The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

Russia’s invasion of Ukraine has already taken a terrible human toll and sent the world into a tailspin. Western governments have responded by funneling money and weapons to Ukraine and unleashing new forms of economic warfare.

In the luxury sector, firms such as Richemont, Burberry, Hermès, LVMH, Kering and Chanel have suspended their operations in Russia, whilst a growing list of Russian oligarchs have effectively had their credit cards cancelled. The Savigny Luxury Index (SLI) dipped 3 percent on the day of invasion and is down by almost 12 percent since the beginning of the year, approaching the 15 percent slide we saw in March 2020 when the world went into lockdown.

In 2002 to 2003, the world was facing a similar situation. The US was talking up its planned invasion of Iraq while a new deadly airborne virus, SARS, was spreading in Asia. From George W Bush’s famous speech on the “axis of evil” in January 2002 to the day of the invasion of Iraq in March 2003, the SLI fell over 40 percent. This is what was being said then:

All of the above apply today. The last point on the uncertainty of war, notably how long and how intense it will be, is particularly pertinent. In the case of Iraq, the threat from so-called “weapons of mass destruction” was a smoke screen. Now, we have a Russian leader with the world’s largest nuclear arsenal saying that nuclear retaliation is on the table should NATO interfere. This has people on high alert and is likely to seriously curb tourism to Europe, the world’s biggest luxury shopping destination, just as it was becoming easier to book flights.

ADVERTISEMENT

The export bans imposed by Western governments will not have much direct impact on luxury sales. It is estimated that the Russian market accounts for only 1 to 2 percent of sales for most luxury brands. The freezing of assets belonging to oligarchs with links to the Kremlin will have some impact on niche segments of ultra luxury, such as super yachts and high jewellery, as well as super prime property, but billionaires are plenty these days. Forbes counts 2,755 of them worldwide, of which only 177 are Russian.

The elephant in the room is Russian oil. Russia is the world’s third largest producer of oil, behind the US and Saudi Arabia. One month into the conflict, the price of Brent crude has reached a 14-year high, fuelled, in part, by suggestions that European Union nations could join the US in a Russian oil embargo. Surging oil prices are concerning to a luxury goods industry that has already faced substantial increases to logistics costs as a result of the global supply chain crisis brought on by the pandemic. This is likely to impact on the bottom line, though firms will surely attempt to pass on at least some of the increased cost to consumers, something only the crème de la crème of the sector may be able to achieve.

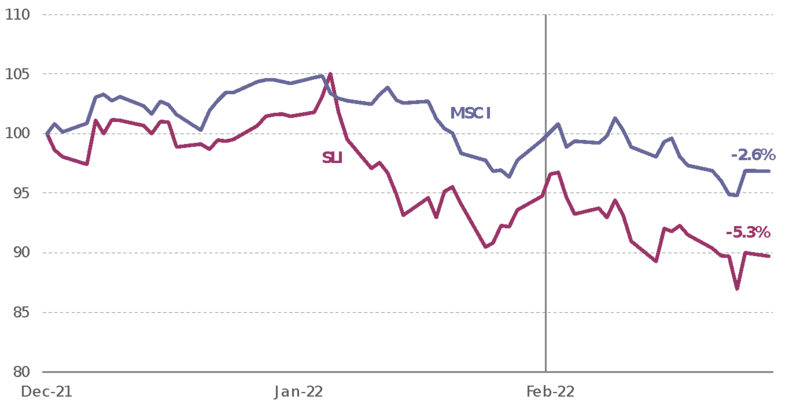

The Savigny Luxury Index (“SLI”) fell 5 percent in February on the back of Russia’s invasion of Ukraine whilst the MSCI lost almost 3 percent of its value. As usual we see more pronounced volatility in luxury stocks compared to the rest of the market, the good news for the sector being that the ups tend to be greater than the downs relative to the market as a whole.

SLI vs. MSCI

Going up

Going down

What to watch

The way things unfold in Ukraine will have a huge impact on the outlook for the sector. At best, the conflict will cool, but the world will still face a stiff increase in living costs and international travel will remain sluggish. The worst case is too horrible to think about.

ADVERTISEMENT

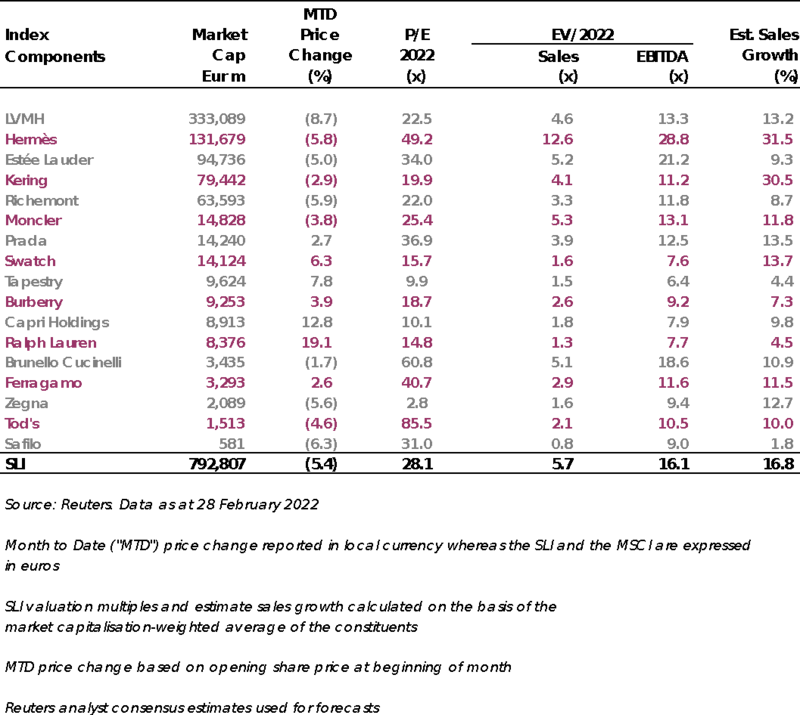

Sector valuation

Pierre Mallevays is a partner and co-head of merchant banking at Stanhope Capital Group.

In 2020, like many companies, the $50 billion yoga apparel brand created a new department to improve internal diversity and inclusion, and to create a more equitable playing field for minorities. In interviews with BoF, 14 current and former employees said things only got worse.

For fashion’s private market investors, deal-making may provide less-than-ideal returns and raise questions about the long-term value creation opportunities across parts of the fashion industry, reports The State of Fashion 2024.

A blockbuster public listing should clear the way for other brands to try their luck. That, plus LVMH results and what else to watch for in the coming week.

L Catterton, the private-equity firm with close ties to LVMH and Bernard Arnault that’s preparing to take Birkenstock public, has become an investment giant in the consumer-goods space, with stakes in companies selling everything from fashion to pet food to tacos.