The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

For Isabel Marant, the new year brings with it a new look.

On Monday, the French label will unveil a new brand identity, complete with a refreshed logo and updated packaging design conceived by New York-based British art director Peter Miles, who in the past has worked with brands from Marc Jacobs and Celine to Proenza Schouler.

The changes to the logo typeface are relatively subtle — as Marant puts it, it’s “not an earthquake,” but rather an evolution to signal the next chapter of the label she started in 1994.

“It was to explain the new era we are stepping into,” she told BoF in an interview.

ADVERTISEMENT

There are bigger changes happening behind the scenes. With just shy of €300 million ($323 million) in annual sales last year, Marant, majority owned by the Paris-based private equity firm Montefiore since 2016, is no longer the sometimes-hard-to-find label beloved by fashion insiders for capturing nonchalant Parisienne style.

The brand has a path to hitting €500 million in sales within four years, said chief executive Anouck Duranteau-Loeper, who joined the company from Paco Rabanne in 2016 after leading the leather-goods business at Céline and working on strategy at LVMH. In recent years, Marant has opened dozens of stores, and on the product side, it has launched menswear and expanded its accessories offering, adding eyewear, jewellery and leather bags to the lineup.

Marant has had successes, most recently its £695 Oskan Moon bag, which has emerged as a popular new hero style since its debut in December. But it stumbled early in the pandemic, and, as a small brand in a market dominated by a few giants, struggled to navigate the turbulence that came with the onset of Covid-19. Montefiore tried to sell the brand a year ago. (Now, the firm says it’s flexible about an exit).

Marant and the brand’s chief executive Anouck Duranteau-Loeper say the brand has reached a new level of maturity in the past five years, after it brought on Paris-based private equity firm Montefiore as a majority investor in a bid to accelerate growth in 2016.

Now, it wants to signal to its customers and the industry that the label is ready to play at a higher level. The new products, the new stores, and yes, the new logo, are all part of that grand plan.

“With all the changes that we made, it makes sense to also change the logo,” said artistic director Kim Bekker, a longtime collaborator of Marant’s who rejoined the business in 2021 after leaving for a brief stint at Saint Laurent. “It really establishes all the growth that the company has been through the last two years.”

Realising the next stage of growth won’t be easy, however. The brand’s recent run of success has come during a near-unprecedented boom in luxury spending. It will need to execute its next phase as the industry enters into a period of uncertainty. Isabel Marant is positioned at the affordable end of the luxury segment and remains relatively small, with sales a sliver of the billions generated by luxury’s biggest players. This makes it more vulnerable if an economic downturn causes middle-class consumers to pull back on spending.

Yet the business performed better than expected in 2022, both in terms of sales numbers and earnings growth, said Guillaume Leglise, vice president and senior analyst at credit rating and research firm Moody’s Investor Service. In January of last year, Moody’s upgraded the brand’s credit rating to B2, with a stable outlook. That is still below investment grade, but indicates Marant’s financial prospects are brighter than they were two or three years ago.

ADVERTISEMENT

“The brand positioning is well oriented, it is resonating very well with customers despite all the current challenges,” Leglise said. “The numbers demonstrate the brand is very successful.”

Isabel Marant carved out a niche for herself with fashionable yet wearable designs that embodied a French-girl cool aesthetic. In the 2000s and early 2010s, the brand’s elevated take on jersey sweats, wedge sneakers and bohemian-meets-rock chick dresses gained wide traction among consumers, spurring pacey growth for the independent label. Many retailers stocked the brand’s mainline and its contemporary-priced sister brand Isabel Marant Etoile. A 2013 high-low collaboration with H&M was a blockbuster hit.

“There has always been a consistent vision for the brand that is reflective of Isabel’s personal style,” said Rickie de Sole, women’s fashion and editorial director at Nordstrom. “The collections often exude a joyous and optimistic embrace of life, our customers can easily see themselves in it.”

For years, Marant was content flying somewhat under the radar (in the early days, part of the brand’s appeal with insiders was that outside of its home market, it wasn’t that easy to find). But soon the space Marant occupied became more crowded. Fast fashion players mimicked the French girl aesthetic, lower-priced French contemporary names like Sandro and Zadig and Voltaire expanded outside their home market, and direct-to-consumer labels like Sezane and Rouje emerged onto the scene.

It is a strong brand in terms of consumer love. It’s a brand of aficionados, so it’s a brand that can create that very strong loyalty without being a pure luxury player.

In 2016, Marant sold a 51 percent stake in her company to Montefiore, receiving a cash injection as well as a strategic partner with the expertise to help the business scale.

Even then, it wasn’t easy sailing. The Covid-19 pandemic briefly stymied growth plans, with sales falling 13 percent in 2020. Last year, Montefiore explored an exit from the company after five years. However, despite having “strong interest from different parties,” it shelved plans amid an uncertain market following the outbreak of war in Ukraine, Montefiore president Eric Bismuth said. (The firm is “very flexible regarding timing” for a future exit, Bismuth said.) But the brand bounced back more quickly than expected.

“It is impressive, because it’s not a high end luxury brand so it doesn’t have this irrational sentiment to buying it,” said Celia Friedman, managing director of the luxury division at strategy consulting firm Publicis Sapient. “But it is a strong brand in terms of consumer love. It’s a brand of aficionados, so it’s a brand that can create that very strong [loyalty] without being a pure luxury player.”

Part of Isabel Marant’s success lies in the fact that the brand is well diversified for a brand of its size, both in terms of product and geography, said Friedman. A well-balanced distribution strategy has also helped, she added. The brand has grown from nine stores in 2016 to 73 today, even as it has continued to leverage wholesale. Combined, the two channels provide decent global exposure while remaining “still very curated,” according to Duranteau-Loeper.

ADVERTISEMENT

On the product side, adding leather goods to its offering and building out other accessories has helped fuel growth, with the category now driving 30 percent of sales. Marant and her team have repositioned the Etoile line to complement rather than cannibalise mainline sales.

Initially, Etoile was a proposition in and of itself, offering buyers a route into the brand at a lower price point, explained Marant. Now, it’s presented as a more casual offering geared toward holiday and weekend dressing.

“There’s a difference in price tag, because there’s a difference in the nature of the product,” said Duranteau-Loeper. “You would buy your denim from Etoile and you would buy your fancy, sparkling dress or leather from Isabel Marant.”

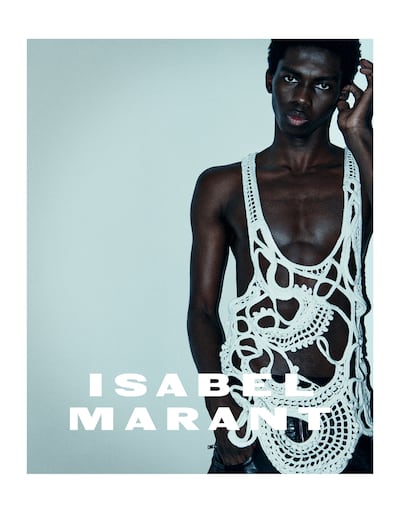

Going forward, the focus will be on nurturing its menswear, which has been renamed Marant as part of the rebrand. The plan is to expand its menswear store footprint by opening locations in key cities globally, adding to the two standalone stores currently in Paris. The ambition is to grow menswear to drive 10 to 15 percent of sales, up from about 5 percent currently, said Duranteau-Loeper.

Internal forecasts indicate the brand is on track to hit the €500 million mark within the next four years. Competition for consumer attention will only intensify should a recession hit. While luxury shoppers are more insulated from economic turbulence, they still tend to become more discerning during times of economic uncertainty, tending to gravitate to higher-end, big-name brands, which can be viewed as a better investment.

Meanwhile, Isabel Marant remains a niche brand in a fragmented industry, said Moody’s Leglise. For brands driven by ready-to-wear that’s rooted in a very specific aesthetic, staying relevant becomes more difficult.

“For this kind of brand … you really need to have the right collection at the right time, to have the right product to keep the brand appeal,” he said. “If you start to miss [the mark on] a collection, things can quickly go wrong.”

Yet Marant’s signature style of French je ne sais quoi still has strong appeal. The global appetite for French luxury shows no signs of slowing down, said Publicis Sapient’s Friedman, while Marant’s DNA is more rooted in culture and female empowerment, rather than a specific look, giving the brand codes more longevity.

“‘French-girl cool’ is more about style and energy than a specific look,” said Nordstrom’s De Sole. “The trends are always evolving, but the desire to feel confident and carefree with a halo of polish will always be relevant.”

Despite challenges — and challengers — the brand that launched French contemporary has remained profitable during the Covid-19 crisis, and is adding new lines and stores to drive growth.

An avalanche of new competitors has threatened the label’s dominance as the ultimate exporter of Parisienne style. Chief executive Sophie Duruflé and deputy CEO Anouck Duranteau-Loeper reveal their defence plan.

The Swiss watch sector’s slide appears to be more pronounced than the wider luxury slowdown, but industry insiders and analysts urge perspective.

The LVMH-linked firm is betting its $545 million stake in the Italian shoemaker will yield the double-digit returns private equity typically seeks.

The Coach owner’s results will provide another opportunity to stick up for its acquisition of rival Capri. And the Met Gala will do its best to ignore the TikTok ban and labour strife at Conde Nast.

The former CFDA president sat down with BoF founder and editor-in-chief Imran Amed to discuss his remarkable life and career and how big business has changed the fashion industry.