The Business of Fashion

Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

Joseph Altuzarra can’t help but get a little emotional.

“I don’t want to say ‘the pandemic changed me’ … but the pandemic changed me,” he told BoF in a recent interview. “It changed everything. It changed the entire outlook creatively for the brand, how we market … we made things much more personal.”

Both Altuzarra and his company, which he founded in 2008, experienced dramatic changes during the pandemic, and they’re both different now. Altuzarra, the man, welcomed a baby girl into his family in 2019. Like many parents, he faced the reality of lockdown with an infant, all the while scrambling to figure out what to do about a fashion business that was not only wholesale-dependent at a time when many luxury retailers simply stopped paying their vendors but also focused on dresses and tailoring for the office or an evening out. (From the beginning, Altuzarra’s vision of the brand was particularly dressed up and fitted, and he maintained that through-line even as fashion moved toward a more voluminous, relaxed attitude.)

“There were moments of fear,” he said. “I didn’t know how we were going to make it through.”

ADVERTISEMENT

Then, in the middle of it all, Altuzarra split with French luxury group Kering, which acquired a 40 percent minority stake in the label in 2013, but has since rationalised its portfolio, exiting smaller brands that it, like rival LVMH, has struggled to scale.

Like Christopher Kane, who ended its partnership with Kering in 2018, Altuzarra bought back the group’s stake in October 2020 and is now self funded. (The Pinault family, which controls Kering, still has stakes in smaller labels through Artémis, its holding company).

“Kering was a minority shareholder during a really pivotal time in the life of the brand. They were so helpful in helping us grow, and they gave us an incredible amount of support and resources,” Altuzarra said. “Over time the partnership naturally evolved, their strategy changed — and our strategy changed.”

While having cash and operational support from a strategic group sounds like a dream for any young fashion house, there can be downsides, too. Smaller labels can be hit with heavy corporate charges without really benefiting from many of the so-called synergies that can come from being part of a big group. At the same time, they are often not prioritised by senior management, who may see them as a distraction from the bigger brands that dominate their portfolios.

A spokesperson for Kering confirmed the split, adding that the companies “greatly enjoyed collaborating over the years, and they stay on friendly terms.”

Back on his own, Altuzarra partnered with chief executive Shira Sue Carmi — who joined the company in January 2020 — to re-tool the business for the harsh realities of pandemic life without the support of Kering.

“There had been a time when it felt like to be a brand with a capital B, you sort of needed to take a step back. The brand needed to be bigger than the designer in some ways,” he said. “The kernel of truth that I kept on circling back to is that Altuzarra is a very, very personal thing to me, my name being on the door.”

Altuzarra and Carmi cut costs, including letting go of 15 percent of the staff, and began experimenting. A home collaboration with Etsy, planned before the pandemic but launched in April 2020, was a sell-out success, inspiring them to add the category to the main line in November 2021. (It’s already nearly sold-out, just months later.) Knitwear, too, became a huge priority with a take that was more “feminine, sophisticated — not just sweatsuits,” as Carmi described it. The category now makes up almost 50 percent of the business, even as clients come back to more tailored looks.

ADVERTISEMENT

They also dialled back the number of main line collections they produced per year from four to two, reducing the amount of time and energy Altuzarra spent on that part of the business.

“The most common pitfall [for brands that only design two seasons a year] is that there’s not enough variety,” Carmi said. “So the breadth of the collection really hasn’t changed. Because of the six months cycle, there’s outwear, coats and summer dresses in both collections.”

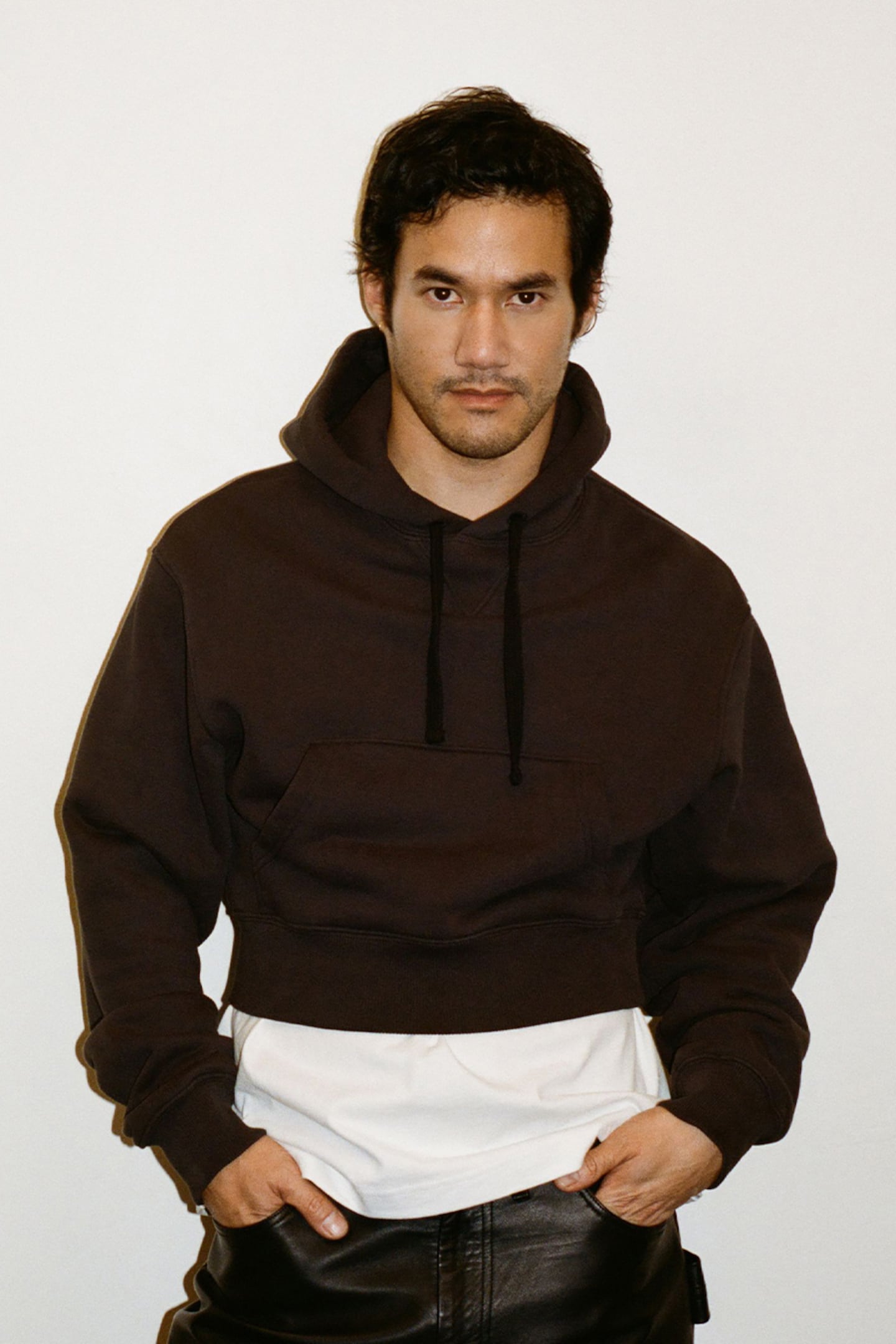

Then there was the launch of Altu in late 2021, a lower-priced second line which the company has marketed as “genderful.”

“It’s definitely one of those projects that pre-pandemic Joseph would say, ‘This is not what people are expecting of me,’” he said. “But Shira was so supportive, and it really, again, came from a very personal place. I’ve been playing around and experimenting in my own wardrobe a lot more and the arrival of Emma, in a weird way, helped solidify the idea in my mind. It’s absurd how gendered fashion is.”

The line, sold primarily through a standalone e-commerce site (Matchesfashion is currently the only retail partner), targets a more cost-conscious customer, with prices starting at around $195 for a white T-shirt. (The leather pants, which were the inspiration for the collection and a staple in Altuzarra’s own closet, are a top-seller at $895.)

Carmi said that across the business, offering lower price points has been an important step in creating stability. (The $545 woven cactus leather “Watermill” tote is now the top-selling bag.) But the designer’s ready-to-wear is in demand, too, she said. (A gold lamé dress from the spring collection, for instance, sold out immediately.)

The overall increase in high-end apparel sales is benefiting brands across the board, including those who offer a designer point of view for a more reasonable price. While many luxury customers buy designer from head-to-toe, others are more likely to splurge on accessories and shop a bit more carefully when it comes to clothes.

“The customer’s psyche right now is if they’re going to spend a lot of money, they want something from a very big brand,” said retail consultant Robert Burke, who has known Altuzarra since before he launched the collection. “They’ve gotten much more educated on how to spend to get the most out of their money. That price point that Joseph is playing in really speaks to them.”

ADVERTISEMENT

What’s more, Burke added that, from the beginning, Altuzarra’s willingness to participate in the commercial part of the business set him apart from his peers. “It was always about clothes that people will wear,” he said. “He possessed a more left-right brain approach.”

Still, even with demand for fashion goods rising as the worst of the pandemic recedes, running a small brand without the backing of a strategic partner can be challenging. Especially as consumers flock to blue-chip labels and the big groups that dominate the sector use their leverage over everyone from store owners to influencers. While Altuzarra declined to share current revenue figures, the business generated less than $20 million in 2016. In 2022, sales are projected to increase 50 percent from last year, and up 30 percent from before the pandemic.

“There’s definitely many more ways to run these businesses now than there were. We’re not as dictated by the system and this path of growth,” Carmi argued. “Yes, it takes discipline, but it also is really going back to Joseph and his creativity. That’s the only really differentiating factor.”

How the trio behind the London label navigated a split with Kering and beat the pandemic by betting on merch line More Joy.

LVMH’s decision to pull the plug on the Fenty fashion label it launched with Rihanna only two years ago underscored just how elusive start-up success has been for Europe’s big luxury groups.

The luxury goods maker is seeking pricing harmonisation across the globe, and adjusts prices in different markets to ensure that the company is”fair to all [its] clients everywhere,” CEO Leena Nair said.

Hermes saw Chinese buyers snap up its luxury products as the Kelly bag maker showed its resilience amid a broader slowdown in demand for the sector.

The group’s flagship Prada brand grew more slowly but remained resilient in the face of a sector-wide slowdown, with retail sales up 7 percent.

The guidance was issued as the French group released first-quarter sales that confirmed forecasts for a slowdown. Weak demand in China and poor performance at flagship Gucci are weighing on the group.