The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

The beauty industry has already seen a wave of acquisitions and investments in 2023, and dealmakers say they’re just getting started.

So far in January, Procter & Gamble purchased textured hair care brand Mielle Organics, AS Beauty, parent company of Laura Geller Beauty and Cover FX, acquired skin care brand Bliss, and Mario Dedivanovic’s cosmetics line Makeup by Mario landed a $40 million minority investment, valuing the brand at over $200 million.

The flurry of deals is reminiscent of the heady days of 2019, when an earlier wave of start-up skin care and makeup brands were snapped up by conglomerates and private equity firms; Shiseido bought Drunk Elephant for $845 million and Unilever acquired Tatcha for an estimated $500 million.

The economy isn’t as healthy as it was then, and over the last three years buyers have learned the hard way that fast-growing start-ups can struggle to maintain momentum, and find it even harder to scale and turn a profit at the same time.

ADVERTISEMENT

This time around, buyers are being more cautious, looking for brands with strong balance sheets, and an even stronger grip on their customers’ loyalty. Lines that target wealthier consumers, who are most likely to keep spending even in a recession, are particularly in demand (though there are trendy products at lower price points that have attracted buyers’ attention). As potential acquirers are being more selective, the buzziest brands in hot categories like hair care are getting the lion’s share of interest.

“This economic backdrop is not encouraging, but there are deals to be done for great companies and growth capital to be deployed,” said Vennette Ho, managing director, global head of beauty and personal care, at Financo Raymond James. “Brands need to prove strong, steady growth and real profitability.”

Others see the biggest wave of deals coming later in the year, as brands prove they can navigate the current economic turbulence.

“‘A’ assets will have the luxury to wait it out, and make sure they get credit for what they can do in the first quarter in order to ensure they get the ... optimal valuation,” said Ashleigh Barker, head of beauty and personal care at Lincoln International.

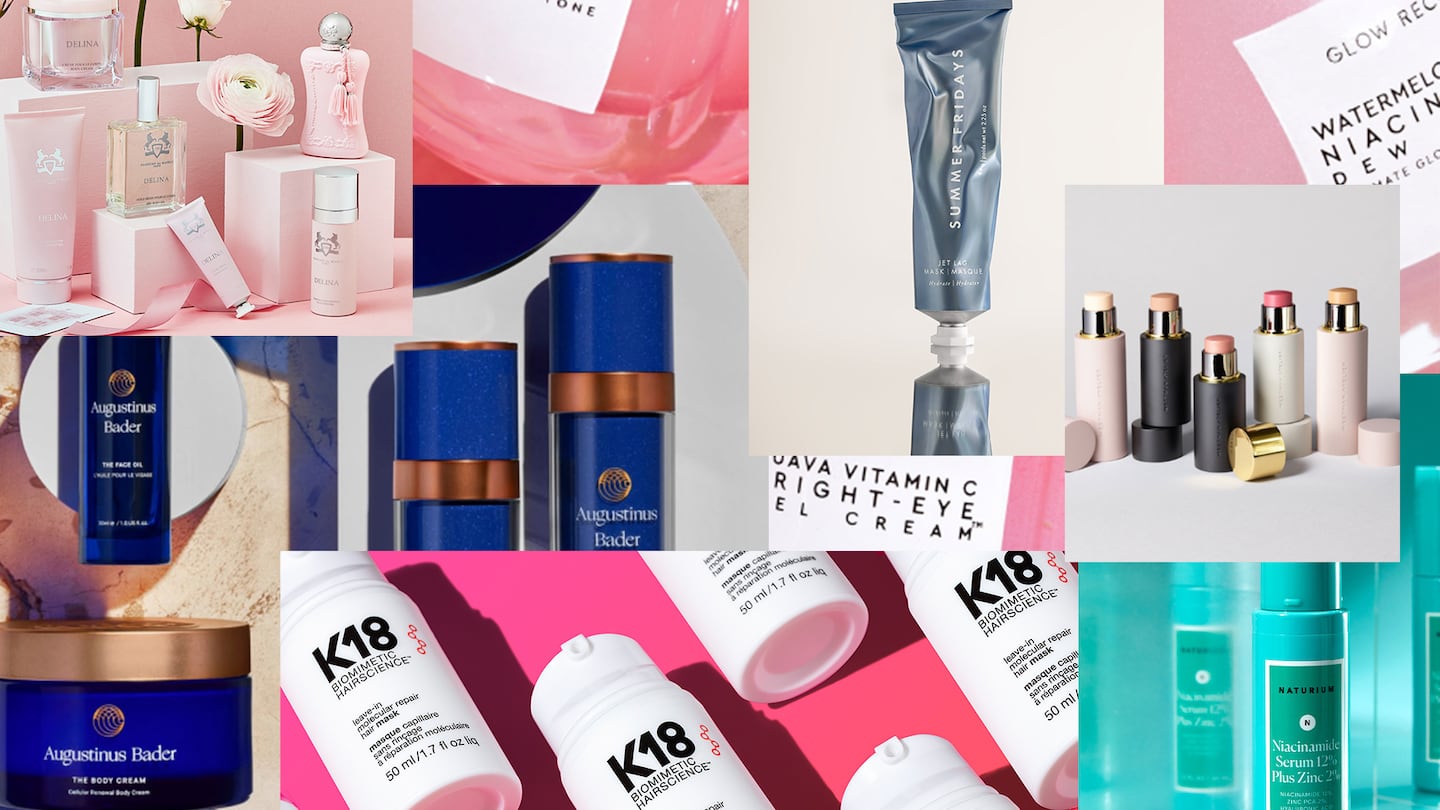

The Business of Beauty spoke with industry executives, financial advisors, investors and market sources to identify seven beauty lines with strong identities, innovative products, and sound financials that have put them on buyers’ radars.

2023 Estimated Retail Sales: $280 million

2022 Estimated Retail Sales: $180 million

Co-founded in 2018 by Augustinus Bader, a German doctor who specializes in stem cell research, and Charles Rosier, the brand positioned itself early as a miracle skin care line, taking on La Mer and other established luxury lines. Bader’s hero products, the Rich Cream and the Cream, each retailing for $290 for a 50ml bottle, were championed by the retailer Violet Grey and actress Melanie Griffith, with sales hitting $70 million in 2020. The brand has since launched equally luxurious – and expensive – body creams, lip balms, lash serums, shampoos and conditioners. Today, Augustinus Bader products are also sold at Sephora, Nordstrom and on its e-commerce website, among others.

ADVERTISEMENT

The brand itself checks many of the boxes strategics are eyeing. Following reported interest from big beauty strategics like LVMH, The Estée Lauder Companies and L’Oréal in 2022 – as well as reported outbounds to garner even more interest – Augustinus Bader raised $25 million in a funding round from Antoine Arnault, Natalia Vodianova and Javier Ferrán in November, valuing the brand at $1 billion. Sources say any company willing to spend well over that amount could be a winner.

2023 Estimated Retail Sales: $250 million

2022 Estimated Retail Sales: $150 million

In just two years, K18, the prestige hair brand founded by Aquis co-founders Suveen Sahib and Britta Cox, has developed a fervent following. Dramatic before and afters and fanatical testimonials from TikTokers and stylists, helped the brand cross the $150 million sales mark in 2022. It’s frequently cast as a rival to Olaplex, which leveraged a similarly devoted following to a 2021 initial public offering.

The brand has plenty of room to grow – it only launched two shampoos in late 2022 to supplement its popular $75 Leave-In Molecular Repair Hair Mask. Strategic buyers seem just as interested in K18′s technology. The brand patented its peptide technology, which changes and repairs the hair’s polypeptide chains that have been broken, and has an exclusive license for the keratin genome. According to multiple sources, the brand has done no buyer outreach but is receiving inbounds at a pace reminiscent of the busiest dealmaking periods in 2019.

The Olaplex comparisons may be wearing thin – that brand’s stock is down 70 percent from its IPO price. Still, as one investor said, “everyone wants the next Olaplex and this is it. If you look at the list of biggest hair brands, K18 is the only one that hasn’t been acquired.”

Others to watch: Colorwow, Vegamour

2023 Estimated Retail Sales: $80 million

ADVERTISEMENT

2022 Estimated Retail Sales: $55 million

Masstige skin care line Naturium, cofounded by influencer Susan Yara, is the first brand spun out of Ben Bennett’s brand incubator The Center.

Naturium has a strong foothold at Amazon, where it smartly focused on use-case and ingredients, versus brand name at launch. It’s also sold at Target, where it ranks in the top three best-selling premium skin care brands, people familiar with Naturium’s performance said. The brand’s 2022 move into body care from facial skin care has also been well received.

Mass beauty has long needed a refresh. While a private equity shop might seem like a temporary home for Naturium, strategics that have an eye on growing that area of the business have identified it as a target, sources said.

Others to watch: Versed

2023 Estimated Retail Sales: $100 million

2022 Estimated Retail Sales: $60 million

Luxury colour cosmetics is the domain of beauty conglomerates and global fashion brands – think Chanel, Gucci and Tom Ford. Co-founders Gucci Westman and her husband David Neville have managed to carve out a unique niche within the category: founder-led, luxury, and clean.

Westman, a makeup artist with deep runway expertise and ties to strategics like L’Oréal (she previously served as Lancôme’s International Artistic Director), is likely to have her pick of partners. Westman Atelier has raised just $10 million since December 2020. According to sources, The Estée Lauder Companies reportedly showed interest in the brand in 2022.

Westman Atelier has a diversified distribution network in the US (it is sold at Sephora, Bergdorf Goodman and Credo), and has proven it can travel with its partnerships with Selfridge’s and Harrod’s in the UK, Mecca in Australia and Le Bon Marche in France. But as the luxury brand plots its next expansion, likely into Asia, it will need a backer with deep pockets.

Others to watch: Kosas

2023 Estimated Retail Sales: $300 million

2022 Estimated Retail Sales: $250 million

Rather than developing a designer or celebrity fragrance license or joint venture with a partner, buyers are looking for artisanal businesses that develop their scents in house. Parfums de Marly is one of the few standalone businesses to fit that criteria. Founded in 2009, the luxury French brand, inspired by Louis the XV’s Chateau de Marly, has carved out a substantial business. But with so many buyers coming to the table for Byredo in 2022, Parfums de Marly is sought after but needs to hit the right timing (other equally desirable fragrance brands are expected to be in market soon). Selling to a private equity firm versus a strategic buyer, could be an outcome here.

Others to watch: Creed

2023 Estimated Retail Sales: $140 million

2022 Estimated Retail Sales: $125 million

Sarah Lee and Christine Chang, co-founders of Korean beauty brand Glow Recipe, were said to be shopping the line in 2022, people familiar with the matter told The Business of Beauty. At the time, the brand was reportedly valued at $400-500 million. The “fruit-forward” brand hit $100 million in retail sales in 2021 and around $125 million in sales in 2022, according to a person with knowledge of the business. Although the brand has seen year-on-year growth, sources say that Glow Recipe needs to find an audience beyond its young customers, and at other retailers in addition to Sephora.

Others to watch: Osea

2023 Estimated Retail Sales: $70 million

2022 Estimated Retail Sales: $50 million

Since launching in 2018, Marianna Hewitt and Lauren Ireland’s Summer Fridays has expanded from its Instagrammable Jet Lag mask to an assortment that spans skincare, clean colour, body and even merch. Hewitt and Ireland have also assembled a dream team around them: John Heffner, CEO and Chairman, and Kimberley Natale, President, have been in the business of taking brands to market before (see Helen of Troy’s purchase of Drybar in 2020). This is expected to be an ambitious year for Summer Fridays as it hopes to achieve a 40 percent increase in retail sales. While some sources say the buzzy brand is more likely to be on a 2024 timeline, the pieces are in place for an exit.

Opens in new window

Opens in new windowThis month, BoF Careers provides essential sector insights to help beauty professionals decode the industry’s creative landscape.

The skincare-to-smoothie pipeline arrives.

Puig and Space NK are cashing in on their ability to tap the growth of hot new products, while L’Occitane, Olaplex and The Estée Lauder Companies are discovering how quickly the shine can come off even the biggest brands.

Demand for the drugs has proven insatiable. Shortages have left patients already on the medications searching for their next dose and stymied new starters.