The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

Kanye West’s fall from grace is going to cost Adidas $250 million this year alone. “Lipstick King” Austin Li left brands in the lurch during a crucial selling period in China before making a miraculous reappearance on Alibaba’s Taobao in September, attracting 50 million viewers. Johnny Depp’s defamation case drove a spike in publicity as well as soaring sales of the Dior Sauvage fragrance he fronts. Brand associations with larger-than-life personalities can be a rollercoaster of highs and lows, and social media has only raised the stakes.

Brands often turn to artists with larger-than-life personalities to boost brand awareness and turbocharge sales. But along with the prospect of big rewards, these associations come with inherent risk and can sometimes backfire, leaving brands running for cover.

Teaming up with West (now known as Ye) was a boon for multiple brands — until it wasn’t. His Yeezy collection for Adidas was a runaway success since its first release in 2015. Last year, it generated an estimated $1.7 billion in sales. Partners Gap and Balenciaga felt a less direct but valuable halo effect from their associations with Ye, too. But these links hit a tipping point of toxicity when the rapper began spewing racist, antisemitic bile last month.

Balenciaga was relatively quick off the mark when it came to cutting ties with Ye, who opened the brand’s Paris Fashion Week show on 2 October. Fifteen days later, the footage and associated images were wiped from the brand’s channels and those of some publishers, while the Yeezy Gap Engineered by Balenciaga collection that launched earlier this year was pulled from multi-brand e-tailers and Balenciaga’s own website.

ADVERTISEMENT

Adidas was slower to react, likely due to the significantly higher financial stakes of its links with Ye. The company which placed the relationship under review on 6 October only formally terminated its agreement with Ye on 25 October, and that after significant public pressure on social media, compounded by the entertainer’s taunt on the Drink Champs podcast: “I can say antisemitic things and Adidas can’t drop me. Now what?”

Of course, scandal sometimes does no harm. In some instances, it can even be good for business. When Dior decided to maintain its ties to Johnny Depp after he lost a 2020 defamation suit against The Sun newspaper, which labelled him a wife beater, internet searches for Sauvage after shave spiked by almost 25 percent, buoying sales.

The more recent defamation case, Johnny Depp vs Amber Heard, which dominated social media for several months earlier this year, was also a boon for Dior, as fans rallied behind the star, praising the brand for standing by Depp and airing his Sauvage ad.

Sometimes, controversy can be good for business. Chanel, Burberry and H&M dropped Kate Moss in 2005 when British tabloids published photos allegedly showing her using cocaine (though she was later cleared of any drug offence charges). But after the British model was named as the UK’s creative director of Diet Coke this July, she quipped at a launch party unveiling four limited-edition can designs: “I’ve always loved coke.”

While it’s hard to predict when a scandal will erupt, and which way the wind will blow, there are steps that brands can take to minimise risk. The first: have the proper paperwork in place. Most celebrity contracts contain moral turpitude and/or disparagement clauses which give a brand some leeway in determining whether a relationship with a celebrity can be terminated without notice due to bad or badly perceived behaviour.

Careful selection and vetting of celebrities can also mitigate risk. With Ye, the writing was very much on the wall. See his harassment of ex-wife Kim Kardashian and incitement of violence against her then boyfriend Pete Davidson. In fact, within a week of launching the first Yeezy Gap Engineered by Balenciaga collection earlier this year, Ye made headlines by launching a music video in which he was depicted burying Pete Davidson alive.

Diversification is another key tactic. Chanel, for example, has forged its celebrity associations so that the brand is not overly reliant on any one individual. In fact, its flagship Chanel No.5 perfume has had many faces: Catherine Deneuve, Carole Bouquet, Nicole Kidman, Brad Pitt, Giselle Bundchen and Michiel Huisman, which, of course, has other benefits too: creating hype around who will next be the face of the fragrance.

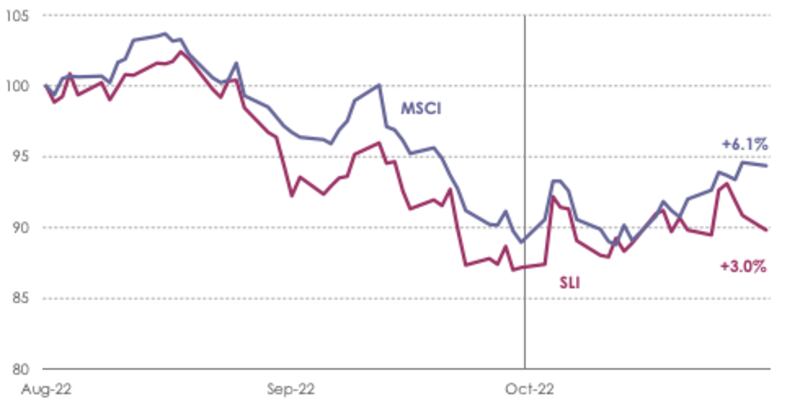

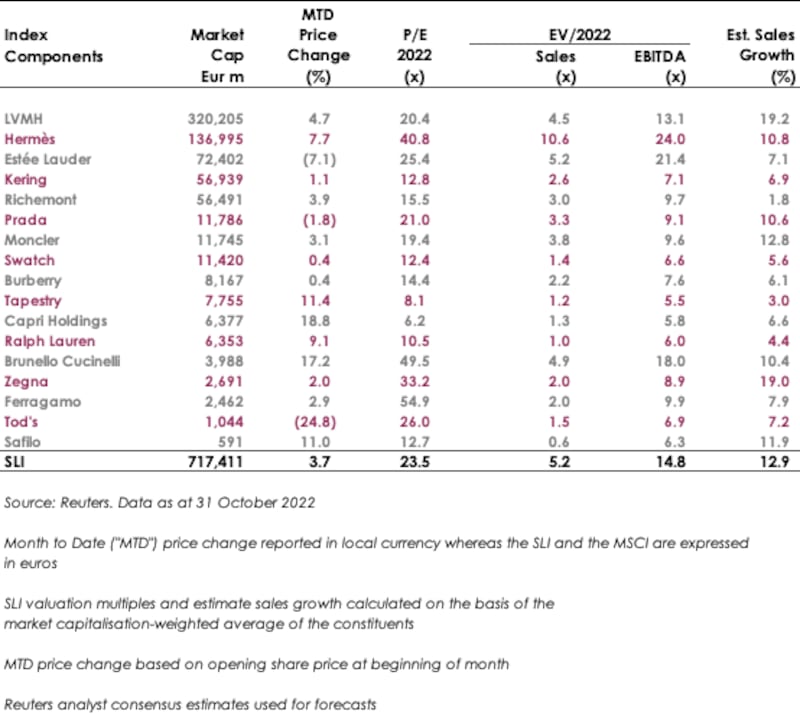

The Savigny Luxury Index (“SLI”) gained 3 percent in October on the back of mixed third quarter results leading it to underperform the MSCI which gained 6 percent.

ADVERTISEMENT

Going up

Going down

Social media is in crisis. In the latest turn of events, Elon Musk’s acquisition of Twitter has resulted in a spike of racist posts on the site and his subsequent car crash management of the company has spawned the trending topic #RIPTwitter. Ye also made an offer for conservative social media platform Parler (after he was kicked off Twitter) and Donald Trump, whose Twitter account has just been re-instated by Musk, launched a me-too Twitter platform called Truth Social in 2021. Bottega Veneta was first to act. As early as last year, the brand deleted its social media accounts. Now, Balenciaga has deleted its Twitter account. Is this the beginning of fashion’s exodus from the platform and others?

Pierre Mallevays is a partner and co-head of merchant banking at Stanhope Capital Group.

In 2020, like many companies, the $50 billion yoga apparel brand created a new department to improve internal diversity and inclusion, and to create a more equitable playing field for minorities. In interviews with BoF, 14 current and former employees said things only got worse.

For fashion’s private market investors, deal-making may provide less-than-ideal returns and raise questions about the long-term value creation opportunities across parts of the fashion industry, reports The State of Fashion 2024.

A blockbuster public listing should clear the way for other brands to try their luck. That, plus LVMH results and what else to watch for in the coming week.

L Catterton, the private-equity firm with close ties to LVMH and Bernard Arnault that’s preparing to take Birkenstock public, has become an investment giant in the consumer-goods space, with stakes in companies selling everything from fashion to pet food to tacos.