The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

MANCHESTER, United Kingdom— Boohoo Group is empire building.

Last week, the ultra-fast fashion e-commerce company, best known for its Insta-trendy and low-priced apparel, made an £18.2 million ($22 million) play for the online businesses of Karen Millen and Coast.

The opportunistic move to purchase two struggling British high street players out of administration signals broader ambitions for Boohoo. The company has established a leading position among a new breed of online players that have effectively used social media to target a young, fashion-conscious consumer base eager for an ever-changing selection of ultra-cheap clothing. Karen Millen and Coast target an older, higher-spending demographic with the potential to diversify Boohoo's reach and consolidate its position within the market.

Where Boohoo’s current stable of brands caters to a generation that dares-to-bare in tight-fitting outfits on Instagram, Coast is better-known for more formal occasion-wear and Karen Millen targets a more aspirational, professional audience.

ADVERTISEMENT

“Karen Millen is for would-be WAGs,” said Maria Malone, principal lecturer in fashion business at Manchester Metropolitan University, referring to a colloquial British phrase for sports stars’ wives and girlfriends. “Coast is going to a wedding.”

The acquisition sets Boohoo up to go after a bigger prize: an online fast-fashion empire with a broader appeal that could grow to rival the industry's two incumbents Zara and H&M.

"Where Inditex was the disruptor historically, Boohoo is claiming that mantle," said Panmure Gordon analyst Andrew Blain, referencing the meteoric rise of Zara's parent company, which displaced the dominance of players like Gap Inc across high streets and malls over the last twenty years.

The acquisition sets Boohoo up to go after a bigger prize: an online fast-fashion empire.

While Boohoo remains a fraction of Inditex’s size, it clearly intends to continue to expand. Its acquisition of Karen Millen and Coast has the potential to shore up the company’s position in an uncertain market by diversifying its consumer base and building a broader stable of brands, just like other more established players have done.

Founded in Manchester in 2006, Boohoo has expanded swiftly to become one of the most successful among a new cohort of disruptive online-only players taking fast fashion to a new cadence and ultra-low price point. The company has thrived off a slick blend of social-media marketing and test-and-repeat merchandising model that’s challenged established players.

It has bolstered its growth with a string of acquisitions, acquiring a controlling stake in PrettyLittleThing — the brand set up by two of Boohoo-co-founder Mahmud Kamani’s sons — for a cash consideration of £3.3 million in 2017. Later that year it took on US-based NastyGal for $20 million. In March, it bought MissPap, another UK-based online retailer.

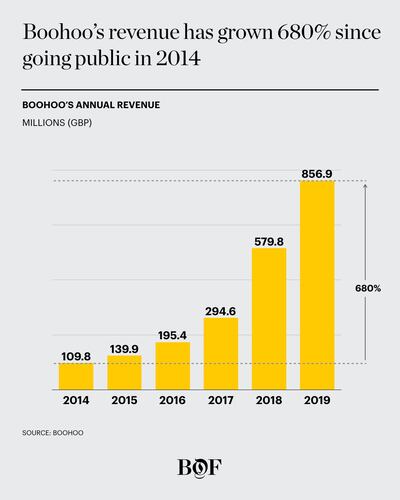

It has proved to be a wildly successful business model. Since the company went public in 2014, sales have grown nearly eight-fold, hitting £856.9 million ($1 billion) in the fiscal year ending in February and proving resilient to a tough trading environment that has dented profits at many rivals. It's not hard to see where some of those sales are coming from: even as Boohoo's revenue has jumped, long-standing high-street fixtures are crumbling; Topshop-owner Arcadia Group narrowly avoided bankruptcy earlier this year.

At the same time, the company’s position could still be seen as precarious. Other online retailers have enjoyed swift success, and then stumbled. Boohoo acquired Nasty Gal — one of social-media-driven e-commerce’s early success stories — out of bankruptcy and its not clear consumers’ appetite for the company’s current brand of fashion will continue to grow.

ADVERTISEMENT

"They have a very specific market at the moment and if they're going to survive and grow, they need to expand," said Malone, pointing to shifting consumer attitudes towards sustainability and disposable fashion. "Times are changing with fast fashion...these young people will grow into that mindset, so they'll look for an older, more conservative, smarter, more polished look, and they'll grow out of the typical Boohoo look."

While Boohoo’s average price point was around £13 per item in 2017, a typical Karen Millen dress is more likely to retail at upwards of £100. The fast-fashion retailers’ current target customer ranges from 16 to 30, whereas the company pegs the Coast consumer at upwards of 25 and Karen Millen skews towards women 30 and above.

Where Inditex was the disruptor historically, Boohoo is claiming that mantle.

Though other multi-brand retailers have shown it is possible to build a diverse stable of brands through organic growth, investors and analysts largely praised the opportunistic land grab. Boohoo’s share price rose around 3 percent last week following the deal announcement.

The acquisition’s £18.2 million price tag looks cheap given that Karen Millen and Coast’s websites generated £28 million in sales last year. In addition to the brand value, the fast-fashion company is acquiring valuable customer data and a solid sourcing network — two big expenses when building a brand from scratch. The deal doesn’t include Karen Millen and Coast’s network of physical stores. Boohoo’s betting it can mimic the strategy it deployed to great success with previous acquisitions, plugging the brands into its online platform and swiftly scaling them with its test-and-repeat business model.

“The plan over time will be to build a suite of different brands that attract a different customer,” said Citigroup analyst Adam Cochrane. “You are seeing quicker churn in and out of brands, so to have diversification and a pipeline out of that for Boohoo would make it more secure.”

However, the company's ambitions are not without risk. As Boohoo has grown, its business practises have already drawn greater scrutiny from regulators and investors. Earlier this year, the company was called out in a UK parliamentary report for failing to do enough to tackle "unsustainable and "exploitative" business practises. Last month, the chair of the parliamentary committee that conducted the inquiry wrote to the company's chairman about its continued failure to engage with workers' rights initiatives. Boohoo declined to comment.

“It’s certainly a concern for investors,” said Panmure Gordon’s Blain. “The biggest criticism is CSR and corporate governance, and all investors have a keen eye on these issues.”

There’s also a question over whether Boohoo can translate its slick plug-and-play strategy to a higher price point and more quality-conscious consumer.

ADVERTISEMENT

“The real test will be to prove the secret sauce works with other businesses,” Citi’s Cochrane said.

Related Articles:

[ Inside the Fashion Nova Hype MachineOpens in new window ]

[ Can Lightning Strike Twice with Love Island's New Fashion Partner?Opens in new window ]

From analysis of the global fashion and beauty industries to career and personal advice, BoF’s founder and CEO, Imran Amed, will be answering your questions on Sunday, February 18, 2024 during London Fashion Week.

The State of Fashion 2024 breaks down the 10 themes that will define the industry in the year ahead.

Imran Amed reviews the most important fashion stories of the year and shares his predictions on what this means for the industry in 2024.

After three days of inspiring talks, guests closed out BoF’s gathering for big thinkers with a black tie gala followed by an intimate performance from Rita Ora — guest starring Billy Porter.