The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

LONDON, United Kingdom — Hermès' and Kering's impressive 2019 results announcements this month have done little to offset investor fears over 2020. Both groups reported double-digit revenue growth and increased profitability but were cautious about the impact of the coronavirus on 2020 trading.

Kering witnessed a slowdown in both its brick-and-mortar and online businesses in China, the latter being affected by warehouse closures, but anticipated to make up for the shortfall in sales in the first half by boosting its marketing efforts in the region during the second half of 2020.

Hermès has re-opened its stores in China, further to a slowdown of new cases of coronavirus in the market, but has not yet seen a return to normal traffic. Other companies, including Tod's, Burberry and Moncler have joined the chorus, claiming a dramatic drop in business in mainland China, along with fears as to the potential impact of the virus spreading further afield.

Corporate activity has markedly picked up this month. Private equity firm favourite Golden Goose changed hands from the Carlyle Group to Permira, attracting a valuation of €1.3 billion ($1.46 billion); other private equity deals included the acquisition of a majority stake in French fragrance brand Creed by BlackRock and the acquisition of Coeurdor SAS — a French manufacturer of metal accessories for the luxury industry — by Riri Group, a portfolio company of French midcap investor Chequers Capital.

ADVERTISEMENT

In jewellery, Vicenza-based goldsmith and high-end jeweller FOPE was acquired by CoMo, an Italian investment company headed by Claudio Costamagna and Andrea Morante, and Asian luxury watch retailer The Hourglass acquired New Zealand-based Mansors Jewellers as part of its efforts to expand presence in the market. Safilo Group acquired a majority stake in US-based eyewear company Privé Goods as part of a strategy to grow its proprietary brands business. Finally, Mike Ashley’s investment vehicle, Frasers Group, acquired a 12.5 percent stake in Mulberry.

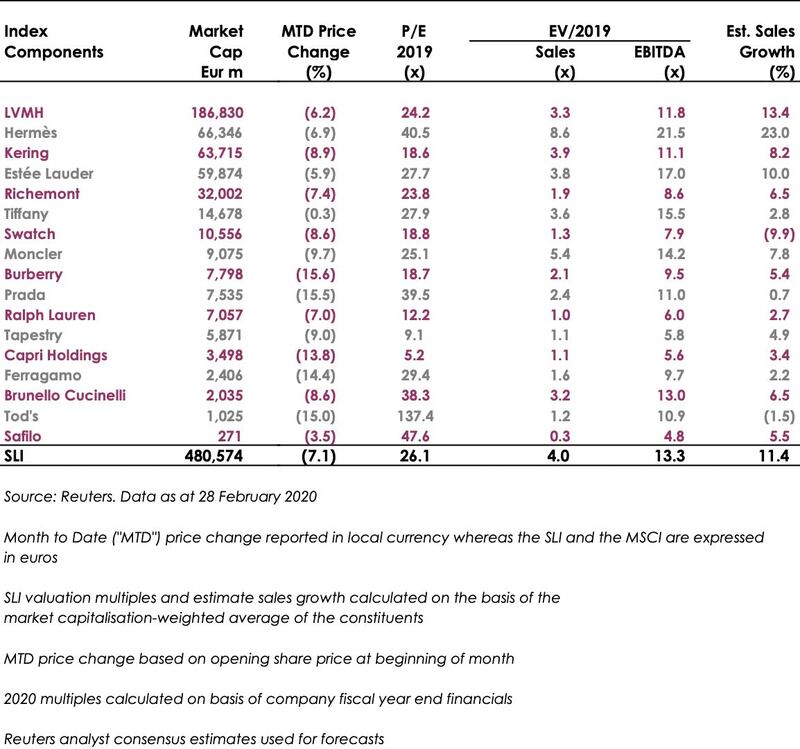

The Savigny Luxury Index (SLI) took a nosedive this month, ending 7.1 percent down, reflecting the importance of China and the Chinese traveller to the luxury industry. We would normally expect the SLI to show greater volatility than the overall market, but the MSCI global benchmark fell an astonishing 7.5 percent in February as markets were gripped by fear over the ramifications of a potential global pandemic.

SLI versus MSCI

SLI Graph February 2020

Going Up

Going Down

What to Watch

The market correction in February has, hopefully, already "priced in" the full impact of the coronavirus so that the worse can be expected to be behind us. That would be good news, particularly coming off of hefty stock market valuations across the board. We are, however, getting mixed signals with the virus spread decelerating in China but accelerating everywhere else. No doubt this virus will continue to dominate share price valuations in the short term.

Pierre Mallevays is the founder and managing partner of Savigny Partners LLP, a mergers & acquisitions advisory firm focusing on luxury brands and retail.

In 2020, like many companies, the $50 billion yoga apparel brand created a new department to improve internal diversity and inclusion, and to create a more equitable playing field for minorities. In interviews with BoF, 14 current and former employees said things only got worse.

For fashion’s private market investors, deal-making may provide less-than-ideal returns and raise questions about the long-term value creation opportunities across parts of the fashion industry, reports The State of Fashion 2024.

A blockbuster public listing should clear the way for other brands to try their luck. That, plus LVMH results and what else to watch for in the coming week.

L Catterton, the private-equity firm with close ties to LVMH and Bernard Arnault that’s preparing to take Birkenstock public, has become an investment giant in the consumer-goods space, with stakes in companies selling everything from fashion to pet food to tacos.