The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

MENLO PARK, United States — Facebook Inc. is participating in a $125 million fundraising for an Indian start-up that is aiming to bring more commerce to social networks like, well, Facebook.

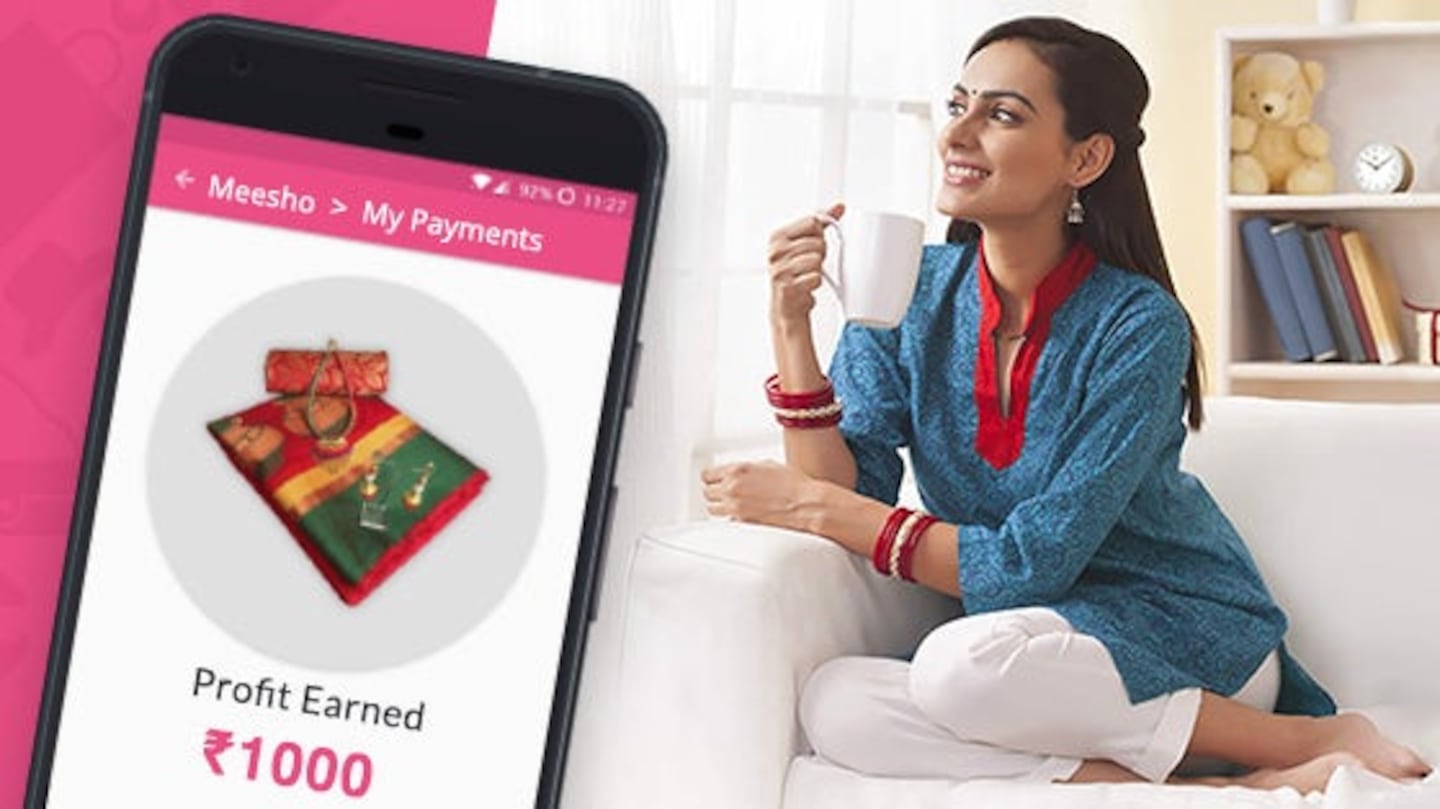

Meesho, based in Bangalore, is what’s known in the tech industry as a social commerce start-up, allowing people to build connections online and then sell through services such as Facebook and its WhatsApp and Instagram services. The funding round was led by South Africa’s Naspers Ltd. and also included Sequoia, Shunwei Capital, Venture Highway and Arun Sarin, the former chief executive officer of Vodafone Group Plc.

Meesho is part of a crop of new e-commerce companies that are trying to take advantage of social connections to facilitate sales. The start-up says that it has a network of more than 2 million “social sellers” in 700 towns across India, focusing on categories like apparel, wellness and electronics.

“Our social sellers are small retailers, women, students and retired citizens, with 70 percent being homemakers who have found financial freedom and a business identity without having to step outside their homes,” said Vidit Aatrey, Meesho co-Founder and CEO.

ADVERTISEMENT

India has become an increasingly competitive market for e-commerce, the last unclaimed major country after Amazon.com Inc. took hold of the US and Alibaba Group Holding Ltd. won China. Amazon is spending billions to gain share in India, while Walmart Inc. paid $16 billion for control of local leader Flipkart Online Service Pvt.

Naspers has a history of backing start-ups in China and India — and reaping big profits. It invested in China’s gaming giant Tencent Holdings Ltd. and India’s Flipkart, before the Walmart purchase. It led a $1 billion funding round in the Bangalore-based online food company Swiggy in December.

Naspers shares have risen 23 percent this year, valuing the company at about $98 billion.

By Saritha Rai and Loni Prinsloo; editors: Peter Elstrom and Edwin Chan.

In 2020, like many companies, the $50 billion yoga apparel brand created a new department to improve internal diversity and inclusion, and to create a more equitable playing field for minorities. In interviews with BoF, 14 current and former employees said things only got worse.

For fashion’s private market investors, deal-making may provide less-than-ideal returns and raise questions about the long-term value creation opportunities across parts of the fashion industry, reports The State of Fashion 2024.

A blockbuster public listing should clear the way for other brands to try their luck. That, plus LVMH results and what else to watch for in the coming week.

L Catterton, the private-equity firm with close ties to LVMH and Bernard Arnault that’s preparing to take Birkenstock public, has become an investment giant in the consumer-goods space, with stakes in companies selling everything from fashion to pet food to tacos.