The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

SAN FRANCISCO, United States — When investors of the direct-to-consumer shoe brand Birdies pressured the start-up to burn through the $10 million it raised by buying more online ads and doubling the employee headcount, founders Bianca Gates and Marisa Sharkey resisted.

“Our investors [were] like, ‘Spend the money!’ and intuitively, we were like, ‘This is silly,’” Gates told BoF. “Why grow faster if it costs us more to acquire customers than to sell the product?”

But the sentiment among investors seems to be shifting, Gates said. “It was like a one-eighty. Now more than ever, there’s pressure to show profitability and product-market fit.”

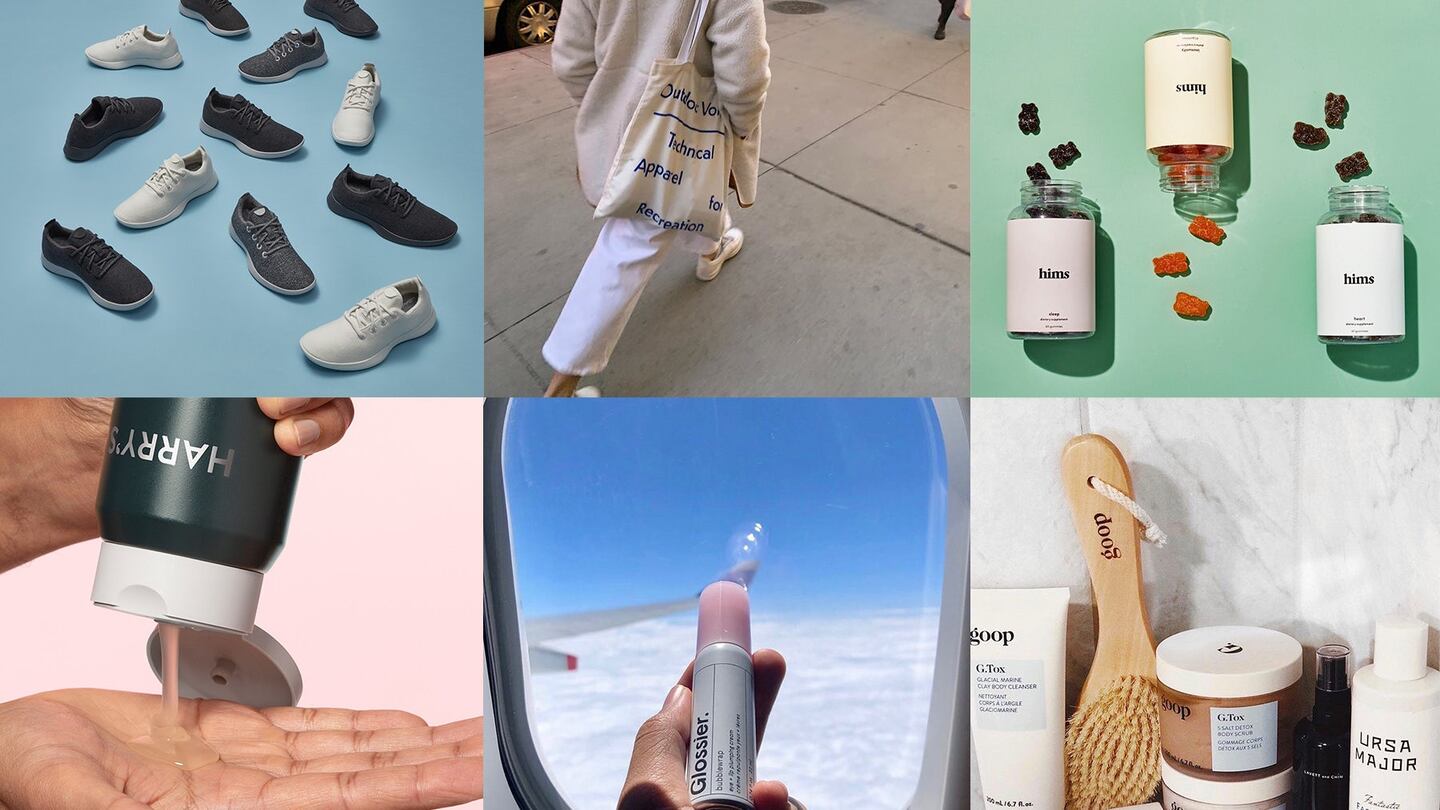

Birdies' investors aren't alone in re-evaluating their priorities. For nearly a decade, venture capital firms bankrolled buzzy, cleverly branded direct-to-consumer product companies like Bonobos and Glossier in hopes of exponential growth, vying for market domination over a healthy bottom line. But this strategy has yet to pan out. Few startups in the product category have been able to secure lucrative exits for their investors. Many are stuck on a cycle of aggressive forced growth, followed by fundraising higher and higher rounds to facilitate that growth — all without regard to profit.

ADVERTISEMENT

Outdoor Voices is the latest DTC darling, with more than $60 million raised from VC investors, to grapple with mounting losses and rising customer acquisition costs. Unable to raise another round of funding at a higher valuation, it took a down round from current investor General Catalyst late last year. Brandless is another recent example: the online consumer products store announced earlier this month that it is shuttering operations after two-and-a-half years and $300 million raised.

The public markets, meanwhile, have demonstrated that even the unicorns are worth less than what Silicon Valley predicted. Casper, the pioneer of the mattress-in-a-box concept, was valued at over $1 billion in 2017. In its initial public offering earlier this month, shareholders offered a far lower valuation with an initial market capitalisation of $467 million.

“You have this double whammy of increased customer acquisition costs and more competition, and this combination can be deadly,” said Adam Valkin, managing director at General Catalyst.

You have this double whammy of increased customer acquisition costs and more competition.

As a result, venture capitalists — especially those investing in later stages — are shifting their strategy to invest more cautiously, favouring profit over revenue and organic marketing over Instagram ads, industry sources say. Some predict that the volume of investments in the consumer product category will go down this year, though data from Dealogic shows that the last quarter of 2019 had 23 venture capital deals in consumer product companies totaling $292 million, up more than $100 million from the previous quarter.

“Venture capital has soured on consumer product businesses — particularly DTC apparel and footwear,” said Matthew Tingler, managing director at investment bank Baird. And like Outdoor Voices, he added, “I expect many of these companies will run out of funds and raise money at lower valuations.”

Even dealmakers are taking on fewer clients today because they fear that they won’t find buyers for startups that are not profitable, according to one investment banker who spoke to BoF on the condition of anonymity. “We’ve had to be a lot more cautious in terms of taking on assignments because brands that used to be highfliers at one point, you look under the hood now and the numbers paint a different picture,” they said.

Investors who continue to bet on product-driven businesses will also have to face the reality that these companies simply can’t scale the same way technology platforms do. Innovation-driven funds like Forerunner Ventures are focusing on the fact that consumer interests are shifting away from products and toward other categories, like health and education.

“You can’t run the same playbook year after year because things are changing around you,” said Kirsten Green, Forerunner’s founding partner. “If you try to run the same playbook that you did in 2015, it’s going to be hard to have the same advantages.”

ADVERTISEMENT

No More Inflated Valuations

Already, term sheets are reflecting lower valuations, according to Tingler. Consider this: As of last year, Away was valued at $1.4 billion despite the fact that, in 2018, its revenue was projected to reach $150 million. That’s more than nine multiples of sales.

Today, however, Tinger and his associates are seeing valuations hover around three times revenue, if not lower. Alex Song, founder of Innovation Department, a digital brand creation platform that recently raised $3 million in venture capital, said valuation multiples are currently around two, if not lower.

“Look at the public comps,” he said. “Casper is trading at less than 2x.”

All Eyes On EBITDA

As valuations drop, the metrics that determine these figures are also shifting. Revenue used to be the prime indication of valuation for brands, said Frederic Court, founder of Felix Capital. "But eventually, these businesses will have valuations driven by profitability… it's about generating a healthy profit margin."

Eventually, these businesses will have valuations driven by profitability.

Investors today are less focused on growth metrics and topline numbers and more focused on the bottom line, according to Birdies’ Founder Gates, whose backers include Norwest Venture Partners and Forerunner Ventures. “A lot of investors were looking at topline without considering how much it took to get there, but now the question is, ‘At what point will you be profitable?’ and there’s more scrutiny than ever.”

Instead of sales growth, metrics like repeat purchases, organic conversions, returns and exchanges are what gets attention today, she added.

ADVERTISEMENT

“Unless you’re sub-$25 million [in revenue] and investing in growth, as you mature, you should get valued on EBITDA,” or earnings before interest, tax, depreciation and amortisation, said the Innovation Department’s Song.

Rethinking Paid Digital Marketing

For many brands, customer acquisition costs remain the biggest hindrance to turning a profit, thanks in part to rising prices at Google and Facebook (which includes Instagram). Brands across the board increased their paid digital spend by 42 percent in the past two years, according to Adobe Digital Insights, but click-through rate is up only by 11 percent. General consumer fatigue over targeted ads may also be to blame for low click-through and conversion rates.

"It was maybe dangerous 10 years ago but it's definitely dangerous today to invest in a business where the only real driver of growth is performance marketing," said Nick Brown, managing partner and co-founder of Imaginary Ventures. "The era of funding new businesses where the only opportunity for growth is to plow money in Facebook and Google is over."

To combat waning conversions, brands like Glossier and jewellery line Mejuri are diversifying their marketing channels, using billboards, direct mail, subway ads, brick-and-mortar pop-ups and TV commercials to reach consumers.

In fact, the surging premium for online ads has led traditionally venture capital-backed companies to seek alternative sources of funding. Clearbanc, for instance, said it will lend $1 billion this year to companies looking for money to spend on Google and Facebook ads. Instead of receiving equity in exchange for cash, Clearbanc charges a 6 to 12.5 percent fee for the loan, which companies would pay through revenue sharing. (It’s a steep fee, but one that may appeal to startups who cannot qualify for a traditional bank loan due to their unprofitability.)

For many brands, customer acquisition costs remain the biggest hindrance to turning a profit.

“We’ve got a lot of factors that play in our favour,” said Michele Romanow, co-founder of Clearbanc. “We have seen the VC model where they inject a ton of money that has broken these companies… It’s becoming much more difficult for them to raise dollars from VCs who look for 10X growth. We don’t need 10X growth.”

The challenges in digital acquisition also means that the direct channel alone is not as fruitful as it seemed a decade ago. Today, investors like Court are looking for a diversified distribution strategy that includes wholesale, concession and brick-and-mortar retail.

Late-Stage Growth Investors Affected More Heavily

The sector seeing the most formidable challenges, according to PR executive and investor Jesse Derris, is mid- to late-stage investors who participate in series B, C and D rounds.

“From my vantage point, we’re seeing pre-seed and seed checks being written,” said Derris, whose namesake communications agency represents the likes of Warby Parker, Everlane and Reformation. “I don’t think the early stage will change in the immediate future.”

Forerunner’s Green agrees. “Our focus [has always been] on companies innovating in their categories and presenting new models of doing businesses,” she said. “That framework hasn’t changed.”

Interest in Health, Community and Beyond

What counts as innovation, however, has changed. While many investors have deemed apparel a saturated market, there is still buzz around adjacent categories. Wellness is growing, and so are platforms that service shifting consumer habits, like secondhand retailers and clothing rental sites.

“Now you have a more intentional consumer and they’re feeling gorged on spending but maybe also feeling like they’re not having their well-being met,” Green said, pointing to health as a promising category as well.

Despite challenges for later-stage investors, early-stage investors like Green are seeing no shortage of other innovative upstarts — especially those that operate through a platform — or interesting marketplaces, which see greater efficiencies with scale.

Song points to Goop as an example of a media platform that gained an audience through its content and in turn, directed that audience to its retail offerings. This type of community, said Valkin at General Catalyst, means that unit economics are "naturally healthier because you don't have to spend too much to acquire customers."

Community, nonetheless, can be difficult to scale. Even with its loyal readers and conference-attendees, Goop’s biggest scaling opportunity is still through traditional wholesale.

Valkin also cites Rebag, an online resale site that buys and sells luxury handbags under the General Catalyst portfolio, as an example of a company with a circular — and therefore sustainable — supply-and-demand business model where inventory expands alongside its buyers.

Ultimately, the reset among investors isn’t an earth-shattering indictment of the high-risk, high-reward business model that defines venture capital, according to Derris. “This is the first reckoning for this market,” he said. “But that's just sort of cyclical, where investors are chasing growth at all costs and then when people get a little bit scared, they start [to] pull back and say, ‘Listen, growth is less important than building a profitable business.’ It’s a cycle that repeats itself through the history of time.”

Disclosure: Felix Capital is part of a group of investors who, together, hold a minority interest in The Business of Fashion. All investors have signed shareholders’ documentation guaranteeing BoF’s complete editorial independence.

Related Articles:

[ How Online Brands Can Pave a Path to ProfitabilityOpens in new window ]

[ The Direct-to-Consumer ReckoningOpens in new window ]

[ How 'Direct-to-Consumer' Blew Up RetailOpens in new window ]

The Los Angeles-based accessories label has been a well-kept secret in the industry, but founders Yang Pei and Stephanie Li are hoping to change that through new acquisitions, opening brick-and-mortar stores and using AI to speed up the design and production process.

Designer Carly Mark sparked conversation about what it takes to make it as an emerging designer in New York when she announced she was shutting her ready-to-wear line and moving to London. On Thursday she held her last sample sale.

To stabilise their businesses brands are honing in on what their particular consumer wants to buy, introducing new categories and starting conversations.

That’s the promise of Zellerfeld, a 3D-printing partner to Louis Vuitton and Moncler that’s becoming a platform for emerging designers to easily make and sell footwear of their own.