The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

THE CHEAT SHEET

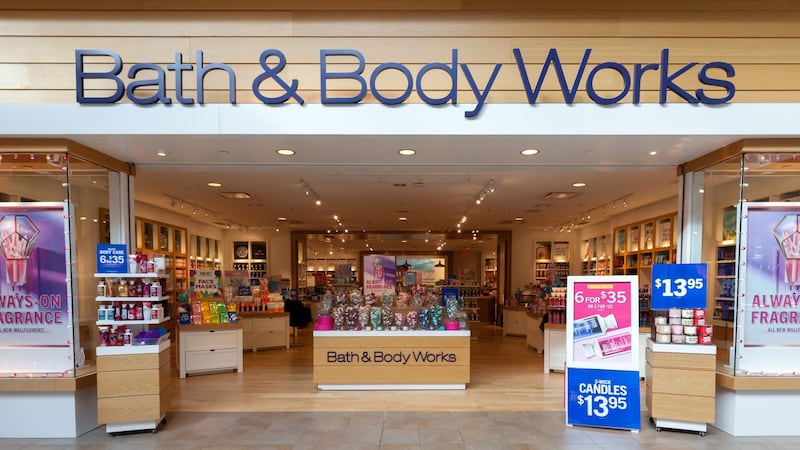

Does Victoria's Secret's Owner Have a Plan B?

Bath & Body Works | Source: Shutterstock

Early Returns From America's Reopening

ADVERTISEMENT

Inside a mall in Atlanta, Georgia | Source: Shutterstock

Health concerns are surely keeping some shoppers at home. But the pandemic is changing retail in other ways that could reduce brick-and-mortar foot traffic for the long term. Many consumers have undoubtedly gotten used to shopping online. And a Piper Jaffray analyst compared visiting a newly reopened luxury department store in Houston as "jarring" and "more akin to shopping in a warehouse."

The Bottom Line: Scenes of crowded stores and lines snaking through malls also mask the turmoil happening behind the scenes, including rent disputes, major mall tenants in financial peril and the prospect that tens of thousands of stores may never reopen.

China's Halting Recovery

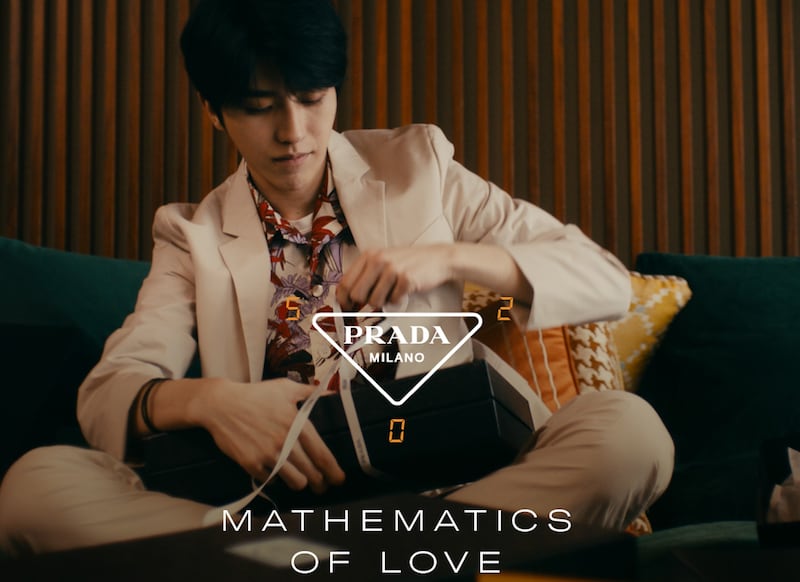

Cai Xukun Stars in Prada 520 Campaign | Source: Courtesy

China's retail rebound has been uncomfortably slow. There's even talk of a "W" shaped recovery, where the economic momentum sparked by stores and factories reopening falters as consumers fail to turn up. The marketing around the May 20 holiday (the date sounds like "I love you" in Mandarin) reflects the uncertainty of the times. Prada, Louis Vuitton and others are rolling out their 520 campaigns, the first major marketing opportunity in months, since Covid-19 crushed spending around Chinese New Year and Valentine's Day. The campaigns mainly centre around relatively affordable items and more muted styles that sell well in a weak economy. And though some luxury brands can count on lines around the block outside their boutiques, they are putting new emphasis on digital marketing as well, including livestreams featuring top influencers.

The Bottom Line: Another trend emerging out of China is the bifurcated nature of recovery. Luxury brands appear confident of a quick rebound, while the rest of the fashion industry is bracing for a long, slow return.

SUNDAY READING

ADVERTISEMENT

Professional Exclusives You May Have Missed:

The Week Ahead wants to hear from you! Send tips, suggestions, complaints and compliments to brian.baskin@businessoffashion.com.

Was this BoF Professional email forwarded to you? Join BoF Professional to get access to the exclusive insight and analysis that keeps you ahead of the competition. Subscribe to BoF Professional here.

As the German sportswear giant taps surging demand for its Samba and Gazelle sneakers, it’s also taking steps to spread its bets ahead of peak interest.

A profitable, multi-trillion dollar fashion industry populated with brands that generate minimal economic and environmental waste is within our reach, argues Lawrence Lenihan.

RFID technology has made self-checkout far more efficient than traditional scanning kiosks at retailers like Zara and Uniqlo, but the industry at large hesitates to fully embrace the innovation over concerns of theft and customer engagement.

The company has continued to struggle with growing “at scale” and issued a warning in February that revenue may not start increasing again until the fourth quarter.