The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

The pandemic is rewriting the rules of retail — and an emerging class of digitally native companies are swooping on struggling brands to boost their reach.

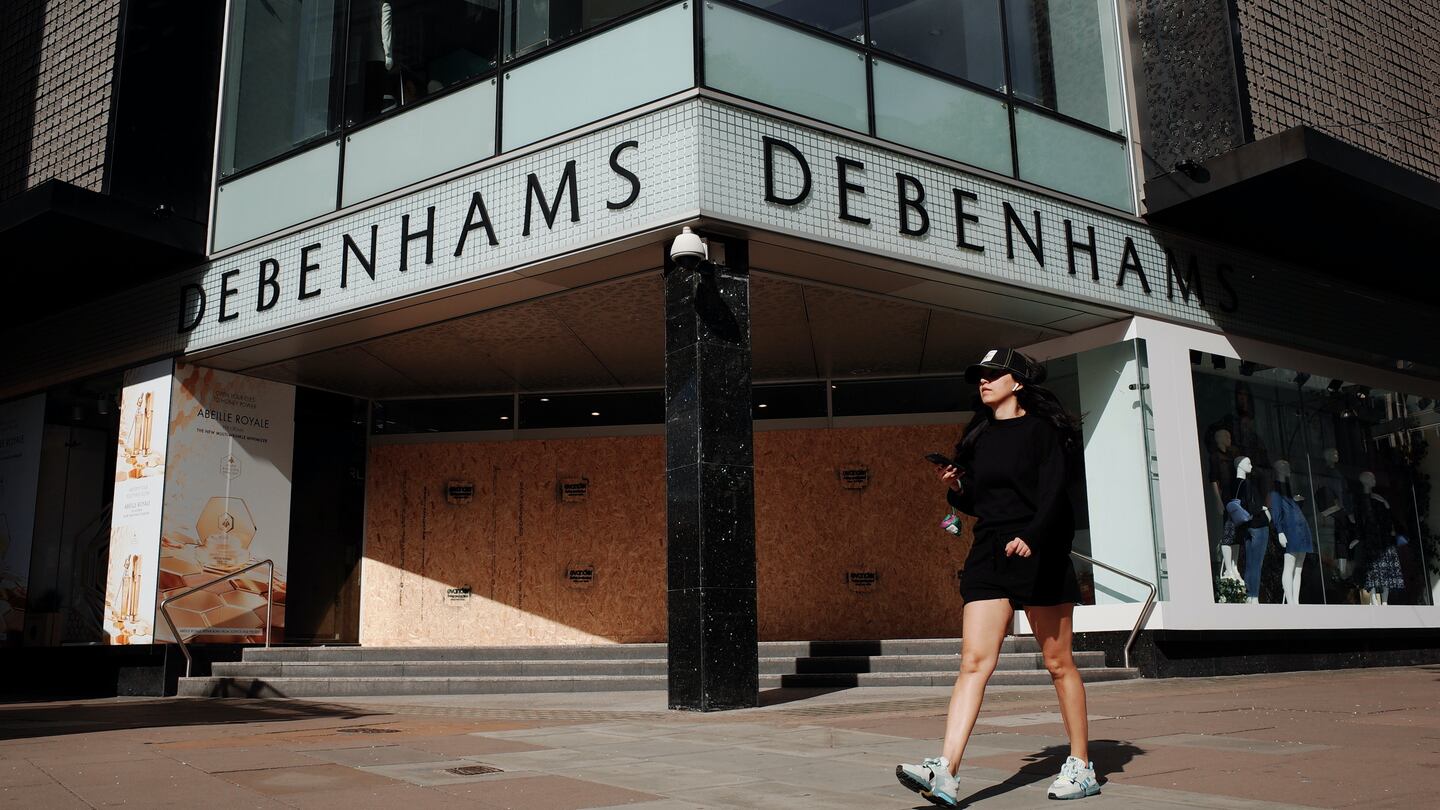

On Monday, Boohoo Group confirmed its purchase of ailing department store Debenhams’ brand and website for £55 million, marking the latest pandemic-era acquisition for the ultra-fast-fashion e-commerce site (in June, it snapped up Oasis and Warehouse brands out of administration for £5 million). Meanwhile, fast-fashion platform Asos confirmed it is in talks to acquire brands including Topshop and Topman out of administration from Arcadia Group.

Over the pandemic, Boohoo and Asos boomed with their digital first models and savvy marketing tactics well placed to capture the wallets of shoppers stuck at home. Meanwhile, brick-and-mortar retailers like Topshop and Debenhams, which were once the mainstays of the British high street, reeled from the impact of lockdowns, falling into administration as the pandemic served the final blow to the already struggling retail businesses. The fallout was felt globally. In the US, larger players like Neiman Marcus and J.Crew filed for bankruptcy, while in France struggling high street label Naf Naf sold to its Turkish-Tunisian supplier SY International.

While Neiman Marcus and J.Crew emerged from bankruptcy with much of their retail network intact, often ailing brands are sold to new owners who see more value in their names than in their stores.

ADVERTISEMENT

Topshop, for example, still has a strong heritage and high level of consumer awareness, making it ripe for a successful brand resuscitation. Asos’ negotiations with Arcadia creditors are focused on the group’s jewel brands without their stores. Boohoo, too, has no plans to diversify beyond e-commerce into physical retail. The group is only buying the department store’s website, customer lists and private label brands, leaving its 130 brick-and-mortar stores out of the transaction.

The transactions speak to what is most valuable to today’s fashion retailers: large store networks, with their high operating costs, are liabilities rather than assets. Access to customers, and their data, carries a premium.

“Brands are important, even tired, fading brands,” said Guy Elliott, retail analyst at Publicis Sapient. “They’re buying consumers. They’re buying a brand that has history.”

Debenhams fits that mould. Despite its recent struggles, its website still has around 300 million visitors a year. Its own fashion brands appeal to an older shopper, helping Boohoo expand beyond its core customer base, which tends to be teenagers and consumers in their 20s.

“Given Debenhams’ challenges, it is perhaps easy to forget the scale and broad appeal of the brand,” Jeffries analyst Andrew Wade wrote in a note.

Boohoo plans to gut Debenhams’ fashion and homeware wholesale business, which currently accounts for about 30 percent of website revenues. Instead it will focus on the retailer’s marketplace, which is relatively cheap to maintain but could grow quickly with Boohoo’s marketing prowess behind it.

Through the marketplace, Boohoo is expanding into fashion-adjacent categories that have surged over the pandemic, including homewares and sports. The group also has plans to grow the beauty business, which already operates at scale with 6 million customers and partnerships with leading prestige brands from Dior and Chanel to Benefit and Bobbi Brown. While the Debenhams website will continue to sell beauty products using a wholesale model, Boohoo said it would look to add new brands via the marketplace.

Asos has a substantial wholesale business, but it also operates its own marketplace and a number of own-label brands, a segment it has been dialling up in recent years. Its interest in acquiring Topshop, Topman, Miss Selfridge and HIIT suggests it’s looking to bolster its direct business and reduce reliance on third-party brands.

ADVERTISEMENT

“Asos already has some of these brands on its site, it knows how Topshop sells to existing customers for instance, and can stop those sales going to a competitor,” said Maureen Hinton, global retail research director at GlobalData.

The jury’s still out on whether passing up on stores in favour of a pure digital proposition, as Boohoo Group is planning to do with Debenhams, is a smart move. While this week’s developments highlight the importance — and growing power — of e-commerce players in today’s retail landscape, experts say this isn’t the end of physical retail.

Some argue that experience-led stores that can act as brand builders still have meaning, especially in a post-Covid world where shoppers are eager to do things. In the US, brands that survived bankruptcy like Brooks Brothers and Neiman Marcus will continue to have stores.

“On the one hand, you could say the store portfolios were losing money. They had too much real estate ... You can certainly seeing the only players not wanting to have the burden of that full store estate,” said Elliott.

“But I don’t see a high street without clothing stores. So [if] it’s not them, there will be others. Because people love to shop — and they love to shop physically.”

Related Articles:

Boohoo Buys Debenhams Brand for £55 Million

Report: Asos Is Front-Runner To Buy Topshop Brand

ADVERTISEMENT

The Rise and Fall of Topshop: What Went Wrong

The company, under siege from Arkhouse Management Co. and Brigade Capital Management, doesn’t need the activists when it can be its own, writes Andrea Felsted.

As the German sportswear giant taps surging demand for its Samba and Gazelle sneakers, it’s also taking steps to spread its bets ahead of peak interest.

A profitable, multi-trillion dollar fashion industry populated with brands that generate minimal economic and environmental waste is within our reach, argues Lawrence Lenihan.

RFID technology has made self-checkout far more efficient than traditional scanning kiosks at retailers like Zara and Uniqlo, but the industry at large hesitates to fully embrace the innovation over concerns of theft and customer engagement.