The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

MILAN, Italy — On the overcast morning of Gucci's Spring/Summer 2020 runway show, swarms of millennials camped outside of the brand's headquarters on Via Mecenate. The mob — many of whom travelled from other European cities and beyond— arrived hours ahead for a glimpse of Chinese heartthrob and boy-band member Xiao Zhan.

By the end of the week, Gucci's seven Weibo posts featuring a GG monogram-clad Xiao drew over 1.3 million reposts and 1.1 million likes. The hashtag #XiaoZhanMilanFashionWeek (he travelled exclusively for the brand) accumulated over 720 million views — more than double the 310 million clocked under Gucci's official Weibo hashtag for the entire runway show, #GucciSS20.

Given Xiao’s own staggering following of 18.6 million, it isn’t surprising that he outperformed Gucci in China (Gucci did not respond to BoF’s request for comment). More surprising, however, is the fact that many luxury brands don’t seem to mind playing second fiddle to celebrities.

Celebrities have always been a front-row fixture at runway shows, but the KOL (key opinion leader) strategy has taken on a life of its own in China, where McKinsey & Co. estimates that young shoppers born after 1990 are already spending as much as their Gen X parents on luxury goods annually.

ADVERTISEMENT

Gucci’s move was, by many metrics, a success. But behind the scenes, a growing number of industry leaders are suggesting that brands now need to tread carefully. Enlisting celebrities to battle for publicity during fashion week does wonders for brand exposure, but the ubiquitous strategy comes with risks.

Frenetic Celebrity Culture

In her book “Hijacking the Runway,” Teri Agins chronicled how celebrities have taken over the fashion industry. She wrote that “the balance of Fashion Week power” had shifted as early as 1993, when photographers, rather than encircling the runway, were stationed at a pit with clear views of the front row.

"[After that] the front row had become part of the content of the show — and a vehicle for celebrities," Agins wrote, quoting Fern Mallis, the former executive director of the CFDA who is credited with transforming New York Fashion Week.

Xiao Zhan at Gucci Spring/Summer 2019 | Source: Weibo

Social media has intensified the shift (with China being one of the markets where it is especially pronounced), leading to a situation where celebrities can overshadow the brand’s products and message during runway season. The worry that some now have is that by championing a celebrity-first approach in the feed, some luxury brands could over time see their DNA eroded.

Yet many now see no viable alternative since the value of celebrities in the marketing mix is unrivalled. On a global level, take Jennifer Lopez's surprise finale appearance at Versace, which according to Launchmetrics generated $9.4 million in media impact value in the first 48 hours.

“Social media has revolutionised fashion shows, from the audience experience to merchandising and marketing,” says Dan Cui, former fashion director at GQ China and founder of brand consultancy Caius. “This change isn’t going to stop anytime soon.”

ADVERTISEMENT

China is home to over 855 million digital consumers, who McKinsey & Co. estimate spend as much as 44 percent of their time on social media apps. This goes some way in explaining the mainland’s frenetic celebrity culture, which has been embraced by luxury houses as the core of their fashion week strategies. Nowadays, showgoers will invariably spot huddles of photographers around Chinese stars in front rows, from Cai Xukun at Prada or Angelababy and Sophie Zhang at Dior.

“To Chinese consumers, fashion week equals celebrities,” says Maggie Mao, deputy executive editor-in-chief and fashion director at Grazia China. “Netizens want to know what celebrities are up to during fashion week; for brands, the goal is that a bag or pair of shoes will go viral and sell out.”

Chinese celebrities are known for moving product at an alarming pace, be it sitting at a front row, at the airport, or on social media apps like Xiaohongshu. When brands are inviting stars to fly across the globe to attend their shows (often for sums upwards of $1 million, according to Whaley), it is important for brands to get their money’s worth. But whether the problem is oversaturation on social media (especially around activation-packed times such as fashion month) or younger fans, conversions aren’t guaranteed in today’s digital climate.

“Now, Chinese consumers don’t focus as much on what celebrities are wearing or link it to the brands they’re wearing,” says Grazia’s Mao. “[Sometimes,] the idol’s status can overshadow the brand.”

Lost in Translation

Elijah Whaley, advisor at Chinese influencer marketing agency ParkLu, argues that the above is part of a wide problem. “On Chinese social media, no one cares what the brand says about itself, they care what the celebrity or influencer says. Brands can’t buy attention the same way they used to.”

Whaley sees this as a battle between “what is right for the market and what brands have traditionally done.” As a result, “kids on the internet have more control than multinational brands that are hundreds of years old.”

But celebrities will always be a valuable part of a brand’s marketing strategy, fashion month or otherwise. And more often than not, a young idol’s followers will focus more on him or her than the dad sneakers in the frame. “It’s unavoidable and inextricable, most people will only care about the celebrities,” says Grazia’s Mao. “The good thing is that often, their obsession ends up rubbing off on the brand.”

ADVERTISEMENT

Kids on the internet have more control than multinational brands that are hundreds of years old.

Gucci’s social media strategy has succeeded thanks in part to its strong brand and aesthetics, which are instantly recognisable irrespective of the celebrity being dressed. However, not every brand can say the same, and allowing China’s constantly changing ranks of idols to dominate a brand’s own conversation can provide instant gratification but little long-term benefit.

“We’re in an age of information where it doesn’t matter what a brand says about itself,” says Whaley. “[This is] an issue for brands in general, but especially for luxury who are trying to project a certain type of image.”

Cui reckons that only a few brands' fashion week strategies are sustainable. There are exceptions, of course: he says that Thom Browne "always considers how the brand is communicated in every detail to provide a complete show experience," whereas Chanel's (albeit budget-allowing) showmanship is extravagant in its own right.

Brand Above All

Erecting a cruise ship or rocket in the Grand Palais isn't an option for all luxury brands, but Chanel's strategy provides other takeaways. Though in no short supply of global ambassadors, the brand is notoriously meticulous in selecting them — an ordeal that brands have been navigating for years. At the brand's Spring/Summer 2020 show on October 1, actress Xin Zhilei joined Japan's Nana Komatsu and South Korean girl group Blackpink's Jennie Kim on the front row.

"This is not about whether they are the most sought-after celebrities," its president of fashion Bruno Pavlovsky told BoF in an earlier interview. "It is more about the interaction and mutual understanding between them and the brand." Indeed, some of the house's favourite faces like French actress Marine Vacth don't use social media at all.

Chanel's strategy doesn't appear to have changed since, and when the house does appoint a new ambassador (such as Chinese actress Zhou Xun or model Liu Wen), they become fixtures at runway shows and ad campaigns for years, rather than seasons. Zhou, for one, seldom walks a red carpet in a gown by another brand.

By committing to continuity, the $10 billion behemoth hasn’t ceded control to the masses online. “We won’t change our brand strategy for the young generation...what we need to do is letting them feel the coherence of our brand,” Pavlovsky added.

Some established brands opt out of the influencer route entirely. Hermès' "policy of product, not of image" as coined by Chief Executive Axel Dumas has shifted the brand's marketing focus off celebrities. "They stand apart, or at least, further apart from the world of celebrities and influencers," says Interbrand's Global Chief Learning and Culture Officer Rebecca Robins.

Perhaps this is not something all brands could pull off, but notably, not many have tried. “[This] has had a powerful and sustainable impact on the brand’s value, one that is almost unique, in the luxury industry,” Robins notes, adding that “a celebrity-first strategy can be highly effective, but the greatest celebrity ecosystem will never be a panacea for poor product.”

Ultimately, Cui says, Chinese consumers covet European luxury goods because of their prestige and heritage, which will outlive even the most attention-grabbing ploys. “There’s no need for brands to overexert themselves to begin with.”

“Brands should engage with the Chinese market and adapt to its needs, but also realise where their brand’s true value lies.”

Additional reporting by Queennie Yang.

时尚与美容

FASHION & BEAUTY

Givenchy's 70th Anniversary T-shirts | Source: Givenchy

Givenchy Embraces Anniversary with Limited Edition T-Shirts

Perhaps in an effort to win back favour from Chinese consumers after being caught up in a sovereignty scandal last month that cost them brand ambassador Jackson Yee, Givenchy leaned into celebrations for the 70th anniversary of the People's Republic of China by gifting select fans 70 limited edition t-shirts commemorating the event. Unlike Chinese New Year or Qixi Festival — both of which are popular occasions for luxury brands to release special editions for the China market — this year's big anniversary, celebrated with a week-long holiday on the mainland, saw few fashion and beauty brands jumping on the bandwagon. (Givenchy's WeChat)

Net-A-Porter Flagship to Open on Tmall’s Luxury Pavilion

Net-a-Porter's store within the Tmall Luxury Pavilion "app-within-an-app" infrastructure will offer more than 130 luxury and designer brands at launch, then continue to expand over the coming months. The store will feature exclusive capsule collections from Net-a-Porter and its menswear counterpart, Mr. Porter, and deliver customised brand pages, personalised content and recommendations and exclusive VIP rewards to shoppers. The store launch marks the long-awaited start of operations of Feng Mao, the joint venture that Alibaba and Yoox Net-a-Porter announced last October. As a part of the partnership, the e-commerce giant will lend its resources and expertise in marketing, payments and technology, while Richemont's Yoox Net-a-Porter Group leverages its strong relationships with leading luxury brands. The JV is 51 percent owned by YNAP and 49 percent owned by Alibaba. (Alizila)

French Beauty Brands Constantly Reinventing for China Market

Brands such as L'Oréal, and LVMH-owned Sephora and Guerlain, are constantly reinventing and creating niche products for the Chinese market. Earlier this year, Sephora released its China Red cosmetic range, with the express purpose of reinterpreting elements of traditional Chinese culture to "resonate with Generation-Z consumers." According to Daxue Consulting, the rise of C-beauty and competition from other Asian countries means Chinese consumers do not want to pay premium prices for Western brands unless they are truly superior. French brands that fit this bill include Filorga's 'skin booster' and L'Oréal's Revitalift Filler range. (SCMP)

科技与创新

TECH & INNOVATION

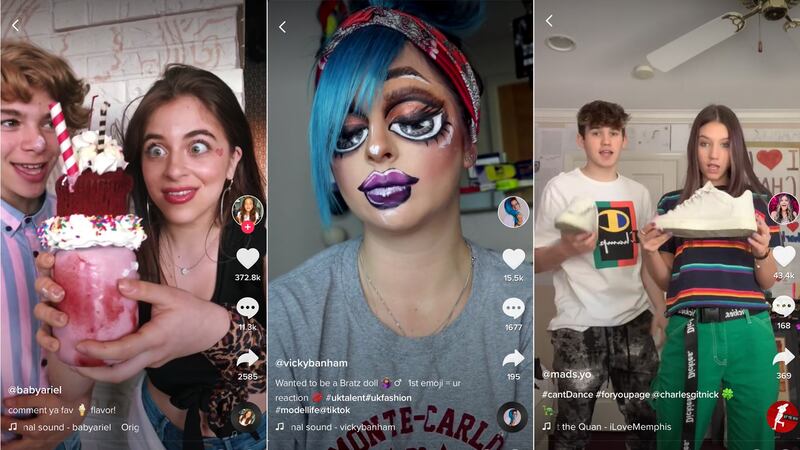

Tik Tok users | Source: Tik Tok, (L-R) @babyariel, @vikybanham and @mads.yo

TikTok’s Video Search Debuts in China

Users on TikTok (known as Douyin in China) can now press a "Search" button mid-video, drag a rectangle around a target area, and instantly perform a visual search for the area's contents. This means that, by selecting someone's face, the app will show you a list of other videos that person appears in. If you select a shirt someone is wearing, the app will attempt to locate that shirt on an e-commerce site. The feature is currently still in the testing phase, and is only available on the Chinese version of the app, but the new capability is expected to appear on international versions of TikTok in the near future, and be a big boost for the hit platform's e-commerce capabilities. (Radii)

Paypal Becomes First Foreign Company to Get Chinese Payments License

China's central bank has approved PayPal's acquisition of a 70 percent stake in Chinese digital payment company GoPay. Effectively, this makes PayPal the first foreign firm licensed to provide digital payment services in China. GoPay is a small Chinese payments provider that functions similarly to PayPal — it allows merchants to accept non-credit card payments straight from their websites. The deal opens the door for PayPal to process digital transactions in China — which are estimated to total in the trillions. But it won't be easy to break the duopoly Alibaba's AliPay and Tencent's WeChat Pay, which have dominated the market by making it easy for merchants to use their services and accept payments from mobile phones rather than setting up the infrastructure to accept credit card payments. As of last year, more than 8 million brick-and-mortar stores in China accepted AliPay. (FT)

Tencent Voice Assistant May Debut This Year

Tencent's hotly anticipated voice assistant, to be called Xiaowei, will provide voice interaction with WeChat's first-party services, those offered natively by the messaging service, as well as third-party services ranging from food delivery to ride-hailing and flight-booking. Tencent has already enlisted partners Spring Airlines and Chang'An Auto Group with the latter likely to introduce Xiaowei in year-end car models. Sony and Vivo plan to include the new voice assistant pre-installed in forthcoming mobile phones and any of WeChat's billion-plus users will be able to access Xiaowei through a dedicated mini-programme after launch.(China Daily)

消费与零售

CONSUMER & RETAIL

Source: Ryoji Iwata for Unsplash

Single Consumers on the Rise

The number of single adults in China had surpassed 222 million by the end of 2017, accounting for 15 percent of the mainland's total population. Among this vast single pool, whose sheer size exceeds the population of Russia and the UK combined, many are cash-rich urban-dwellers who are increasingly open to spending more on fun. China's new-age "single aristocrats," the fast-growing group of well-off millennials who live the single lifestyle by choice, have already left a mark on China's consumption landscape. The keyword search of "single" rose threefold on e-commerce platforms during 2019's Qixi Festival. In February, investment advisory Sinolink Securities released a report, predicting future growth in single-friendly industries such as tourism, high-end cosmetics, mini-size household appliances, pets, and self-improvement courses. (Jing Daily)

Golden Week Travelers Head to Europe in Larger Numbers

A 13 percent increase of Chinese passengers are expected in Europe over this week's Golden Week holiday, a public holiday to mark the 70th anniversary of the founding of the PRC which runs October 1 to 7. Global Blue and Alipay have teamed up to reach them with extra tax refund coupons available from 16 partner brands in eight European shopping destinations, including Paris, London, Barcelona, Madrid, Munich, Rome, Milan and Florence. European destinations are expected to prove particularly popular due to continuing unrest in Hong Kong and a newly introduced tax on consumer goods in Japan, lessening the attractiveness of traditional Chinese travel hotspots. (Global Blue)

China Digital Consumer Trends

This year, online retail sales in China are expected to swell to $1.5 trillion, representing a quarter of China's total retail-sales volume. The country's 855 million digital consumers are among some of the most avid users of mobile phones and social media in the world. Though the opportunities are great, challenges are becoming more challenging, with growth of online retail sales cooling from the heady 40 and 50 percent annual rates seen in the early part of the decade to 25 percent compound annual growth in the past few years. And an increasingly crowded marketplace has led to fierce competition among brands, pushing up the cost of acquiring new customers and retaining them. For example, the cost per thousand user views (CPM) of advertisements placed on Tmall has increased by an average of 60 percent since 2017. (McKinsey)

政治,经济与社会

POLITICS, ECONOMY, SOCIETY

In store mobile payment | Source: Shutterstock

China’s Social Credit System Is Coming for Businesses

China's "social credit" system, which was first announced in 2014 and will effectively "rate" all individuals in China by next year, could also be an issue for brands, with a report by the consultancy Sinolytics for the European Union Chamber of Commerce in China indicating that "corporate" social credit is coming for foreign brands, and a bad credit score could very well mean life or death in that market. According to the report, companies will have ratings categorised according to performance in sectors like tax, customs authentication, environmental protection, product quality, work safety, e-commerce, and cybersecurity. The potential implementation of corporate social credit scores is just a digital evolution of what brands have already been adjusting to in China. Most luxury brands are aware that they're always the first target if there's a crackdown on "decadence" or if anti-corruption measures kick in, and they already act with caution in mainland China. (Wired)

China Homage Tops Game Charts on Nation’s Birthday

"Homeland Dream," a world-building title from Tencent akin to SimCity, has become the most downloaded free game on the Chinese Apple iOS store since its launch days ahead of the PRC's 70th anniversary on October 1. The game, developed in partnership with the state-run People's Daily newspaper, allows players build a virtual metropolis from scratch while collecting cartoonish images of Communist slogans, national landmarks and politically tinged buzzwords such as "One Country, Two Systems." To whip up nationalistic sentiment, the country also celebrated by screening a string of patriotic films and televising a parade of military might through the heart of Beijing. (Bloomberg)

Chinese Manufacturing Expands More Than Expected

China's manufacturing activity expanded at the fastest pace in 19 months in September, driven by higher output and new orders, a Caixin survey showed Monday, suggesting domestic demand is supporting the economy amid a prolonged trade war with the US. The Caixin China General Manufacturing Purchasing Managers' Index (PMI), which gives an independent snapshot of operating conditions in the manufacturing sector, rose to 51.4 from 50.4 in August, the highest reading since February 2018. The number 50 marks the dividing line between expansion and contraction. The higher the reading above 50, the faster the expansion, while the further below 50 the greater the contraction. (Caixin)

China Decoded wants to hear from you. Send tips, suggestions, complaints and compliments to our Shanghai-based Asia Correspondent casey.hall@businessoffashion.com.

With consumers tightening their belts in China, the battle between global fast fashion brands and local high street giants has intensified.

Investors are bracing for a steep slowdown in luxury sales when luxury companies report their first quarter results, reflecting lacklustre Chinese demand.

The French beauty giant’s two latest deals are part of a wider M&A push by global players to capture a larger slice of the China market, targeting buzzy high-end brands that offer products with distinctive Chinese elements.

Post-Covid spend by US tourists in Europe has surged past 2019 levels. Chinese travellers, by contrast, have largely favoured domestic and regional destinations like Hong Kong, Singapore and Japan.