, selling or purchases. If employees don’t have adequate knowledge of resale programmes, it is a missed opportunity for the brand.

BoF: In January, BoF reported on how most fashion firms have still not effectively leveraged comprehensive education and development for retail sales associates and, as a result, are leaving money on the table. “Historically, companies don’t look at their frontline people as the lever to grow revenues, but in fact, it is the lever,” Steve Kramer, CEO of retail software company Workjam, told BoF.

The article further reported that the need to attract and retain top salespeople is amplified by the fact that, if today’s digital-savvy consumers do make the trek to a store to buy a fashion item, whatever the price point, they have high expectations for salespeople.

With retail staff another critical consumer touchpoint and conduits for marketing messages, brands and retailers must include, within essential training of store associates, any information of any resale offering, including where and how consumers can purchase or trade-in second-hand goods.

This is a sponsored feature paid for by Trove as part of a BoF partnership.

The company, under siege from Arkhouse Management Co. and Brigade Capital Management, doesn’t need the activists when it can be its own, writes Andrea Felsted.

As the German sportswear giant taps surging demand for its Samba and Gazelle sneakers, it’s also taking steps to spread its bets ahead of peak interest.

A profitable, multi-trillion dollar fashion industry populated with brands that generate minimal economic and environmental waste is within our reach, argues Lawrence Lenihan.

RFID technology has made self-checkout far more efficient than traditional scanning kiosks at retailers like Zara and Uniqlo, but the industry at large hesitates to fully embrace the innovation over concerns of theft and customer engagement.