The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

A new study conducted by resale service provider Trove and Worldly, the sustainability analytics provider formerly known as Higg Inc., has found that branded resale efforts — such as Coach’s pre-owned offering (Re)Loved or Patagonia’s secondhand platform called Worn Wear — can have a positive effect on carbon footprints, though it won’t be as effective as other supply chain decarbonisation efforts such as reducing waste in the production process or using recycled materials.

Resale’s green credentials are fiercely debated. Proponents say secondhand sales reduce demand for new garments; critics counter that the spread of resale may actually drive overconsumption if consumers believe they can shop new and then sell their purchases onward after a few wears.

The study finds that some brands can reduce their emissions by relying on resale programmes to drive more sales, as this would allow them to scale back the amount of new merchandise they produce without sacrificing growth. The more coveted the product, the easier the math: a handbag might retain 50 percent or more of its value in the secondhand market, allowing its maker to grow revenue and profits while making fewer new bags. The same applies to durable outdoors wear. But the strategy likely wouldn’t work for fast fashion, which doesn’t retain much resale value.

“Every player must understand the strategies that will help their decarbonisation efforts, and the ones that will not — it’s not a one-size-fits-all [solution],” said Andy Ruben, founder and executive chairman of Trove.

ADVERTISEMENT

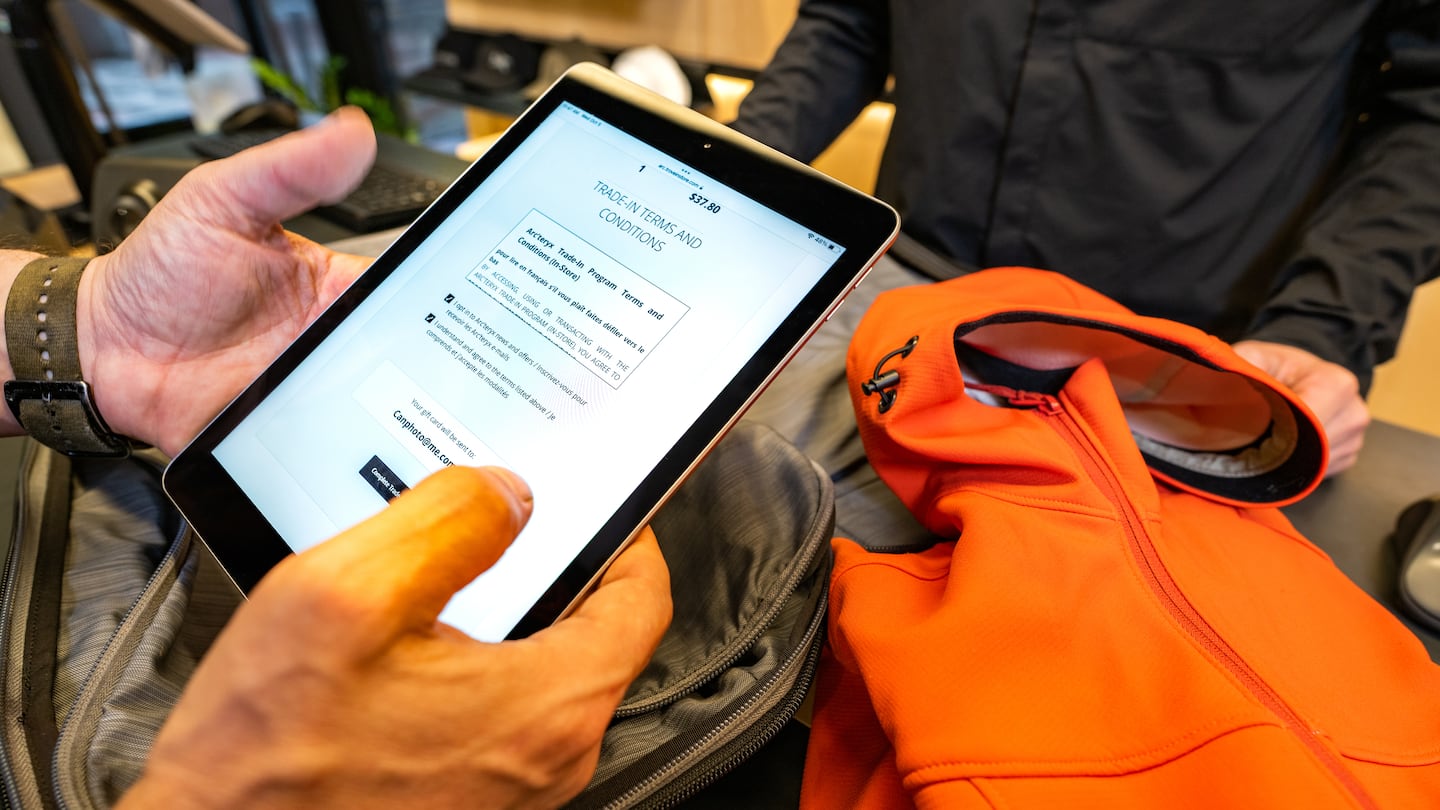

Trove’s technology powers exactly the sort of resale programmes the report describes, with clients including Eileen Fisher and Arc’teryx. The report measures the carbon footprint of different products — fast fashion, athleisure, premium apparel, mid-tier apparel and outdoor — both new and pre-owned, and then took into account their respective resale factors such as the size of the programme, sell-through rate and resale prices. It’s the first time researchers have been able to directly quantify the effect of different resale initiatives on carbon footprint.

These components will have varying effects on new production and whether resale revenue can contribute to overall sales growth, assuming an annual revenue increase of 5 percent and product increase of 2 percent across all five product archetypes.

The calculations show that the more a brand can rely on resale for revenue, the larger the carbon impact of its resale initiative. Under these circumstances, the report concluded that resale programmes among premium apparel brands and outdoor retailers are particularly effective because their products are designed to last and therefore retain significant value in the secondary market.

For an outdoor apparel company, a resale programme that makes up about a quarter of overall sales could help lower annual emissions from 15 to 16 percent by 2040, the report found.

On the other hand, fast fashion brands will likely see minimal carbon mitigation from resale initiatives because their secondhand products are less coveted, and therefore less likely to command high enough prices to be a viable revenue stream. Circular programmes for fast fashion players will have less than 1 percent of impact on carbon emissions, according to the study.

Achieving the most ideal carbon offset goals, however, won’t be an easy feat either. In order to meet the 15 percent carbon reduction benchmark for outdoor apparel brands, these companies must cut total production by 26 to 35 percent (while maintaining 5 percent annual growth in revenue), the report found.

This means resale must comprise about 25 percent of their revenue and about 35 percent of total units sold, according to Ruben. Currently, Trove’s brand partner with the biggest resale programme counts 5 percent of sales from its secondhand offering.

But with imminent regulations in Europe and California that would potentially require brands to significantly reduce their carbon emissions anyway, Ruben said he believes brands soon won’t have a choice when it comes to overhauling their supply chains.

“The only choice is how,” he said.

Ultra-fast fashion e-tailer PrettyLittleThing is the latest brand to launch a secondhand marketplace, playing into a debate over whether resale is becoming a smokescreen for even more and faster consumption.

BoF’s definitive guide to fashion resale, covering the evolution of the market, its growth and upside, consumer behaviours and recommendations for crafting a data-driven resale strategy.

BoF unpacks emerging models of resale services for brands, including Reflaunt, a startup that counts Ganni’s founder among its latest investors, and Vestiaire Collective’s new ‘Brand Approved’ programme.

Cathaleen Chen is Retail Correspondent at The Business of Fashion. She is based in New York and drives BoF’s coverage of the retail and direct-to-consumer sectors.

As the German sportswear giant taps surging demand for its Samba and Gazelle sneakers, it’s also taking steps to spread its bets ahead of peak interest.

A profitable, multi-trillion dollar fashion industry populated with brands that generate minimal economic and environmental waste is within our reach, argues Lawrence Lenihan.

RFID technology has made self-checkout far more efficient than traditional scanning kiosks at retailers like Zara and Uniqlo, but the industry at large hesitates to fully embrace the innovation over concerns of theft and customer engagement.

The company has continued to struggle with growing “at scale” and issued a warning in February that revenue may not start increasing again until the fourth quarter.