The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

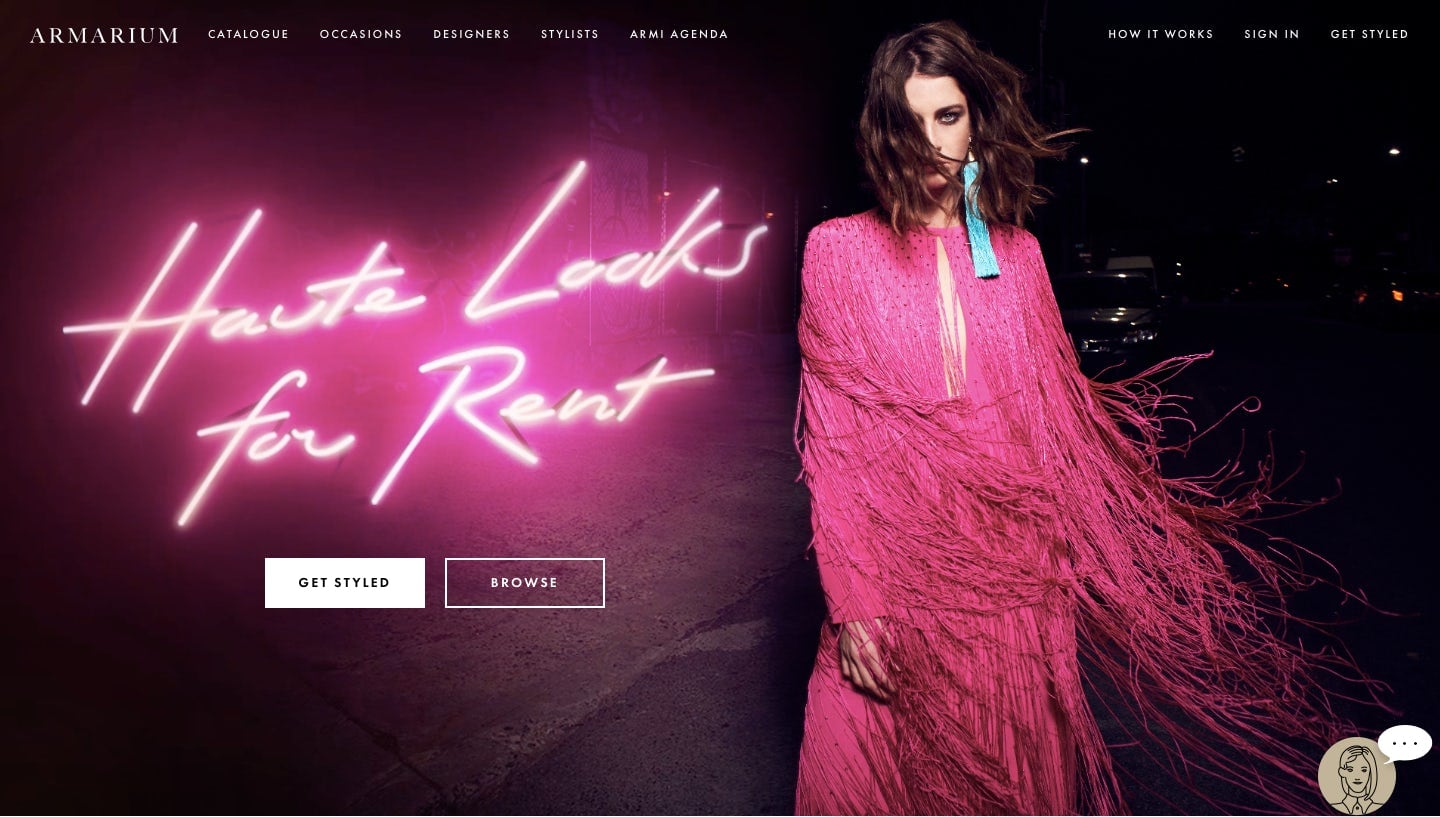

NEW YORK, United States — Armarium, a rental service that offers items from Bottega Veneta, Thom Browne, Altuzarra and other luxury designers, is shutting down after failing to find a buyer.

The New York-based company was co-founded by Trisha Gregory and Alexandra Lind Rose and launched in 2016. It raised $5 million from investors including Adrian Cheng's C Ventures, Carmen Busquets, Tommy Hilfiger and Farfetch Chief Brand Officer Holli Rogers. Operations will cease on March 7; the company has fewer than 15 employees, Gregory told BoF.

Armarium took a different approach from Rent the Runway, by far the most prominent player in the increasingly crowded fashion rental market. It offered runway looks from designers like Christopher Kane, Rick Owens and Maison Margiela, who otherwise eschewed the rental model, with fees ranging from $200 to $800 (one-time rentals at Rent the Runway are mostly well under $300).

Armarium also partnered with a network of boutiques and stores to widen its reach with customers and sometimes rent store inventory, with partners including Le Bon Marché, Browns and The Webster. It tapped a team of stylists to help customers find their rental pieces and complement them with accessories for sale from retail partners.

ADVERTISEMENT

Of its customers, 60 percent rented more than once and 35 percent either bought the item they rented or something else from the retailer or brand, Gregory told BoF. However, the company struggled with the high cost of running a rental business, including complicated logistics and customer service. Armarium also had to carefully invest in its brand identity in order to woo luxury brands and retailers that have historically been sceptical of the model.

As part of a luxury conglomerate or large retailer, Armarium would have been better equipped to tackle these challenges, Gregory said.

The consumer adoption of rental is happening much faster than the brands and the retailers.

“The consumer adoption of rental is happening much faster than the brands and the retailers, so it was hard to meet that supply with that demand,” said Gregory, explaining that Armarium spent “a lot of time and resources educating the market” and saw luxury customers’ perceptions on renting evolve over the course of the business’s existence.

Luxury customers started renting for more than just formal occasions, but for every-day wear too, and were drawn to the model to experiment with different styles and because of its sustainability angle, according to Gregory.

“It was important that the client never thought the rental process was a downgrade…. Operationally it’s a hard business to run on minimal funds,” she said.

Prospective investors were concerned Armarium wasn’t taking the same approach as Rent the Runway.

“Venture capital investors, particularly on the west coast, are looking for mass, mass scale online and while that was absolutely our aim, luxury is a different beast,” said Gregory. “It is high touch. The margins are far greater, but the business is also omnichannel.”

Gregory remains bullish on the future of the luxury rental business model and said Armarium came to market too early to survive in its current iteration.

ADVERTISEMENT

“This is a way to consciously consume and to really access some of fashion’s most exciting products that in turn lure you into a brand in a different way,” she said. “It’s just a matter of time before this is an offering that is for sure plugged into most global luxury brands and retailers.”

Over the last few years, retailers from all parts of the market have experimented with rental offerings, which have high logistical costs and complex customer service needs. Rental services are fewer in the luxury space, but Flont (which offers fine jewellery) and Vivrelle (which focuses on handbags) exist; luxury watch rental platform Eleven James shut down in 2018.

Disclosure: Carmen Busquets is part of a group of investors who, together, hold a minority interest in The Business of Fashion. All investors have signed shareholders’ documentation guaranteeing BoF’s complete editorial independence.

Related Articles:

[ The Fashion Rental Market Tested and Explained: Who Has the Best Service?Opens in new window ]

[ Three Strategies for Brands Entering the Rental MarketOpens in new window ]

[ Everyone Is Launching Rental Services. Is There Enough Demand?Opens in new window ]

Nordstrom, Tod’s and L’Occitane are all pushing for privatisation. Ultimately, their fate will not be determined by whether they are under the scrutiny of public investors.

The company is in talks with potential investors after filing for insolvency in Europe and closing its US stores. Insiders say efforts to restore the brand to its 1980s heyday clashed with its owners’ desire to quickly juice sales in order to attract a buyer.

The humble trainer, once the reserve of football fans, Britpop kids and the odd skateboarder, has become as ubiquitous as battered Converse All Stars in the 00s indie sleaze years.

Manhattanites had little love for the $25 billion megaproject when it opened five years ago (the pandemic lockdowns didn't help, either). But a constantly shifting mix of stores, restaurants and experiences is now drawing large numbers of both locals and tourists.