The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

As the 2010s come to a close, BoF reflects on how the past decade transformed the fashion industry — and the culture at large. Explore our insights here.

SHANGHAI, China — To say much has changed in China over the past decade would be an understatement.

The country has rapidly shifted gears in the last ten years; once the epicentre of global manufacturing, few would now argue that China is anything but the world’s most important luxury market and a breeding ground for exciting brands and businesses.

Below, BoF explores some of the forces that defined China’s fashion, beauty and luxury markets between 2010 and 2019, in the process illuminating the trends likely to shape them in years to come.

ADVERTISEMENT

Giants Dominated China’s Retail Warzone

China is the world’s largest e-commerce market, with online retail transactions set to reach just shy of $2 trillion by the end of 2019, according to the International Trade Administration. (That’s over half of all transactions globally.)

Alibaba's 2018 Singles' Day event | Source: Courtesy

No event encapsulates China's e-commerce scale better than Singles' Day, launched by Alibaba in 2009. The event achieved global renown in 2015 when sales hit $14.3 billion — beating that year's online sales in the US for Black Friday ($2.74 billion) and Cyber Monday ($3.07 billion), according to figures from Adobe's digital index. To capitalise on the frenzy, established global players inked deals to localise their offerings. In 2016, sneaker marketplace Stadium Goods linked up with Tmall. This year, Farfetch merged its China business with JD.com's platform, while Net-a-Porter parent company Richemont announced its joint venture with Alibaba's Tmall platform in October.

Rival platforms from JD.com and Alibaba will be responsible for 56 percent of all online retail sales in China this year, eMarketer estimates. In 2014, Alibaba's $25 billion listing on the New York Stock Exchange has long held the record for the world's largest initial public offering. Five years later, the company raised up to $12.9 billion in a landmark second listing in Hong Kong.

Apps Became Lifestyle Necessities

This past decade, China's tech triumvirate of Baidu, Alibaba and Tencent expanded their investments into everyday interactions and transactions, from streaming to healthcare. Tencent's WeChat (launched in 2011) has grown from a simple WhatsApp-like messaging tool to an everyday must-have. The platform's ubiquity lies in its mini programmes — a function that launched in 2017 and houses other apps on its interface, allowing users to shop, order food, stream shows, pay bills and chat with friends without leaving the app. It is now a crucial asset for fashion and beauty brands to connect with their customers.

As the decade progressed, China's tech space became more crowded as upstarts challenged WeChat's screen-time stronghold. ByteDance-owned short video app Douyin, which launched in September 2016, has drawn Dior and Adidas to its platform (albeit with varying success). Its Western equivalent TikTok has been downloaded over 750 million times this year, beating Facebook, Instagram, YouTube and Snapchat, according to Sensor Tower.

ADVERTISEMENT

Social Media Mediums Evolved

China's social media landscape went through four main stages over the decade. First was the blogging boom that followed Weibo's 2009 launch. Then, in 2012, WeChat official accounts allowed users to follow brands and public figures. Short video curation followed, thanks to the popularity of specialised short video apps like Douyin, Meipai, Kuaishou and Weishi from 2015 onwards. More recently, influencers (known locally as Key Opinion Leaders, or KOLs), flooded into the livestream space on the likes of YY.com, Inke, Huajiao, Yizhibo and Taobao Live, which launched in 2016. The medium is still going strong: "Lipstick king" Austin Li made a record on this year's Singles' Day when he sold 15,000 lipsticks in five minutes on Taobao's livestream platform.

KOLs promoting L'Oréal products via livestream ahead of Singles' Day | Source: Alizila

E-Commerce Got Social; Social Media Got Shoppable

An increased focus on community within Chinese e-commerce has altered the way people shop and communicate. WeChat launched its wallet function in 2013 and WeChat stores a year later. Dior was the first luxury brand to sell goods on its platform in 2016.

But two other players are leading the scene. Xiaohongshu, founded in 2013, grew from a TripAdvisor-esque recommendation platform to a hotbed of beauty, fashion and lifestyle content with built-in e-commerce functionality. It's now a prime channel for luxury brands to engage with over 85 million monthly active users. (Xiaohongshu's success could also be attributed to Instagram being blocked by Beijing's Great Firewall in 2014.) In four years, Pinduoduo went from a Groupon group-buying clone to the third largest e-commerce platform in China. It recently hosted an online holiday pop-up shop for Amazon, which appears to be revamping its China strategy after shuttering its China e-commerce business in April 2019.

Fans and Brands Funded China’s KOL Economy

China’s burgeoning social media ecosystem amplified the frenzy around celebrities and KOLs, making them indispensable assets for brands looking to engage with China’s consumers. Their scale and profitability is unparalleled — local think tank TopKlout estimates that by 2020, the KOL industry will be worth up to 300 billion yuan ($43 billion).

ADVERTISEMENT

Increasingly diverse casting saw global brands embrace Asian and Chinese models in their campaigns over the decade. 2010 marked the year Liu Wen became the first Chinese ambassador for Estée Lauder, and by 2016, top stars like Yang Mi as well as xiao xian rou (little fresh meat) heartthrobs Cai Xukun and Lu Han repped brands from Versace to Prada and Cartier and took over fashion week front rows in Paris and Milan. The latter phenomenon paved the way for China's burgeoning male beauty and menswear markets as young men leave conservative gender norms in the past.

Cai Xukun for Prada | Source: Courtesy

Consumers Can Forgive, but Never Forget

In April 2018, Balenciaga and French department store Printemps apologised to Chinese customers after allegations of mistreatment. But it was Dolce & Gabbana's scandal later that year which kicked off a cycle of brands scrambling to amend relationships with a market that has in many cases become their biggest growth driver. Some crises stemmed from map and website-related offences relating to Chinese sovereignty (see Dior and Versace); others involved brands distancing themselves from employees and collaborators who sided with Hong Kong's pro-democracy protests (see Nike and Vans). Where some labels have managed to eventually bounce back, crisis management is more critical than ever for success and survival in the market.

‘Made in China’ Became ‘Designed in China’

In 2011, the country overtook the United States to become the world's largest producer of manufactured goods (in turn doubling its GDP per capita in the short span of a decade), according to McKinsey & Co. But rising costs and ongoing US-China trade tensions are diverting investment into neighbouring nations Vietnam and Cambodia.

China's image as a source of low-cost, poor quality goods has, over the course of the decade, been overtaken by a rebranding of the country as a hotbed for local design talent. Shanghai Fashion Week's organisers have in recent years elevated their event with a rich network of trade shows and showrooms, drawing buyers from esteemed retailers around the globe. Since 2016, Shanghai-based incubator Labelhood has championed emerging designers from Shushu/Tong and Ximon Lee, both now sold by global retailers including Farfetch and Ssense.

Rihanna in Guo Pei at the 2015 Met Gala | Source: Shutterstock

In 2015, Rihanna sported Chinese couturier Guo Pei's now-infamous "omelette dress" on the Met Gala's China: Through the Looking Glass red carpet, launching a thousand memes. From January 2018, Tmall's China Day (now China Cool) project brought local giants Lining and Peacebird to runways in New York and Paris Fashion Week, upping the youth appeal for their once-dusty brands. These ascents were fuelled by guo chao (national pride relating to nostalgic and traditional Chinese elements manifesting in casualwear and streetwear looks). Going forward, consumer pride in homegrown brands isn't likely to wane.

Global and Local Brands Rode China’s Beauty Wave

China's beauty market was reportedly worth $57.8 billion as of 2018 and its consumers aren't afraid to splash out on unfamiliar categories, be it at-home beauty devices or online marketplaces for plastic surgery. The country has become the world's biggest revenue driver in beauty, fuelling growth for industry giants from L'Oréal to Estée Lauder Companies (which saw a 40 percent sales growth in the country during its 2017 fiscal year). Local beauty brands are also capitalising on the guo chao wave, from this year's white-hot Palace Museum lipstick collection to C-beauty stalwarts Herborist, Pechoin, Inoherb and Kans.

Consumption and Retail Started Levelling Out

In detailing his goals to centre economic growth away from manufacturing, President Xi Jinping introduced the phrase "consumption upgrade" into China's retail lexicon in 2015. Consumption went on to drive nearly 80 percent of China's GDP growth in 2018 (from less than 50 percent eight years prior), booming across luxury goods, beauty and household product categories. Meanwhile, improved e-commerce infrastructure gave lower income groups greater opportunities to buy affordable, low quality goods.

The shift dovetailed with the rise of China's second and third-tier cities after 2012, thanks to an influx of young working Chinese, as well as investment into technology and infrastructure. While brands like Armani and Burberry cited lower-tier cities as strong growth-drivers as early as 2013, the likes of Louis Vuitton, Chanel, and Dior remained cautious until the latter half of the decade, when lower-tier retail expansion became an imperative. Cities such as Chengdu, Wuhan and Chongqing have become favourites among China's younger population in recent years thanks to their social media-friendly attractions, boutiques and cuisines. Looking to the next decade, they will be integral growth points for fashion, beauty and luxury brands alike.

Stay tuned for part two, to be published next week.

时尚与美容

FASHION & BEAUTY

Source: Bosie

Could Genderless Fast Fashion Win In China?

As high-end designers from Wales Bonner to Thom Browne blur the lines between menswear and womenswear globally, Chinese label Bosie is making a case for mass-market fashion players in the genderless space. The homegrown brand has found favour among the mainland's increasingly inclusive "Post-95" generation with its colourful and quirky aesthetic, completing a 10 million yuan ($1.4 million) Series A funding round in April. Founded last year by a group of nine millennials, Bosie recorded 30 million yuan ($4.26 million) in sales on Singles' Day 2019 alone — a figure equivalent to its total net sales in 2018. Co-Founder Liu Guanyao says that streamlining the brand's design, production and marketing processes (rather than separating menswear and womenswear collections) allows Bosie to operate more efficiently and sustainably, while its positioning as a genderless fast fashion designer label, makes it accessible and appealing to a vast consumer demographic. (Nino Tang for BoF China)

Coach, Tory Burch Feel the Burn in China’s ‘Quality Crackdown’

For years, China has carried out "random quality inspections" on imported goods, with luxury products sometimes getting caught in the crosshairs. Last week, Shanghai's Market Supervision Bureau announced inspection results on 125 batches of clothing. Twenty-three failed to meet the department's standards (local media outlets noted tensile strength of materials, pH levels and colourfastness as issues), with Tory Burch, Coach, Tommy Hilfiger, and DKNY among the brands called out. Though the Bureau has ordered the brands to stop selling impacted products immediately and take measures to protect consumers, the crackdowns are typical during periods of high political tension and companies should be able to weather the storm. (Jing Daily)

Could Tiffany Lose its Lustre in China?

Following luxury giant LVMH's $16.2 billion deal to buy Tiffany & Co., the American jeweller missed third-quarter profit estimates due to weak demand in the Americas and Hong Kong, which has now been hit by pro-democracy protests for over six months. Despite reporting double-digit growth in Mainland China, data from No Agency suggests that Tiffany (once a top choice for Chinese shoppers) has been usurped by Cartier and Van Cleef & Arpels. Fewer Chinese visitors are visiting and shopping in the US due to the repatriation of luxury spending to the mainland and the ongoing US-China trade war. This is especially important for Tiffany as travel consumption accounts for 20 percent of its total business. The brand has recently invested in its mainland presence, and LVMH will undoubtedly be focused on ramping up its appeal to Gen-Z customers in a bid to boost Tiffany sales. (No Fashion)

科技与创新

TECH & INNOVATION

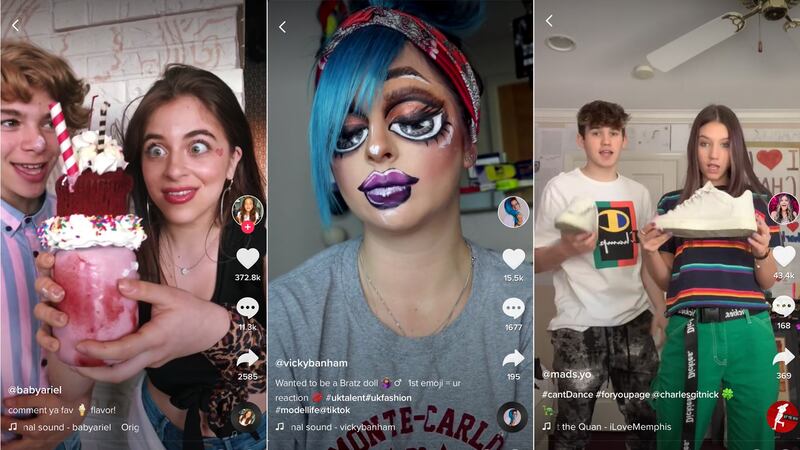

Tik Tok users | Source: Tik Tok, (L-R) @babyariel, @vikybanham and @mads.yo

The Road Ahead for TikTok

ByteDance's teen tech phenomenon TikTok has released a list naming the 100 top trends that shaped the app's record-breaking 2019. Noteworthy fashion and beauty moments include VSCO girls (a teen subculture with a scrunchie-centric aesthetic) and "walk a mile" videos, in which users create high-heels out of absurd objects in a riff on a pop song by Iggy Azalea. TikTok fame is increasingly an aspirational end-goal for teens across the world and the app is moving towards monetised rewards for its content creators. While it has no plans to be a news platform, TikTok is becoming increasingly political and will have to tackle misinformation and fake news to avoid falling foul of global regulations. Regarding allegations that TikTok censors content to avoid offending the Chinese government, General Manager of TikTok North America and Australia Vanessa Pappas echoed Chief Executive Alex Zhu's earlier comments: "We do not censor any content based on political sensitivities. Everything from the US market is driven from the US team." (New York Times)

Tencent Leans Into Luxury

WeChat parent company Tencent is courting official partnerships with the world's top luxury designers. A week after the tech giant announced plans to work with Burberry on social retail, it linked up with Gucci for a wide-ranging digital partnership spanning the Internet of Things, AI, data science, smart retail, content generation and digital thought leadership. According to Gartner data, 60 percent of monitored luxury fashion brands had WeChat stores as of April 2019, compared to rival Tmall's 51 percent uptake as of September. But brands rolling out cross-platform campaigns should take note: Tencent and Alibaba's rivalry means WeChat blocks links to listing on the latter's Tmall platform. (Gartner)

A Disappointing Year for Chinese Venture Capital Funding

Chinese companies have failed to keep the momentum from last year's VC funding sprees amid the US-China trade war and macroeconomic headwinds. From October 1 to November 19, the country's start-ups received $4.1 billion in 183 deals — a fraction of the capital from the same period a year earlier, when firms cashed in $10.9 billion over 388 rounds. Prior to mid-November this year, start-ups raised $35.6 billion over 2,047 rounds, compared to last year's $93.4 billion for 2,795 funding rounds. Granted, Chinese companies are still recording large capital infusions, but only three rounds made it above the $1 billion mark so far (compared to four in the US), whereas ten Chinese start-ups did last year. (Crunchbase)

消费与零售

CONSUMER & RETAIL

Clot x Air Jordan 1 Mid “Fearless” | Source: StockX

What’s Killing China’s Streetwear Spirit?

Annual streetwear gathering Innersect hit Shanghai on December 6, drawing mobs of sneakerheads eager to cross paths with industry heavyweights from artists and skaters to entrepreneurs and creatives. But the event, founded by Clot's Edison Chen, saw brawls break out across the exhibition space during its second day, as attendees reportedly fought over limited edition drops (like Chen's Nike collaboration, the Clot x Air Jordan 1 Mid "Fearless" model) and access to phone charging banks. As the venue's wifi servers became overwhelmed by attendees, others allegedly used signal blockers and bots to stop transactions from going through and score shoes for themselves. Many have argued that these clashes go against streetwear's community-centric roots. "We designed the shoes, not so people would fight over them, but to create something cool," Chen said in an interview, calling the clash for shoes "the least healthy part of sneakerhead culture." (Jiemian)

What Brands Need to Know About Chinese Airport Travellers

International airports have become the new malls for Chinese jet-setters, who splash out on luxury goods in duty free shops more than any other group. Now, airports, duty free companies and Chinese tech giants are coming together to upgrade the experience for this lucrative demographic. Premium experiences and customer service touch-points in airports are key to tempting Chinese travellers to spend, with Singapore's Changi airport a successful case in point. Tapping into Alibaba and Tencent's mobile payment methods are also crucial to making the shopping process as seamless as possible. Going forward, brands should pay attention to store location, catering to daigou (cross border personal shoppers) and keeping up with shifting travel trends. (Jing Daily)

COS Dips its Toes in China’s Rental Market

H&M-owned COS is teaming up with local subscription-based rental platform Y-Closet in a bid to attract China's sustainable shoppers and test their appetite for the rental market. China's opaque and segmented market has driven H&M to partner with the four-year-old local equivalent of Rent the Runway, which has drawn 15 million registered users to its monthly subscription service. In a statement, the Swedish fashion giant said that the trial would allow it "to explore customer demand, the business model, potential to scale and sustainability factors" in a market that has experienced a lack of momentum on the sustainable fashion front thus far. (Reuters)

政治、经济、社会

POLITICS, ECONOMY, SOCIETY

Riot police stand off against demonstrators in front of a Bally store inside New Town Plaza shopping mall | Source: Getty Images

‘Fangirls’ Defend China From Hong Kong Protesters and the World

A vast cohort of young Chinese patriots (nicknamed 'fangirls' for possessing the passion usually reserved for pop idols) are patrolling social media platforms like Facebook and Weibo to defend their motherland against Beijing's naysayers. Armed with slogans and memes, their targets have included supporters of Hong Kong's pro-democracy protests, from Houston Rockets General Manager Daryl Morey to brands like Coach and Apple as well as individual celebrities. Most of their targets have since apologised in the hopes of appeasing their mainland consumer and fanbases. While the bulk of Westerners reckon Chinese netizens are forced to abide by Beijing's values, the users' resistance towards perceived mistreatment and misrepresentation of their country paints a dual-sided picture (others include "50 cent armies" paid to post pro-China content). (Bloomberg)

Sixty Percent of Americans View China Unfavourably

China's ascent on the world stage has not translated to a rise in its fanbase, particularly as the US-China trade war drags on. Anti-China sentiment in the US and Canada hit record highs this year (60 and 67 percent respectively, according to a new poll from the Pew Research Center, the latter following China's response to Canada's detention of Huawei's Meng Wanzhou). The situation is demonstrably more severe in Japan (85 percent), Sweden (70 percent) and France (62 percent). Meanwhile, Russia and Nigeria — which have maintained good relations with the Asian superpower — were the most pro-China, with 71 and 70 percent approval ratings. (Newsweek)

China to Streamline Foreign Work Visa Application Process

The arduous work permit application process — long a bugbear of expats in China — is slated for change. A new government policy document reveals plans to simplify the process for work permits, permanent residencies and employment for overseas workers. The goal is to attract skilled foreign workers and boost business in the country's Yangtze River Delta region, which includes major commercial hubs Shanghai, Hangzhou and Nanjing. The move forms part of China's wider efforts to attract global talent to its shores and boost its tech and innovation industries — Hangzhou, for example, has offered subsidies and other incentives to foreign entrepreneurs. (SCMP)

China Decoded wants to hear from you. Send tips, suggestions, complaints and compliments to our Shanghai-based Asia Correspondent casey.hall@businessoffashion.com.

With consumers tightening their belts in China, the battle between global fast fashion brands and local high street giants has intensified.

Investors are bracing for a steep slowdown in luxury sales when luxury companies report their first quarter results, reflecting lacklustre Chinese demand.

The French beauty giant’s two latest deals are part of a wider M&A push by global players to capture a larger slice of the China market, targeting buzzy high-end brands that offer products with distinctive Chinese elements.

Post-Covid spend by US tourists in Europe has surged past 2019 levels. Chinese travellers, by contrast, have largely favoured domestic and regional destinations like Hong Kong, Singapore and Japan.