The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

NEW YORK, United States — Cosmetics maker Estee Lauder Cos Inc reported lower-than-expected quarterly sales, hurt by less demand for Clinique and Estee Lauder skin care products and a stronger dollar.

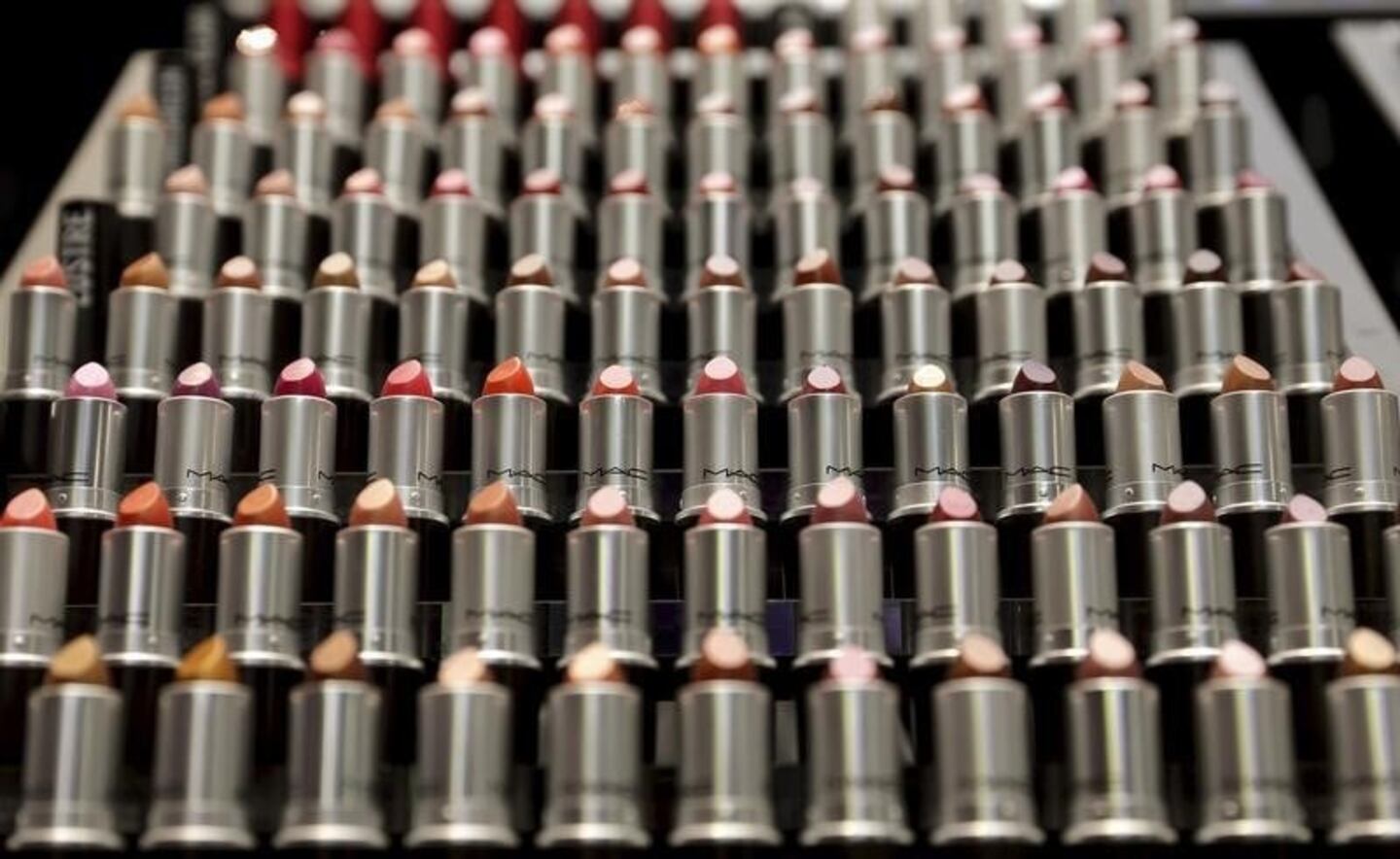

Shares of Estee Lauder, which also makes M.A.C and Bobbi Brown makeup products, fell 2 percent to $86.85 in premarket trading on Monday.

The company has been focusing on catering to younger customers by offering brands such as Smashbox and Bobbi Brown, as its "heritage" brands Estee Lauder and Clinique lose some shine in North America.

Sales in the company's skin care division fell 16 percent to $1.01 billion in the fourth quarter, the worst fall in at least two years. The division contributed about 40 percent to total sales in the quarter ended June 30.

ADVERTISEMENT

Net income attributable to Estee Lauder fell to $153.0 million, or 40 cents per share, in the quarter, from $257.7 million, or 66 cents per share, a year earlier.

In the prior-year quarter, retailers advanced sales orders of about $178 million before Estee Lauder upgraded its IT infrastructure.

Excluding items, Estee Lauder earned 40 cents per share, above the average analyst estimate of 34 cents, according to Thomson Reuters I/B/E/S.

The company's revenue fell 7.4 percent to $2.52 billion, missing analysts' estimate of $2.57 billion.

By Yashaswini Swamynathan; editor: Maju Samuel.

In 2020, like many companies, the $50 billion yoga apparel brand created a new department to improve internal diversity and inclusion, and to create a more equitable playing field for minorities. In interviews with BoF, 14 current and former employees said things only got worse.

For fashion’s private market investors, deal-making may provide less-than-ideal returns and raise questions about the long-term value creation opportunities across parts of the fashion industry, reports The State of Fashion 2024.

A blockbuster public listing should clear the way for other brands to try their luck. That, plus LVMH results and what else to watch for in the coming week.

L Catterton, the private-equity firm with close ties to LVMH and Bernard Arnault that’s preparing to take Birkenstock public, has become an investment giant in the consumer-goods space, with stakes in companies selling everything from fashion to pet food to tacos.