The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

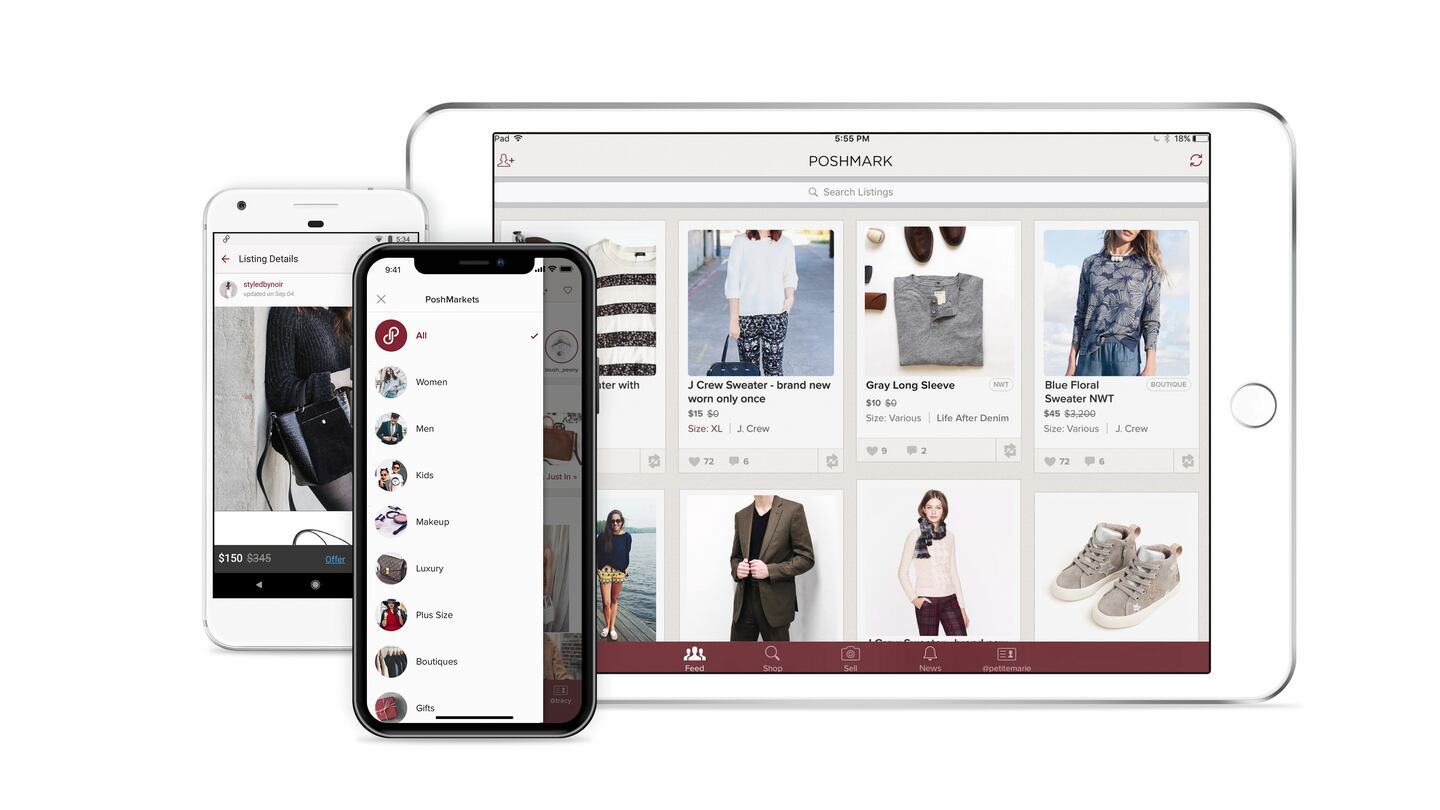

Online fashion marketplace Poshmark Inc. and instalment-payment company Affirm set terms for their US initial public offerings Wednesday, joining a rush of companies expected to tap public markets early in 2021.

Poshmark is seeking as much as $257.4 million, according to separate filings Wednesday with the US Securities and Exchange Commission.

Affirm Holdings Inc. filed on Tuesday to raise $935 million in its listing.

Poshmark will offer 6.6 million shares at $35 to $39 apiece. Its share sale is being led by Morgan Stanley, Goldman Sachs Group Inc. and Barclays Plc. The company plans to list its shares on the Nasdaq Global Select Market under the symbol POSH.

ADVERTISEMENT

At the top end of the price range, the IPO could give Poshmark a fully diluted valuation of about $3.3 billion, and a market value of almost $2.9 billion.

By Crystal Tse

In 2020, like many companies, the $50 billion yoga apparel brand created a new department to improve internal diversity and inclusion, and to create a more equitable playing field for minorities. In interviews with BoF, 14 current and former employees said things only got worse.

For fashion’s private market investors, deal-making may provide less-than-ideal returns and raise questions about the long-term value creation opportunities across parts of the fashion industry, reports The State of Fashion 2024.

A blockbuster public listing should clear the way for other brands to try their luck. That, plus LVMH results and what else to watch for in the coming week.

L Catterton, the private-equity firm with close ties to LVMH and Bernard Arnault that’s preparing to take Birkenstock public, has become an investment giant in the consumer-goods space, with stakes in companies selling everything from fashion to pet food to tacos.