The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

Chinese e-commerce giant Alibaba has a launched fast fashion platform, AllyLikes, to target Western consumer markets, news that was first reported this week by Chinese tech blog, Tech Planet.

Chinese shopping site Shein, which pumps out thousands of new styles per week at ultra-low prices, has taken the world’s Gen-Z consumers by storm amid a cross-border e-commerce boom, overtaking Amazon as the top shopping app on US app stores in May.

Alibaba looks to be aiming to tap into that boom and, with deep networks in China’s fashion supply chain and experience in cross-border logistics, in addition to its technical expertise, it may be better placed to compete with Shein than anyone else.

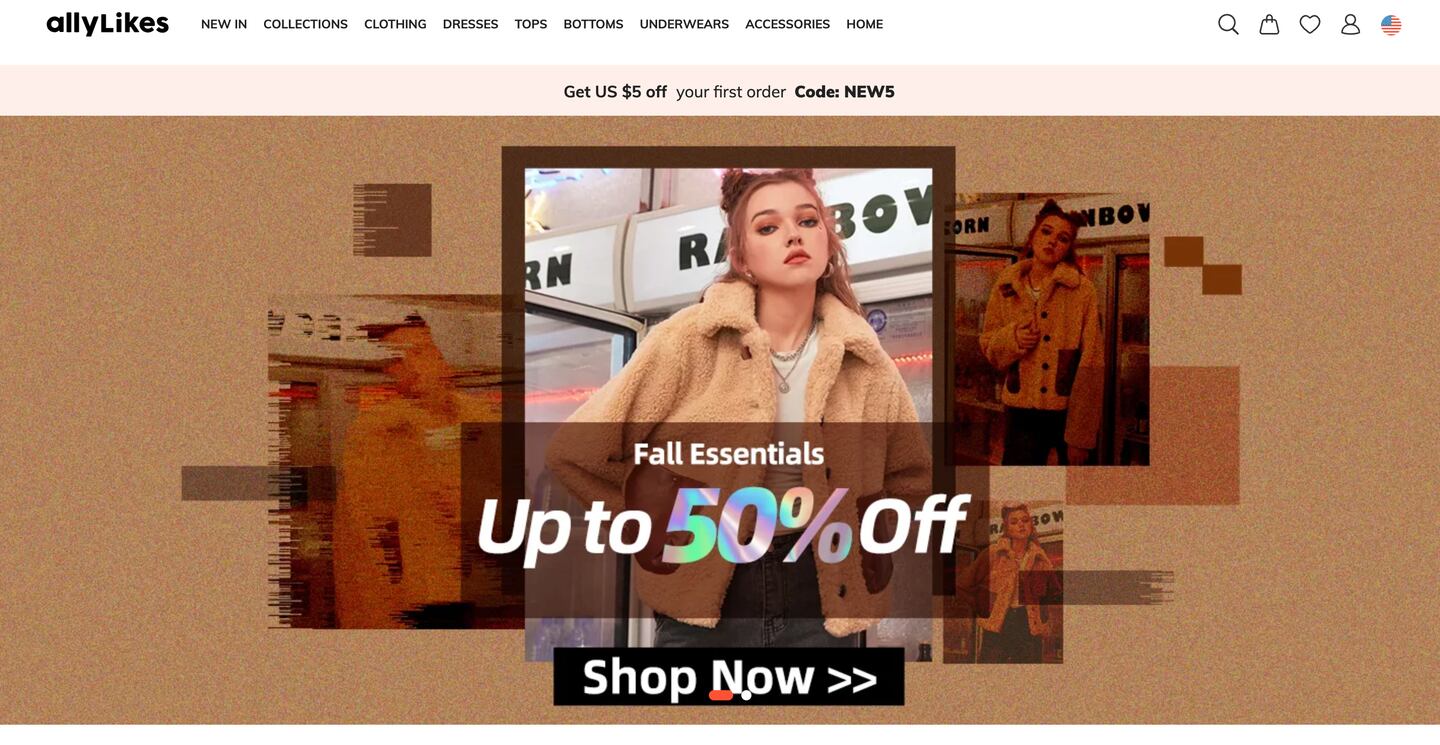

AllyLikes’ website and app shows fashion and accessories at very low prices, with “Fall Essentials” advertised from $5.99 and “100+ New Arrivals” advertised on its homepage. A banner advertisement declares free shipping to the US on orders over $49. According to the AllyLikes website, it currently ships to European countries including France and Italy, as well as Canada and the US.

ADVERTISEMENT

AllyLikes is still in infancy, with data from Sensor Tower showing app downloads of less than 10,000 worldwide across the iOS App Store and Google Play last month. In comparison, Shein’s app had 5 million downloads from the iOS store and 9 million from Google last month, South China Morning Post reported.

Alibaba did not respond to a request for comment prior to publication.

Learn more:

The Chinese fast fashion giant’s new design competition seems aimed at shifting opinion on a company whose labour and environmental records have become frequent targets for regulators and consumers.

With consumers tightening their belts in China, the battle between global fast fashion brands and local high street giants has intensified.

Investors are bracing for a steep slowdown in luxury sales when luxury companies report their first quarter results, reflecting lacklustre Chinese demand.

The French beauty giant’s two latest deals are part of a wider M&A push by global players to capture a larger slice of the China market, targeting buzzy high-end brands that offer products with distinctive Chinese elements.

Post-Covid spend by US tourists in Europe has surged past 2019 levels. Chinese travellers, by contrast, have largely favoured domestic and regional destinations like Hong Kong, Singapore and Japan.