The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

This article appeared first in The State of Fashion 2020 Coronavirus Update, an in-depth report focusing on the themes, issues and opportunities impacting the global fashion industry in the wake of the coronavirus, co-published by BoF and McKinsey & Company. To learn more and download your free copy of the report, click here.

LONDON, United Kingdom — Before Covid-19, fashion was already a "winner-takes-all" industry. Now, even though we are only at the beginning of the pandemic, it is almost certain that the crisis will intensify the industry's polarising nature. The shutdown of physical retail and the slump in both consumer and investor confidence will irrevocably alter the fashion business landscape by accelerating the decline of struggling companies and buoying stronger empires.

Companies in all categories will be forced to review their positioning in this stark new landscape and, for once, the much-maligned phrase “adapt or die” will not be an overstatement. It will be remembered as a Darwinian moment for the global fashion industry.

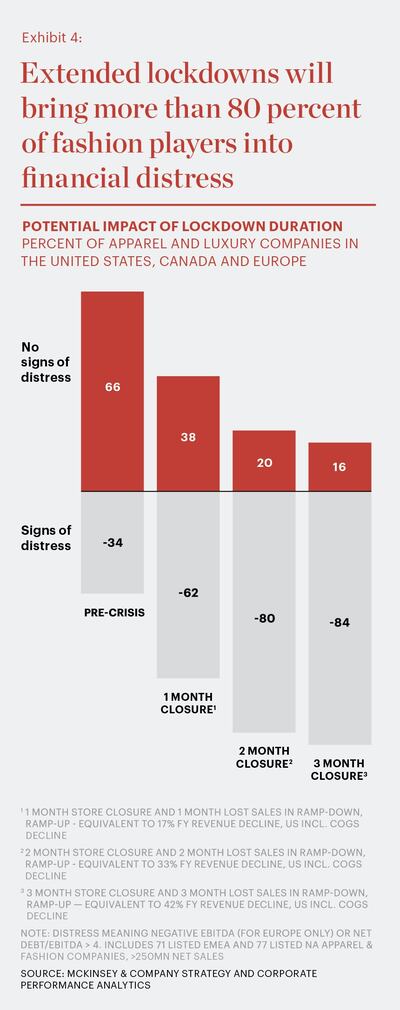

The stakes are indeed very high. While McKinsey analysis revealed that 34 percent of listed fashion businesses in North America and Europe were displaying signs of financial distress before the coronavirus first broke out, we predict that after two to three months of store closures that figure will more than double to over 80 percent. In fact, the financial market — which could face its biggest economic contraction since the second World War — is still faring better overall than apparel players, whose valuations and stock prices have plummeted to dramatic lows, with year-to-date losses of more than 40 percent in mid-March.

ADVERTISEMENT

34 percent of listed fashion businesses ... were displaying signs of financial distress before the coronavirus first broke out.

These headwinds will widen the gap between fashion's winners and losers, with the latter likely to file for bankruptcy, seek government aid, close, or become targets for stronger players or private equity firms. Early indicators of things to come are already playing out on the global stage, with heavily indebted US department store Neiman Marcus reportedly commencing bankruptcy talks, Hong Kong-based supply chain giant Li & Fung receiving a $930 million privatisation offer and UK retailer Laura Ashley declaring insolvency.

Even before the outbreak began, more than half of the fashion companies in the McKinsey Global Fashion Index (MGFI) were classified as "value destroyers" in The State of Fashion 2020 report — meaning their profit does not exceed their estimated cost of capital — and that number has been growing each year. The pandemic spells more trouble for this group, which includes department store giants, high street brands and venture-backed start-ups.

Many department stores failed to adequately reinvent their value for consumers following the 2008 financial crisis. Struggling high street players have been unable to catch up with consumer demand. And venture-backed companies that prioritised growth over profits are now struggling with liquidity as venture funds scale back investments. Digitally inept discount players operating their businesses at low margins, in addition to brands targeting consumer groups other than core online shoppers, are likely to struggle more than others. Multi-brand boutiques will also suffer, grappling with demanding rent obligations and dwindling cash reserves resulting from already poor margins and excess stock.

The ensuing financial distress will spur industry consolidation to an extent significantly greater than that caused by the 2008 global financial crisis, which led to approximately 300 US fashion companies declaring bankruptcy. Though M&A activity will slow down at first as companies struggle with liquidity and stock devaluations, it will pick up once the dust settles as strong, strategic investors and private equity companies take the opportunity to acquire distressed assets for a steal. This is especially true for fragmented categories like footwear and stock-laden, wholesale-focused brands. Even the industry's top 20 "super winners" are not fully immune from the crisis and have seen valuations plummet. Between January 1 and March 24, stock prices declined more than 40 percent (which is the average for all apparel players) for six out of 20 super winners cited in The State of Fashion 2020 report.

However, in the aftermath of a crisis, resilient players can outperform rivals. Power can be consolidated as previously held market share is freed up once competitors fall away. With better access to resources and government aid, powerful fashion conglomerates are at an advantage and Asian and Middle Eastern investors will push on with cross-border acquisitions while the markets are down. Some outperforming players will be emboldened by opportunities that arise during the consolidation reshuffle.

Maintaining a future-orientated outlook is key to enabling stronger players to thrive beyond the crisis. Fashion businesses need to steel themselves for a turbocharged “survival of the fittest” climate. To start, a re-evaluation of their core will foster growth by improving liquidity and bringing potential acquisition targets into focus. Thereafter, a cautious re-appraisal of business models and future market positioning will allow agile players to thrive. Companies must strategically think about their future now. This includes identifying financial leverage, divestitures, acquisition opportunities and strategic partners, increasing earnings, and creating operational and financial stability early in the recession.

Power can be consolidated as previously held market share is freed up once competitors fall away.

In previous global crises, some players identified opportunities in future-proofing brands, such as GAP's acquisition of Athleta in 2008, which it used to enter the rising sportswear category and is now driving the company's growth. Others may opt to rebuild their brand through privatisation without shareholder pressure or link arms with a strong partner to guarantee liquidity. Elsewhere, private equity funds will purge their portfolios of weaker players, providing onlookers with a chance to identify new targets and privatise amid low valuations.

During this wave of consolidation, M&A activity and insolvencies, fashion players must be alert to opportunities concealed in market gaps that open as other companies shutter, be it in real estate, revenue potential or talent, which will pave the way for post-pandemic prosperity. Companies that struggled before this crisis will be hit especially hard, but some resilient players and PE firms will emerge even stronger. Ultimately, the success of most opportunities seized during fashion’s big shakeout will be a factor of how well companies prepare themselves now — and how fast they are able to evolve to suit their newly changed environment.

The British musician will collaborate with the Swiss brand on a collection of training apparel, and will serve as the face of their first collection to be released in August.

Designer brands including Gucci and Anya Hindmarch have been left millions of pounds out of pocket and some customers will not get refunds after the online fashion site collapsed owing more than £210m last month.

Antitrust enforcers said Tapestry’s acquisition of Capri would raise prices on handbags and accessories in the affordable luxury sector, harming consumers.

As a push to maximise sales of its popular Samba model starts to weigh on its desirability, the German sportswear giant is betting on other retro sneaker styles to tap surging demand for the 1980s ‘Terrace’ look. But fashion cycles come and go, cautions Andrea Felsted.