The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

Hello BoF Professionals, your exclusive weekly briefing is ready, with members-only analysis and a digest of the week’s top news. Don't forget to download the BoF Professional iPhone app.

This week, a nine-year-old named Andrew wrote a letter to Keith Phillips, the bankruptcy judge overseeing the case of Toys R Us, which filed for Chapter 11 protection earlier this month. The shuttering of Toys R Us, the largest toy store chain in the US, would be “bad for kids” and make them “very unhappy”, read the letter. But recent filings show a business that is in deep trouble — and facing many of the same pressures confronting fashion and luxury retailers.

Of course, Toys R Us has suffered from specific challenges, such as the rise of video games. But like fashion and luxury retailers, the toy store chain has struggled to compete with e-commerce players and taken a hit from declining traffic at American shopping malls and a wider retail malaise.

Then there’s the crippling weight of its debt — $5.2 billion as of July 29 — which begs the comparison between Toys R Us and the American luxury department store giant Neiman Marcus, which is also heavily indebted, has been teetering on the brink of bankruptcy and, earlier this year, abandoned its plans to IPO in favour of “strategic alternatives”. (A buyer has yet to materialise. In June chief executive Karen Katz said the company was no longer exploring a sale to Hudson's Bay, which has expressed interest in the business, but can afford to simply wait for the right price as Neiman’s predicament worsens.)

ADVERTISEMENT

Neiman Marcus desperately needs to show positive momentum, but has been forced to prioritise the servicing of the $4.4 billion debt load which financed its buyout by Ares Management and the Canada Pension Plan Investment Board back in 2013. In the first nine months of its last fiscal year, the company paid $220 million in interest payments. This burden has pushed executives into cost-cutting mode, meaning the company has less to invest in evolving its business and making the changes it must implement to survive the so-called “retail apocalypse” and transition to a new omnichannel reality.

Neiman Marcus was set to release its full-year results this week, but has pushed back its report to October 10. In its last filing in June, the company reported third-quarter 2017 revenue of $1.11 billion, down 4.9 percent on the same period last year. Same-store sales also fell 4.9 percent.

Importantly, Neiman Marcus has a strong online business, accounting for about one third of total sales. Indeed, e-commerce is perhaps the one bright spot for the company. But its June report showed online sales were up just over 2 percent year-on-year to $356 million — not exactly stellar growth in a rapidly growing global luxury e-commerce market.

In sum, the weight of the company’s debt is creating a downward spiral that makes recovery increasingly unlikely as overall revenue continues to fall.

Much like Toys R Us, the demise of Neiman Marcus would have a worrying ripple effect across the industry. A universe of fashion labels depends on wholesale partnerships with the department store chain. If Neiman Marcus can’t find a way out of its negative spiral, it may take a chunk of the industry with it. Watch this space.

THE NEWS IN BRIEF

BUSINESS AND THE ECONOMY

H&M's profits tumble after summer discounting. The Swedish retailer's pretax profit fell 20 percent to $614.7 million during the three months ending August 31, due to larger-than-normal discounts of leftover inventory in stores as younger consumers continue to make more purchases online. Shares also tumbled 4.6 percent, taking the year-to-date fall to 15.8 percent. As a result, the company decreased the number of stores it plans to open in the next year to 385, down from 400.

ADVERTISEMENT

Unilever purchases Korean cosmetics maker for $2.7 billion. The Anglo-Dutch consumer goods giant's acquisition of Carver Korea from shareholders, including Goldman Sachs, will bolster its position in the region. South Korea is the fourth-largest skincare market in the world. Unilever, which posted sales last year of €321 million ($378.2 million), is rapidly increasing the number of beauty brands in its portfolio: it recently acquired Dermalogica, Ren and Murad.

Nike relies on Asia after US sales slump. Nike beat its first-quarter profit estimates despite a weakening US market by relying on strong overseas sales, especially in China and Latin America, and streamlining global operations. The company is also pursuing new channels for distribution: in July, it announced a partnership with Amazon.

Louis Vuitton and Hermès lead Interbrand ranking, Ralph Lauren is dropped. Interbrand's Best Global Brands 2017 ranking — which measures financial performance and a brand's ability to influence customer choice — found that while Apple, Google and Microsoft are the three most valuable brands, Burberry and Prada are losing momentum: Burberry slipped three places to 86, while Prada dropped 13 places to 94. Ralph Lauren fell out of the rankings, from 98th last year. Louis Vuitton held its position at 19, Hermès climbed two places to 32 and Gucci climbed one spot to 51.

PEOPLE

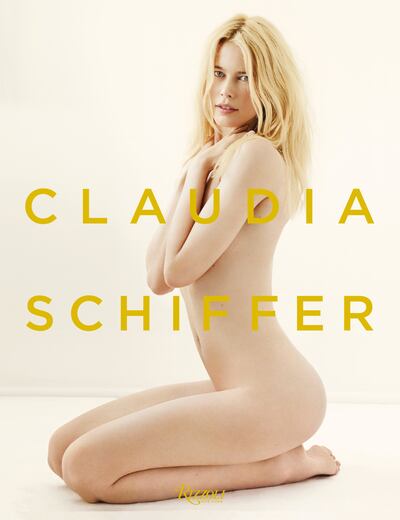

Claudia Schiffer's book cover | Source: Courtesy

Claudia Schiffer releases retrospective book. The German model is celebrating her 30-year career with a self-titled book published by Rizzoli. It includes a selection of her favourite images by photographers including Mario Testino, Peter Lindbergh and Steven Meisel. Schiffer is also flexing her collaboration muscles: she is set to partner with Aquazzura on a range of shoes and with Art Deco on a makeup line that includes a "Denim Blue" eye palette.

Street style photographers rally around #nofreephotos. About 40 members of an unofficial union named "The Photographers" — including Adam Katz Sinding of Le 21ème — began adding the hashtag to Instagram posts at the end of Milan Fashion Week to digitally protest brands and bloggers that use their images for editorial and commercial purposes without credit or compensation.

Michelle Gass appointed chief executive at Kohl's. Gass, who joined the company in 2013 as chief merchandising officer, has been instrumental in launching new product categories and bringing new brands such as Under Armour into stores. Kohl's chairman, chief executive and president Kevin Mansell will retire in May 2018 after 35 years at the helm of the US department store. Chief operating officer Sona Chawla take the role of president.

ADVERTISEMENT

Vanessa Kingori named British Vogue publishing director. The former publishing director of GQ and GQ Style — where she broke barriers as the title's first female publisher and Condé Nast UK's first black publisher — will join Edward Enninful at British Vogue in December. Current publishing director Stephen Quinn will retire after 26 years. Meanwhile, Wired and Ars Technica's group commercial director Nick Sargeant will assume Kingori's duties, adding the British GQ and GQ Style titles to his existing role.

TECHNOLOGY

Burberry partners with Apple on AR app feature. The British brand utilised Apple's ARKit technology to develop an augmented-reality tool that interacts with users' smartphone cameras and digitally redecorate their surroundings with drawings by the artist Danny Sangra. The launch comes as many luxury retailers try to find new ways to engage with customers online.

Levi's launches tech jacket with Google. The smart jacket created with Google's experimental ATAP division is coming to market one year after it was first announced and will retail for $350. Its cuff fabric, crafted from copper-cored fibres, responds to touch like a smartphone and connects to mobile devices through a Bluetooth dongle.

Alibaba takes a controlling stake in delivery company Cainiao. The e-commerce company invested an additional $800 million, and pledged $15 million over the next five years, to expand the unprofitable shipping network and take more control of its own distribution infrastructure in China and beyond. Alibaba is intent on market domination in the region, but recently denied claims that it pressured 44 brands to quit rival e-commerce site JD.com. Reports alleged that brands were told to choose between its marketplace and Alibaba's Tmall.

BoF Professional is your competitive advantage in a fast-changing fashion industry. Missed some BoF Professional exclusive features? Click here to browse the archive.

The British musician will collaborate with the Swiss brand on a collection of training apparel, and will serve as the face of their first collection to be released in August.

Designer brands including Gucci and Anya Hindmarch have been left millions of pounds out of pocket and some customers will not get refunds after the online fashion site collapsed owing more than £210m last month.

Antitrust enforcers said Tapestry’s acquisition of Capri would raise prices on handbags and accessories in the affordable luxury sector, harming consumers.

As a push to maximise sales of its popular Samba model starts to weigh on its desirability, the German sportswear giant is betting on other retro sneaker styles to tap surging demand for the 1980s ‘Terrace’ look. But fashion cycles come and go, cautions Andrea Felsted.