The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

On Tuesday, Spanish perfume group Puig announced that it was acquiring Byredo. Puig declined to disclose financial details, but media reports last week estimated a price tag for the Swedish fragrance brand of about €1 billion ($1.07 billion).

If that number is accurate, Byredo would be the second billion-dollar acquisition for Puig in as many years, following its purchase of makeup line Charlotte Tilbury in June 2020. Puig’s other brands include Nina Ricci, Paco Rabanne, Penhaligon’s, Carolina Herrera and Dries van Noten, which launched fragrance and lipstick in March.

This sale poses a powerful question for the industry: Is an “indie” brand still indie if it’s been acquired in a 10-figure deal by an international conglomerate?

In fragrance, you’re either so small that only fragrance connoisseurs know you exist, independent and cool, or part of the machine.

ADVERTISEMENT

It wasn’t until just over a decade ago that niche perfume brands really started gaining attention, or in the case of Byredo and Le Labo, mainstream popularity.

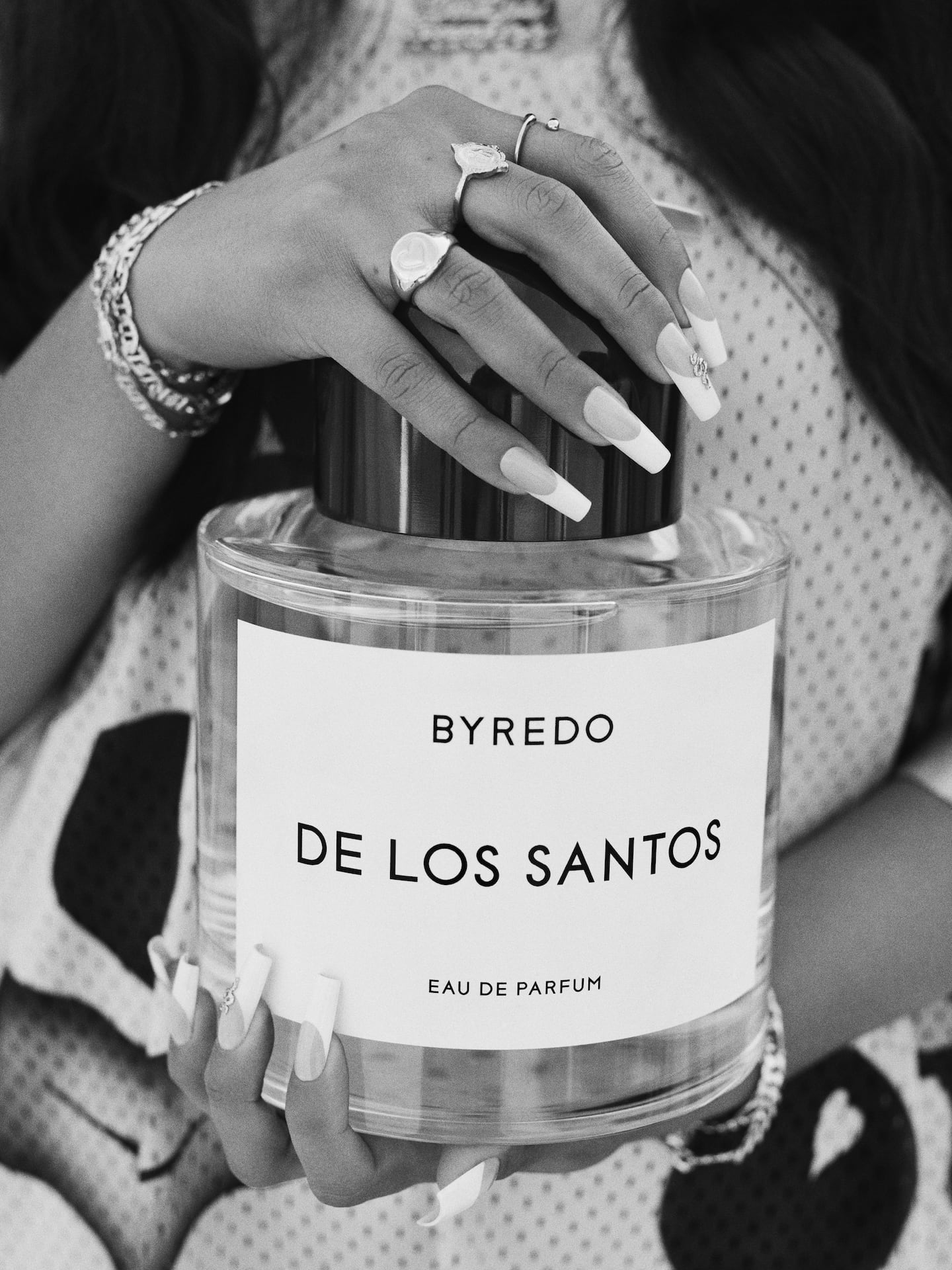

Customers liked the artisanal positioning, as well as scents that felt less “mass” than those that dominated the market. Branding for these scents centred on “stories” about travel and feelings, or more intense or rare ingredients, in contrast to blockbuster fragrances with more generic notes. Prices are also higher: Byredo charges nearly $200 for a 1.7 ounce bottle and $276 for a 3.4 ounce bottle.

“Now is this going to be like a mainstream brand?” a friend asked me of Byredo’s fate. News of the sale gave her a moment of pause. “I don’t want everyone walking around buying and smelling like Gypsy Water and Bal d’Afrique because they can find it everywhere.”

It’s not the first time a multi-billion-dollar, global beauty conglomerate has bought a smaller, artisanal perfume label. Estée Lauder went on an indie fragrance buying spree several years ago, acquiring Le Labo and Editions de Parfums Frédéric Malle in 2014 and By Kilian in 2016. It was reported that Lauder paid about $60 million dollars for Le Labo, which is a tiny sale in terms of beauty acquisitions. In 2016, L’Oréal also bought Atelier Cologne, which earlier this year closed its North American businesses in the US and Canada.

While small financially, these sales were meaningful for the beauty industry. After a decades-long reign of designer fragrance brands like Ralph Lauren, Giorgio Armani, Dior, Saint Laurent, Calvin Klein, Marc Jacobs and more, Lauder and L’Oréal saw where the market was going. Consumer preferences were changing and there was more demand for niche perfume, which only intensified during the past six to eight years.

Consumer trepidation around the acquisition may be tied to a mental block associated with a “billion-dollar” figure — how can a beauty line possibly maintain its artisanal, small-brand feel once it has such a large price tag attached to it or a global beauty company as an owner?

The sentiment is always the same: the acquired brand is accused of “selling out” and its longtime fans worry that the new parent company will ruin the brand they think they “discovered.” It happens any time a “cool” beauty brand sees rapid growth and increased demand, whether it’s Drunk Elephant in skin care or Ilia in makeup. Whether those fears will prove true depends on what Puig plans to do with Byredo.

Look to Le Labo as an example: Santal 33 has become mainstream, as far as $200 eau de parfums go, but the line still offers exclusive, limited products. A “City Exclusives” collection drops every September, where scents are available for one month only and priced higher than the permanent assortment (I fear I bought $800 worth of fragrance last September after spending almost a year rationing the tiny bottle I got the year before). Even though it’s owned by Lauder, Le Labo maintains its autonomy and still feels like a “small” brand.

ADVERTISEMENT

From skin care to hair care, and now fragrance, every category’s buzzy moment seems to yield a perfectly-timed acquisition, or a spurt of acquisitions. The pandemic led to heightened interest in skin care, which then led to a handful of companies that hit massive growth spikes and exited, like Youth to the People, Farmacy and Tula. Similarly, in hair care there was the sale of Briogeo in April and Amika in May. Byredo seems like another perfectly timed sale: fragrance sales soared last year and the category continues to see growth.

It was probably inevitable that Byredo was going to get acquired by a beauty conglomerate. And that leads to the question of whether Byredo, like Le Labo, can perhaps have a foot in both worlds.

Opens in new window

Opens in new windowThis month, BoF Careers provides essential sector insights to help beauty professionals decode the industry’s creative landscape.

The skincare-to-smoothie pipeline arrives.

Puig and Space NK are cashing in on their ability to tap the growth of hot new products, while L’Occitane, Olaplex and The Estée Lauder Companies are discovering how quickly the shine can come off even the biggest brands.

Demand for the drugs has proven insatiable. Shortages have left patients already on the medications searching for their next dose and stymied new starters.