The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

NEW YORK, United States – Farfetch wants to dominate the luxury market online, but investors and analysts are starting to question what it will cost for the marketplace to achieve that goal.

The company’s stock has plunged 16 percent since reporting Thursday that losses more than doubled in the first quarter from a year earlier, to $109.2 million. Farfetch has always run in the red, spending heavily on the technology behind its platform and on winning customers in an increasingly crowded online marketplace.

And those efforts have paid off with years of torrid growth: the value of goods sold on Farfetch in the first three months of the year hit $415 million, up 42 percent from a year earlier (as a marketplace, Farfetch takes a cut of each sale). In an interview, Chief Executive José Neves said that Farfetch "has barely scratched the surface" when it comes to dominating luxury e-commerce.

“There’s tremendous, incremental opportunity here,” Neves said. “To me, there’s a question of who is going to take the lion’s share of the luxury market online. I want to be the platform that allows our brands and boutique partners to grab this opportunity.”

ADVERTISEMENT

I want to be the platform that allows our brands and boutique partners to grab this opportunity.

The formula of running big losses to secure explosive growth is common in the world of e-commerce. Indeed, Farfetch has modelled aspects of its operations on Amazon, which racked up billions of dollars in losses as it expanded into new markets and offered free shipping and other perks to bring in new customers.

Farfetch's pitch to consumers is that it offers the widest selection of luxury goods, with more than 400 brands on offer from thousands of sellers from around the world. The company has taken steps to solidify its lead on that front, with a just-launched foray into resale, as well new cachet in the streetwear market with last year's acquisition of Stadium Goods.

But in order for potential customers to know about that vast selection, Farfetch is having to advertise — a lot. Farfetch’s “demand generation expense,” or its spending on customer acquisition, hit $31.4 million in the first quarter of 2019, a signficant jump from the $19.3 million it spent the prior year.

“The market is very crowded and competitive, and Farfetch needs to work to create brand recognition and capture customers,” said Neil Saunders, the Managing Director of GlobalData Retail. [If] Farfetch becomes reliant on an elevated level of marketing spend to keep customers active … under this model it is very difficult to move to profitability.”

The market is very crowded and competitive, and Farfetch needs to work to create brand recognition and capture customers.

The combination of high customer acquisition costs and the unexpected spate of acquisitions raises questions about how long it will take for Farfetch to turn a profit, said Deborah Aitken, a senior industry analyst with Bloomberg Intelligence.

Farfetch’s focus on offering the widest selection may also have a limit, analysts say. The most popular luxury brands, many of which have been steering customers away from department stores and toward their own boutiques, may also adopt a similar approach online.

"Mega-brands — who dominate the luxury industry today — have little to gain from feeding 'winner takes all' third-party distribution platforms," said Luca Solca, head of luxury goods research at Bernstein, in a research note earlier this month. " We'd expect Gucci and Prada will soon realise this."

Some analysts see evidence that Farfetch’s strategy will eventually pay off. J.P. Morgan analysts called the post-earnings slide in Farfetch shares “an overreaction,” and Aitken noted that platform order contribution, the gross profits left over once advertising and other demand generation expenses are deducted, rose from $40 to $50 [per order] in the first quarter.

ADVERTISEMENT

The demand has been phenomenal and so we want to double down on that

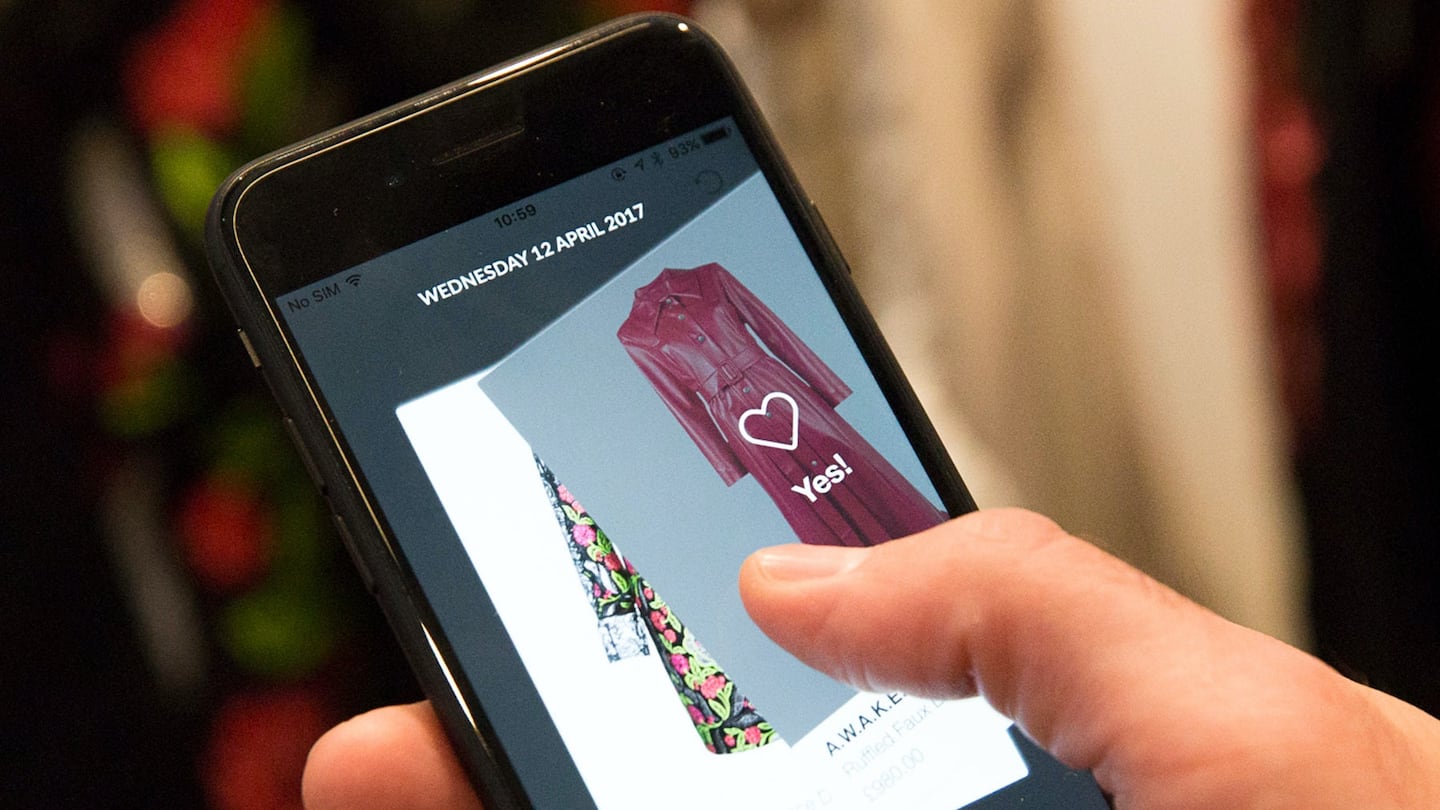

Part of the business model also includes Farfetch Black & White, a white label service that allows brands to run aspects of their retail business through Farfetch's site. Farfetch has already nabbed a partnership with British department store Harrods, and exclusively runs the company's e-commerce division. Farfetch also has a partnership with Chanel in which it's built an "augmented boutique" for the storied French brand in Paris. It uses Farfetch's operating system to create a digital retail experience for Chanel, utilising technology like a fashion adviser app and RFID product sensors. While these are small, one-off partnerships, they can become highly-lucrative services that are easily mimicked.

Neves said the way forward for Farfetch is double-down on what’s already working. He said the company is eyeing the resale market in order to determine if there are “opportunities to expand.” Farfetch also intends to spin off Stadium Goods into its own line of streetwear apparel, building on the existing and limited drops Stadium Goods already puts out.

This will be our first foray into first-party owned inventory.

“The demand has been phenomenal and so we want to double down on that,” Neves said. “This will be our first foray into first-party owned inventory. I think it’s going to be really interesting because Stadium Goods has a lot of street credibility and a big following.”

The question is whether these efforts will grow faster than customer acquisition costs. Companies that spend much of their capital on fuelling demand are attracting increased scepticism, as competition drives up marketing costs online and some investors call the long-term effectiveness of the model into question.

Related Articles:

[ Farfetch Signals Growing Ambitions in ResaleOpens in new window ]

As the German sportswear giant taps surging demand for its Samba and Gazelle sneakers, it’s also taking steps to spread its bets ahead of peak interest.

A profitable, multi-trillion dollar fashion industry populated with brands that generate minimal economic and environmental waste is within our reach, argues Lawrence Lenihan.

RFID technology has made self-checkout far more efficient than traditional scanning kiosks at retailers like Zara and Uniqlo, but the industry at large hesitates to fully embrace the innovation over concerns of theft and customer engagement.

The company has continued to struggle with growing “at scale” and issued a warning in February that revenue may not start increasing again until the fourth quarter.