The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

Not so long ago, the most straightforward — and often the least expensive — way for many mainland Chinese consumers to buy the latest fashion or beauty items from their favourite global luxury brands wasn’t to head to their local shopping malls, or even hop online. Instead, they often travelled to Hong Kong, or further afield, visiting London, Paris or New York to shop at flagship stores, where they could feel more assured about the authenticity, price advantages and wider selection of items, cementing their reputations of being among the global luxury industry’s top spenders.

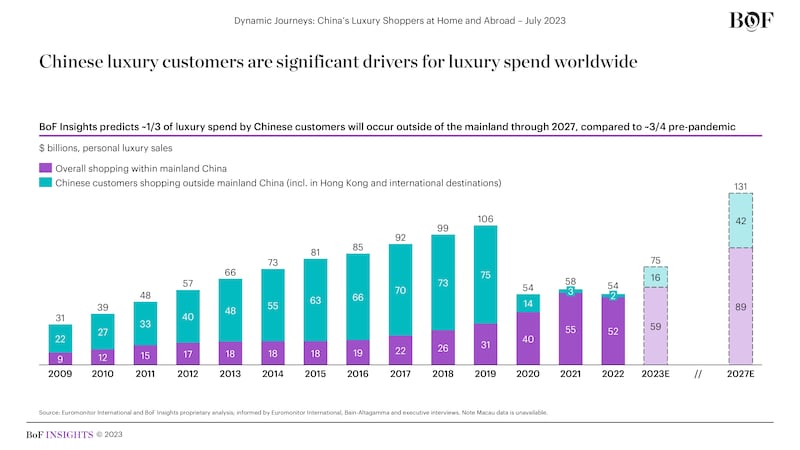

Though the spending continues — forecast to total $75 billion this year — things have changed, according to research for BoF Insights’ latest report, Dynamic Journeys: China’s Luxury Shoppers at Home and Abroad. As Chinese luxury spending continues to recover from the economic impact of China’s zero-Covid policies to surpass pre-pandemic levels and reach $107 billion by 2025, the geographic shift of where that shopping takes place is taking shape — by 2027, BoF Insights expects that two-thirds of the $131 billion of Chinese luxury purchases will occur within mainland China and one-third outside — a balance that marks a complete reversal from pre-pandemic times.

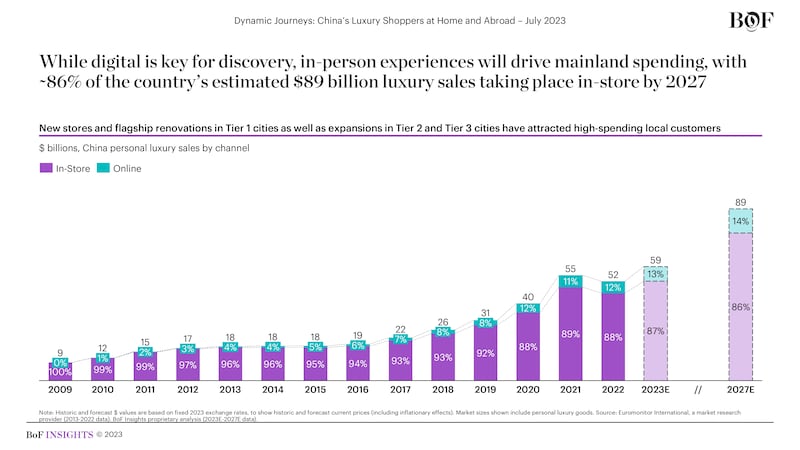

Amid this, Chinese consumers — more and more of whom are part of a burgeoning affluent cohort — are reshaping how and where they shop relative to pre-pandemic years, the BoF Insights report finds. At home, digital is still key for discovery on platforms like WeChat, Douyin and Xiaohongshu, but more and more in-person touchpoints are driving local spending. This will happen as local and foreign brands and retailers not only expand or renovate their stores, but also as they prioritise service, starting with staff — many on-the-ground store associates are already nurturing personal relationships with top customers by, for example, inviting them in-store to purchase limited edition products or attend special, one-off cultural events.

Much of this shopping is taking place amid a widespread embrace of domestic tourism. Three years of closed international borders encouraged the exploration of local destinations, with a long-lasting impact even after borders reopened in early 2023, bolstered by infrastructure improvements to transit, hotels and entertainment options, including luxury shopping. According to proprietary surveys fielded by BoF Insights and fielded by affluent research specialist Altiant in mainland China, almost all surveyed high-net-worth individuals (with investable assets worth a median $1.5 million to $2 million) and more than two-thirds of general customers plan to travel domestically for leisure in the next 12 months. Topping travel wish lists for both cohorts is the tropical island province of Hainan, which is in the midst of a major initiative to become a duty-free luxury shopping destination — attracting global luxury brands, such as Louis Vuitton, Gucci and Dior.

ADVERTISEMENT

This is not to say international travel is off the table. Nearly all surveyed high-net-worth individuals and about half of general customers have international travel plans in the year ahead. Japan tops the global wish list, with other popular destinations such as the US also expected to benefit from the lifting of restrictions for China’s shoppers to travel without tour groups. However, those who travel abroad will be looking for more than price advantages and tax savings when luxury shopping, according to experts speaking with BoF Insights, who note that culture- and nature-inspired experiences, rather than shopping alone, are key motivations for Chinese travelling abroad.

For global luxury brands and retailers, the impact of these consumer shifts are profound, and both international and domestic strategy must be adapted accordingly. As Iris Chan, partner and head of international client development at Digital Luxury Group, told BoF Insights, “From a customer relationship management perspective, China is . . . at a different level [than where it once was]. Brands must be prepared for customers that have higher expectations than ever. They need to consider that there are more components to the shopping experience [for Chinese luxury customers] than just price.”

BoF Insights is The Business of Fashion’s data and advisory team, partnering with leading fashion and beauty clients to help them grow their brands and businesses. Get in touch at insights@businessoffashion.com to understand how BoF Insights support your company’s growth for the long term.

This Masterclass explores how global luxury brands and retailers can adapt to China’s shifting shopping landscape.

Benjamin Schneider is the Senior Research Lead at the Business of Fashion (BoF). He is based in New York City as part of BoF’s Insights team, which arms fashion and luxury executives with proprietary business intelligence.

Diana Lee is the Director of Research & Analysis at The Business of Fashion. She is based in London and oversees the content strategy and roadmap for BoF Insights.

With consumers tightening their belts in China, the battle between global fast fashion brands and local high street giants has intensified.

Investors are bracing for a steep slowdown in luxury sales when luxury companies report their first quarter results, reflecting lacklustre Chinese demand.

The French beauty giant’s two latest deals are part of a wider M&A push by global players to capture a larger slice of the China market, targeting buzzy high-end brands that offer products with distinctive Chinese elements.

Post-Covid spend by US tourists in Europe has surged past 2019 levels. Chinese travellers, by contrast, have largely favoured domestic and regional destinations like Hong Kong, Singapore and Japan.