The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

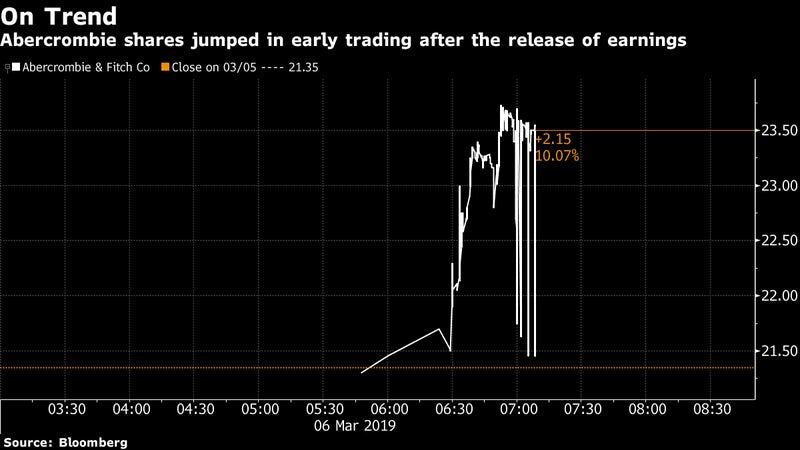

NEW ALBANY, United States — Abercrombie & Fitch Co surged in early trading after a key sales metric topped analysts' estimates and an upbeat forecast for the current year showed the company's rebound has legs.

Comparable sales increased for a sixth consecutive quarter, climbing 3 percent in the period that ended February 2, more than double analysts’ predictions. Net sales this year will rise 2 to 4 percent, the company said. The low end of that range equates to about $3.66 billion, compared with projections for $3.61 billion.

Source: Bloomberg

Digital sales are making up a significant piece of the revenue pie. Direct-to-consumer sales topped $1 billion last year, chief executive Fran Horowitz said in a statement.

ADVERTISEMENT

The company’s teen-focused Hollister chain continued to resonate with consumers during the holiday quarter, and showed strong comparable sales growth of 6 percent, more than twice what analysts estimated.

Still, the company continues to struggle to reinvigorate its namesake Abercrombie brand, which posted a 2 percent drop in comparable sales. The company said in January that weakness in women’s tops and dresses hurt the chain last quarter.

Investors are looking to Kristin Scott to bring her successes at Hollister to the Abercrombie brand. She was promoted in November to the new role of global brands president, where she’s been tasked to drive growth at both chains.

The shares jumped as much as 11 percent in premarket trading. The stock had already climbed 6.5 percent this year through Tuesday’s close.

By Lisa Wolfson with assistance from Karen Lin; editors: Anne Riley Moffat, Jonathan Roeder.

In 2020, like many companies, the $50 billion yoga apparel brand created a new department to improve internal diversity and inclusion, and to create a more equitable playing field for minorities. In interviews with BoF, 14 current and former employees said things only got worse.

For fashion’s private market investors, deal-making may provide less-than-ideal returns and raise questions about the long-term value creation opportunities across parts of the fashion industry, reports The State of Fashion 2024.

A blockbuster public listing should clear the way for other brands to try their luck. That, plus LVMH results and what else to watch for in the coming week.

L Catterton, the private-equity firm with close ties to LVMH and Bernard Arnault that’s preparing to take Birkenstock public, has become an investment giant in the consumer-goods space, with stakes in companies selling everything from fashion to pet food to tacos.