The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

NEW YORK, United States — For nearly 20 years, eBay has been the dominant player in the market for vintage clothing and accessories. Now, a slew of start-ups are poised to disrupt the business of online fashion resale.

The last quarter of 2012 saw a veritable avalanche of activity in the space, including the launch of no fewer than five notable online vintage sites: Byronesque, Bib and Tuck and Nifty Thrifty in October; Vaunte and Shop Hers in November. That same month, online fashion juggernaut ASOS took a 30 percent stake in the year-old, pre-owned designer fashion site Covetique, while in December, leading luxury goods marketplace 1stdibs raised a $42 million Series B round from Index Ventures, Spark Capital and Benchmark.

So why the sudden surge of activity?

"I think that eBay is obviously a sensationally successful marketplace in business, but less and less specialised as a result of that," said Danny Rimer, a general partner at Index Ventures, who now sits on the board of directors of 1stdibs. "Smaller, more specific subsegments don't get the type of following or focus that they need. All these elements could be on eBay, but the buyer is actually looking for a better environment. They want the selection to be done for them."

ADVERTISEMENT

What's more, fashion consumers, trained by the growth of fast fashion and flash sales, are used to buying many more clothes than they did a decade ago — and in today's post-recessionary economy, where the social barriers to buying and selling previously worn goods are much lower than before, many are turning to the resale market to fuel and feed their appetite. Indeed, premium fashion resale sites like Covetique, which launched over a year ago and has been described as "eBay meets Net-a-Porter," are thought to be gaining significant traction with consumers, encouraging others to target the space.

But the challenge for the many new start-ups aiming to exploit the curated fashion resale opportunity is clear: they must be unique and selective enough to draw people away from eBay, but broad enough to scale. They also need to make the resale process as streamlined and hassle-free as possible, while de-risking buying through reliable product authentication and quality control.

"Since eBay, there's been very little innovation in the space," said Nicola McClafferty, CEO and co-founder of Covetique, which has "hundreds" of sellers and takes a 37.5 percent commission on sales. Much like Linda's Stuff, an ultra-famous eBay PowerSeller, Covetique makes it easy for sellers to unload unwanted pieces. "We take the pieces in, photograph them and manually check quality and authenticity," said McClafferty. But unlike Linda's Stuff, Covetique takes its point of view very seriously. The site sells designer brands like Proenza Schouler and Azzedine Alaïa, and operates a blog that currently features a story on what celebrities like Kate Moss and the Duchess of Cambridge are wearing on the slopes this winter, as well as a collage of menswear-inspired looks timed to coincide with the recent round of men's shows. Both stories link to curated selections of related products available on the site.

“We want the overall buying experience to be as close to a luxury retail environment as possible,” said McClafferty.

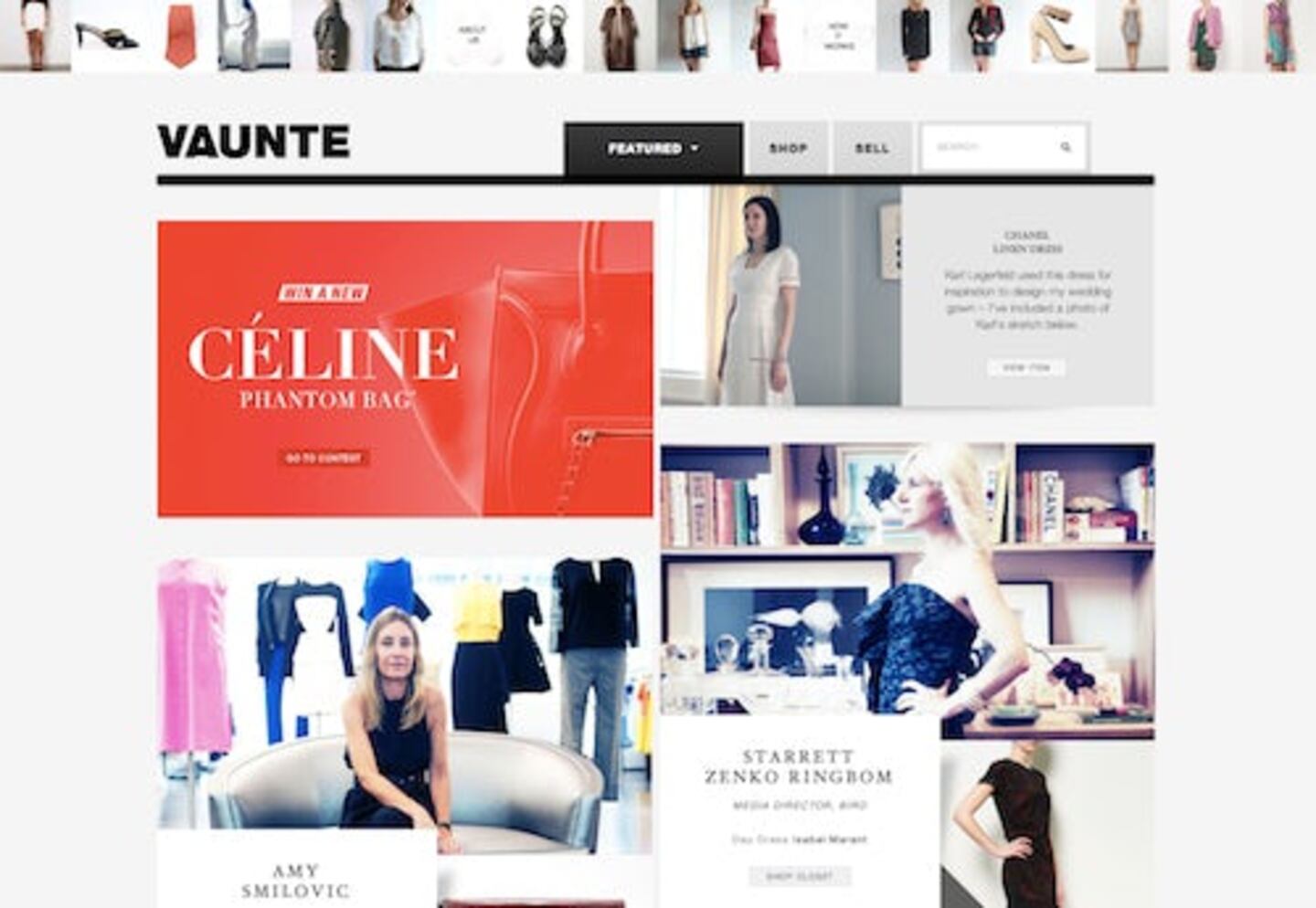

Pushing the hyper-curated, editorialised approach even further is Vaunte, a members-only, peer-to-peer marketplace founded by two former Gilt Groupe employees, Leah Park and Christian Leone, which invites consumers to "shop the closets of socialites, stylists, editors and models" who it features in magazine-worthy spreads. And what about sellers who wish to remain anonymous? "We're launching a premium service very soon for women who don't necessarily want to be featured — or quite frankly, who we don't want to feature. We'll ship these items for you, curate them, curate the shots," said Park. Vaunte takes a 20 percent commission on sales.

"To succeed [in this space], you have to do something very different than eBay. You have to be different than Linda's Stuff," said Shana Fisher, managing partner of High Line Venture Partners, who invested an undisclosed small sum in the Los Angeles-based Shop Hers, a pre-owned designer fashion marketplace site which launched in November and has so far attracted about 5,000 users.

“The difference between our site and other sites is that we don’t care who that seller is,” said Shop Hers founder Jaclyn Shanfeld. “There’s still a stigma [to resale]. We let women stand behind the closet, not be known and let the product shine.” Shop Hers does, however, ask users to create personal profiles — much like on eBay, real names are rarely used — detailing their size, style preferences and designer favourites. The site then matches them with “style soul mates” selling relevant items. Shop Hers takes an 18 percent commission on sales, less than Covetique and Vaunte, but doesn’t take on the burden of photographing merchandise. Once items are sold, sellers must send them to Shop Hers, which inspects them for authenticity, but the seller is responsible for creating listings and marketing items to fellow users. Shop Hers encourages its buyers and sellers to interact via a “style soul mates” network.

Another marketplace building a community around the buying and selling of second-hand fashion is Material Wrld, which currently has about 8,000 active users. Material Wrld encourages users to attract a following — in order to more easily make sales — by posting a stream of personal style photos. Designer Steven Alan, one of the site's investors, also believes that offline events will play a significant role in the site's growth. In November, Material Wrld hosted a pop-up shop inside the VPL store on New York's Mercer Street, selling vintage from the closets of notable Material Wrld users, including former Barneys New York fashion director Julie Gilhart and stylist Polina Aronova. "You have to differentiate," said Alan. "User experience is key. So is getting your name known."

ADVERTISEMENT

Byronesque, a curated online vintage site which launched in October with a 'Farfetch for vintage' model, has teamed up with a number of well-regarded vintage shops, including New York's What Goes Around Comes Around and Paris' Quidam de Revel, to make their carefully sourced inventory accessible to a global audience.

"We launched quietly and so far uniques are over our projections," said founder and CEO Gill Linton. Byronesque, which raised $140,000 in 2011 from Andrew Rosen, the late Marvin Traub and Morty Singer from Marvin Traub Associates and digital agency King & Partners, is about to close a second round of seed funding, which includes additional investment from Rosen, Linton revealed.

Nifty Thrifty, yet another online vintage site which launched in October, is much like Buffalo Exchange or Beacon's Closet on the web, stocking affordable and trendy inventory, which it buys and holds. But unlike Buffalo Exchange or Beacon's Closet, Nifty Thrifty does not deal with individual sellers. Instead, founders Mark Kingdon and Topper Luciani source inventory from vintage specialists all over the United States. Kingdon, who is also an investor in luxury resale marketplace The Real Real, said holding inventory (and buying in bulk) makes the business easier to scale. After three months, the site has attracted 13,000 members. "It's impossible to curate when you're listing items [on eBay]," said Kingdon. "The market is eager for disruption."

But how big can these fashion resale start-ups get? With eBay still the dominant force in the space and Etsy not too far behind, is there room for another big player? Or several?

Nasty Gal, which launched in 2006 as an eBay store with vintage finds, offers some indication of the potential. "When I first started Nasty Gal, I was 22 and had nothing to lose," said founder Sophia Amoruso. "My objective was to work for no one but myself and vintage has such incredible margins that it wasn't very difficult to accomplish that." Nasty Gal, which raised a $40 million Series B round in August, is estimated to have brought in over $100 million in 2012. The site now stocks new merchandise from brands including Sam Edelman and Jeffrey Campbell, as well as its own label. But the majority of the used clothing market, thought to be worth between $15 billion and $18 billion in the US alone, is still very much offline, meaning that vintage-only sites have plenty of room to grow.

And what of the long-term impact of this wave of online resale start-ups on consumer behaviour and the fashion industry at large? Over time, will their continued growth encourage shoppers to slowly shift away from long-term ownership of clothes in favour of continual wardrobe refreshes?

“The last 10 years have been about a surplus of merchandise,” said Shanfeld. “The new approach is to keep your wardrobe moving. Women are smart enough to know that just because it’s a beautiful piece doesn’t mean you have to save it for the daughter who you may or may not have in the future.”

Lauren Sherman is a fashion journalist based in New York.

BoF Careers provides essential sector insights for fashion's technology and e-commerce professionals this month, to help you decode fashion’s commercial and creative landscape.

The algorithms TikTok relies on for its operations are deemed core to ByteDance overall operations, which would make a sale of the app with algorithms highly unlikely.

The app, owned by TikTok parent company ByteDance, has been promising to help emerging US labels get started selling in China at the same time that TikTok stares down a ban by the US for its ties to China.

Zero10 offers digital solutions through AR mirrors, leveraged in-store and in window displays, to brands like Tommy Hilfiger and Coach. Co-founder and CEO George Yashin discusses the latest advancements in AR and how fashion companies can leverage the technology to boost consumer experiences via retail touchpoints and brand experiences.