The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

This article appeared first in The State of Fashion 2020 Coronavirus Update, an in-depth report focusing on the themes, issues and opportunities impacting the global fashion industry in the wake of the coronavirus, co-published by BoF and McKinsey & Company. To learn more and download your free copy of the report, click here.

LONDON, United Kingdom — If ever there was a time to turbocharge digital, it is now. The global pandemic's shutdown of offline retail channels has pushed digitally inept fashion companies to the brink. With no or limited avenues to recover lost sales, purely offline players whose revenues hinge on brick-and-mortar sales have been hit hardest. Many multi-channel businesses have had their first glimpse of what it takes to be truly digital-first, and this step change in consumer adoption is likely to stick when we emerge from the crisis.

Almost overnight, the global fashion industry's reliance on digital channels has accelerated faster than anyone could have anticipated prior to the crisis. This could spell trouble for department stores and speciality retail, in addition to smaller players incapable of adapting to a digital-first mentality.

But there is a silver lining emerging in Asia. Evidence from China suggests that consumers there increasingly embraced digital solutions for shopping, entertainment and communications thanks to the response of brands and retailers who quickly enhanced their digital capabilities by launching or improving innovative new channels. Nike — whose digital sales in the region grew 36 percent in the third quarter ended February 29 — leveraged Taobao livestream bloggers during lockdown in China, while local fashion group Peacebird grew retail sales as a result of innovative customer engagement on their WeChat channel, which featured over 100 live broadcasting sessions with influencers and drew over one million consumers.

ADVERTISEMENT

The global fashion industry's reliance on digital channels has accelerated faster than anyone could have anticipated.

Social media platforms in the region have also seen pockets of momentum and have delivered much-needed solutions for some brands and retailers. WeChat saw a 159 percent boost in transaction volume for fashion brand mini-programmes (brand-powered app-in-apps embedded within its interface) between January and February 2020 during the peak of China’s outbreak. WeChat offers features that allow store assistants to message consumers and complete purchases, generating a much-needed revenue source for brands operating in the quagmire of a crisis. Through WeChat Groups and WeChat Work, companies are able to engage clients and integrate their profiles into their brand’s account.

Other digital solutions used by retail assistants during the lockdown in China included livestreaming sessions on WeChat or platforms such as Yizhibo, which effectively turned empty luxury brand stores into virtual shopping stages hosted by the staff. As seen on apps like Xiaohongshu and Taobao, brand-to-shopper video chats and broadcasted influencer-curated assortments were well-received, with the number of Chinese brands livestreaming on Taobao up by 700 percent.

In March 2020, executives like Giovanni Pungetti, Greater China and APAC chief executive of OTB Group, which controls brands Marni, Diesel and Maison Margiela, embraced experiments with livestream commerce. "It's a completely different way of doing business for us [but] we have been able to reach every corner of China [and] we have been able to make some business," he said. "I always underline this to our shareholders in Italy: everything we are learning in this moment…will be an added weapon we can use to increase and grow [more broadly elsewhere] when things get back to normal," he added.

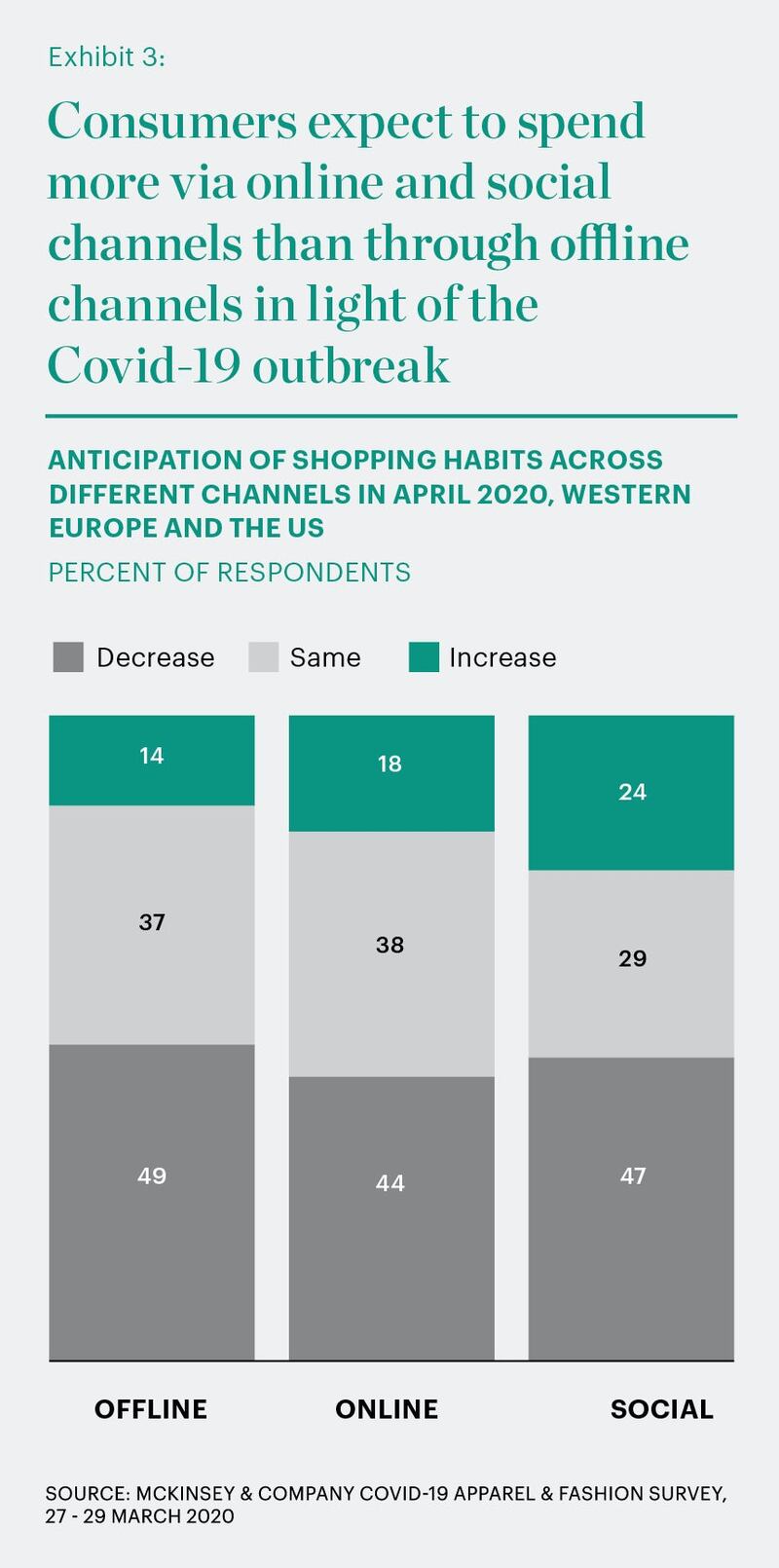

For strong players looking to accelerate demand online, staying ahead of fashion’s digital step change will mean adopting these next-level modes of engagement. People will acclimate to the wider digitisation of consumer journeys as digital content creation becomes their primary mode of brand interaction. According to a McKinsey survey, almost a quarter of US and European consumers expect to increase their spend via social channels in April 2020. As the crisis also pushes 13 percent of European consumers to browse online e-tailers for the first time, brands should take the opportunity to become not just more digitally adept, but to become digital frontrunners.

“Working from home or staying at home may well drive more non-work screen time, which would give marketers additional shots on goal,” said Simeon Siegel, managing director and senior analyst at BMO Capital. However, marketing opportunities may not translate into much-needed revenue. “Whether they convert is another story,” he said.

Indeed, the broader outlook for online is challenging. Despite the aforementioned uptick in social commerce, 44 percent of US and European consumers expect to decrease online purchases overall, which is not far behind the 49 percent who expect to decrease offline purchases as of April 2020.

Though much about the pandemic's duration and trajectory remains uncertain, businesses can expect that recovery will be a gradual process as society adjusts to the new normal, consumers continue to avoid large crowds and social distancing rules remain in force. Even after stores begin to re-open, fashion's digital step change demands that companies change their mindset and begin to operate like pure digital players: rather than asking what benefits online can offer offline channels, players should ask how their brick-and-mortar presence can support e-commerce sales. Digital plans should be prioritised when it comes to talent, time, allocated inventory and future investments, and marketing spend should be shifted to digital channels, with ROI precisely tracked.

Digital strategies should also closely inform partnerships and brand positioning at every stage.

The strongest players will quickly scale up and strengthen their digital capabilities, which will allow them to capitalise on future opportunities and protect their businesses from risks. Investing more in existing digital capabilities — such as improving the customer journey and the broader customer experience — should happen alongside pioneering new ways of engaging with consumers online. Livestreaming services, omnichannel inventory capabilities and social commerce platforms are just the tip of the iceberg.

ADVERTISEMENT

Digital strategies should also closely inform partnerships and brand positioning at every stage. Brands should consider platforms as a way of preserving their reach and fulfilment capability, while identifying a suitable digital model that will lay the groundwork to build traffic in cost-efficient ways. The window of opportunity to invest and leap forward will not last forever.

For consumers, the rapid and recent pivot to digital will continue long after the immediate crisis, but for most fashion players, it will come at a cost. Since digital channels can be less profitable than physical retail, players need to establish a balanced model that prioritises digital growth in an integrated way with cutting-edge customer experience. It is important to remember that digital channels are not a “silver bullet” to compensate for the shortfall in revenue from stores — in making this switch, some businesses may become smaller, at least for a while, which will open up the need to revisit their operating model as they adjust to the new reality.

Successful social media acquisitions require keeping both talent and technology in place. Neither is likely to happen in a deal for the Chinese app, writes Dave Lee.

TikTok’s first time sponsoring the glitzy event comes just as the US effectively deemed the company a national security threat under its current ownership, raising complications for Condé Nast and the gala’s other organisers.

BoF Careers provides essential sector insights for fashion's technology and e-commerce professionals this month, to help you decode fashion’s commercial and creative landscape.

The algorithms TikTok relies on for its operations are deemed core to ByteDance overall operations, which would make a sale of the app with algorithms highly unlikely.