The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

When so-called BNPL — buy now, pay later — apps took off at the start of this decade, their appeal was easy to understand, since buying stuff is always easier if you don’t have to put up all the money right away. Their target audience was also pretty clear — Gen-Zers and Millennials who enjoyed making impulse purchases but who disliked credit cards. These days, retirees and others on fixed incomes have become some of the fastest growing users of the apps, and high interest rates have killed off some entrants into the field. What hasn’t changed? A lot of uncertainty over how BNPL companies can make money in the long run, and whether they’re actually providing a cheaper alternative to credit cards or just a new way to lure borrowers into unwise levels of debt.

Typically by letting consumers pay for purchases in three or four installments. Most BNPL services spread them out over the course of a few weeks, often without interest, although many charge fees for late payments. Spending on BNPL purchases jumped from $33 billion in 2019 to $300 billion by 2023, according to GlobalData, a research provider; it projects that figure to rise to $570 billion by 2026.

Not really. The “installment plan” is a type of credit that really got going in the 19th century, as the Industrial Revolution offered consumer goods to the masses — if they could pay for them. Most famously, Singer sewing machines were sold for a “dollar down, dollar a week.” The practice of offering weekly or monthly purchase plans spread, as makers of furniture, pianos, farm equipment and automobiles looked to make products more attainable. Credit cards then broadened the practice of delaying payments to cover smaller purchases. But credit cards tend to be disliked by the young people attracted to BNPL; as a group, young shoppers are wary of providers that profit when customers don’t pay their balances.

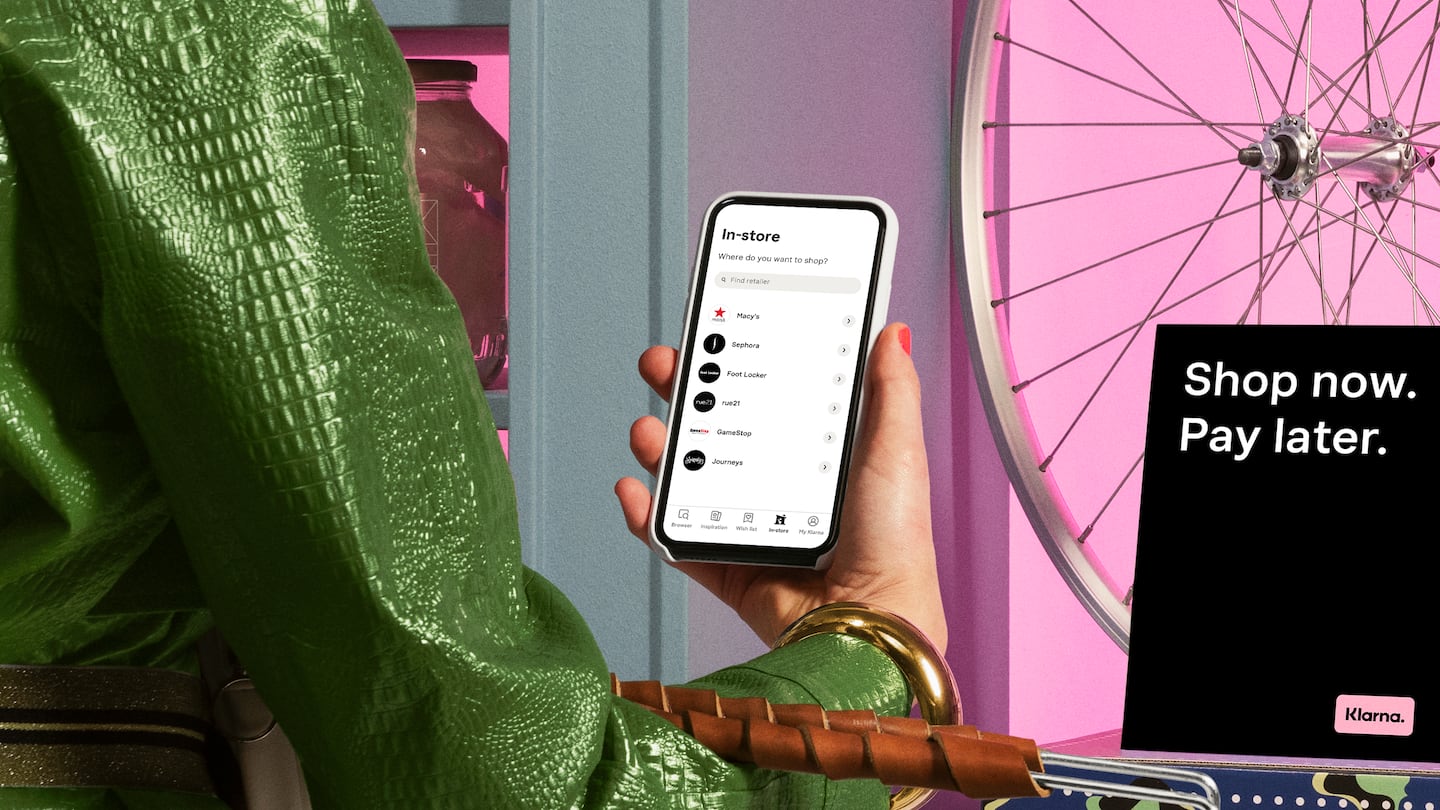

Several reasons. For one, online shopping exploded during the pandemic. And investment poured into a roster of new startups that offered apps that were user friendly and targeted at young people making purchases for items costing $200 or less, including Klarna, Afterpay, Affirm, Zip and Zilch. Most BNPL isn’t about buying big-ticket items; it’s about using an app to snap up that must-have jacket in the expectation that you’ll pay it off quickly. The fact that there generally aren’t rigorous credit checks slowing down an initial purchase also helps. Finally, this corner of the fast-credit industry was able to grow at a blistering pace partly due to the lack of regulation.

ADVERTISEMENT

BNPL started off with a focus on fashion and with a Millennial and Gen-Z consumer base. But the audience for such fast-credit apps has expanded. By December 2023, Klarna said the 60-plus group was the fastest-growing age segment — with home and gardening climbing to one of the most popular categories for shoppers to use the product for. That’s seen as in large part being a reaction to inflation’s spiraling rise in recent years, which has many consumers of all ages looking for ways to stretch their money or put off paying bills a bit longer. To the dismay of regulators, people are using BNPL apps not just for one-time purchases but to pay for recurring costs such as energy bills, takeaways and even groceries.

After initial rapid growth that led to heady valuations for some newcomers, they hit a rough patch. In 2022, Klarna saw its value plunge from $46 billion to $6.7 billion, while Affirm’s stock tumbled 90 percent by the end of the year, while Zip had shed about 95 percent of its value. (The firms have picked up to an extent since then.) That reflected three trends. One was a rush of new competitors into the field, including big tech companies like Apple Inc. and Amazon.com Inc., retail banks like HSBC Holdings Plc and Barclays Plc, Wall Street firms like Goldman Sachs Group Inc and Citigroup Inc and new major players in previously underserved markets, like Gulf-based Tabby and Huabei in China.

Another factor was the rise in interest rates engineered by many central banks to fight inflation. That raised costs for BNPL firms that were borrowing the money with which they made payments to merchants or lent to consumers, a burden that increased with the volume of loans. The inflation squeeze also meant that more BNPL loans went bad. In the first half of 2022, Klarna reported that its losses had tripled with high operating costs and credit losses. Since then, the firm has said that more people are paying back on time and default rates are at their lowest, at 1 percent. Still, nearly a quarter of BNPL users missed one or more repayments in the six months to December 2023 in the UK.

There are several, but they all share one thing: When a customer uses buy now, pay later as a payment option, the BNPL provider foots most of the bill up front, paying the merchant the full amount. The customer then pays back the BNPL provider in installments. Since BNPL firms typically don’t charge interest, they turn to a variety of revenue sources: Some BNPL apps make money by charging retailers a small fee. Some also charge consumers late fees. Others make money off of advertising or have opened up subscription models for extra channels of revenue. Major partnerships with the travel and hospitality sector have been struck, and some have launched debit services too.

BNPL players often use partner banks as a source of funding. Some startups also secure debt financing from investors to pay for purchases in advance. For example, Zilch’s debt facility is funded by Goldman Sachs. Klarna is a bank, so it can use customer deposits from conventional bank accounts it offers in Sweden and Germany to fund its activity.

Regulators and consumer advocates worry that it could be a form of irresponsible lending. Consumers grappling with accelerating inflation and rising interest rates could load up on debt using different apps and then overdraw their bank accounts or take on credit card debt to service their BNPL accounts. The Citizens Advice Bureau in the UK found one in five BNPL users had missed or made a late BNPL payment in the last twelve months, and almost a third who were due to make a payment in the last month borrowed money to repay their installments. More broadly, the possibility that BNPL leads people into a chain of borrowing could create hidden risks for the banking system.

Britain’s FCA says the sector must be regulated, while Australia’s BNPL firms will need to adhere to responsible lending obligations and hold Australian credit licenses, and California has fined unlicensed lenders. The companies themselves say they offer a cheaper alternative to the high interest rates on credit card bills, bank overdrafts, and revolving debt that are alternatives sources of funds for their customers.

By Aisha S Gani

Plans that let US consumers pay over time helped generate a record $222.1 billion in online holiday sales Nov. 1 through Dec. 31.

The statement was the latest sign that federal regulators are scrutinising the increasingly popular form of consumer credit.

Instalment payment services helped fuel sales for years. But high interest rates could soon have shoppers pulling back.

Designer brands including Gucci and Anya Hindmarch have been left millions of pounds out of pocket and some customers will not get refunds after the online fashion site collapsed owing more than £210m last month.

Antitrust enforcers said Tapestry’s acquisition of Capri would raise prices on handbags and accessories in the affordable luxury sector, harming consumers.

As a push to maximise sales of its popular Samba model starts to weigh on its desirability, the German sportswear giant is betting on other retro sneaker styles to tap surging demand for the 1980s ‘Terrace’ look. But fashion cycles come and go, cautions Andrea Felsted.

The rental platform saw its stock soar last week after predicting it would hit a key profitability metric this year. A new marketing push and more robust inventory are the key to unlocking elusive growth, CEO Jenn Hyman tells BoF.