The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

BoF’s Start-Up School comprises of essential tools and accessible and insightful guidance on topics including fundraising, product-market fit and planning your exit; along with templates and frameworks based industry best-practice. Become a member to gain immediate access.

LONDON, United Kingdom — As an essential tool for any company, be it a start-up or an established institution, a business plan details what your company is, where you want it to go and how it can get there. Potential investors are one key audience for your business plan, but it can also act as a communication tool to help you align your teams — to provide not only clarity but milestones against which your business can measure its progress.

"Running a business is an all-consuming commitment [and] more than 90 percent of fashion start-ups will fail in the first 3 to 5 years," says Imran Amed, founder and chief executive of the Business of Fashion, who first shared these principles as a lecturer in Fashion Business at Central Saint Martins. "Your ability to succeed rests not only on your creativity; it rests on your ability to do all these other things. You need to be tough and assertive. Persevere and try again until you figure it out."

However, a business plan is not written in stone. Your plans will naturally evolve as you learn more about the market and gain feedback from customers, so you should treat your business plan as a living, breathing document that helps to ensure you’re on the right path to achieving your goals.

ADVERTISEMENT

"You realise some initial flaws, and you might uncover some strengths you hadn't thought about," said August Bard Bringéus, who co-founded Swedish menswear brand Asket in 2015 and saw the company's gross revenue increase by almost 200 percent from 2016 to over €1 million in 2017.

There are five essential components to a fashion business plan: an executive summary; your vision and objectives; an understanding and analysis of the market and competitive landscape; your implementation plan; and financials. Here, BoF breaks down these structural elements to create an impactful business plan.

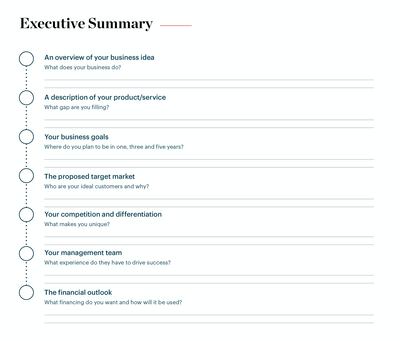

The Executive Summary

This section provides an overview of the business plan. It is what some call the “elevator pitch”, which will briefly introduce your business. It encapsulates the key points, ideas and objectives of your business in a short, concise statement that should be no more than a page.

BoF's Start-Up School executive summary template

Jen Rubio, co-founder of direct-to-consumer luggage brand Away, which launched in 2015 and has secured over $81 million in funding, has sought investment herself and is now an angel investor. She believes every pitch should answer five questions:

"[You should] personalise your pitch to press and editors, but it's even more important that you do that with investors. They're also likely not in your industry so explain things simply and clearly. Don't be afraid to put things into a context that they will immediately understand," adds Rubio.

It is easier to formulate your executive summary at the end of the process of creating your business plan because, until you go through the whole process of putting your plan together, you might not necessarily know what that overall summary is. However, it should sit at the beginning of your business plan to frame the document.

ADVERTISEMENT

The Vision and Objectives

Detailing your goals will help external and internal stakeholders understand your overall vision. This is the part of the business plan where you bring your unique point of view to life. What is it that you’re going to bring to the market that is different? What particular market need are you trying to fill? And which customer are you targeting?

“You need to consider why you are doing what you are doing,” said Asket’s Bringéus. Without that, “chances are you aren’t going to make it very far because it’s so easy to start a brand and there’s a plethora of alternatives out there.”

Asket utilised a message of timeless, ethical and sustainable pieces that resonates with its customers, demonstrating how a compelling brand narrative can grab consumers’ and investors’ attention. However, if your overall vision lacks an attention-grabbing factor, you can make your objectives stand out through detail orientation.

"We had this vision that was pretty boring, but very precise and you could break it down into quantifiable objectives. It made it very operational, which is something you sometimes struggle with [when] building a brand. We were very disciplined around these criteria," said Nicolaj Reffstrup, who founded Danish label Ganni with his wife and the brand's creative director Ditte in 2009. L Catterton, the consumer-focused private equity firm, acquired a 51 percent stake in Ganni in 2017. That year, the brand generated around $45 million in sales and expected revenue to grow by 50 percent for 2018.

The Market and Competition

Providing an understanding and analysis of the market and competitive landscape signposts to investors what part of the market you are playing in. This section should detail how big the market is and how quickly it is growing, with relevant data and evidence to show why there is a good market opportunity. Investors will also want to know who the other competitors in the market are, what their position is, if they are growing and how you will differentiate yourself from them.

If you’re going after a market that is growing quickly, others will also try to capitalise on this growing market opportunity; if you’re moving into a slower moving market, you will need to steal market share from other companies, who might have certain weaknesses or blind spots. You need to be clear about what is going on in that market landscape and why you believe there’s an opportunity.

ADVERTISEMENT

"I didn't invent lipstick, but I reinvented it," said Bobbi Brown, the founder of global beauty brand Bobbi Brown Cosmetics, which she sold for $70 million to Estée Lauder Companies just four years after launching in 1991 with just 10 shades.

The Implementation Plan

This section will explain what it takes to deliver on your objectives and go after the market opportunity. This will include how you communicate as a business; how you intend to hire staff; what space you need; and which expertise you might outsource. A three-year implementation plan is a desirable average time frame to reflect a long-term vision.

Your implementation plan should be the largest and most comprehensive section of your business plan. It should detail a step-by-step basis, in a chronological order, and possibly season-by-season as you are operating within the fashion industry. You should identify the resources and people you will need at each stage or season to continue the vision and objectives you set out — but ensure these are realistic to be achievable.

"Sometimes I see founders looking at $100 million in their third year, and they've set a bar that is impossible," said Nick Brown, partner at venture capitalist firm Imaginary Ventures, which he launched with Natalie Massenet. The firm has invested in the likes of Farfetch, Glossier and Everlane. "I always say: project down to what you can actually see in front of you, and then tell a vision about how you see the brand evolving."

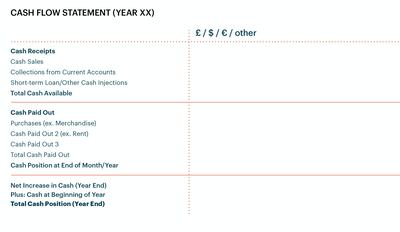

The Financials

Providing economic evaluations help you to identify both how you see your business growing from a revenue standpoint but also how you see the business’s needs growing from a cost standpoint, and what that implies for funding. You should consider how you think the business will grow in terms of profit and revenue, and what financing you will need to make that happen.

BoF's Start-Up School cash flow statement template

"I've seen too many companies blow up because they grew too fast and couldn't execute on the growth," said Stephen Hawthornthwaite, who co-founded sustainable footwear brand Rothy's in 2016. Last year, the company sold over 1 million pairs of shoes, generating revenue north of $140 million. Goldman Sachs Investment Partners invested $35 million in Rothy's in December 2018.

This section should include an income statement, detailing profit and loss, that shows the top line growth of your business. This will project when you will be profitable. A cash flow statement then shows the peaks and troughs of cash on a monthly basis and identifies what funding needs you require to finance the growth of your business. You should remember that while you might be profitable on an income statement basis, this might translate differently in cash flow.

Read the full guide and access additional industry leading entrepreneurship advice in BoF's Start-Up school. Become a member to gain immediate access.

In 2020, like many companies, the $50 billion yoga apparel brand created a new department to improve internal diversity and inclusion, and to create a more equitable playing field for minorities. In interviews with BoF, 14 current and former employees said things only got worse.

For fashion’s private market investors, deal-making may provide less-than-ideal returns and raise questions about the long-term value creation opportunities across parts of the fashion industry, reports The State of Fashion 2024.

A blockbuster public listing should clear the way for other brands to try their luck. That, plus LVMH results and what else to watch for in the coming week.

L Catterton, the private-equity firm with close ties to LVMH and Bernard Arnault that’s preparing to take Birkenstock public, has become an investment giant in the consumer-goods space, with stakes in companies selling everything from fashion to pet food to tacos.