The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

Ever heard of girl math?

The concept is simple. Say you’re contemplating a Loewe bucket bag. The price tag may be a hefty $2,550, but if you use the bag five days a week for the next year, it’ll equate to only about $10 per wear.

Now enter girl math’s cousin, Croissant. With Croissant, you can resell the Loewe bag after a year for $1,500, which means the cost would come down to $1,000 — no girl math needed.

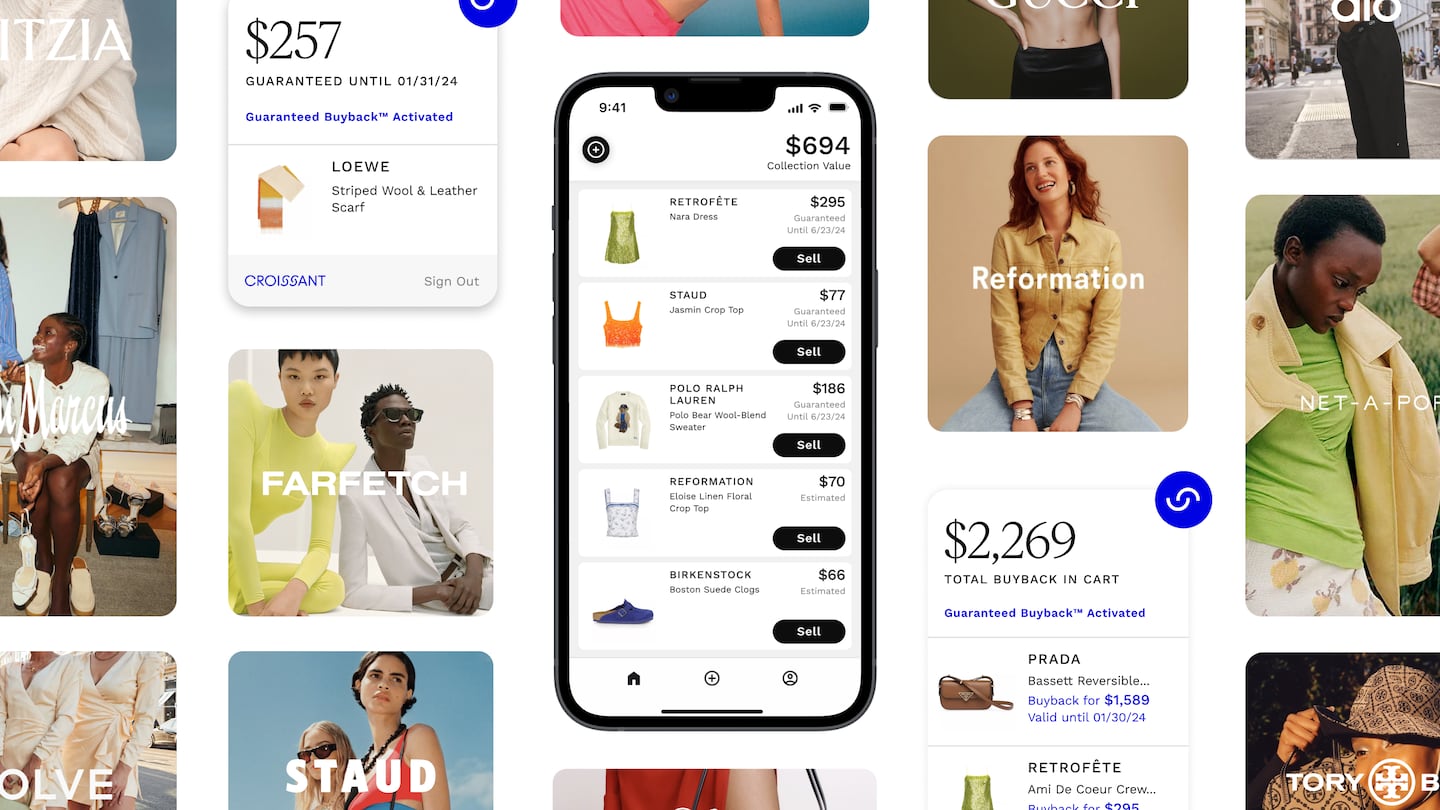

Croissant is a financial-technology company that connects retail to resale on a single platform. As of this week, customers can download the Croissant Chrome extension, and when they browse select brands or retailers — including Reformation, Ssense and Nike — they’ll be able to see a “guaranteed buyback” value for each product.

ADVERTISEMENT

That guaranteed value is what Croissant will pay to buy back the piece within a certain time frame, typically a year. Shoppers who buy from the 50 or so merchants the Croissant extension currently supports will be able to resell their purchases to Croissant when they’re ready. The service will give them a cash payment and then list the goods on a number of resale platforms, including eBay and The RealReal.

The process aims to not only remove the friction of selling something on the fragmented secondhand market, but also incentivise purchases on the primary market by showing consumers the market value of the handbag or dress they’re already itching to buy.

The unit economics of online resale, however, are notoriously difficult. Giants in the space such as The RealReal and ThredUp still struggle to turn a profit.

By working with merchants as well as customers, Croissant is hoping to snag a large piece of the market by offering an attractive payout and a painless process, while introducing a new model of resale.

“We’re seeing a movement where people care more about the longevity and beauty of what they buy,” said John Howard, Croissant’s chief executive and co-founder, “And we can help accelerate that.”

The company determines its guaranteed buyback price based on the average secondhand value of an item, which it calculates using algorithms that scour the online pre-owned market. It takes a percentage on each item it resells and also generates revenue from its retail partners, which integrate the software on their e-commerce sites. (The Chrome extension is free for shoppers, as well as the merchants that haven’t directly installed Croissant, which comes with a fee.)

Croissant’s buyback guarantee prices are competitive; a Bottega Veneta bag, for instance, can fetch at least half of its retail value. A $328 Reformation dress, meanwhile, can be sold back to Croissant for $155.

Howard positions his start-up as the antithesis of buy-now, pay-later firms like Klarna and Affirm and an enabler of conscious consumerism, because rather than encouraging shoppers to take on credit to be able to afford something, Croissant shows them their purchases as assets in a portfolio.

ADVERTISEMENT

In practice, however, Croissant seems more likely to fuel consumerism — especially on the more premium side of the market. So far, its merchant partners have seen an average increase of 50 percent on their average order values, according to Howard, former director at investment firm KKR’s private-equity division.

“It’s people trading up to better things, and yes, they’re spending more for those kinds of things, but they’re doing it with intentionality,” Howard said.

In the resale space, Croissant could make an even bigger splash. While it’s easy to buy pre-owned luxury pieces online, it’s much harder to offload them. There are dozens of options, but many require photographing each item, waiting weeks, if not months, for it to sell, and printing out shipping labels to eventually mail it out.

So far, there are a few services that offer a solution to these challenges. The RealReal offers an at-home pickup service for sellers, but depending on the product, the payout might be miniscule. Resale-as-a-service platform Recurate, meanwhile, sets up take-back programmes for luxury brands, selling pre-owned goods across the resale ecosystem on behalf of their clients.

But on the customer side, the service is only available through Recurate’s individual partners. If someone wanted to sell multiple products from a range of brands, they’d still have to do it manually, one by one.

The Croissant app, on the other hand, is able to scrape a user’s email for all of their e-commerce purchases in the past two years and immediately display a guaranteed buyback value. So far, that estimate has been accurate by an average margin of 3 cents on Croissant’s resold pieces since launching in July, according to Howard.

Croissant has raised $24 million in seed funding so far. Howard’s team includes Amazon alum John Klose as chief technology officer; Vrishti Mongia, who has held roles at Meta and Moda Operandi, as head of product; and chief marketing officer Andrew Parietti, who was a founding partner of Outdoor Voices.

Its pitch to brands and retailers is that, by working directly with Croissant, they can more prominently advertise on their websites the resale values of their products and generate greater sales.

ADVERTISEMENT

The Chrome extension will earn the platform incremental revenue through affiliate programmes, but Howard said he hopes it will also help convince additional merchants to work with Croissant directly.

“Retailers win with higher average order values and stronger customer loyalty,” he said. “Customers win with financial empowerment, and the reselling side wins too because we can afford to make prices work better when we’re not just relying on the exchange happening on the side of resale.”

The RealReal and ThredUp are both eyeing at least EBITDA breakeven by 2024.

Millions of low-cost fashion products are showing up in thrift stores and on resale sites, but that’s not curbing the industry’s primary growth.

Secondhand sales are booming, but few retailers go it alone. Here’s what brands should consider when selecting a resale partner.

Cathaleen Chen is Retail Correspondent at The Business of Fashion. She is based in New York and drives BoF’s coverage of the retail and direct-to-consumer sectors.

Successful social media acquisitions require keeping both talent and technology in place. Neither is likely to happen in a deal for the Chinese app, writes Dave Lee.

TikTok’s first time sponsoring the glitzy event comes just as the US effectively deemed the company a national security threat under its current ownership, raising complications for Condé Nast and the gala’s other organisers.

BoF Careers provides essential sector insights for fashion's technology and e-commerce professionals this month, to help you decode fashion’s commercial and creative landscape.

The algorithms TikTok relies on for its operations are deemed core to ByteDance overall operations, which would make a sale of the app with algorithms highly unlikely.