The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

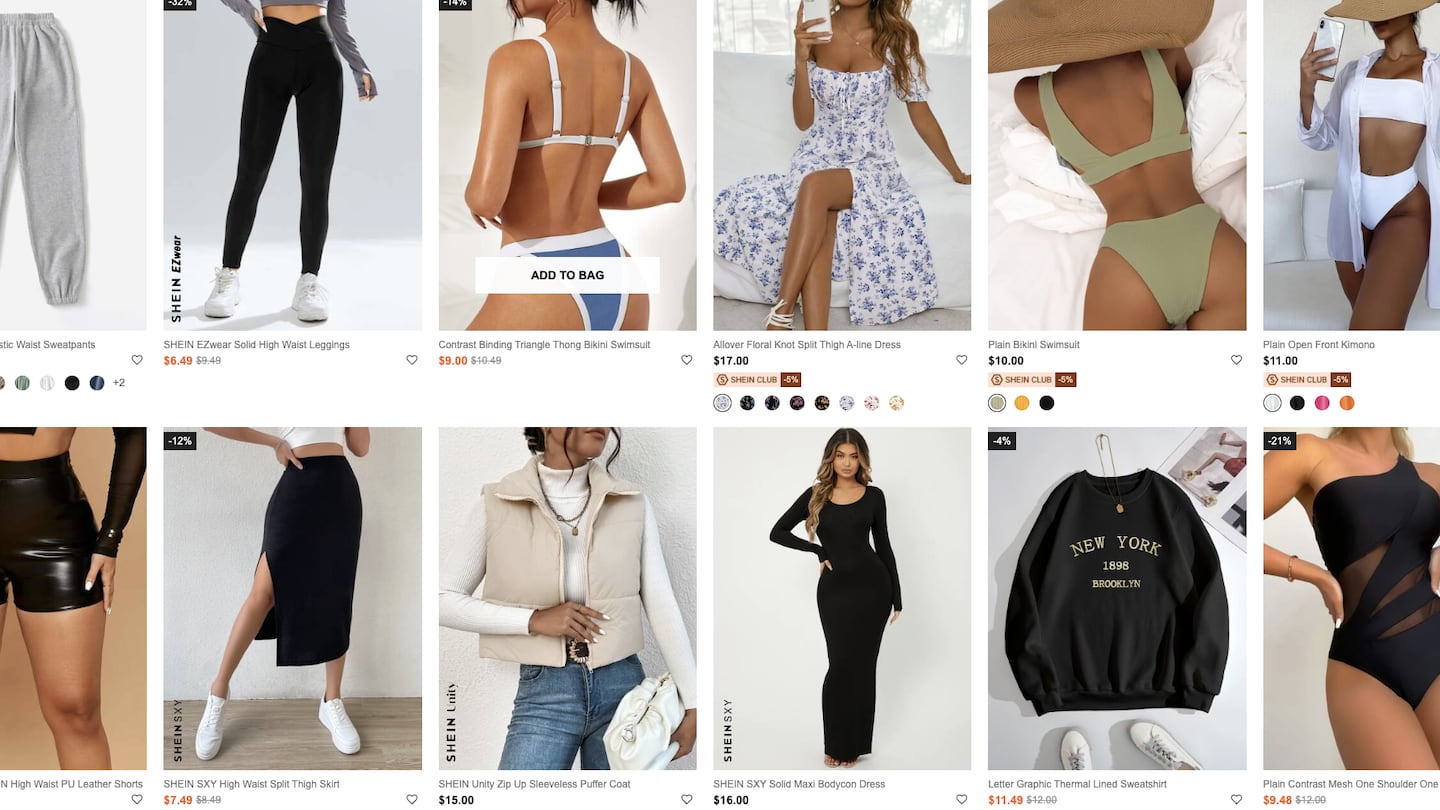

Shein, the Chinese fast fashion giant that’s now based in Singapore, has raised $2 billion, according to a report in the Wall Street Journal Wednesday.

This latest funding values the company at $66 billion, well below the $100 billion valuation Shein received a year earlier. Investors leading the round are Sequoia Capital, General Atlantic and Mubadala, the sovereign-wealth fund of the United Arab Emirates.

Known for its ultra-low prices and thousands of new styles everyday, Shein saw its sales slowing in the summer and fall of 2022 after years of explosive growth, according to BoF analysis of data from Earnest Analytics.

In 2023, however, Shein expects revenue to grow by 40 percent, according to sources cited in the Wall Street Journal report. Last year, Shein posted $23 billion in sales, the people said.

ADVERTISEMENT

Shein currently faces regulatory scrutiny from American lawmakers amid geopolitical tensions with China. A lower valuation would give room for the company to recover market value in the case of an IPO, existing investors told the Journal.

Congress sent a letter to Shein, among other international retailers, earlier this month posing the question of whether their supply chains comply with US legislation that bans cotton sourced from China’s Xinjiang region.

Shein also faces heightened competition from rival Temu, a shopping app made by Chinese online marketplace Pinduoduo that touts just as affordable prices and deep assortment of products.

In recent months, Shein has opened new warehouses and manufacturing facilities in the US and Europe.

“We’re very excited about the direction of the business,” said Peter Day, Shein’s global head of strategic communications, told BoF earlier this year. “We see ourselves as being well-positioned in the macroeconomic environment.”

Learn more:

Shein’s Years of Explosive Growth Are Over. What’s Next?

The fast-fashion retailer saw sales decline in the back half of 2022, as the novelty of its endless selection of trendy, ultra-cheap clothes wears off.

The company, under siege from Arkhouse Management Co. and Brigade Capital Management, doesn’t need the activists when it can be its own, writes Andrea Felsted.

As the German sportswear giant taps surging demand for its Samba and Gazelle sneakers, it’s also taking steps to spread its bets ahead of peak interest.

A profitable, multi-trillion dollar fashion industry populated with brands that generate minimal economic and environmental waste is within our reach, argues Lawrence Lenihan.

RFID technology has made self-checkout far more efficient than traditional scanning kiosks at retailers like Zara and Uniqlo, but the industry at large hesitates to fully embrace the innovation over concerns of theft and customer engagement.