The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

Yesterday, BoF was first to bring you the news of the recent $18 million investment in Farfetch.com. Today, we continue a week focused on e-commerce by examining the historical challenges faced by online retailers and how recent innovations and infrastructural advances have fundamentally improved the economics of e-commerce, setting the stage for a renaissance in online retail.

SAN FRANCISCO, United States — Following the burst of the dot-com bubble in early 1999, e-commerce suffered from a lack of venture capital investment. The unrealised, over-hyped expectations for e-commerce — at a time when the market, consumer technology and infrastructure were less evolved — and the subsequent burns left venture firms with a nasty aftertaste. Perhaps the most spectacular fashion e-commerce failure was that of Boo.com, which launched in the Autumn of 1999, burned through $135 million in venture capital in just 18 months and was liquidated in 2000.

But on closer inspection, e-commerce has also faced additional complexities and capital inefficiencies that, for years, continued to push investors away.

HISTORICAL CHALLENGES AND FIRST MOVER ADVANTAGE

ADVERTISEMENT

First, e-commerce lacked defensibility. With software or other internet services, intellectual property or the complexities of build create barriers to market entry for would-be competitors. But e-commerce businesses are essentially selling products. The most important elements of these businesses are the assortment, breadth and variability of the merchandise they offer, along with overall access to this merchandise. Access to inventory is not a sufficient barrier, however, as other stores can carry the same products unless a business has exclusive agreements with vendors, which happens rarely and usually only for a limited time.

In the absence of defensibility, companies needed to demonstrate solid metrics around scale of revenues, registered users and overall profitability in order to secure investment. But for e-commerce companies, this requirement created something of a catch-22. When compared to software or other internet services, start-up costs for e-commerce companies were higher, due to the expense associated with buying physical inventory, setting up a logistics platform for warehousing and fulfilment, and acquiring and retaining customers. Furthermore, since they operated at the wholesale level, their margins were relatively smaller.

In order to work and attract investment, these businesses required scale. But in order to achieve scale, they needed significant investment.

There were a few big success stories, such as e-Bay and Amazon, which gained significant first mover advantages. As Josh Kopelman of First Round Capital has pointed out, from 1999 to the beginning of 2010, the list of top general e-commerce sites in the United States remained almost unchanged. In fashion, online juggernauts like Net-a-Porter, Yoox, Neiman Marcus, and Shopbop maintained their incumbent positions.

IMPROVED ECONOMICS AND REDUCED ENTRY COSTS

In recent years, however, the tides have turned in e-commerce. For one, consumers are now acclimated to the concept of online retail. According to Forrester, the online retail market in the US alone is expected to grow to $279 billion by 2015. But critically, major innovations and infrastructural advances have also fundamentally improved the economics of e-commerce, attracting significant venture capital interest in the sector.

Starting in 2007, US private sales pioneers like Gilt Groupe, Rue La La, Hautelook and Ideeli were able to drive massive consumer adoption in a very short amount of time when compared to traditional e-commerce sites. They offered designer fashion at significant discounts, distributed directly to email inboxes.

With timing and supply constraints to compel immediate action, these members-only sites successfully identified and leveraged key behavioural insights to drive engagement, collect customer data and generate rapid sales. But perhaps most importantly, their ability to move product much more quickly than traditional sites reduced cash flow requirements. Indeed, many flash sales sites buy on consignment, while others do not touch or pay for inventory at all until it is purchased by the end consumer.

ADVERTISEMENT

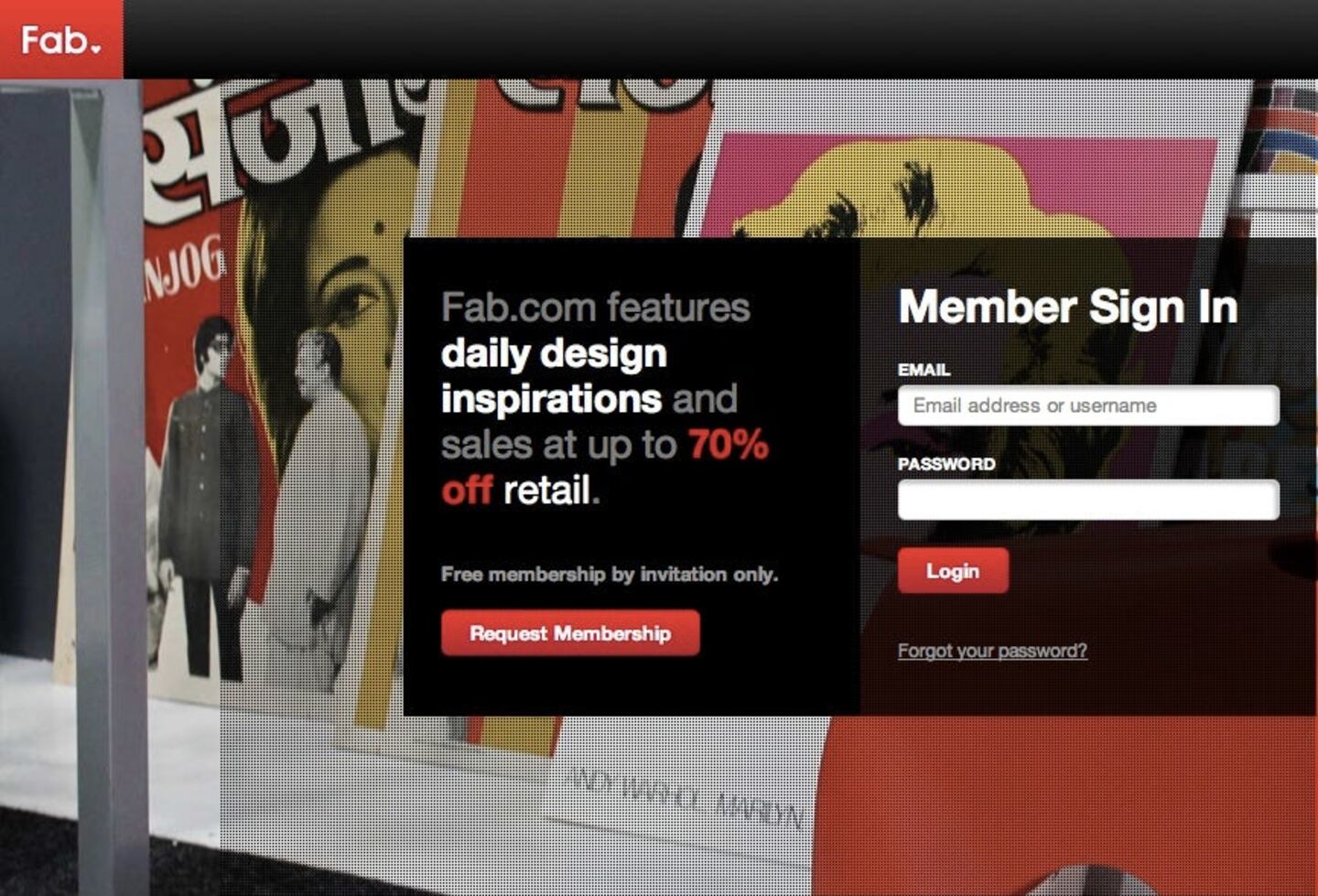

In recent cycles, the rise of social media channels like Facebook and Twitter have also enabled e-commerce businesses to acquire customers and accelerate growth far more efficiently. Fab.com, which sells discounted furniture, jewelry and art in 72-hour flash sales, has leveraged social media to great success, attracting a total of 1.65 million registered users in just six months. According to The Wall Street Journal, in November of last year the start-up processed approximately 100,000 orders, double the previous month, and is now averaging $1.4 million in sales per week. The company recently raised a Series B round of $40 million, led by Andreessen Horowitz, valuing Fab.com at more than $200 million. "They've leveraged social extremely effectively," said general partner Jeff Jordan in a blog post on the transaction.

The evolution of e-commerce solutions like Shopify, Magento and BigCommerce, along with the growth of Software-as-a-Service (SaaS) tools like Mailchimp, RJ Metrics and Shipwire and the rise of Amazon Web Services, a cloud computing platform, have also made it significantly easier and cheaper for retailers to build and manage beautifully designed e-commerce storefronts. Additionally, leveraging APIs (application programming interfaces that make it easy for software programs to talk to each other) has made integration much more time- and cost-efficient, not only for the consumer-facing storefront, but also in terms of the back-end workflow.

Innovation across the supply chain is also making development easier, improving scalability and easing integration, while also decreasing capital requirements for e-commerce businesses. Web-based point of sale systems, wholesale marketplaces, ordering and invoicing software, enterprise resource planning systems, and shipping and fulfilment systems are becoming simpler, cheaper and more flexible. In fact, companies can now use highly efficient software-as-a-service (SaaS) tools across the entire supply chain, paying periodically to access hosted software, without having to incur the costs and complexities of hosting and managing back-end infrastructure.

NEW OPPORTUNITIES AND ECOSYSTEMS

In the context of these improved economics, there are a number of problems to be solved that provide interesting opportunities in e-commerce. Traditionally, retailers have faced difficulties in turning customer data into actionable insight. This is beginning to change. SaaS tools let retailers more easily access and make sense of data, opening up opportunities for businesses to leverage the inadvertent "buyer profiles" that consumers are now creating as they express themselves on social media. Particularly interesting are the taste and behavioural data that consumers share on social curation sites like Svpply, Pinterest, Lyst and The Fancy.

While brands and retailers are scratching their heads solving their data issues, consumers are frustrated with the process of discovering products. It’s easy browse through a physical store, but searching millions of items online is overwhelming. Even if you know you want to buy a black pair of shoes, you still end up with thousands of options. Discovering products that are right for you remains challenging.

The growth of new technology channels and ecosystems created and supported by large players is also providing fertile ground for e-commerce innovation. Alongside the growth of social channels like Facebook, which offers retailers new ways to achieve viral distribution and offer social discovery, the mobile commerce market is expected to reach $31 billion in the US alone by 2016, up from $3 billion in 2010. But while these new channels create new opportunities for e-commerce companies, they also present a major challenge: multi-channel integration. Historically, merchants have been forced to cobble tools together to create a seamless, multi-channel workflow.

EBay's new X.commerce initiative aims to address this problem, offering retailers a single platform that lets them easily add, customise and integrate tools from the X.commerce marketplace, making it easier for young companies to capitalise on the multi-channel opportunity. The stated vision of the X.Commerce initiative is to "help merchants and businesses of all sizes to compete and thrive in the fast-changing world of social, mobile, local and digital driven e-commerce."

ADVERTISEMENT

Indeed, with improved economics, new opportunities and goliaths like eBay supporting the ecosystem, the stage is set for a renaissance in online retail and the growth of disruptive business models built around new ways of buying, selling and engaging with goods.

Tomorrow, we explore the recent explosion of new business models in online retail, including personal subscription, social merchandising, mass customisation and collaborative consumption.

Elizabeth Knopf is a former investment associate and the co-founder of Sorced, an online showroom.

The nature of livestream transactions makes it hard to identify and weed out counterfeits and fakes despite growth of new technologies aimed at detecting infringement.

The extraordinary expectations placed on the technology have set it up for the inevitable comedown. But that’s when the real work of seeing whether it can be truly transformative begins.

Successful social media acquisitions require keeping both talent and technology in place. Neither is likely to happen in a deal for the Chinese app, writes Dave Lee.

TikTok’s first time sponsoring the glitzy event comes just as the US effectively deemed the company a national security threat under its current ownership, raising complications for Condé Nast and the gala’s other organisers.