The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

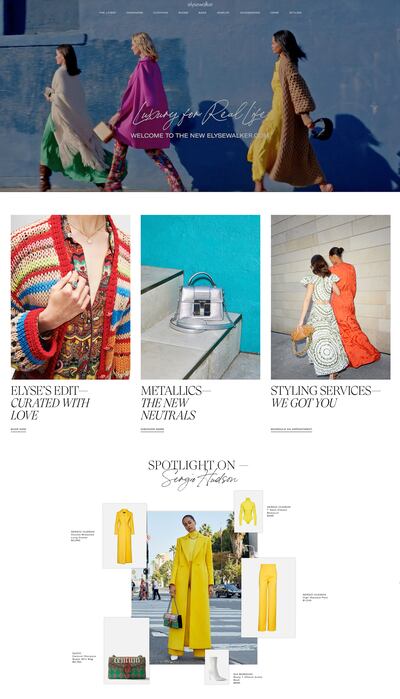

When it comes to e-commerce, Elyse Walker is hoping the third time will be the charm.

Since opening her namesake luxury boutique in the Pacific Palisades 22 years ago, Walker has expanded her business to six locations throughout Southern California. Known for a laid-back curation of luxury basics, Elysewalker stores have been profitable since day one, enticing customers to shop with the brand again and again through a tenacious personal styling programme.

Walker has had a bumpier journey online. In 2010, she launched the first iteration of Elysewalker.com. Two years later, Walker teamed with the e-commerce retailer Revolve on a new digital concept, Forward by Elysewalker — later known as FWRD. She served as fashion director for the new business, but could not operate her own online website. Around when Revolve went public in 2019, Walker exited the relationship and began planning a new, independent online venture.

Now, Walker is rolling out a new version of Elysewalker.com, going live on Jan. 18. She said her business has done just fine without a major online presence — sales were up more than 50 percent last year compared with 2019 — but that e-commerce is key to building out her mini-retail empire.

ADVERTISEMENT

The relaunch of e-commerce will bring some other changes to the business. Her company recently purchased a warehouse and doubled its headcount. And after two decades of self-funding, Walker is now looking for outside capital and a partner.

“To take this company from $50 to $100 million, and then to the next level, we are 100 percent aggressively working this year… to bring in outside investors,” Walker said, adding that she’s open to any kind capital, whether it’s from a bigger, strategic player or a private equity firm.

With a unique-enough edit and localised appeal, a number of independent boutiques find success operating a few stores, even as global brands and retailers, from Farfetch to Gucci, grab an ever-larger share of luxury sales for themselves. Especially since 2020, local boutiques were able to capitalise on the work-from-home consumer whose savings and overall financial situation improved during the pandemic.

To take this company from $50 to $100 million, and then to the next level, we are 100 percent aggressively working this year… to bring in outside investors.

But the attributes that make for an exciting in-real-life shopping experience are much harder to pull off online.

Walker hopes that her existing roster of customers will follow her latest e-commerce venture, and that those close personal connections will set the website apart from competitors such as Net-a-Porter and MatchesFashion. On the new website, which the retailer built in-house, each stylist will have their own web page with their distinct product curation. It will also allow stylists to send their personalised recommendations to clients via email and other channels.

“We own our customer… she trusts us and now, she’ll have better [access] to way more products and be able to reach us to her living room,” Walker said.

Elysewalker stores are known for their exceptional customer service. The bulk of transactions are generated by 21 sales associates — called “stylists” within the business — who text or DM shoppers on a regular basis with personalised recommendations. That keeps clients extremely loyal, even when they can’t visit the stores in person. Half of all customers live out of state, the company said.

“You have retailers like Nordstrom, which is known for its customer service, and sure, it’s good to a degree, but [Elysewalker] is just so much more personalised,” said Gabriella Santaniello, a retail analyst based in the Los Angeles area. “I actually have a sales associate who texts me all the time.”

ADVERTISEMENT

A website will also allow Elysewalker to carry more products from more designers. Some of its best-selling products are by global independent labels such as Alanui, Totême, Zeynep Arcay and Paris Texas. The e-commerce site will bring in some new wholesale partners, such as Los Angeles-based designer Rosetta Getty.

Elysewalker is hardly the only multibrand retailer to double down on loyalty as a driver of growth rather than customer acquisition; Neiman Marcus announced its own customer communications initiative in 2020, building its own app for sales associates to connect with existing customers. But Elysewalker already has a track record of profitable success: at least 35 percent of sales are generated by its personal styling services shipped through the mail rather than walk-ins to the store.

Still, brick-and-mortar will remain an integral component of the business, and the most effective connections with customers are always in-person, Walker said. After a successful pop-up styling service in the Hamptons this summer, the retailer is looking to open its first East Coast location later this year.

Stores and in-person events are a powerful driver of word-of-mouth marketing, Walker added. Even with the e-commerce launch, she anticipates that it will be her existing customers who will spread the word about the new channel.

“We meet 10 women, or 100 women, and let them be our brand ambassadors,” she said. “If we do our job well, all of our clients will go out and bring us new ones.”

Luxury retailers have long gone the extra mile to serve top-spending VIPs. Now, more brands are finding ways to scale personalised customer service. Here’s how to get it right.

American luxury retail has changed, but customers are still hungry for the special feeling only an exceptional multi-brand store can offer. Can a crop of upstarts and a few savvy incumbents succeed where others have failed?

As the Omicron variant sweeps across the world, retailers are reckoning with an inescapable reality: Covid-19 is here to stay. BoF outlines the fundamental facts that should inform the industry’s next moves.

Cathaleen Chen is Retail Correspondent at The Business of Fashion. She is based in New York and drives BoF’s coverage of the retail and direct-to-consumer sectors.

The British musician will collaborate with the Swiss brand on a collection of training apparel, and will serve as the face of their first collection to be released in August.

Designer brands including Gucci and Anya Hindmarch have been left millions of pounds out of pocket and some customers will not get refunds after the online fashion site collapsed owing more than £210m last month.

Antitrust enforcers said Tapestry’s acquisition of Capri would raise prices on handbags and accessories in the affordable luxury sector, harming consumers.

As a push to maximise sales of its popular Samba model starts to weigh on its desirability, the German sportswear giant is betting on other retro sneaker styles to tap surging demand for the 1980s ‘Terrace’ look. But fashion cycles come and go, cautions Andrea Felsted.