The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

BEIJING, China — On the heels of its IPO announcement, Chinese e-commerce juggernaut Alibaba has a serious 'catch-22' on its hands when it comes to the company's relationship with luxury brands.

Alibaba’s incredible reach and policy of lax policing has yielded a massive business built on “black” and “grey” market resellers, who offer unlicensed and counterfeit luxury goods at significant discounts. This is a business that the company cannot afford to lose. However, the scale of this business coupled to China’s increasing primacy as a market have some major luxury brands seeking legal recourse, something that has caught the attention of potential investors.

In response, Alibaba has begun a campaign to create legitimate relationships with high-end brands. But for more brands to partner with Alibaba, the Chinese marketplace must more seriously crack down on unauthorised reselling, which constitutes the vast majority of their luxury goods business. Because the company’s short- and long-term interests are so profoundly at odds, however, Alibaba finds itself having to perform an incredibly tricky balancing act.

Alibaba should take a page out of Google’s book, maximising revenue in the short term, while buying critical time to build enduring relationships with Western brands and fundamentally shift the way Chinese consumers buy luxury goods.

ADVERTISEMENT

For many outside of China, the underlying forces that have contributed to Alibaba’s rise and current circumstances remain a mystery. In China, buying authentic luxury product directly — when possible (it’s often not) — frequently results in a “fully-landed” cost that is a full 50 to 100 percent above standard pricing in other markets, like Europe and the US. This incredible premium has led savvy consumers to seek other paths to purchase, including buying overseas and “haitao,” buying online through a VPN (virtual private network).

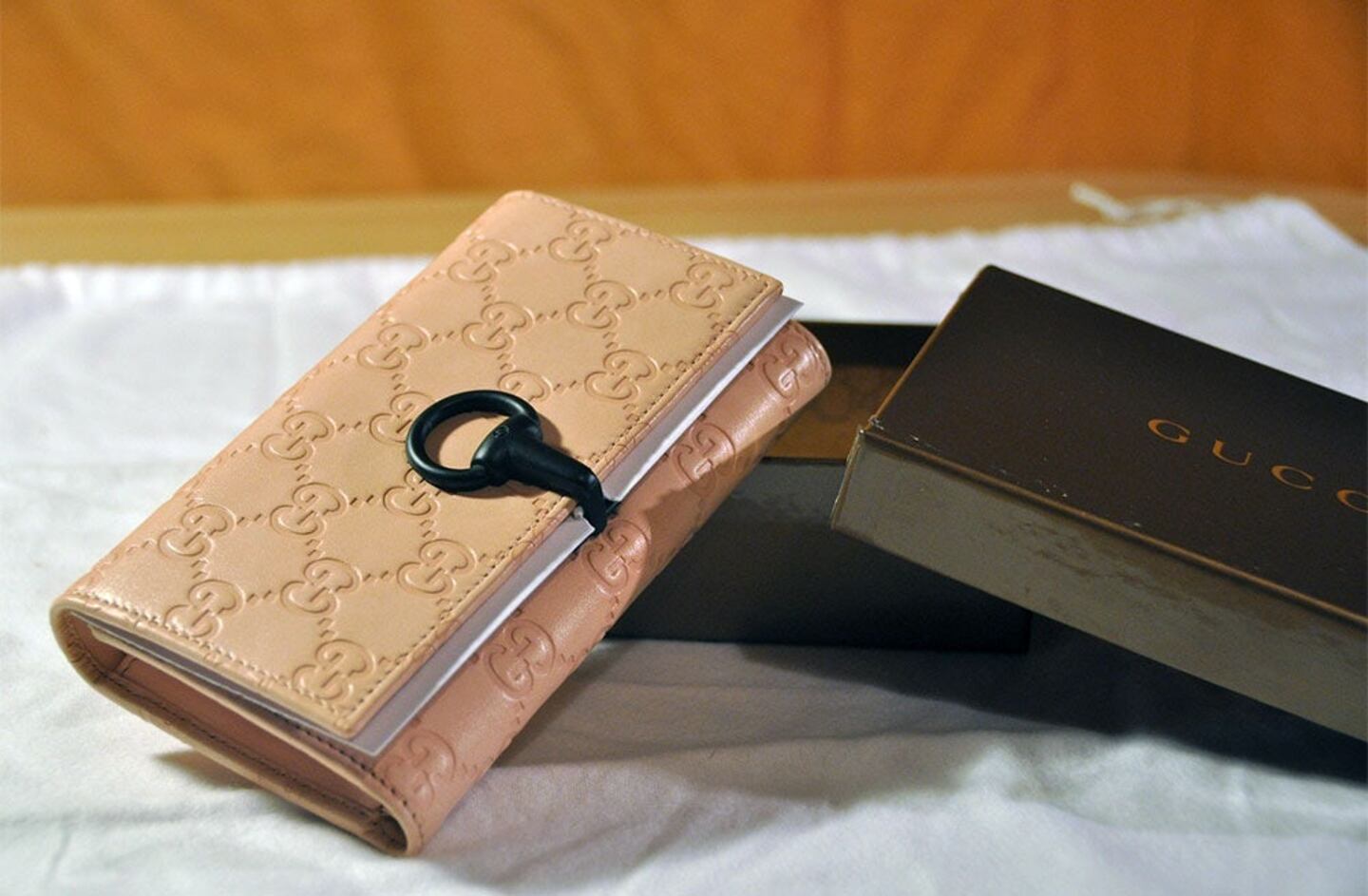

One of the most popular methods — and the core of Alibaba's luxury business — is enabling consumers to buy through foreign-based luxury product resellers, known as "daigou". A $15 billion annual business, daigou are resellers and shopping agents that serve consumers directly as well as through popular channels like Sina Weibo, WeChat, and, of course, Alibaba's Taobao and Tmall, which are primary distribution engines for daigou. Ostensibly, daigou purchase goods in foreign markets and transport them back to China, but, in reality, the majority sell primarily unlicensed or counterfeit goods, meaning that Alibaba's Taobao and Tmall — multi-billion dollar businesses — are, in fact, largely founded on the buying and selling of grey and black market goods. And, in building these powerful marketplaces, Alibaba has trained the Chinese consumer to pay less and buy Western luxury products via intermediaries.

On the back of their IPO announcement, however, Alibaba’s reseller model is being scrutinised more closely — and some top Western luxury brands are taking legal action. China’s uneven regulatory environment leaves the company with a significant amount of wiggle room, but the international market is less forgiving. Alibaba increasingly understands that addressing the concerns of these brands (and, more critically, the market) is essential to its future success in high-end goods and so the company has begun ramping up efforts to remove counterfeit products from Tmall and Taobao.

But this removal effort comes at a potentially dire cost. The Chinese consumer is well-researched, astute and has grown accustomed to the reseller model. They will not be willing to suddenly start paying 50 percent more for what are ostensibly the same goods. Consequently, without significant forethought and care, removing these products will almost certainly result in reduced buying on Alibaba's properties, driving consumers elsewhere to buy through familiar resellers (who can simply switch platforms), opening the market for potential competitors such as WeChat, O Fashion and Ymatou.

So, what’s the best path forward for Alibaba?

The terrain is rocky, but not impassable. First, Alibaba should try to play both sides for as long as it can, maximising earnings while minimising damage in the short-term. In the end, though, Alibaba must recognise that top brands like Gucci (which initiated a lawsuit alleging the company was participating in the violation of trademarks that was withdrawn only when Alibaba agreed to cooperate with Gucci parent company Kering) must be treated as partners for the e-commerce giant to have long-term viability in the luxury market. But that these partnerships are possible, at all, is testament to the extent that luxury brands now depend on Alibaba to reach Chinese consumers at scale.

In parallel, Alibaba must begin to convince the consumer that its Tmall stores are authentic and that buying on Tmall is the equivalent of buying from an international source. This will not be an easily overcome emotional hurdle for the consumer. What's more, Tmall must also be competitive on price with daigou and other online channels, if not overseas tourism. This will take time, significant resources and a considered effort on the part of Alibaba, something that must be done in partnership with brands.

Fortunately, Alibaba has big pockets and can weather the storm, much like Google did following its acquisition of YouTube. Viacom’s litigation was troubling to the market, but ultimately Google was able to stall long enough to evolve YouTube and capitalise on explosive growth fuelled largely by illegal content. And, in the case of Alibaba, until top luxury brands wake up and start investing intelligently in their own direct-to-consumer e-commerce and branding efforts, Alibaba can and should position Tmall stores to be the only legitimate game in town.

ADVERTISEMENT

On the flip side, if brands can build their own channels for awareness and high quality sales — and if they can match daigou pricing — then Alibaba’s luxury consumer courtship post-IPO could indeed prove difficult.

Brian Buchwald is the CEO and co-founder of Bomoda Group, a media and business intelligence company based in New York and Shanghai. Joshua Neckes is the chief revenue officer at Bomoda Group.

The views expressed in Op-Ed pieces are those of the author and do not necessarily reflect the views of The Business of Fashion.

How to submit an Op-Ed: The Business of Fashion accepts opinion articles on a wide range of topics. Submissions must be exclusive to The Business of Fashion and suggested length is 700-800 words, though submissions of any length will be considered. Please send submissions to contributors@

In 2020, like many companies, the $50 billion yoga apparel brand created a new department to improve internal diversity and inclusion, and to create a more equitable playing field for minorities. In interviews with BoF, 14 current and former employees said things only got worse.

For fashion’s private market investors, deal-making may provide less-than-ideal returns and raise questions about the long-term value creation opportunities across parts of the fashion industry, reports The State of Fashion 2024.

A blockbuster public listing should clear the way for other brands to try their luck. That, plus LVMH results and what else to watch for in the coming week.

L Catterton, the private-equity firm with close ties to LVMH and Bernard Arnault that’s preparing to take Birkenstock public, has become an investment giant in the consumer-goods space, with stakes in companies selling everything from fashion to pet food to tacos.