The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

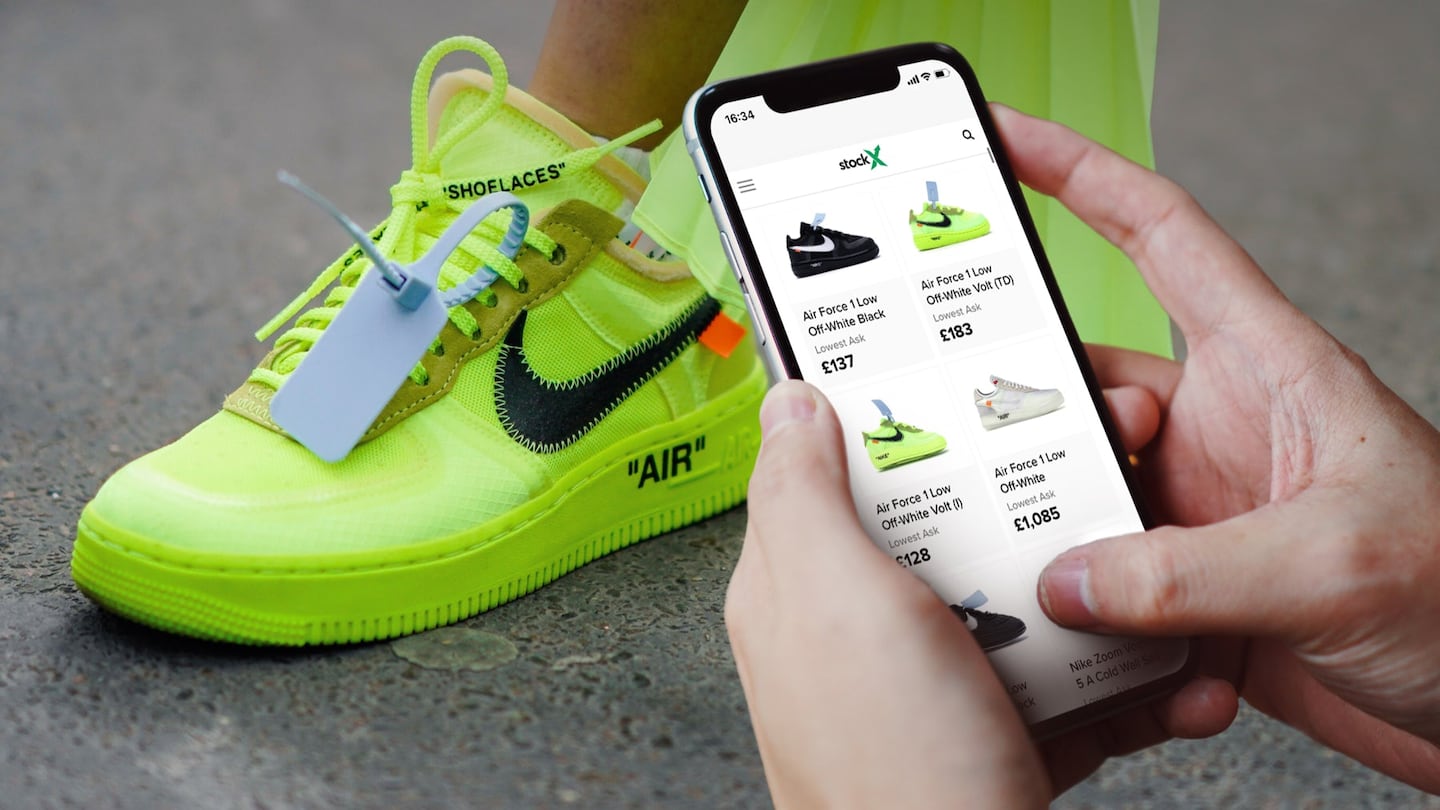

Sneaker marketplace StockX said on Thursday it had raised $255 million in a late-stage financing round, valuing the company at more than $3.8 billion.

The online retailer of sneakers, apparel, electronics, collectibles and trading cards is expected to make preparations to go public as soon as later this year, according to a person familiar with the matter.

The capital raise was led by technology focused investment firm Altimeter Capital, with new investment from growth-equity company Dragoneer and existing investors. As part of the deal, $195 million was used to buy stakes from some StockX employees, while the rest of the round was used to buy new shares.

The Detroit-based company’s current valuation is 35 percent higher than its last valuation of $2.8 billion during a Series E funding round in December, when it raised $275 million.

ADVERTISEMENT

The popular e-commerce marketplace lets customers either bid on an item or buy the product at the displayed price. It closed more than $7.5 million in trades and reported a gross merchandise value of $1.8 billion for the year ended Dec. 31, 2020, raking in a revenue of $400 million.

StockX, which serves over 200 million visitors to its online marketplace across 200 countries, hit profitability in the second half of last year.

By Juby Babu and Sohini Podder; editors: Amy Caren Daniel and Devika Syamnath.

In 2020, like many companies, the $50 billion yoga apparel brand created a new department to improve internal diversity and inclusion, and to create a more equitable playing field for minorities. In interviews with BoF, 14 current and former employees said things only got worse.

For fashion’s private market investors, deal-making may provide less-than-ideal returns and raise questions about the long-term value creation opportunities across parts of the fashion industry, reports The State of Fashion 2024.

A blockbuster public listing should clear the way for other brands to try their luck. That, plus LVMH results and what else to watch for in the coming week.

L Catterton, the private-equity firm with close ties to LVMH and Bernard Arnault that’s preparing to take Birkenstock public, has become an investment giant in the consumer-goods space, with stakes in companies selling everything from fashion to pet food to tacos.