The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

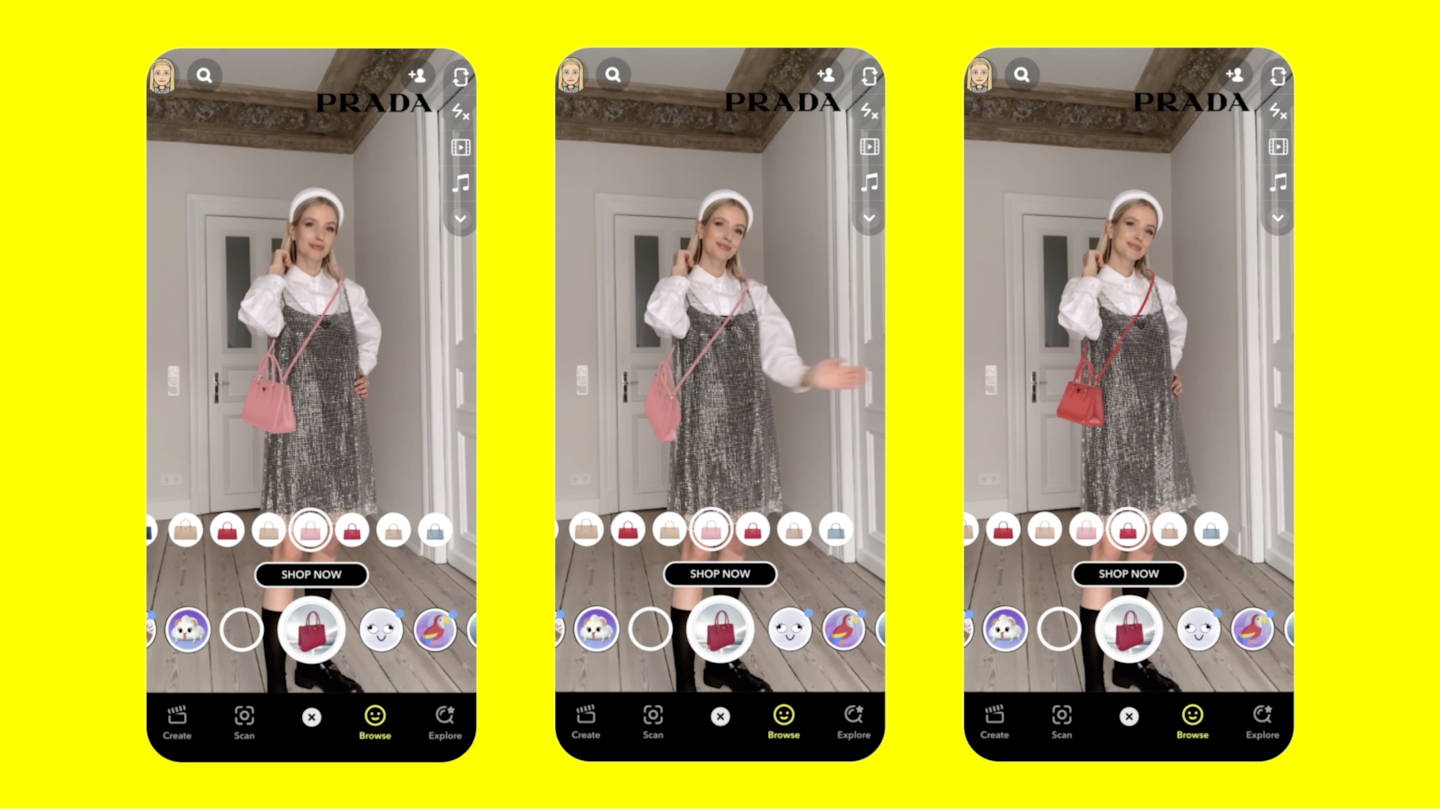

A suite of development tools powered by Snap Inc.’s Augmented Reality arm are seeking to foster more sophisticated and seamless integrations of its technologies. Today, Snap Inc. counts Prada, Farfetch and Gucci among its roster of fashion clients who are partnering with the company to utilise its AR capabilities.

Evolving from a camera company at its inception in 2011, Snap Inc. has maintained its focus on imagery and visual communication, through its photo messaging service Snapchat, while expanding into new technologies that enhance and innovate the format for brands and end consumers.

BoF’s State of Fashion Report 2022, created in partnership with McKinsey & Co., states that 37 percent of fashion executives cite social commerce as one of the top three themes that will impact their business in 2022. For seamless integration — from virtual AR try-ons, to extended reality (XR) solutions to gamify the path to purchase — fostering deeper partnerships with social media platforms across their ecosystem can provide significant growth opportunity.

“Lenses” — social photo and video filters used every day by over 200 million Snapchat users — are supported by a community of over 250,000 creators, developers and partners who build millions of AR experiences for end consumers, using a roster of Snap applications.

Snap offers programmes and partnerships that help businesses to drive growth within the augmented reality space. It’s Creator Marketplace provides opportunities for lens creators and developers, connecting them to brands and agencies searching for AR talent. Similarly, Ghost, Snap’s AR Innovation Lab — which holds $4.5 million in special funding for research and development — offers access to Snap’s creative and technical teams to help developers and small companies explore new AR use cases.

Now, BoF sits down with Snap Inc.’s vice president of product Peter Sellis to understand the evolving use cases of its AR solutions, the technology required to harness them effectively, and the commercial benefits of investing.

What insight can Snap Inc. share on how end-consumers are engaging with its AR technologies?

Snap platforms have supported AR since 2015. For the first couple of years, it was almost exclusively face-driven. It made sense, as that’s exactly what consumers used Snapchat for, communicating with photos and videos. Indeed, a lot of AR early on was applied to still imagery rather than video.

Then, we saw an amazing transformation over the course of the last three years, with real acceleration in the last year. There are now so many more world-facing use cases for AR and almost three quarters of our daily users are experiencing it every day — which is more than 200 million people. That equates to one of the biggest countries in the world every day having an AR experience. That leaves it pretty open to brands and businesses to be successful.

One of big drivers here has been the migration of AR creation outside of just the platforms themselves. Lens Studio, our suite of tools, offers any creator enterprise-grade solutions to create top tier AR experiences. Now, brands are lending intellectual property to AR and partnering with creators to bring context to what they make, bringing consumers, creators, agencies and brands closer together. It’s kick-started everybody’s creativity and democratised that process.

What role will spatial technology play in harnessing the power of XR?

Spatial technology is critical to innovation. While this technology is still evolving, the latest version of Snapchat Spectacles really feels like they’re at the start of something bigger, as opposed to the end of what we’ve been through so far.

We’re at the beginning of spatial technology being incredibly powerful and impactful. We have the potential to map space in detail.

Smart glasses — wearable computer glasses that overlay information onto real world surroundings — may feel a little too heavy, or the field of vision, may be a little too narrow. All those things are technology problems, issues that tech companies have become great at solving. Previously, these kinds of products were so far from practical, it was hard for anyone to test them and see it as the future. It’s not just in the glasses, but also in how we map the world around us.

Now, we’re at the beginning of spatial technology being incredibly powerful and impactful. We have the potential to map space in detail. Not just walls and surfaces, but things like Big Ben or Notre-Dame. When you aim your camera at it, it attaches an experience to that surface in a way that is clearly more aware than just flat surface. That kind of experience is really a harbinger of what’s to come.

How have the use cases for Snap’s AR technologies evolved?

The most exciting use cases right now are around virtual try-ons. Things like apparel are still very challenging for so many different reasons, particularly in terms of the material texture and how it falls and drapes.

With AR sneakers, some of the original examples like Gucci and Dior, still had room to improve even further, but you could already see how impactful this technology could be in terms of try-ons. The internet in general has done a typically poor job of fit analytics and product recommendations. While it’s getting there with different models, skin tones and more varied options, it’s still been pretty stagnant over the last 20 years. For many apparel brands, you should want to take that leap. All customers have different bodies and they want to know what it’s going to look like on them. If we can close that gap even a little, there’s a huge opportunity.

Snap is well positioned to help this because clothing comes down to an expression of who you are and how you’re feeling. We see it in the way people change their Bitmoji outfits, take selfies or use filters. It’s just such a powerful form of self-expression that can carry into try-ons and the overall shopping experience.

Can you point to a strategy that exemplifies the evolution of Snap Inc.’s capabilities?

There are two separate approaches that are coming together over time. There is the self-expression route which creates something really engaging for the consumer. Brands can turn shopping online from a very solitary experience into a social one, featuring virtual try-ons that you can share with friends, post on your story, and get feedback on. Meanwhile, on the merchant side of things, Snap has a suite of offerings, which includes 3D try-ons, distribution on both our AR and brand’s platform, as well as fit analytics that improve results.

Partnering with Snap is going to be increasingly practical, as brands look to increase conversions and decrease returns. In the past, brands may have focused on their conversion funnel or email marketing. Now, they’ll focus on AR to fit better. It’s going to become part of that toolkit.

Gucci, Prada, The North Face and Farfetch are the strongest examples of brands who consistently lean into whatever is next, but the technology itself is actually a huge, on-going investment to keep innovating. Without partners like Snap Inc., it would be it would be challenging. You would have to shift the whole company. That’s why these brands have explored AR with us.

What are the core commercial benefits of fashion companies investing in AR?

When people get their hands on your product, when they try it, the likelihood of them purchasing it goes up. AR is an incredibly cost-efficient way to get consumers to test product. Currently, some businesses are achieving less than $0.01 US cents per try-on for their products.

Partnering with Snap Inc. is going to be increasingly practical, as brands look to increase conversions and decrease returns.

Will it be as good as getting somebody in the store? Not quite yet, but it gets better every day. Is the return rate lower than a shopper who tries it out in the store? Not yet, but again, it’s getting better. Those two things, combined with the fact that they’re both much lower cost to implement than getting somebody into your store or doing a pop up, appeals not only to the marketing team, but the finance team too.

Below, that is more of an emotional appeal. All brands and retailers need to look at their stores and their website and consider the experience gap. It comes down to retail technology centring on commerce. It’s about checking out as quickly as possible and funnel optimisation, but all it results in is a grid of products. If you’re able to create more of what you offer in the real world, brands will be ten times closer to replicate in-person shopping than simply images and a credit card check out.

What product innovation is being prioritised over the medium term?

Try-on is certainly a key area, but it’s unfair to say that in itself is just one area. A year and a half ago, shoes were obviously very big. Now, makeup is a completely different focus exploring skin tones and colour texture. On the accessory side, hats, eyewear, jewellery and handbags bring new challenges — how can we innovate so that customers are prepared to buy a 2000-pound handbag that they’ve never touched? Things like cloth simulation are going to be very important for us.

We’re also investing in the user experience, things like voice recognition to move through the processes a little bit faster and other strategic investments. Our other big investment has been Vertebrae, which is essentially a 3D asset content management system. We’re scaling up their capacity to quickly show brands their products in 3D as an out-of-the-box visualisation for their website or apps.

You can even distribute this out to other platforms like TikTok, because we’re starting to focus off-platform. If the overlap is small between a brand’s customer and our user or they’re not yet invested in the Snapchat platform, that’s alright. We still want to provide the technology and the experience for them.

This is a sponsored feature paid for by Snap Inc. as part of a BoF partnership.

The extraordinary expectations placed on the technology have set it up for the inevitable comedown. But that’s when the real work of seeing whether it can be truly transformative begins.

Successful social media acquisitions require keeping both talent and technology in place. Neither is likely to happen in a deal for the Chinese app, writes Dave Lee.

TikTok’s first time sponsoring the glitzy event comes just as the US effectively deemed the company a national security threat under its current ownership, raising complications for Condé Nast and the gala’s other organisers.

BoF Careers provides essential sector insights for fashion's technology and e-commerce professionals this month, to help you decode fashion’s commercial and creative landscape.